Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

28 Agosto 2023 - 3:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No.

)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material under §240.14a-12 |

EMAGIN CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ |

Fee paid previously with preliminary materials |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ACTIVE/124620044.5

About eMagin Corporation

eMagin is the leader in OLED microdisplay technology, enabling the visualization of digital information and imagery for world-class customers in the military, consumer,

medical and industrial markets. The Company invents, engineers, and manufactures display technologies of the future and is the only manufacturer of OLED displays in

the United States. eMagin's Direct Patterning Technology (dPd™) will transform the way the world consumes information. Since 2001, eMagin's microdisplays have

been used in AR/VR, aircraft helmets, heads-up display systems, thermal scopes, night vision goggles, future weapon systems and a variety of other applications. For

more information, please visit www.emagin.com.

Important Cautionary Information Regarding Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on the Company’s current expectations, estimates and projections

about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions

made by the Company and Samsung Display Co., Ltd. (“Samsung Display”), all of which are subject to change. In this context, forward-looking statements often address

expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,”

“seek,” “see,” “will,” “may,” “would,” “might,” “potentially,” “estimate,” “continue,” “target,” similar expressions or the negatives of these words or other comparable

terminology that convey uncertainty of future events or outcomes. All forward-looking statements by their nature address matters that involve risks and uncertainties,

many of which are beyond our control, and are not guarantees of future results, such as statements about the consummation of the proposed transaction and the anticipated

benefits thereof. These and other forward-looking statements, including the failure to consummate the proposed transaction or to make or take any filing or other action

required to consummate the proposed transaction in a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions

that could cause actual results to differ materially from those expressed in any forward-looking statements. Accordingly, there are or will be important factors that could

cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution

must be exercised in relying on forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: (i) the ability of the

parties to consummate the proposed transaction in a timely manner or at all; (ii) the satisfaction (or waiver) of closing conditions to the consummation of the proposed

transaction, including with respect to the approval of the Company’s stockholders; (iii) potential delays in the consummation of the proposed transaction; (iv) the ability

of the Company to timely and successfully achieve the anticipated benefits of the proposed transaction; (v) the occurrence of any event, change or other circumstance or

condition that could give rise to the termination of the merger agreement; (vi) the Company’s ability to continue as a going concern on a stand-alone basis; (vii) potential

litigation relating to the proposed transaction; (viii) the risk that disruptions from the proposed transaction will harm the Company’s business, including current plans and

operations; (ix) the ability of the Company to retain and hire key personnel; (x) potential adverse reactions or changes to business relationships resulting from the

announcement or completion of the proposed transaction; (xi) legislative, regulatory and economic developments affecting the Company’s business; (xii) general

economic and market developments and conditions; (xiii) the evolving legal, regulatory and tax regimes under which the Company operates; (xiv) potential business

uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction that could affect the Company’s financial performance;

(xv) restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions;

and (xvi) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as the Company’s

response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the proxy statement

filed with the SEC in connection with the proposed transaction on July 20, 2023 (the “Definitive Proxy Statement”).

Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included

under the caption “Risk Factors” in the Company’s most recent annual and quarterly reports filed with the SEC and any subsequent reports on Form 10-K, Form 10-Q or

Form 8-K filed from time to time and available at www.sec.gov. While the list of factors presented here is, and the list of factors presented in the Definitive Proxy

Statement are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present

significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the

forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability and similar risks, any of which

could have a material adverse effect on the Company’s financial condition, results of operations, or liquidity. The forward-looking statements included herein are made

only as of the date hereof. The Company does not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result

of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Contact

eMagin Corporation

Mark A. Koch

Chief Financial Officer

845-838-7900

investorrelations@emagin.com

Sharon Merrill Associates, Inc.

Nicholas Manganaro

617-542-5300

eman@investorrelations.com |

ACTIVE/124620042.7

PROTECT YOUR INVESTMENT

Top 5 Reasons to Vote FOR the Transaction

1

Samsung Display’s proposed deal price is their BEST and FINAL offer

• The Board negotiated the price increase from $1.10 to $2.08 after 4 bumps in 6 months of

extensive negotiations

• $2.08 per share all-cash transaction represents immediate and certain value to shareholders

2 eMagin was unable to secure a production-licensing partner

• Hundreds of millions of dollars and at least 3 years are required to design and build a mass-manufacturing line for consumer AR/VR – not affordable to standalone eMagin currently and no

commercially capable counterparty so far

• Samsung is not interested in a partnership or licensing agreement

3 NO other buyer during the market check

• A solicitation of competing offers from 8 strategic parties yielded no actionable alternatives

4 Significant capital raise needed to cover operating losses and fund new

equipment as a standalone company

• Such capital raise would be heavily dilutive to existing stockholders

• As of August 21, 2023, eMagin has borrowed $10.0 million from Samsung Display under a loan

and security agreement that will need to be repaid if the merger is terminated

• eMagin’s independent registered public accounting firm has raised substantial doubt about the

company’s ability to continue to operate (“going concern”)

5 Leading independent proxy advisors ISS and Glass Lewis recommend

voting FOR this deal

• Additionally, Nomura Securities rendered a fairness opinion and determined that the merger

consideration was fair

Your vote is important. Vote now FOR the transaction

1

2

3

4

5 |

ACTIVE/124620044.5

Frequently Asked Questions: Our Proposed Merger with

Samsung

Isn’t eMagin better off

going it alone and not

doing this transaction?

• The proposed merger is more favorable to eMagin’s shareholders than any

other realistically available alternative, including continued operation as

an independent company.

• As a stand-alone company eMagin would need to raise significant capital

to fund new equipment and cover operating losses. Such a capital raise

would be heavily dilutive to existing stockholders.

• As of August 21, 2023, eMagin has borrowed $10.0 million from Samsung

Display under a loan and security agreement that will need to be repaid if

the merger is terminated.

• eMagin’s independent registered public accounting firm has raised

substantial doubt about the company’s ability to continue to operate

(“going concern”).

Don’t you have potential

other strategic

alternatives?

• eMagin solicited competing offers from eight strategic counterparties; all

eight declined a merger deal.

• To date eMagin has been unsuccessful in its efforts to secure a mass

production partner.

• Samsung Display has expressed no interest in a partnership or licensing

agreement with eMagin.

Is Samsung the best

buyer?

• To date, Samsung Display is the only party to express any interest in a

merger transaction.

Did you maximize the

price for shareholders?

• eMagin’s board immediately rejected Samsung Display’s initial offer of

$1.10 per share.

• The final deal price of $2.08 per share was reached after several rounds of

extensive negotiations with the board from October 2022 through May

2023.

• This all-cash transaction represents immediate and certain value to

eMagin’s shareholders.

Did any independent

third parties validate

this was the best price?

• The two leading independent proxy advisory firms, ISS and Glass Lewis,

have recommended voting FOR the transaction.

• Nomura rendered a fairness opinion and determined that the merger

consideration was fair.

Your vote is important. Vote now FOR the transaction

If you have any questions about the special meeting or need assistance in voting your shares, please call our proxy solicitor,

Innisfree M&A Incorporated toll-free at (877) 717-3930 |

Cautionary Statement Regarding Forward-Looking Statements

This document contains “forward-looking statements” within

the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934. These forward-looking statements are based on the Company’s current expectations, estimates and projections

about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s

beliefs and certain assumptions made by the Company and Samsung Display Co., Ltd. (“Samsung Display”), all of which are subject

to change. In this context, forward-looking statements often address expected future business and financial performance and financial

condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,”

“could,” “seek,” “see,” “will,” “may,” “would,” “might,”

“potentially,” “estimate,” “continue,” “target,” similar expressions or the negatives

of these words or other comparable terminology that convey uncertainty of future events or outcomes. All forward-looking statements by

their nature address matters that involve risks and uncertainties, many of which are beyond our control, and are not guarantees of future

results, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking

statements, including the failure to consummate the proposed transaction or to make or take any filing or other action required to consummate

the proposed transaction in a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and

assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Accordingly,

there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and,

therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements.

Important risk factors that may cause such a difference include, but are not limited to: (i) the ability of the parties to consummate

the proposed transaction in a timely manner or at all; (ii) the satisfaction (or waiver) of closing conditions to the consummation of

the proposed transaction, including with respect to the approval of the Company’s stockholders; (iii) potential delays in the consummation

of the proposed transaction; (iv) the ability of the Company to timely and successfully achieve the anticipated benefits of the proposed

transaction; (v) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the

merger agreement; (vi) the Company’s ability to continue as a going concern on a stand-alone basis; (vii) potential litigation relating

to the proposed transaction; (viii) the risk that disruptions from the proposed transaction will harm the Company’s business, including

current plans and operations; (ix) the ability of the Company to retain and hire key personnel; (x) potential adverse reactions or changes

to business relationships resulting from the announcement or completion of the proposed transaction; (xi) legislative, regulatory and

economic developments affecting the Company’s business; (xii) general economic and market developments and conditions; (xiii) the

evolving legal, regulatory and tax regimes under which the Company operates; (xiv) potential business uncertainty, including changes to

existing business relationships, during the pendency of the proposed transaction that could affect the Company’s financial performance;

(xv) restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business

opportunities or strategic transactions; and (xvi) unpredictability and severity of catastrophic events, including, but not limited to,

acts of terrorism or outbreak of war or hostilities, as well as the Company’s response to any of the aforementioned factors. These

risks, as well as other risks associated with the proposed transaction, are more fully discussed in the proxy statement filed with the

SEC in connection with the proposed transaction on July 20, 2023 (the “Definitive Proxy Statement”).

Additional risks and uncertainties that could cause actual outcomes

and results to differ materially from those contemplated by the forward-looking statements are included under the caption “Risk

Factors” in the Company’s most recent annual and quarterly reports filed with the SEC and any subsequent reports on Form 10-K,

Form 10-Q or Form 8-K filed from time to time and available at www.sec.gov. While the list of factors presented here is, and the list

of factors presented in the Definitive Proxy Statement are, considered representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of

forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking

statements could include, among other things, business disruption, operational problems, financial loss, legal liability and similar risks,

any of which could have a material adverse effect on the Company’s financial condition, results of operations, or liquidity. The

forward-looking statements included herein are made only as of the date hereof. The Company does not assume any obligation to publicly

provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise,

should circumstances change, except as otherwise required by securities and other applicable laws.

Additional Information and Where to Find

It

In connection with the proposed transaction between

the Company and Samsung Display, the Company filed with the SEC the Definitive Proxy Statement on July 20, 2023 relating to the special

meeting scheduled for August 31, 2023, which has been sent or provided to Company stockholders. The Company may also file other documents

with the SEC regarding the proposed transaction. This document is not a substitute for the Definitive Proxy Statement or any other document

which the Company may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS AND DOCUMENTS

INCORPORATED BY REFERENCE THEREIN, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Definitive Proxy Statement and

other documents that are filed or will be filed with the SEC by the Company through the website maintained by the SEC at www.sec.gov,

the Company’s investor relations website at emagin.com/investors or by contacting the Company’s investor relations department

at the following:

Investor Relations

investorrelations@emagin.com

Participants in the

Solicitation

The Company and certain of its directors and executive

officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in respect of the proposed

transaction and any other matters to be voted on at the special meeting. Information regarding the Company’s directors and executive

officers, including a description of their direct interests, by security holdings or otherwise, is contained in the Definitive Proxy Statement

in connection with the proposed transaction. Company stockholders may obtain additional information regarding the direct and indirect

interests of the participants in the solicitation of proxies in connection with the proposed transaction, including the interests of Company

directors and executive officers in the proposed transaction, which may be different than those of Company stockholders generally, by

reading the Definitive Proxy Statement and any other relevant documents that are filed or will be filed with the SEC relating to the proposed

transaction. You may obtain free copies of these documents using the sources indicated above.

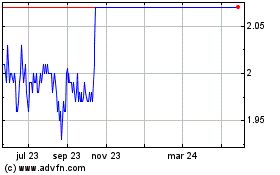

eMagin (AMEX:EMAN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

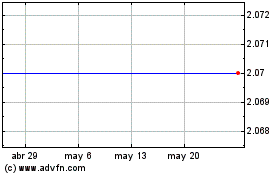

eMagin (AMEX:EMAN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025