TIDMAVAP

RNS Number : 0300D

Avation PLC

23 October 2020

AVATION PLC

("Avation" or "the Company")

UNAUDITED Financial Results for the YEar ended 30 june 2020

and Interim Management Statement

Avation PLC (LSE: AVAP), the commercial passenger aircraft

leasing company, announces preliminary unaudited financial results

for the year ended 30 June 2020.

Key Financial Results

-- Revenue increased 14% to a record $135.3 million;

-- Unrealised gain on aircraft purchase rights of $27.1 million recognised;

-- Cash and bank balances increased 7% to $114.6 million;

-- Impairment losses of $35.5 million recognised, reflecting the

COVID-19 pandemic, industry and customer disruption;

-- Profit before taxation decreased 43% to $14.6 million, in challenging conditions; and

-- Net cash from operating activities increased 20% to $88.5 million.

Operational Highlights

-- Two aircraft were repossessed from Thomas Cook and transitioned to VietJet;

-- Three new ATR72-600 aircraft were acquired during the year;

-- Three Fokker 100 aircraft were transferred to the lessee on completion of finance leases;

-- First ever commercial aircraft financed with a Green loan -

recognised by Airline Economics as "Deal of the Year for

Innovation"; and

-- Ongoing management of exposure to Virgin Australia

administration with transition of five of 13 aircraft on lease to

date.

COVID-19 Strategy

-- The Company has implemented a strategy to preserve liquidity and cashflow;

-- Short-term rent deferrals totalling approximately $13.1 million granted to airline customers;

-- Loan repayment deferrals totalling approximately $24.4

million obtained from secured lenders; and

-- The Company has elected to temporarily pause capital expenditure and dividends.

Executive Chairman, Jeff Chatfield, said:

"Avation has posted a satisfactory result in a volatile

environment. Avation is profitable in a challenging time for both

the airline and aircraft leasing sector.

"At the outset of the COVID-19 pandemic Avation instituted a

programme of support for its airline customers by agreeing to defer

payment of a portion of their rent in the short-term. The cashflow

impact of this support programme has been mitigated by adjusting

the amortisation profiles of related financings with the agreement

of lenders. Since the start of the pandemic the Company has also

reduced administration costs and has instituted a temporary pause

on capital expenditure with the goal of preserving liquidity.

"The Company believes that airlines will require significant

number of leased aircraft in the post pandemic phase due to the

vast number of older aircraft that have been retired and the impact

of the pandemic on airline balance sheets, reducing their ability

to purchase aircraft directly. This supports the Company strategy

of being focussed on relatively new and popular commercial aircraft

types.

"The Company is fortunate that some of its largest customers are

in countries where there has been a brief or manageable impact from

the pandemic. We are now observing a return to service of certain

customers including VietJet, airBaltic, EVA Air and Mandarin

Airlines which combined represent of the order of 60% of Avation's

future unearned contracted leasing revenue.

"Avation is optimistic about the long-term opportunity for

airline travel particularly the turboprop and narrow-body aircraft

sectors. The Company will position itself for a return to growth

through opportunistic purchases and delivery of its orderbook in a

post pandemic environment "

Financial Highlights and Analysis

30 June 30 June

2020 2019 Change

US$ 000's US$ 000's

Revenue 135,274 119,055 14%

Depreciation (46,666) (41,011) 14%

Administrative expenses (11,913) (10,954) 9%

%

Other income and expenses, net (1,150) 49

--------------------------------------------- ----------- -----------

Operating profit excluding Unrealised gain

on purchase rights, Gains on disposal and

Impairment loss on aircraft 75,545 67,139 13%

Finance income and expenses, net (55,721) (51,606) 8%

--------------------------------------------- ----------- -----------

Profit before tax excluding Unrealised gain

on purchase rights, Gains on disposal of

aircraft and Impairment loss on aircraft 19,824 15,533 28%

Unrealised gain on aircraft purchase rights 27,110 -

Gains on disposal of aircraft 3,230 10,026

Impairment loss on aircraft (35,524) -

--------------------------------------------- ----------- -----------

Profit before taxation 14,640 25,559 (43%)

Taxation (4,924) 132

--------------------------------------------- ----------- -----------

Profit after tax 9,716 25,691 (62%)

EPS 15.4 cents 40.3 cents (62%)

Dividend per share 10.6 cents 9.25 cents 15%

Fleet assets (1) 1,242,176 1,269,682 (2%)

Total assets 1,415,584 1,392,750 2%

Cash and bank balances 114,585 107,448 7%

Net asset value per share (US$) (2) $3.53 $3.74 (6%)

Net asset value per share (GBP) (3) GBP2.86 GBP2.95 (3%)

1. Fleet assets are defined as property, plant and equipment

plus assets held for sale plus finance lease receivables.

2. Net asset value per share is total equity divided by the

total number of shares in issue, excluding treasury shares, at

period end.

3. Based on GBP:USD exchange rate as at 30 June 2020 of 1.23 (30 June 2019 : 1.27)

Aircraft Fleet

Aircraft Type 30 June 2020

Boeing 777-300ER 1

Airbus A330-300 1

Airbus A321-200 7

Airbus A320-200 2

Boeing 737-800 1

Airbus A220-300 6

Fokker 100 2

ATR 72-600 22

ATR 72-500 6

-------------

Total 48

At June 30, Avation's fleet comprised 48 aircraft, including

seven aircraft on finance lease. The weighted average age of the

fleet is 4.1 years (2019: 3.4 years) and the weighted average

remaining lease term is 6.9 years (2019: 7.5 years).

Fleet assets decreased 2% to $1,242.2 million (2019: $1,269.7

million). Three ATR72-600 aircraft were added to the fleet in the

period. Three Fokker 100 aircraft were transferred to the lessee

airline upon completion of their finance leases. Narrowbody

aircraft make up 47.5% of the fleet as at 30 June 2020.

Avation has orders for eight additional ATR 72-600 aircraft and

has purchase rights for a further 25 aircraft.

Airline Customers in Administration (update as of 23 October

2020)

Avation had two airline customers (Virgin Australia and

Braathens) subject to insolvency administrations as of the end of

the reporting period.

Virgin Australia

Avation had a total of 13 aircraft on lease to Virgin Australia

when it entered administration. These included six ATR72-500

aircraft, five ATR72-600 aircraft and two Fokker 100 jet aircraft.

Since the commencement of administration, Avation has entered into

new lease arrangements for five of these aircraft, including

finance leases for the sale of the two Fokker 100 aircraft,

operating leases for two ATR72-500s with a new airline customer in

Australia and a five year operating lease for an ATR72-500 aircraft

with a new airline customer in Asia.

The three remaining ATR72-500s have been returned to Avation and

are now undergoing maintenance in preparation for re-marketing for

lease or sale. The Administrator has also commenced the return of

the five ATR72-600 aircraft. Avation is now seeking to reposition

or sell a total of eight ATR72 aircraft. The total secured debt

outstanding against these eight aircraft amounts to US$30.7

million.

The majority of the Company's claim against Virgin Australia

consists of outstanding rent and end-of-lease return maintenance

compensation. Avation's preliminary proof of debt claim against

Virgin Australia amounts to US$74.7 million. On 25 August 2020, the

Administrator released a report to creditors which provided

guidance that the estimated return to unsecured creditors will be

9%-13% of the amount owed with payment expected prior to 30 June

2021.

Braathens

Avation had two ATR72-600 aircraft on lease to Braathens when it

entered administration. The airline has now successfully exited

administration and restarted operations. Avation has agreed new

lease terms with the airline including extensions in lease duration

from 10 to 12 years. The Company has also negotiated adjustments to

the amortisation profiles of the related financings with the senior

lender to reflect the revised lease terms. Avation is optimistic of

maintaining a profitable customer relationship with Braathens in

the event that airline is able to maintain the current lease

terms.

Recognition of Purchase Rights

The Company holds Purchase Rights to acquire 25 additional

aircraft under its contract with ATR. In December 2019, the Company

changed its business model for Purchase Rights by recognising that

it holds excess Purchase Rights over and above the Company's

requirement to acquire additional ATR aircraft for its fleet. The

Company will seek to dispose of excess Purchase Rights from time to

time when market conditions are favourable. In recognition of this

change in business model, the Company recognised the Purchase

Rights at fair value through profit or loss in the financial

statements.

Purchase Rights for 25 ATR72-600 aircraft, represent a material

source of growth for Avation and potential value for shareholders.

Fair values for Purchase Rights were determined by the Company

based on an independent third-party valuation of the aircraft

delivery positions. The recognition of this asset on the balance

sheet has generated an unrealised gain of $27.1 million. Purchase

Rights are subject to revaluation through profit or loss at each

future balance sheet date.

Debt summary

30 June 2020 30 June 2019

US$000's US$000's

Loans and borrowings 1,071,738 1,078,288

Unrestricted cash and bank

balances 35,290 61,689

Net indebtedness (1) 1,036,448 1,016,599

Debt to assets (2) 75.7% 77.4%

Weighted average cost of secured

debt (3) 3.6% 3.7%

Weighted average cost of total

debt (4) 4.5% 4.6%

1. Net indebtedness is defined as loans and borrowings less unrestricted cash and bank balances.

2. Debt to assets is defined as total debt divided by total assets.

3. Weighted average cost of secured debt is the weighted average

interest rate for secured loans and borrowings at period end.

4. Weighted average cost of total debt is the weighted average

interest rate for total loans and borrowings at period end.

The weighted average cost of total debt decreased to 4.5% as at

30 June 2020 (2019: 4.6%). The weighted average cost of secured

debt decreased to 3.6% at 30 June 2020 (2019: 3.7%).

At the end of the year, Avation's debt to assets ratio was 75.7%

(2019: 77.4%). At 30 June 2020, 90.7% of total debt was at fixed or

hedged interest rates (2019: 92.0%). The proportion of unsecured

debt to total debt was 32.3% (2019: 32.0%).

Avation will continue to source secured and unsecured debt

finance to fund fleet growth with the overriding objective of

lowering its weighted average cost of finance.

Avation is currently reviewing alternatives in relation to the

Avation Capital S.A. 6.5% senior notes due 2021 issued under

Avation's global medium-term note programme and has retained

specialist financial advisers, PJT Partners, to assist with this

process.

Dividend

The Board declared an interim dividend of 2.1 US cents per share

in respect of the six months ended 31 December 2019, which was paid

9 January 2020.

A dividend of 8.5 US cents per share declared in respect of the

financial year ended 30 June 2019 was paid on 18 October 2019.

The Company advised in May 2020 that as part of the COVID-19

strategy to preserve liquidity there would be no further dividends

for this financial period.

Market Positioning

Avation's strategy is to target growth and diversification by

adding new airline customers, while maintaining a low average

aircraft age and long remaining lease term metrics. Avation focuses

on new and relatively new commercial passenger aircraft on

long-term leases. Avation is capable of owning, managing and

leasing turboprop, narrowbody and twin-aisle aircraft and

engines.

The Company's business model involves rigorous investment

criteria and has a history of delivering consistent profitability

while seeking to mitigate the risks associated with the aircraft

leasing sector. Avation will typically sell mid-life and older

aircraft and redeploy capital to newer assets. This approach is

intended to mitigate technology change risk, operational and

financial risk, support sustained growth and deliver long-term

shareholder value.

Avation is an active trader of aircraft and from time to time

will consider the acquisition or sale of individual or smaller

portfolios of aircraft, based on prevailing market opportunities

and consideration of risk and revenue concentrations.

Engine Leasing

In January 2020 Avation completed the purchase of a Pratt &

Whitney PW127M aircraft engine. This acquisition represents

Avation's first investment in an individual engine for leasing.

Avation entered into a short-term lease of this engine. Airlines

require access to spare engines to ensure continuous operation of

aircraft. This new business line is synergistic to Avation's core

aircraft leasing business.

Interim Management Statement

The Company's continuing focus for the 2021 financial year is to

preserve liquidity and maintain cashflow while the pandemic

persists and the airline industry is severely impacted.

Management believes that the risks associated with its portfolio

of assets have been reduced through the growth and diversification

that has been achieved in recent years.

In addition to operational cash flows, funding is traditionally

sourced from capital markets, asset-backed bank lending and

disposal of selected aircraft. Access to acceptably priced funding

is a risk, which is common to all capital-intensive businesses.

Specific risks which are inherent to the aircraft leasing industry

include, but are not limited to, ongoing pandemic impacts on

travel, the creditworthiness of airline customers, over-production

of new aircraft and market saturation, technology change, residual

value risks, competition from other lessors and the risk of

impairment of aircraft assets.

Results Conference Call

Avation's senior management team will host a conference call on

23 October 2020, at 1pm BST (UK) / 8am EST (US) / 8pm SGT

(Singapore), to discuss the Company's financial results. Investors

can participate in the conference call by using the following

link:

https://avation.emincote.com/avapFY2020/vip_connect

You will need to register your name and email address. You will

receive a telephone number, a passcode and an individual PIN

number. The conference call will also be webcast live through the

following link:

https://avation.emincote.com/avapFY2020

To view the webcast, you will need to register your name and

email address . A replay of the broadcast will be available on the

Investor Relations page of the Avation Plc website.

Annual General Meeting

The annual general meeting of the Company is expected to be held

at the Company's headquarters in Singapore on 8 December 2020 at

9am GMT (UK) / 5pm SGT (Singapore). Notice of the annual general

meeting will be issued in due course.

Forward Looking Statements

This release contains certain "forward looking statements".

Forward looking statements may be identified by words such as

"expects," "intends," "initiate", "anticipates," "plans,"

"believes," "seeks," "estimates," "will, " or words of similar

meaning and include, but are not limited to, statements regarding

the outlook for Avation's future business and financial

performance. Forward looking statements are based on management's

current expectations and assumptions, which are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. Actual outcomes and results may differ

materially due to global political, economic, business,

competitive, market, regulatory and other factors and risks.

Further information on the factors and risks that may affect

Avation's business is included in Avation's regulatory

announcements from time to time, including its Annual Report, Full

Year Financial Results and Half Year Results announcements. Avation

expressly disclaims any obligation to update or revise any of these

forward-looking statements, whether because of future events, new

information, a change in its views or expectations, or

otherwise.

Basis of presentation

This announcement covers the unaudited results of Avation PLC

for the year ended 30 June 2020.

Financial information presented in this announcement is being

published for the purposes of providing preliminary Group financial

results for the year ended 30 June 2020. The financial information

in this preliminary announcement is not audited and does not

constitute statutory financial statements of Avation PLC within the

meaning of section 434 of the Companies Act 2006. The Group

statutory financial statements for the year ended 30 June 2020 are

expected to be delivered to the Registrar of Companies by 31

October 2020. (as at the date of this report, such statutory

financial statements have not been reported on by the independent

auditors of the Company). However, the independent auditors have

indicated that the audit opinion on such statutory financial

statements will be an unqualified opinion with a material

uncertainty related to going concern. Such financial statements

will include a disclosure by the Directors of the Company that

there is a material uncertainty relating to the Directors'

intention to obtain an extension to the 6.5% senior notes due 2021.

The Board of Directors approved this financial information on 22

October 2020. Avation PLC's most recent statutory financial

statements for the purposes of Chapter 7 of Part 15 of the

Companies Act 2006 for the year ended 30 June 2019, upon which the

auditors have given an unqualified audit report, were published on

27 September 2019 and have been annexed to the annual return and

delivered to the Registrar of Companies.

All "$" amounts in this release are US Dollar amounts unless

stated otherwise. Certain comparative amounts have been

reclassified to conform with current year presentation.

-S-

More information on Avation PLC can be found at: www.avation.net

. Avation welcomes shareholder questions and comments and advises

the email address is: investor @avation.net

Enquiries:

Avation PLC T: +65 6252 2077

Jeff Chatfield, Executive Chairman

AVATION PLC

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

FOR THE FINANCIAL YEARED 30 JUNE 2020

2020 2019

US$'000s US$'000s

Continuing operations

Revenue 135,274 119,055

Other income 1,270 215

136,544 119,270

Depreciation (46,666) (41,011)

Gain on disposal of aircraft 3,230 10,026

Unrealised gain on aircraft purchase rights 27,110 -

Impairment loss on aircraft (35,524) -

Administrative expenses (11,913) (10,954)

Other expenses (2,420) (166)

Operating profit 70,361 77,165

Finance income 1,471 3,722

Finance expenses (57,192) (55,328)

Profit before taxation 14,640 25,559

Taxation (4,924) 132

Profit from continuing operations 9,716 25,691

------------ ------------

Profit attributable to:

Equity holders of the Company 9,714 25,690

Non-controlling interests 2 1

9,716 25,691

------------ ------------

Earnings per share for profit

attributable to equity holders of the Company

Basic earnings per share: 15.39 cents 40.26 cents

Diluted earnings per share 15.36 cents 40.10 cents

------------ ------------

AVATION PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE FINANCIAL YEARED 30 JUNE 2020

2020 2019

US$'000s US$'000s

Profit from continuing operations 9,716 25,691

--------- ---------

Other comprehensive income:

Items that may be reclassified subsequently to profit or loss:

Net loss on cash flow hedge, net of tax (12,947) (18,009)

(12,947) (18,009)

Items that may not be reclassified subsequently to profit or loss:

Revaluation (loss)/gain on property, plant and equipment, net of tax (4,230) 8,181

--------- ---------

Other comprehensive income, net of tax (17,177) (9,828)

Total comprehensive income for the year (7,461) 15,863

--------- ---------

Total comprehensive income attributable to:

Equity holders of the Company (7,463) 15,862

Non-controlling interests 2 1

--------- ---------

(7,461) 15,863

--------- ---------

AVATION PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE FINANCIAL YEARED 30 JUNE 2020

2020 2019

US$'000s US$'000s

ASSETS

Non-current assets

Property, plant and equipment 1,057,901 1,225,324

Trade and other receivables 11,601 8,930

Finance lease receivables 85,019 37,137

Goodwill 1,902 1,902

Derivative financial assets - 363

Aircraft purchase rights 27,110 -

---------- ----------

1,183,533 1,273,656

Current assets

Trade and other receivables 18,210 4,425

Finance lease receivables 7,988 7,221

Cash and bank balances 114,585 107,448

---------- ----------

140,783 119,094

Assets held for sale 91,268 -

---------- ----------

232,051 119,094

---------- ----------

Total assets 1,415,584 1,392,750

---------- ----------

EQUITY AND LIABILITIES

Equity

Share capital 1,108 1,104

Share premium 57,747 56,912

Treasury shares (7,811) (1,147)

Merger reserve 6,715 6,715

Asset revaluation reserve 30,162 34,392

Capital reserve 8,876 8,876

Other reserves (24,302) (11,809)

Retained earnings 148,455 145,644

---------- ----------

Equity attributable to equity holders of the parent 220,950 240,687

Non-controlling interests 72 70

---------- ----------

Total equity 221,022 240,757

---------- ----------

Non-current liabilities

Loans and borrowings 534,755 1,005,693

Trade and other payables 11,725 16,091

Derivative financial liabilities 27,928 10,174

Maintenance reserves 57,141 31,325

Deferred tax liabilities 698 179

---------- ----------

632,247 1,063,462

Current liabilities

Loans and borrowings 536,983 72,595

Trade and other payables 10,155 11,964

Maintenance reserves 3,836 1,166

Income tax payables 1,058 2,806

---------- ----------

552,032 88,531

Liabilities directly associated with assets held for sale 10,283 -

---------- ----------

562,315 88,531

Total equity and liabilities 1,415,584 1,392,750

---------- ----------

AVATION PLC

CONSOLIDATED STATEMENT OF EQUITY CHANGES

FOR THE FINANCIAL YEARED 30 JUNE 2020

Attributable to shareholders of the parent

Share Share Treasury Merger Asset Capital Other Retained Total Non-controlling Total

capital premium Shares reserve revaluation reserve reserves earnings interest equity

reserve

US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s

Balance at 1 July

2019 1,104 56,912 (1,147) 6,715 34,392 8,876 (11,809) 145,644 240,687 70 240,757

Effect of adoption

of IFRS 16 Leases - - - - - - (199) (199) - (199)

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

As at 1 July 2019

(adjusted) 1,104 56,912 (1,147) 6,715 34,392 8,876 (11,809) 145,445 240,488 70 240,558

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

Profit for the

period - - - - - - - 9,714 9,714 2 9,716

Other comprehensive

income - - - - (4,230) - (12,947) - (17,177) - (17,177)

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

Total comprehensive

income - - - - (4,230) - (12,947) 9,714 (7,463) 2 (7,461)

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

Dividends paid - - - - - - - (6,773) (6,773) - (6,773)

Issue of new shares 4 835 - - - - (69) - 770 - 770

Purchase of

treasury

shares - - (6,664) - - - - - (6,664) - (6,664)

Share warrant

expense - - - - - - 592 - 592 - 592

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

Total transactions

with owners

recognised

directly in equity 4 835 (6,664) - - - 523 (6,773) (12,075) - (12,075)

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

Expiry of share

warrants - - - - - - (69) 69 - - -

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

Total others - - - - - - (69) 69 - - -

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

Balance at 30

June 2020 1,108 57,747 (7,811) 6,715 30,162 8,876 (24,302) 148,455 220,950 72 221,022

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- ---------------

AVATION PLC

CONSOLIDATED STATEMENT OF EQUITY CHANGES

FOR THE FINANCIAL YEARED 30 JUNE 2019

Attributable to shareholders of the parent

Share Share Treasury Merger Asset Capital Other Retained Total Non-controlling Total

capital premium shares reserve revaluation reserve reserves earnings interest equity

reserve

US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s

Balance at 1

July

2018 1,080 53,083 - 6,715 27,847 8,876 6,389 124,119 228,109 69 228,178

Profit for the

year - - - - - - - 25,690 25,690 1 25,691

Other

comprehensive

income - - - - 8,181 - (18,009) - (9,828) - (9,828)

--------- --------- ---------- --------- ------------ --------- --------- ---------- ---------- ---------------- ----------

Total

comprehensive

income - - - - 8,181 - (18,009) 25,690 15,862 1 15,863

--------- --------- ---------- --------- ------------ --------- --------- ---------- ---------- ---------------- ----------

Dividend paid - - - - - - - (5,840) (5,840) - (5,840)

Issue of new

shares 24 3,829 - - - - (628) - 3,225 - 3,225

Purchase of

treasury

shares - - (1,147) - - - - - (1,147) - (1,147)

Share warrants

expense - - - - - - 478 - 478 - 478

--------- --------- ---------- --------- ------------ --------- --------- ---------- ---------- ---------------- ----------

Total

transactions

with owners

recognised

directly in

equity 24 3,829 (1,147) - - - (150) (5,840) (3,284) - (3,284)

--------- --------- ---------- --------- ------------ --------- --------- ---------- ---------- ---------------- ----------

Expiry of share

warrants - - - - - - (39) 39 - - -

Release of

revaluation

reserve upon

sale

of aircraft - - - - (1,636) - - 1,636 - - -

--------- --------- ---------- --------- ------------ --------- --------- ---------- ---------- ---------------- ----------

Total others - - - - (1,636) - (39) 1,675 - - -

--------- --------- ---------- --------- ------------ --------- --------- ---------- ---------- ---------------- ----------

Balance at 30

June 2019 1,104 56,912 (1,147) 6,715 34,392 8,876 (11,809) 145,644 240,687 70 240,757

--------- --------- ---------- --------- ------------ --------- --------- ---------- ---------- ---------------- ----------

AVATION PLC

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE FINANCIAL YEARED 30 JUNE 2020

2020 2019

US$'000s US$'000s

Cash flows from operating activities:

Profit before income tax 14,640 25,559

Adjustments for:

Amortisation of lease incentive asset 524 -

Depreciation expense 46,666 41,011

Depreciation of right-of-use assets 217 -

Expected credit loss on receivables and accrued revenue 855 166

Finance income (1,471) (3,722)

Finance expense 57,192 55,328

Gain on disposal of aircraft (3,230) (10,026)

Interest income from finance lease (3,266) (1,382)

Impairment loss on aircraft 35,524 -

Share warrants expense 592 478

Unrealised gain on aircraft purchase rights (27,110) -

Operating cash flows before working capital changes 121,133 107,412

Movement in working capital:

Trade and other receivables and finance lease receivables (5,105) 4,411

Trade and other payables (5,551) 1,412

Maintenance reserves 28,621 8,947

--------- ----------

Cash from operations 139,098 122,182

Finance income received 3,215 2,950

Finance expense paid (51,712) (48,579)

Income tax paid (2,095) (2,946)

--------- ----------

Net cash from operating activities 88,506 73,607

--------- ----------

Cash flows from investing activities:

Purchase of property, plant and equipment (58,739) (328,570)

Proceeds from disposal of aircraft - 70,184

Net cash used in investing activities (58,739) (258,386)

--------- ----------

Cash flows from financing activities:

Net proceeds from issuance of ordinary shares 770 3,225

Dividends paid to shareholders (6,773) (5,840)

Purchase of treasury shares (6,664) (1,147)

Placement of restricted cash balances (33,536) (12,607)

Proceeds from loans and borrowings, net of transactions costs 76,561 301,741

Repayment of loans and borrowings (86,524) (96,854)

--------- ----------

Net cash (used in)/from financing activities (56,166) 188,518

--------- ----------

Net (decrease)/increase in cash and cash equivalents (26,399) 3,739

Cash and cash equivalents at beginning of year 61,689 57,950

--------- ----------

Cash and cash equivalents at end of year 35,290 61,689

--------- ----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UOVSRRVURURA

(END) Dow Jones Newswires

October 23, 2020 02:00 ET (06:00 GMT)

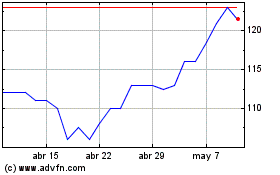

Avation (LSE:AVAP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Avation (LSE:AVAP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024