TIDMWIZZ

RNS Number : 7263G

Wizz Air Holdings PLC

28 July 2021

Q1 F22 RESULTS

CASH FLOW POSITIVE QUARTER, RECOVERY INTO SUMMER

LSE: WIZZ

Geneva, 28 July 2021: Wizz Air Holdings Plc ("Wizz Air" or "the

Company"), the fastest growing European low-cost airline, today

issues unaudited results for the three months to 30 June 2021

("first quarter" or "Q1") for the Company.

Three months to 30 June 2021 2020 Change

-------------------------------------------- --------- ------- ---------

Passengers carried 2,954,213 707,184 317.7%

Revenue (EUR million) 199.0 90.8 119.2%

EBITDA (EUR million) ( 17.8) (42.4) n.m.

EBITDA margin (%) (9.0) (46.7) 37.7ppts

Profit/(loss) for the period (EUR million) (114.4) (108.0) n.m.

Profit/(loss) margin for the period (%) (57.5) (119.0) 61.5ppts

Underlying net profit/(loss) for the period

(EUR million)* (118.7) (56.7) n.m.

Underlying net profit/(loss) margin for

the period (%) (59.6) (56.7) (2.9)ppts

RASK (EUR cent) 2.69 4.36 (38.2)%

Ex-Fuel CASK (EUR cent) 3.57 6.81 (47.5)%

Total Cash (EUR million) 1,662.6 1,587.9 4.7%

Load factor (%) 63.6 55.5 8.1ppts

Period-end fleet 1 41 123 14.6%

-------------------------------------------- --------- ------- ---------

*Q1 FY22 underlying net profit excludes the impact of hedge

gains classified as discontinued (amounting to EUR4.3 million)

József Váradi, Wizz Air Chief Executive commented on the

results:

"The first quarter of F22 remained challenging for the Company

as we operated only 33% of our available capacity as mobility

restrictions continued to be a major barrier to international

travel during this period. We were focused on cash and delivered a

cash flow positive quarter, with a strong liquidity balance of

c.EUR1.7 billion, including c.EUR1.5 billion of free cash - as well

as maintaining our investment grade balance sheet.

Through the quarter we did see encouraging recovery patterns in

passenger air travel. People began returning to flying despite

mobility restrictions still impacting travel. We carried 3.0m

passengers during the quarter, more than four times the number we

carried in the same period of last year. As the quarter progressed

we deployed higher levels of capacity with June operating 62% of

2019 available seat kilometres.

We have now entered a busy part of the summer, ramping up our

operations to meet increased demand whilst maintaining operational

flexibility to deal with evolving travel restrictions as a result

of Covid-19 developments, particularly with respect to new

variants. As we ramp up our operations we continue to be supported

by our dedicated crew and colleagues who have demonstrated agility

and resilience even in the most uncertain and volatile times of

ever changing schedules and expectations."

Commenting on business developments during the period, Mr Váradi

added:

"We continued to strengthen our network for the future,

expanding our Italian market presence further by adding two more

bases, in Rome and Naples. Rome, Fiumicino began operating with

five new A321 aircraft from July and Naples will have a 2 aircraft

operation starting as of August. In Tirana, Albania, we added a 5th

A321 aircraft as we continued to see positive results and strong

demand for our product and service.

We have added leisure routes from our core CEE markets to

Mediterranean destinations to meet strong summer demand. Wizz Air

Abu Dhabi and Wizz Air UK have been impacted by stricter mobility

restrictions, however each has seen gradual improvement in traffic,

particularly along travel corridors to destinations on government

approved lists."

On the summer ramp-up and the outlook, Mr Váradi said:

"We continued ramping up and growing our operations by

recruiting, onboarding and training 600 additional crew. With that

we expect aircraft utilization to increase to 10 hours per day,

getting closer to our pre-pandemic flying times of 12+ hours per

day. In July and August 2021 we expect to operate around 90% and

100% of our 2019 capacity, respectively, making Wizz Air the first

major European airline to fully recover capacity to pre-Covid-19

levels. While we remain cautious with making predictions for the

winter period amid unpredictable government decision making we are

absolutely confident in our much improved competitive positions in

the short, mid and long term arising from continuous fleet growth

based on new aircraft deliveries, an extended market footprint as

well as structural cost advantages arising from fleet up-gauging,

improved commercial arrangements with airports and not being

trapped in debt burden contrary to the vast majority of the

industry.

We remain strategically disciplined on cost and we continue our

fleet renewal, redelivering two A320CEO aircraft with 180 seats and

taking deliveries of six new A321NEOs with 239 seats, that sets our

fleet average seat per aircraft at 207 seats. The accelerated

renewal of our fleet will continue to benefit Wizz Air versus other

competitors on every cost line, including on Fuel CASK even more so

in the current environment where carbon-efficiency is increasingly

critical."

FINANCIAL RESULTS IN Q1

-- Total revenue amounted to EUR199.0 million:

o Ticket revenues increased by 196.8% to EUR87.2 million.

o Ancillary revenues increased by 82.2% to EUR111.9 million.

o Total unit revenue decreased by 38.2% to 2.69 euro cents per

available seat kilometre (ASK).

o Ancillary revenue per passenger decreased by 56.7% versus F21

to EUR37.6, however, versus F20 it was still a 25% increase (up

EUR7.5 per passenger). The decrease in ancillary revenue per

passenger versus Q1 F21 is distorted due to low passenger numbers

and the recognition of cargo revenue under ancillary revenue in Q1

F21.

-- Total cost increased 56.1% to EUR307.7 million:

o Total unit costs decreased by 56.1% to 4.43 euro cents per

ASK, driven by a better asset utilization versus F21)

o Fuel unit costs decreased by 74.0% to 0.86 euro cents per

ASK.

o Ex-fuel unit costs decreased by 47.5% to 3.57 euro cents per

ASK.

-- The statutory loss for the period was EUR114.4 million.

-- Loss for the period excluding exceptional items amounted to EUR118.7m.

-- Total cash at the end of June 2021 increased to EUR1,662.6

million of which EUR1,499.8 million was free cash.

NETWORK ADDITIONS

-- Base rationalization

-- Oslo, Norway: four aircraft

New bases:

-- Rome Fiumicino, Italy: five aircraft

-- Naples, Italy: two aircraft

Base expansion:

-- Tirana, Albania: one additional aircraft, taking the base to five aircraft

-- Fleet expansion to 141 aircraft with the addition of six new

A321neo aircraft in the quarter. At the same time we returned two

end of lease A320ceo aircraft to lessors, which increased the

average seats per aircraft to 207 seats. Wizz Air's average

aircraft age is 5.3 years, one of the youngest fleets of any major

European airline.

SUSTAINABILITY UPDATE

-- On 2 June 2021, the Board announced the creation of a

Sustainability and Culture Committee allowing the Board to dedicate

a separate committee to ESG and culture, chaired by Ms. Charlotte

Pedersen, and with an appointed Director responsible for employee

engagement, Mr. Anthony Radev.

-- On environmental progress is anchored in our investment in

the latest technology aircraft with the highest seat density, which

will enhance the demand for our product in the next ten years as we

will be operating in a more sustainable and cost efficient manner

than the majority of our peers today.

-- In June Wizz Air received an award from World Finance

Magazine for the most sustainable company in the airline industry

2021.

-- Wizz Air does not support the recently published Fit for 55

proposal by the European Commission as it does not create a level

playing field in the industry with regards to taxation of emissions

and kerosene consumption. This will create further market

distortion and further subsidizes inefficient state-backed

carriers:

o We are not supportive of the taxation on kerosene given:

-- It excludes taxation on cargo-only flights (giving a pass to

legacy carriers). Cargo flights drive around 15% of global

emissions

-- It is limited to EEA flights only (giving a pass to long haul

legacy carriers, which cause more than 50% of emissions in the

industry)

o In addition, the kerosene tax is a double taxation with the

current airport-level taxation that was introduced generally to

offset the kerosene tax exemption by Member States as a result of

the 1944 Chicago convention.

-- Wizz Air's CO2 emissions per passenger/km amounted to 74.9

grams per passenger/km for the rolling 12 months to 30 June 2021

and as the industry recovers from Covid-19 we expect emission

intensity to drop quickly as load factors normalize again.

ADDITIONS TO THE MANAGEMENT TEAM

In April 2021 Michael Delehant joined the Leadership Team as an

Executive Vice President and Group Chief Operations Officer. He has

two decades of executive airline experience and a long track record

of leadership, strategy and corporate transformation. After a long

career at Southwest Airlines in the US, he joined Wizz Air from

Vueling in Europe. In his last role at Vueling, Mr. Delehant was

the Chief Strategy and Network Officer.

In June, Robert Carey joined the Leadership Team as President.

Robert started his career in aviation twenty years ago with America

West Airlines, followed by Delta Airlines, after which he spent

over a decade at McKinsey and Company, where he was a Partner prior

to joining Easyjet as Chief Commercial and Strategy Officer in 2017

.

ABOUT WIZZ AIR

Wizz Air, the fastest growing European low-cost airline, operates

a fleet of 142 Airbus A320 and A321 aircraft. A team of dedicated

aviation professionals delivers superior service and very low fares,

making Wizz Air the preferred choice of 10.2 million passengers

in the financial year F21 ending 31 March 2021. Wizz Air is listed

on the London Stock Exchange under the ticker WIZZ. The company

was recently named one of the world's top ten safest airlines by

airlineratings.com , the world's only safety and product rating

agency, and 2020 Airline of the Year by ATW, the most coveted honour

an airline or individual can receive, recognizing individuals and

organizations that have distinguished themselves through outstanding

performance, innovation, and superior service .

For more information:

Zlatko Custovic (Investors), Wizz Air: +36 1 777 9407

Natasha Seager Smith (Media), Wizz Air: +36 1 777 8475

Edward Bridges / Jonathan Neilan, FTI Consulting

LLP: +44 20 3727 1017

- Ends -

Q1 FINANCIAL REVIEW

In the first quarter, Wizz Air carried 2,954,274 passengers, a

317.5% increase compared to the same period in the previous year as

a direct result of the gradually returning travel demand and easing

travel restrictions imposed by governments due to COVID-19. The

Company generated revenues of EUR199.0 million, an increase of

119.3%. These rates compare to capacity increase measured in terms

of ASKs of 255.2% and 264.7% more seats. The underlying loss for

the first quarter was EUR118.7 million.

Consolidated statement of comprehensive income (unaudited)

For the three months ended 30 June - rounded to one decimal

place

2021 2020

Continuing operations EUR million EUR million Change

--------------------------------------- ------------ ------------ -------

Passenger ticket revenue 87.2 29.4 196.8%

Ancillary revenue 111.9 61.4 82.2%

Total revenue 199.0 90.8 119.3%

Staff costs (34.5) (29.3) 17.7%

Fuel costs (63.5) (68.7) -7.6%

Distribution and marketing (7.3) (4.4) 65.9%

Maintenance materials and repairs (41.6) (20.5) 103.0%

Airport, handling and en-route charges (69.9) (21.0) 233.1%

Depreciation and amortisation (90.8) (64.0) 42.0%

Other expenses/income (0.1) 10.7 -100.8%

--------------------------------------- ------------ ------------ -------

Total operating expenses (307.7) (197.1) 56.1%

--------------------------------------- ------------ ------------ -------

Operating profit (108.6) (106.4) 2.1%

--------------------------------------- ------------ ------------ -------

Financial income 0.9 5.0 -81.5%

Financial expenses (20.8) (18.2) 14.4%

Net foreign exchange loss 14.9 12.1 23.0%

Net financing expense (4.9) (1.0) 375.0%

Profit/(loss) before income tax (113.5) (107.4) 5.7%

Income tax (expense)/credit 0.8 0.6 44.9%

--------------------------------------- ------------ ------------ -------

Statutory profit/loss for the period* (114.4) (108.0) 5.9%

--------------------------------------- ------------ ------------ -------

Underlying profit/loss for the period* (118.7) (56.7) 109.4%

--------------------------------------- ------------ ------------ -------

*Q1 FY22 underlying net profit excludes the impact of hedge

gains classified as discontinued (amounting to EUR4.3 million)

Revenue

Passenger ticket revenue increased 196.8% to EUR87.2 million and

ancillary income (or "non-ticket" revenue) increased by 82.2% to

EUR111.9 million, driven by the sharp increase in capacity due to

the gradually returning travel demand. Total revenue per ASK (RASK)

decreased by 38.2% to 2.69 euro cents from 4.36 euro cents in the

same period of F21 driven mostly by exceptional revenue items

included in Q1 F21. For perspective, RASK in Q1 F20 was 3.84 euro

cents and the decline in RASK in Q1 F22 is completely attributable

to load factor differences.

Average revenue per passenger decreased to EUR67.4 in Q1 F22

which was 47.5% lower than the Q1 F21 level of EUR128.3. Average

ticket revenue per passenger decreased from EUR41.5 in Q1 F21 to

EUR29.5 in Q1 F22, average ancillary revenue per passenger

decreased from an exceptionally high EUR86.8 in Q1 F21 to EUR37.6

in Q1 F22, representing a decrease of 56.7%. The decrease in

ancillary revenue per passenger is distorted due to low passenger

numbers and the recognition of cargo revenue under ancillary

revenue in Q1 F21. As noted above, this quarter's average ancillary

revenue per passenger when compared with Q1 F20 (pre-Covid period),

shows an increase of 25.0% from EUR30.1 to EUR37.6 on the back of

strong pricing and sales of products such as flexibility option,

allocated seating etc.

Operating expenses

Operating expenses for the three months increased by 56.1% to

EUR307.7 million from EUR197.1 million in Q1 F21. Total Cost per

ASK ('CASK') decreased by 56.1% to 4.43 euro cents in Q1 F22 from

10.11 euro cents in Q1 F21. CASK excluding exceptional operating

expenses decreased to 4.49 euro cents in Q1 F22 from 7.64 euro

cents in Q1 F21.

Staff costs increased by 17.7% to EUR34.5 million in Q1 F22 from

EUR29.3 million in Q1 F21, driven by higher capacity operated.

Fuel expenses decreased by 7.6% to EUR63.5 million in Q1 F22,

down from EUR68.7 million in the same period of F21. The decrease

was driven primarily by a small gain of EUR4.3 million realized on

discontinued hedges versus the significant loss of EUR51.3 million

realized in Q1 F21. The average fuel price (including hedging

impact and excluding into-plane premium) paid by Wizz Air during

the first quarter was US$538 per tonne, a decrease of 9.0% from

US$591 the same period in F21.

Distribution and marketing costs increased by 65.9% in Q1 F22 to

EUR7.3 million due to the increased revenue performance.

Maintenance, materials and repair costs increased by 103.0% to

EUR41.6 million in Q1 F22 compared to EUR20.5m due to a larger

fleet and end of lease obligations.

Airport, handling and en-route charges increased 233.1% to

EUR69.9 million in the first quarter of F22 versus EUR21.0 in the

prior year, an increase mostly driven behind the ASK increase.

Depreciation and amortisation charges increased by 42.0% in the

first quarter to EUR90.8 million, up from EUR64.0 million in the

same period in F21, as a result of larger fleet and higher

utilization.

Other expenses amounted to EUR0.1 million in the first quarter,

compared to EUR10.7 million income in the same period last

year.

Financial income amounted to EUR0.9 million, down from EUR5.0

million, driven by lower interest rates on deposits.

Financial expenses amounted to EUR20.8 million compared to

EUR18.2 million in Q1 F21.

Net foreign exchange gain was EUR14.9 million, of which EUR21.5

million relate to unrealised foreign exchange gains, compared to a

gain of EUR12.1 million in Q1 F21.

Income tax expense was EUR0.8 million (Q1 F21: EUR0.6 million)

reflecting mainly local business tax and innovation tax in

Hungary.

OTHER INFORMATION

1. Cash, equity

Total cash and cash equivalents (including restricted cash and

cash deposits with more than 3 months maturity) at the end of the

first quarter increased by 4.7% to EUR1,662.6million versus 31

March 2021, of which EUR1,499.8 million is free cash.

2. Hedging positions

Wizz Air operates under a clear set of treasury policies

approved by the Board and supervised by the Audit and Risk

Committee. On 2 June, 2021 Board of Directors approved the Company

's 'no hedge' policy with respect to US dollar and jet fuel price

risk after evaluating the economic costs and benefits of the

hedging programme. Details of the current hedging positions (as of

13 July 2021) are set out below:

Foreign exchange (FX) hedge coverage of Euro/US Dollar

F22 F23

Period covered 9 months 9 months

=============================== ========= =========

Exposure (million) 413 823

Hedge coverage (million) 78 0

Hedge coverage for the period 19% 0%

=============================== ========= =========

Weighted average ceiling 1.17

Weighted average floor 1.12

=============================== ========= =========

Fuel hedge coverage

F22 F23

Period covered 9 months 9 months

================================ ========= =========

Exposure in metric tons ('000) 773 1369

Coverage in metric tons ('000) 170 0

Hedge coverage for the period 22% 0%

================================ ========= =========

Blended capped rate 533

Blended floor rate 484

================================ ========= =========

Sensitivities

-- Pre-hedging, a one cent movement in the Euro/US Dollar

exchange rate impacts this financial year's operating expenses by

EUR3.9 million.

-- Pre-hedging, a $10 (per metric ton) movement in the price of

jet fuel impacts this financial year's fuel costs by $7.5

million.

3. Fully diluted share capital

The figure of 127,574,194 should be used for the Company's

theoretical fully diluted number of shares as at 12 July 2021. This

figure comprises 103,041,132 issued ordinary shares and 24,246,715

new ordinary shares which would have been issued if the full

principal of outstanding convertible notes had been fully converted

on 12 July 2021 (excluding any ordinary shares that would be issued

in respect of accrued but unpaid interest on that date) and 286,347

new ordinary shares which may be issued upon exercise of vested but

unexercised employee share options.

4. Ownership and Control

In preparation for 2021 Annual General Shareholder Meeting

("AGM"), on 2 July, 2021 Company sen t Restricted Share Notice to

Non-Qualifying registered shareholders, informing them of the

number of Ordinary Shares that will be treated as Restricted Shares

and consequently the number of Ordinary Shares in respect of which

they were entitled to exercise their voting rights .

a "Qualifying National" includes: (i) EEA nationals, (ii)

nationals of Switzerland and (iii) in respect of any undertaking,

an undertaking which satisfies the conditions as to nationality of

ownership and control of undertakings granted an operating licence

contained in Article 4(f) of Regulation (EC) No. 1008/2008 of the

European Commission, as such conditions may be amended, varied,

supplemented or replaced from time to time, or as provided for in

any agreement between the EU and any third country (whether or not

such undertaking is itself granted an operating licence); and

a "Non-Qualifying National" includes any person who is not a

Qualifying National in accordance with the definition above.

KEY STATISTICS*

For the three months ended 30 June*

2021 2020 Change

-------------------------------------------------------------------------------------- ---------- --------- -------

Capacity

Number of aircraft at end of period 141 123 14.6%

Equivalent aircraft 137.1 121.4 12.9%

Utilisation (block hours per aircraft per day) 4.42 1.72 157.0%

Total block hours 55,182 19,131 188.4%

Total flight hours 48,418 17,117 182.9%

Revenue departures 23,128 6,767 241.8%

Seat capacity 4,646,853 1,274,324 264.7%

Average aircraft stage length (km) 1,591 1,634 -2.6%

Total ASKs ('000 km) 7,391,209 2,081,105 255.2%

Operating data

RPKs ('000 km) 4,719,299 1,181,986 299.3%

Load factor 63.6% 55.5% 14.5%

Number of passenger segments 2,954,274 707,184 317.5%

Fuel price (average US$ per ton, including hedging impact but excluding into-plane

premium) 538 591 -9.0%

Foreign exchange rate (average US$/EUR, including hedging impact) 1.21 1.13 7.1%

*Figures are rounded to one decimal place

CASK

For the three months ended 30 June*

2021 2020 Change

euro cents euro cents euro cents

--------------------------------------------------- ----------- -----------

Fuel costs 0.86 3.30 (2.44)

Staff costs 0.47 1.41 (0.94)

Distribution and marketing 0.10 0.21 (0.11)

Maintenance, materials and repairs 0.56 0.98 (0.42)

Airport, handling and en-route charges 0.95 1.01 (0.06)

Depreciation and amortisation 1.23 3.07 (1.84)

Other expenses/income 0.00 (0.51) 0.51

Net of financial income and expenses 0.27 0.63 (0.36)

--------------------------------------------- ---- ----------- -----------

Total CASK 4.43 10.11 (5.68)

--------------------------------------------- ---- ----------- -----------

CASK excluding exceptional operating expense 4.49 7.64 (3.15)

--------------------------------------------- ---- ----------- -----------

Total ex-fuel CASK 3.57 6.81 (3.24)

--------------------------------------------- ---- ----------- -----------

*Figures are rounded to two decimal places

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFUWOVRABUBURR

(END) Dow Jones Newswires

July 28, 2021 02:00 ET (06:00 GMT)

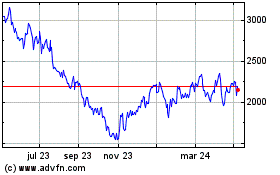

Wizz Air (LSE:WIZZ)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

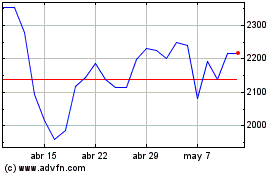

Wizz Air (LSE:WIZZ)

Gráfica de Acción Histórica

De May 2023 a May 2024