0001555074false00015550742023-08-302023-08-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 30, 2023

ALTISOURCE ASSET MANAGEMENT CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| U.S. Virgin Islands | | 001-36063 | | 66-0783125 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5100 Tamarind Reef

Christiansted, U.S. Virgin Islands 00820

(Address of principal executive offices including zip code)

(704) 275-9113

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | AAMC | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 30, 2023, Altisource Asset Management Corporation announced the resignation of Chief Executive Officer, Jason Kopack and plans to move forward with restructuring of lending operations. See Exhibit 99.1 for additional information.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| | Press Release dated August 30, 2023 announcing resignation of Chief Executive Officer and plans to move forward with restructuring of lending operations.* |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Furnished but not “filed” for the purposes of determining liability under Section 18 of the Securities Exchange Act of 1934, as amended.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | Altisource Asset Management Corporation |

| August 30, 2023 | By: | /s/ Stephen R. Krallman |

| | Stephen R. Krallman Chief Financial Officer |

| | | | | |

| FOR IMMEDIATE RELEASE | FOR FURTHER INFORMATION CONTACT: |

| Charles Frischer |

| T: +1-813-474-9047 |

| E: charles.frischer@altisourceamc.com |

Altisource Asset Management Corporation Announces Departure of CEO

Company Moves Forward with Restructure of Lending Operations

CHRISTIANSTED, U.S. Virgin Islands, August 30, 2023 (BUSINESS WIRE) - Altisource Asset Management Corporation (“AAMC” or the “Company”) (NYSE American: AAMC) announces the resignation of Chief Executive Officer, Jason Kopcak.

“We remain committed to the mortgage space,” said Chairman of the Board Ricardo Byrd. “As the Board considers potential replacements, we have appointed Danya Sawyer, Chief Operating Officer of Alternative Lending Group, the Company’s principal operating subsidiary, to serve as Interim CEO of AAMC.”

Significant Progress on Cost Cutting Initiatives and Enhancing Liquidity

As announced during the Company’s recent Earnings Call, the Board mandated a comprehensive review of the Company’s mortgage platform to improve the performance of the business. This review involved assessments of operational efficiency and capacity issues, opportunities for cost reductions, strategies for improving liquidity, among other initiatives, all with a view toward enhancing financial performance. While improvements continue, this review is now completed. The Company has already made significant progress in reducing costs and streamlining operations, including the following (all amounts disclosed below are as of August 25, 2023):

•An across-the-board employee right-sizing, considerably reducing annual payroll costs

•Shuttering the Tampa facility and absorbing functions previously undertaken at that location into operating subsidiaries

•Aggressively reducing expenditures for third-party professional services

•Reducing reliance on short-term lines of credit

•Cash and cash equivalents at the company are currently $16.5 million

•Credit lines have been reduced to $20.2 million

•The current loan portfolio consists of $37.1 million in unpaid principal balance

“Our restructuring and cost reduction efforts are well underway,” Chairman Byrd explained. “These are pivotal steps forward which we believe will facilitate a sustainable mortgage operation.”

About AAMC

AAMC acquires, originates and manages mortgage loans, mortgage-backed securities and equity investments in underserved markets. Additional information is available at www.altisourceamc.com.

AAMC works to employ capital light operating strategies that have historically been implemented across a variety of industry sectors ranging from REIT management and title insurance and reinsurance to private loan acquisition, origination and disposition. AAMC is committed to an investment philosophy of opportunistic deployment of capital in new ventures that we believe will be accretive to shareholder value. We are likewise committed, as a matter of core corporate values, to exemplary environmental, social and governance principles.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections, anticipations, and assumptions with respect to, among other things, the Company’s financial results, margins, employee costs, future operations, business plans including its ability to sell loans and obtain funding, and investment strategies as well as industry and market conditions. These statements may be identified by words such as “anticipate,” “intend,” “expect,” “may,” “could,” “should,” “would,” “plan,” “estimate,” “target,” “seek,” “believe,” and other expressions or words of similar meaning. We caution that forward-looking statements are qualified by the existence of certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors that could cause our actual results to differ materially from these forward-looking statements may include, without limitation, our ability to develop our businesses, and to make them successful or sustain the performance of any such businesses; our ability to purchase, originate, and sell loans, our ability to obtain funding, market and industry conditions, particularly with respect to industry margins for loan products we may purchase, originate, or sell as well as the current inflationary economic and market conditions and rising interest rate environment; our ability to hire employees and the hiring of such employees; developments in the litigation regarding our redemption obligations under the Certificate of Designations of our Series A Convertible Preferred Stock; and other risks and uncertainties detailed in the “Risk Factors” and other sections described from time to time in the Company’s current and future filings with the Securities and Exchange Commission. The foregoing list of factors should not be construed as exhaustive.

The statements made in this press release are current as of the date of this press release only. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, whether as a result of new information, future events or otherwise.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

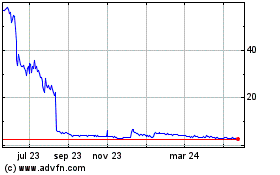

Altisource Asset Managem... (AMEX:AAMC)

Gráfica de Acción Histórica

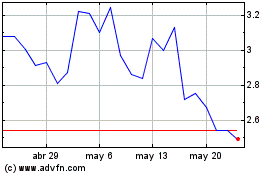

De Nov 2024 a Dic 2024

Altisource Asset Managem... (AMEX:AAMC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024