NextEnergy Solar Fund Limited NESF Transaction (8356M)

14 Mayo 2020 - 1:00AM

UK Regulatory

TIDMNESF

RNS Number : 8356M

NextEnergy Solar Fund Limited

14 May 2020

14 May 2020

NextEnergy Solar Fund Limited

("NESF" or "Company")

Smaller Related Party Transaction with subsidiary of NextPower

Development Ltd

NESF announces that it has agreed to sell two subsidy free

assets under development with a capacity of 115MW for a combined

total consideration of GBP11.5m to a subsidiary of NextPower

Development Ltd ("NextPower") (the "Transaction"). The Transaction

is expected to simultaneously exchange and complete later

today.

The Transaction will result in a net IRR (after NESF's

Transaction costs) significantly in excess of NESF's annualised

target return of 7 - 9% p.a.

The disposal of these assets is in line with the Company's

current strategy of adding up to 150MW of operational subsidy-free

capacity to the portfolio, by building those projects which are

expected to generate a rate of return in line with or in excess of

NESF's target equity annualised return range of 7% to 9%. The

Company will consider divesting those subsidy-free development

assets in its portfolio that are in excess of that capacity or that

are not expected to generate financial returns that are in line

with the Company's target range.

Following a review by the Board and its independent advisers,

the Board concluded that these two subsidy free development assets,

amounting to 115MW, no longer meet the Company's financial

targets.

NESF may sell further subsidy free assets under development from

its portfolio to subsidiaries of NextPower or to other third-party

buyers as the secondary market for subsidy free assets develops and

matures. All related-party disposals are at the Board's discretion

and, in the case of any related party transaction, compliance with

the FCA's Listing Rules, and there are no exclusivity arrangements

in place between NESF and any member of the NEC Group in relation

to the Transaction or future disposals.

NextPower, which was appointed as Developer by NESF at the time

of the Company's IPO in April 2014, and its subsidiaries are under

the common control of the wider NEC Group along with NextEnergy

Capital Limited (Investment Adviser to NESF) and NextEnergy Capital

IM Limited (Investment Manager to NESF) and as such is a related

party of the Company. Based on the amounts involved, the

Transaction constitutes a smaller related party transaction as set

out in Listing Rule 11.1.10R.

For further information:

NextEnergy Capital Limited 020 3746 0700

Michael Bonte-Friedheim

Aldo Beolchini

Cenkos Securities Plc 020 7397 8900

Justin Zawoda-Martin

Robert Naylor

William Talkington

Shore Capital 020 7408 4090

Anita Ghanekar

Darren Vickers

MHP Communications 020 3128 8100

Oliver Hughes

Giles Robinson

Apex Fund and Corporate Services

(Guernsey) Limited 01481 735 827

Nick Robilliard

Notes to Editors ([i]) :

A constituent of the FTSE 250 Index, NextEnergy Solar Fund

("NESF") is a renewable energy infrastructure investment company

that invests primarily in operating solar power plants in the UK

(it may invest up to 15% of its gross assets in other OECD

countries). The Company is committed to ESG principles and

responsible investment and makes a meaningful contribution to

reducing CO2 emissions through the generation of clean solar power.

NESF has been designated a Guernsey Green Fund by the Guernsey

Financial Services Commission and has been awarded the London Stock

Exchange's Green Economy Mark.

NESF has a diversified portfolio comprising 90 operating solar

assets, primarily on agricultural, industrial and commercial sites,

with a combined installed power capacity in excess of 755MW. As at

31 March 2020, the Company has gross assets of GBP993 million, of

which 89% is invested in the UK, and net assets of GBP579 million.

The majority of long-term cash flows from its investments are

inflation-linked.

NESF's investment objective is to provide ordinary shareholders

with a sustainable and attractive dividend that increases in line

with RPI over the long term, while delivering an element of capital

growth through reinvesting net cash generated in excess of the

target dividend. The dividend is payable quarterly and the Company

has announced a total dividend for the year to 31 March 2020 of

6.87p per ordinary share.

NESF is differentiated by its access to NextEnergy Capital Group

("NEC Group"), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division, which since its founding has provided operating asset

management, monitoring, technical due diligence and other services

to over 1,300 utility-scale solar power plants with an installed

capacity in excess of 1.6 GW.

Further information on NESF, NEC Group and WiseEnergy is

available at nextenergysolarfund.com , nextenergycapital.com and

wise-energy.eu .

[1] Note: All data is unaudited as at 31 March 2020, being the

latest date in respect of which NESF has published financial

information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBCGDURBBDGGX

(END) Dow Jones Newswires

May 14, 2020 02:00 ET (06:00 GMT)

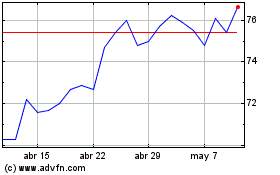

Nextenergy Solar (LSE:NESF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Nextenergy Solar (LSE:NESF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024