Corn ETF Continues Plunge - ETF News And Commentary

01 Abril 2013 - 12:21PM

Zacks

Commodities have had a rough ride over the past year, as a

strong dollar has dulled the potential of many natural resources.

However, we have also seen some solid performances out of a few

commodities in the time frame as well.

In particular, ETF investors have seen some solid trading in the

Teucrium Corn ETF (CORN). This ETF remains the

only pure play fund to target corn, and is thus a great proxy for

the commodity’s performance.

Thanks to a big drought in 2012 and fears over a global food

crunch, CORN was a top performer in the latter half of 2012, adding

over 25% in the time frame. While the bulk of the gains came in

June and July of the time period, CORN managed to hold firm for the

rest of the year and stay at an elevated level.

Lately, however, the trend has been far different with shares of

CORN slumping. In fact, the commodity ETF is now down over 8% in

the past five days, while the dollar ETF UUP is flat, so clearly it

isn’t really dollar strength that is the issue for this commodity

as of late (read Should You Avoid These Agricultural ETFs in

2013?).

What’s Driving CORN?

Instead, the focus in the corn market has been on the inventory

report and the resulting bearishness in the space. Inventories, as

of March 1st, according to the USDA via Bloomberg, hit

5.399 billion bushels, well above the 4.995 billion that analysts

were expecting.

Furthermore, the report showed that plantings will also surge,

up from 97.155 million acres to 97.282 million acres this year.

This level represents the most acreage in three quarters of a

century, adding to the bearish tone hanging over the corn

market.

Unsurprisingly, this shockingly bad report was ill-received by

traders in the grain pits, as they pushed corn futures down to

their limit before the long-weekend. This also led the CORN ETF to

a huge loss, a situation that continued into Monday trading as

well, leaving the fund with a nearly 8% loss in two days (read Time

to Sell This Commodity ETF?).

While this is certainly unfortunate it shouldn’t have been

completely unexpected. We currently have a Zacks ETF Rank of 5 or

‘Strong Sell’ on the fund, along with similarly bearish figures for

many of the other agricultural commodity focused ETFs, suggesting

that the entire space is probably an avoid.

Better Commodity Plays

This bearish report doesn’t bode well for the agricultural

sector going forward, suggesting that low Zacks ETF Ranks may be in

store for this segment for quite some time. After all, with such a

massive corn crop on the horizon, demand for other products like

wheat or soybeans will likely be curtailed, hurting the prospects

of ETFs following these commodities as well (see the Zacks ETF Rank

Guide).

So, for the time being if investors want to make a play on the

commodity space, a look to other segments might be necessary.

Currently, we have solid Zacks ETF Ranks on a few commodities in

the precious metals market such as platinum

(PPLT), palladium (PALL), and

silver (SLV), all of which have Zacks ETF Ranks of

2 or better.

Given the current economic environment and the extra bearishness

surrounding the agricultural market, it could be time to look to

these commodities instead for exposure. Not only do they possess

better Zacks ETF Ranks, but the general outlook is far better,

especially given the latest news out of the USDA on corn.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

TEUCRM-CORN FD (CORN): ETF Research Reports

ETFS-PALLADIUM (PALL): ETF Research Reports

ETFS-PLATINUM (PPLT): ETF Research Reports

ISHARS-SLVR TR (SLV): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

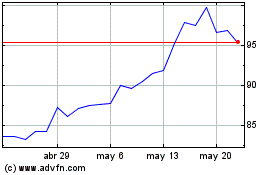

Abrdn Palladium ETF (AMEX:PPLT)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

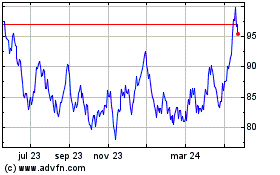

Abrdn Palladium ETF (AMEX:PPLT)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024