Altisource Asset Management Corporation (“AAMC” or the

“Company”) (NYSE American: AAMC) today announced financial and

operating results for the second quarter of 2023.

Second Quarter 2023 Results and Recent Developments

- AAMC obtained a favorable ruling in its litigation with its

preferred shareholder, Luxor, where the appeals court found that

AAMC did not breach any contractual obligations.

- In the Company’s lawsuit against Blackrock and PIMCO, a

court-appointed Staff Master recommended that all of the Company’s

tort and CICO damage claims may proceed in USVI court.

- AAMC second quarter operating results 2023 were similar to the

first quarter of 2023.

- In July 2023, AAMC’s Board of Directors, approved a 2 for 1

stock split, to be treated as stock dividend, with a Record Date of

August 14, 2023. The dividend is expected to close in September

2023.

“We are pleased with the recent developments regarding our court

cases,” said Charlie Frischer, Board Director. “Our current

operations with the lending group are being assessed by the Board

of Directors to determine the best way to achieve the efficiencies

needed for a capital light approach to lending and investing.”

About AAMC

AAMC acquires, originates and manages mortgage loans,

mortgage-backed securities and equity investments in underserved

markets. Additional information is available at

www.altisourceamc.com.

AAMC works to employ capital light operating strategies that

have historically been implemented across a variety of industry

sectors ranging from REIT management and title insurance and

reinsurance to private loan acquisition, origination and

disposition. AAMC is committed to an investment philosophy of

opportunistic deployment of capital in new ventures that we believe

will be accretive to shareholder value. We are likewise committed,

as a matter of core corporate values, to exemplary environmental,

social and governance principles.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding management’s beliefs, estimates, projections,

anticipations, and assumptions with respect to, among other things,

the Company’s financial results, margins, employee costs, future

operations, business plans including its ability to sell loans and

obtain funding, and investment strategies as well as industry and

market conditions. These statements may be identified by words such

as “anticipate,” “intend,” “expect,” “may,” “could,” “should,”

“would,” “plan,” “estimate,” “target,” “seek,” “believe,” and other

expressions or words of similar meaning. We caution that

forward-looking statements are qualified by the existence of

certain risks and uncertainties that could cause actual results and

events to differ materially from what is contemplated by the

forward-looking statements. Factors that could cause our actual

results to differ materially from these forward-looking statements

may include, without limitation, our ability to develop our

businesses, and to make them successful or sustain the performance

of any such businesses; our ability to purchase, originate, and

sell loans, our ability to obtain funding, market and industry

conditions, particularly with respect to industry margins for loan

products we may purchase, originate, or sell as well as the current

inflationary economic and market conditions and rising interest

rate environment; our ability to hire employees and the hiring of

such employees; developments in the litigation regarding our

redemption obligations under the Certificate of Designations of our

Series A Convertible Preferred Stock; and other risks and

uncertainties detailed in the “Risk Factors” and other sections

described from time to time in the Company’s current and future

filings with the Securities and Exchange Commission. The foregoing

list of factors should not be construed as exhaustive.

The statements made in this press release are current as of the

date of this press release only. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements or any other information contained herein, whether as a

result of new information, future events or otherwise.

Altisource Asset Management

Corporation

Condensed Consolidated

Statements of Operations

(In thousands, except share

and per share amounts)

(Unaudited)

Three months ended June

30,

Six months ended June

30,

2023

2022

2023

2022

Revenues:

Loan interest income

$

1,610

$

524

$

3,646

$

524

Loan fee income

300

9

385

9

Realized gains on loans held for sale,

net

10

—

20

—

Total revenues

1,920

533

4,051

533

Expenses:

Salaries and employee benefits

1,909

1,555

3,773

2,479

Legal fees

936

1,379

1,377

2,736

Professional fees

608

309

1,088

575

General and administrative

984

828

1,918

1,557

Servicing and asset management expense

228

181

411

181

Acquisition charges

—

89

—

513

Interest expense

872

—

1,954

—

Direct loan expense

189

—

452

—

Loan sales and marketing expense

382

—

791

—

Total expenses

6,108

4,341

11,764

8,041

Other income (expense):

Change in fair value of loans

390

(325

)

1,239

(325

)

Realized losses on sale of held for

investment loans, net

—

—

(275

)

—

Other

—

8

(2

)

16

Total other income (expense)

390

(317

)

962

(309

)

Net loss from continuing operations before

tax

(3,798

)

(4,125

)

(6,751

)

(7,817

)

Income tax expense

16

7

51

12

Net loss from continuing operations

$

(3,814

)

$

(4,132

)

$

(6,802

)

$

(7,829

)

Net loss attributable to common

stockholders

$

(3,814

)

$

(4,132

)

$

(6,802

)

$

(7,829

)

Continuing

operations earnings per share

Net loss from continuing operations

$

(3,814

)

(4,132

)

$

(6,802

)

(7,829

)

Gain of preferred stock transaction

—

—

0

5,122

Numerator for earnings per share from

continuing operations

$

(3,814

)

$

(4,132

)

$

(6,802

)

$

(2,707

)

Loss per share of common stock -

Basic:

Loss per basic common share

$

(2.16

)

$

(2.00

)

$

(3.84

)

$

(1.31

)

Weighted average common stock

outstanding

1,765,233

2,063,078

1,771,184

2,059,872

Loss per share of common stock -

Diluted:

Loss per diluted common share

$

(2.16

)

$

(2.00

)

$

(3.84

)

$

(1.31

)

Weighted average common stock

outstanding

1,765,233

2,063,078

1,771,184

2,059,872

Altisource Asset Management

Corporation

Condensed Consolidated Balance

Sheets

(In thousands, except share

and per share amounts)

June 30, 2023

December 31, 2022

(unaudited)

ASSETS

Loans held for sale, at fair value

$

21,773

$

11,593

Loans held for investment, at fair

value

51,773

83,143

Cash and cash equivalents

10,532

10,727

Restricted cash

4,002

2,047

Other assets

10,937

10,137

Total assets

$

99,017

$

117,647

LIABILITIES AND EQUITY

Liabilities

Accrued expenses and other liabilities

8,852

10,349

Lease liabilities

1,137

1,323

Credit facilities

42,992

51,653

Total liabilities

52,981

63,325

Commitments and contingencies

Redeemable preferred stock:

Preferred stock, $0.01 par value, 250,000

shares authorized as of June 30, 2023 and December 31, 2022.

144,212 shares issued and outstanding and $144,212 redemption value

as of June 30, 2023 and December 31, 2022, respectively.

144,212

144,212

Stockholders' deficit:

Common stock, $0.01 par value, 5,000,000

authorized shares; 3,443,461 and 1,764,658 shares issued and

outstanding, respectively, as of June 30, 2023 and 3,432,294 and

1,783,862 shares issued and outstanding, respectively, as of

December 31, 2022.

34

34

Additional paid-in capital

149,264

149,010

Retained earnings

34,714

41,516

Accumulated other comprehensive income

21

20

Treasury stock, at cost, 1,678,803 shares

as of June 30, 2023 and 1,648,432 shares as of December 31,

2022.

(282,209

)

(280,470

)

Total stockholder's deficit

(98,176

)

(89,890

)

Total liabilities and equity

$

99,017

$

117,647

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814009043/en/

Charles Frischer T: +1-813-474-9047

charles.frischer@altisourceamc.com

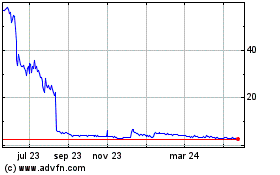

Altisource Asset Managem... (AMEX:AAMC)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

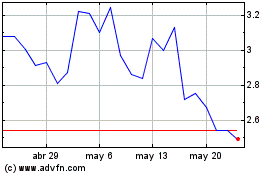

Altisource Asset Managem... (AMEX:AAMC)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025