Zacks #1 Ranked Silver ETFs: SLV, SIVR - ETF News And Commentary

19 Septiembre 2012 - 10:03AM

Zacks

Silver started the year 2012 on a strong note but as the year

progressed , a sluggish global economic outlook coupled with a

strong dollar, kept the prices on check (read: Top Commodity ETFs

In This Uncertain Market). Still silver managed to outperform many

other commodity products in the space since the beginning of the

year. The metal got further support from the announcement of

another round of quantitative easing (QE) last week.

While it is aimed at enhancing economic growth, QE3 might also

curtail the dollar value, providing further boost to the silver

bullion prices. The demand for this precious metal has been growing

due to low interest rates in the developed and many emerging

markets, that are attracting investors towards precious metals for

better storage of wealth.

The white metal will not only continue to benefit from being a

precious metal and a store of wealth, but also from a number of key

industrial applications (read: Are Silver ETFs Back on Track?).

About 50% of the metal’s total demand comes from industrial

applications while 30% comes from jewelry/silverware/coins and

medal manufacturers.

Silver metal ETFs are generally more volatile than their gold

counterparts thanks to high beta (read: Four Easy Ways to Play Beta

and Volatility with ETFs). As a result, investors might like to

consider suitable silver ETFs to play the bullish trend in the

precious metal space.

Below we have analyzed two Zacks #1 Rank (Strong Buy) ranked

silver ETFs - iShares Silver Trust (SLV) and EFTS Physical Silver

Shares Trust (SIVR) as we expect these funds to outperform their

peers.

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook for the underlying industry, sector, style

box, or asset class. Our proprietary methodology also takes into

account the risk preferences of investors. ETFs are ranked on a

scale of 1 (Strong Buy) to 5 (Strong Sell) while they also receive

one of three risk ratings, namely Low, Medium, or High.

The aim of our models is to select the best ETFs within each

risk category. We assign each ETF one of five ranks within each

risk bucket. Thus, the Zacks Rank reflects the expected return of

an ETF relative to other products with a similar level of risk.

iShares Silver Trust ETF (SLV)

Launched in April 2006, this fund generated nearly 104% of

returns over the past three years. It is the largest and most

popular silver bullion ETF in the space with assets of $10.4

billion under management (see more ETFs in the Zacks ETF

Center).

The fund tracks almost 100% the physical price of silver bullion

measured in U.S. dollars, and kept in London under the custody of

JPMorgan Chase Bank N.A.. Each share represents about an ounce of

silver at current prices. The trust issues and redeems shares in

the basket form, and hence the ETF often loses its value relative

to the actual silver price.

The product offers diversification benefits for the long-term

investors, making it the most attractive metal after gold. Though

not a low-cost choice due to its 50 bps expense ratio, SLV has a

lower bid ask spread, which could lessen total costs slightly for

this popular fund. The ETF is highly traded in volumes of more than

12 million shares per day on average (read: Guide to the 25 Most

Liquid ETFs).

The fund has gained over 24% so far this year (as of September

14), making it a solid bet at present.

ETFS Physical Silver Shares (SIVR)

This fund has emerged as a strong winner in the silver bullion

space, returning more than 104% over the last three years. It

offers simple and cost-efficient ways to investors seeking exposure

to silver bullion.

Launched in July 2009, the product so far attracted assets of

$594.8 million and tracks the spot price of silver, net of fees and

expenses. It owns silver bars to back the shares under the custody

of HSBC Bank USA in London.

The product is the low cost choice in the silver commodity space

charging investors a fee of 30 bps per year with low bid/ask spread

and good tracking error. It trades in volumes of more than 200,000

shares per day. Like the iShares counterpart, the product generated

excellent returns of about 25% year-to-date (as of September 14)

(read: The Five Best ETFs over the Past Five Years).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ETF-SILVER TRST (SIVR): ETF Research Reports

ISHARS-SLVR TR (SLV): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

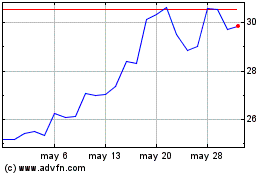

Abrdn Silver ETF (AMEX:SIVR)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Abrdn Silver ETF (AMEX:SIVR)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024