Silver ETFs Outshine Gold - ETF News And Commentary

27 Febrero 2012 - 1:00AM

Zacks

Gold has had an excellent run so far in 2012, returning more

than 13% year-to-date. However, the metal that has handily

outshined gold is its so-called poor cousin-silver, which has

returned a whopping 27% year-to-date.

Some of the factors that have supported precious metals’

excellent run in the current year are rising inflationary

expectations due to continued easing policies from the central

banks, and heightened macroeconomic uncertainty in many countries.

Precious metals act as inflation hedge and also as safe haven

assets. (Read- Gold ETFs May Continue to Shine in 2012)

Interest rates in developed and many emerging markets remain

very low, leading investors towards precious metals for better

store of wealth. Investment demand for the precious metals has been

rising as a result. Unlike gold, which also derives its importance

from being a reserve asset, silver is generally not recognized as a

reserve asset. Consequently, there is a very limited amount of

silver stocks held by governments or central banks.

Historically, silver has had a low correlation with most asset

classes and helps in diversifying a portfolio. Further like

platinum, silver is used in wide range of industrial applications

and its price therefore is affected by the level of global economic

activity. (Read- Gold ETFs Surge On Fed Outlook)

About 50% of the metal’s total demand comes from industrial

applications whereas demand from jewelry/silverware/coins &

medals manufacturers accounts for ~30% of the demand. More than 65%

of the global supply of the metal comes from South Africa.

As the overall global manufacturing has continued to improve

slowly, the demand for silver has been on the rise. If the US

economy can stay on its modest recovery path, silver and platinum

will continue to find support. As such both these metals should be

a part of the portfolio. (Read- Time to Invest in Platinum

ETFs?)

While gold has been on the rise for eleven years in a row,

silver had a negative return of about 8% last year as the fears of

global recession led to drop in industrial demand for the metal. In

general, silver metal and the ETFs are more volatile than gold. As

a result, the investors may find suitable investment opportunities

in silver on any pull-backs.

ETFs present a cost-effective, secure and convenient way to get

exposure to silver metal.

iShares Silver Trust (SLV)

SLV is the largest, most liquid and widely traded ETF. It seeks

to track the spot price of physical silver and its share price

reflects the market price of an ounce of silver less trust’s

expenses.

The custodian of the trust holds physical silver bullion in

London on behalf of the trust. Started in April 2006, the trust

currently has net assets of $10.7 billion and charges a fee of

0.50%. The ETF has returned 37.04% in last three years and 15.29%

since inception. The sponsor intends to get the vaults audited

annually and the inspection certificates are available on the

website.

EFTS Physical Silver Shares Trust (SIVR)

SIVR is a relatively newer ETF; launched in July 2009, it

currently manages assets of $637.6 million. The sponsor of the fund

has waived a part its fee until July 2012, which had lowered the

expense ratio to 0.30% from gross ratio of 0.45%. Like SLV, this

trust holds physical silver bullion in London and the shares

represent beneficial interest in the trust. The price of SIVR is

based on the spot price of silver less trust’s expenses.

The silver bullion held by the trust is inspected biannually and

the silver bar numbers held by the trust are published daily.

So, basically SIVR fulfills the same investment objectives as

SLV at a lower cost but we may add that though SIVR is cheaper in

terms of its expense ratio that it charges to the investors, a part

of the saving may be taken away due to higher trading costs for

this ETF (higher bid-ask ratio), since it is much less liquid than

SLV.

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

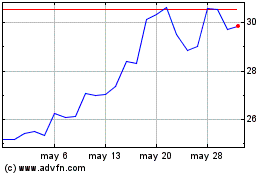

Abrdn Silver ETF (AMEX:SIVR)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Abrdn Silver ETF (AMEX:SIVR)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024