eMagin Corporation (NYSE American: EMAN) (“eMagin”

or the “Company”), a U.S.-based leader in the development, design,

and manufacture of Active-Matrix OLED microdisplays for

high-resolution, AR/VR and other near-eye imaging products, today

announced both leading independent proxy advisory firms,

Institutional Shareholder Services, Inc. (“ISS”) and Glass, Lewis

& Co. (“Glass Lewis”), have recommended that eMagin

shareholders vote in favor of the proposed merger transaction with

Samsung Display Co., Ltd., a subsidiary of Samsung Electronics Co.

Ltd. and a worldwide manufacturer and distributor of display

products.

As previously announced, eMagin shareholders

would receive $2.08 per share in cash in a proposed transaction

valued at approximately $218 million.

ISS and Glass Lewis are the leading

independent, third-party proxy advisors to thousands of

institutional investors and pension funds.

ISS Recommends Vote FOR

Merger

In its endorsement of the proposed transaction,

ISS explained, “Support for this transaction is warranted, in light

of the premium, the cash form of consideration, and the downside

risks to non-approval… The [eMagin] board was able to negotiate

multiple increases in the merger consideration and the results of a

market check did not indicate any superior alternatives. There

appear to be downside risks to non-approval given substantial

doubts regarding the Company’s ability to remain a going concern,

and the cash form of consideration provides liquidity and certainty

of value.”

Glass Lewis Recommends Vote FOR

Merger

Glass Lewis, in its endorsement of the proposed

transaction, noted, “eMagin’s shares have traded tightly in line

with executed deal value across the calendar quarter subsequent to

announcement. During this period, we note no competitive bids or

alternative transaction opportunities have emerged. Taken together,

these factors would seem to suggest the proposed terms—which were

revised substantially over the course of negotiations with [Samsung

Display]—are at least reasonably likely to approximate eMagin’s

control value under extant market conditions, and that there exists

little substantive expectation the Company will receive a

third-party offer or pre-vote sweetener here… Accordingly, we

recommend shareholders vote FOR this proposal.”

How and Where to Vote

eMagin shareholders as of the close of business

on July 20, 2023, are eligible to vote on the pending transaction

and are encouraged to do so by following the instructions set forth

on their proxy cards or voting instruction forms received via mail

or e-mail before the August 31, 2023, Special Meeting of

Shareholders, which is scheduled to begin at 9 a.m. ET.

If you have any questions or need assistance in

voting your shares, please call our proxy solicitor, Innisfree

M&A Incorporated, at (877) 717-3930.

Approvals and Timing

eMagin’s Board of Directors has unanimously

approved the transaction and is recommending that eMagin’s

stockholders approve the transaction and adopt the merger agreement

at the Special Meeting of Shareholders. Certain of eMagin’s

stockholders who collectively hold approximately 98% of the total

voting power of eMagin’s Series B Convertible Preferred Stock,

which is convertible into approximately 21% of the total voting

power of eMagin’s common stock on a fully diluted basis, have

entered into a support agreement pursuant to which they have

committed to vote such shares in favor of the transaction.

The transaction is expected to close in the

second half of 2023, subject to the approval by eMagin’s

stockholders, applicable regulatory approvals and other customary

closing conditions. Until closing, eMagin and Samsung Display

remain separate and independent companies.

Advisors

Nomura Securities International, Inc. is serving

as exclusive financial advisor to eMagin. White & Case LLP and

Goodwin Procter LLP are acting as the Company’s legal counsel.

Evercore Inc. is serving as exclusive financial advisor to Samsung

Display and O'Melveny & Myers LLP is acting as legal

counsel.

About Samsung Display

Samsung Display is a global leader of

cutting-edge display solutions. The company diversifies display

applications not only for smartphones, TVs, laptops, and monitors,

but also smartwatches, game consoles and automotive applications

and has close partnerships with a variety of global manufacturers.

Samsung Display is leading the foldable display market based on its

innovative technology, enabling the world’s first mass-production

of OLED and Quantum Dot-OLED, and endeavors to develop

next-generation technology such as slidable, rollable, and

stretchable displays to provide new experiences and possibilities

to consumers. Samsung Display prioritizes environmental and social

values throughout the entire process of product manufacturing. The

company will further evolve into a sustainable company dedicated to

the development and happiness of humanity. For more information,

please visit https://www.samsungdisplay.com/eng/index.jsp or

https://global.samsungdisplay.com.

About eMagin Corporation

eMagin is the leader in OLED microdisplay

technology, enabling the visualization of digital information and

imagery for world-class customers in the military, consumer,

medical and industrial markets. The Company invents, engineers, and

manufactures display technologies of the future and is the only

manufacturer of OLED displays in the United States. eMagin's Direct

Patterning Technology (dPd™) will transform the way the world

consumes information. Since 2001, eMagin's microdisplays have been

used in AR/VR, aircraft helmets, heads-up display systems, thermal

scopes, night vision goggles, future weapon systems and a variety

of other applications. For more information, please visit

www.emagin.com.

Cautionary Statement Regarding

Forward-Looking Statements

This document contains “forward-looking

statements” within the meaning of the federal securities laws,

including Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934. These

forward-looking statements are based on the Company’s current

expectations, estimates and projections about the expected date of

closing of the proposed transaction and the potential benefits

thereof, its business and industry, management’s beliefs and

certain assumptions made by the Company and Samsung Display, all of

which are subject to change. In this context, forward-looking

statements often address expected future business and financial

performance and financial condition, and often contain words such

as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,”

“seek,” “see,” “will,” “may,” “would,” “might,” “potentially,”

“estimate,” “continue,” “target,” similar expressions or the

negatives of these words or other comparable terminology that

convey uncertainty of future events or outcomes. All

forward-looking statements by their nature address matters that

involve risks and uncertainties, many of which are beyond our

control, and are not guarantees of future results, such as

statements about the consummation of the proposed transaction and

the anticipated benefits thereof. These and other forward-looking

statements, including the failure to consummate the proposed

transaction or to make or take any filing or other action required

to consummate the proposed transaction in a timely matter or at

all, are not guarantees of future results and are subject to risks,

uncertainties and assumptions that could cause actual results to

differ materially from those expressed in any forward-looking

statements. Accordingly, there are or will be important factors

that could cause actual results to differ materially from those

indicated in such statements and, therefore, you should not place

undue reliance on any such statements and caution must be exercised

in relying on forward-looking statements. Important risk factors

that may cause such a difference include, but are not limited to:

(i) the ability of the parties to consummate the proposed

transaction in a timely manner or at all; (ii) the satisfaction (or

waiver) of closing conditions to the consummation of the proposed

transaction, including with respect to the approval of the

Company’s stockholders; (iii) potential delays in the consummation

of the proposed transaction; (iv) the ability of the Company to

timely and successfully achieve the anticipated benefits of the

proposed transaction; (v) the occurrence of any event, change or

other circumstance or condition that could give rise to the

termination of the merger agreement; (vi) the impact of the

COVID-19 pandemic and the current conflict between the Russian

Federation and Ukraine on the Company’s business and general

economic conditions; (vii) the Company’s ability to implement

its business strategy; (viii) significant transaction costs

associated with the proposed transaction; (ix) potential litigation

relating to the proposed transaction; (x) the risk that disruptions

from the proposed transaction will harm the Company’s business,

including current plans and operations; (xi) the ability of the

Company to retain and hire key personnel; (xii) potential adverse

reactions or changes to business relationships resulting from the

announcement or completion of the proposed transaction; (xiii)

legislative, regulatory and economic developments affecting the

Company’s business; (xiv) general economic and market developments

and conditions; (xv) the evolving legal, regulatory and tax regimes

under which the Company operates; (xvi) potential business

uncertainty, including changes to existing business relationships,

during the pendency of the proposed transaction that could affect

the Company’s financial performance; (xvii) restrictions during the

pendency of the proposed transaction that may impact the Company’s

ability to pursue certain business opportunities or strategic

transactions; and (xviii) unpredictability and severity of

catastrophic events, including, but not limited to, acts of

terrorism or outbreak of war or hostilities, as well as the

Company’s response to any of the aforementioned factors. These

risks, as well as other risks associated with the proposed

transaction, are more fully discussed in the proxy statement filed

with the SEC in connection with the proposed transaction on July

20, 2023 (the “Definitive Proxy Statement”). Additional risks and

uncertainties that could cause actual outcomes and results to

differ materially from those contemplated by the forward-looking

statements are included under the caption “Risk Factors” in the

Company’s most recent annual and quarterly reports filed with the

SEC and any subsequent reports on Form 10-K, Form 10-Q or Form 8-K

filed from time to time and available at www.sec.gov. While the

list of factors presented here is, and the list of factors

presented in the Definitive Proxy Statement are, considered

representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realization of forward-looking statements. Consequences of material

differences in results as compared with those anticipated in the

forward-looking statements could include, among other things,

business disruption, operational problems, financial loss, legal

liability and similar risks, any of which could have a material

adverse effect on the Company’s financial condition, results of

operations, or liquidity. The forward-looking statements included

herein are made only as of the date hereof. The Company does not

assume any obligation to publicly provide revisions or updates to

any forward-looking statements, whether as a result of new

information, future developments or otherwise, should circumstances

change, except as otherwise required by securities and other

applicable laws.

Additional Information and Where to Find

It

In connection with the proposed transaction

between the Company and Samsung Display, the Company filed with the

SEC the Definitive Proxy Statement on July 20, 2023, relating to

the special meeting scheduled for August 31, 2023, which has been

sent or provided to Company stockholders. The Company may also file

other documents with the SEC regarding the proposed transaction.

This document is not a substitute for the Definitive Proxy

Statement or any other document which the Company may file with the

SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

DEFINITIVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT

ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THESE DOCUMENTS AND DOCUMENTS INCORPORATED BY

REFERENCE THEREIN, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION AND RELATED MATTERS. Investors and security holders may

obtain free copies of the Proxy Statement and other documents that

are filed or will be filed with the SEC by the Company through the

website maintained by the SEC at www.sec.gov, the Company’s

investor relations website at emagin.com/investors or by

contacting the Company’s investor relations department at the

following:

Investor

Relationsinvestorrelations@emagin.com

Participants in the

Solicitation

The Company and certain of its directors and

executive officers may be deemed to be participants in the

solicitation of proxies from the Company’s stockholders in respect

of the proposed transaction and any other matters to be voted on at

the special meeting. Information regarding the Company’s directors

and executive officers, including a description of their direct

interests, by security holdings or otherwise, is contained in the

Definitive Proxy Statement in connection with the proposed

transaction. Company stockholders may obtain additional information

regarding the direct and indirect interests of the participants in

the solicitation of proxies in connection with the proposed

transaction, including the interests of Company directors and

executive officers in the proposed transaction, which may be

different than those of Company stockholders generally, by reading

the Definitive Proxy Statement and any other relevant documents

that are filed or will be filed with the SEC relating to the

proposed transaction. You may obtain free copies of these documents

using the sources indicated above.

ContacteMagin CorporationMark A. KochChief

Financial Officer845-838-7900investorrelations@emagin.com

Sharon Merrill Associates, Inc. Nicholas

Manganaro617-542-5300eman@investorrelations.com

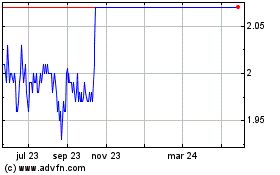

eMagin (AMEX:EMAN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

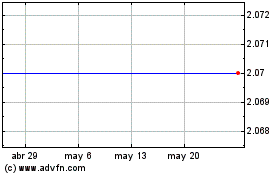

eMagin (AMEX:EMAN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025