TIDMANA

RNS Number : 9344F

Ananda Developments PLC

13 July 2023

13 July 2023

ANANDA DEVELOPMENTS PLC

AQSE: ANA

("Ananda" or the "Company" or the "Group")

UNAUDITED PRELIMINARY RESULTS FOR THE YEARED 31(st) JANUARY

2023

Ananda's ambition is to be a leading provider of high-quality

cannabinoid-based medicines for the treatment of complex, chronic

inflammatory pain conditions.

The information set out below has been extracted from the

Group's draft report and consolidated accounts for the year ended

31(st) January 2023 and has not been audited. A further

announcement will be released by the Company on completion of the

audit, which is expected shortly, and any material changes between

the financial information set out below and the audited financial

information will be disclosed in that announcement.

Chairman's Statement

I am pleased to announce the Company's and the Group's results

for the financial year ended 31(st) January 2023. During the period

Ananda completed the acquisition of the 50 per cent of DJT Group

Limited ('DJT Group') which was not already owned, commenced and

progressed the genetic stabilisation programme being carried out by

DJT Group's 100% owned subsidiary DJT Plants Limited ('DJT

Plants'), successfully cultivated a trial medical cannabis crop in

DJT Plants' unique, carbon efficient & low-cost growing

environment and renewed DJT Plants' Home Office >0.2% THC

cannabis research cultivation licence.

The most significant corporate event during the year was the

completion of the acquisition of DJT Group and restructuring of

certain Director loans to allow the Company access to more

traditional financing methods going forward. The acquisition and

restructuring were completed on 19(th) December 2022, with the

Company paying GBP3.2 million for the remaining 50% of DJT Group,

with consideration being settled via the issue of 350,000,000

ordinary shares of the Company (these shares are in escrow until 19

December 2025).

Subsequent to the year end, the Company announced and has

completed the acquisition of MRX Global Limited and its wholly

owned subsidiary MRX Medical Limited ('MRX').

MRX has invented a proprietary method to formulate cannabis

medicines, the first of which, MRX1, is to be used in two Phase II

Randomised Controlled Trials (RCTs) to investigate the

effectiveness of cannabidiol (CBD) in chemotherapy induced

peripheral neuropathy (CIPN) and in patients with endometriosis.

MRX's cannabidiol formulations meet the requirements set out by the

National Institute for Health and Care Excellence (NICE) for

research into the effectiveness of CBD with no or trace

tetrahydrocannabinol (THC). MRX1 and MRX2, MRX's second

formulation, will also be launched as unlicensed CBPM's (Cannabis

Based Products for Medicinal use in humans) in the coming

months.

The clinical trials have received combined commitments of

GBP1.55 million in external grant funding and will be carried out

by leading investigators at the University of Edinburgh.

In March 2023, the Company also raised a total of GBP427,400 via

the issue of 142,466,667 ordinary shares of 0.2p each in the

Company at a price of 0.3p per share. This, together with the

conversion of the Loan notes cleaned up the balance sheet of the

Company. The Company maintains an unsecured loan facility from me

which it can draw down on, if required and with the agreement of

both parties.

On 27(th) March 2023, the Company held a General Meeting at

which the MRX acquisition was approved by shareholders. As the

acquisition of MRX and MRX Global Limited was not completed until

after the end of the period ended 31(st) March 2023, its accounts

are not consolidated into the financial reports. They will, of

course, be included in the future results and accounts of the

Company.

Since the close of the MRX acquisition General Meeting, the MRX

team has progressed the business significantly. This includes

agreeing to list the MRX unlicenced oils on three separate

specialist clinic formularies and the launch of the MRX website in

June 2023. The website provides an online point of contact for

specialists interested in prescribing MRX cannabinoid based oils.

In May 2023, the Company also announced that MRX had filed patents

over three cannabinoid formulations: MRX1, MRX2 and its most

recently invented formulation MRX3. These formulations are being

developed as cannabidiol-based medicines for the treatment of a

number of complex inflammatory indications which are unmet by

existing treatments. A fourth application was also filed which

covers the proprietary method for formulating these products.

On 10(th) July 2023, Home Office representatives visited DJT

Plants' facility. This visit was a compliance visit as per the

terms of the DJT licence and standard Home Office practice. Two

seasons of cultivation trials have now been undertaken and the

genetic stabilisation programme is at the third generation of

seeds. As a result, this phase of research is now complete and

DJT's costs will reduce whilst the Company continues to plan for

commercial cultivation and manufacturing.

In the period in question, the Group incurred a loss of

GBP1,127,606 (2021: GBP970,343) before tax, of which approximately

GBP862,778 represents operational costs. Net assets of the Group at

the period end were GBP632,734 (2021: GBP288,016) which does not

include the assets of MRX Global Limited and MRX Medical

Limited.

Charles Morgan

Chairman

ENQUIRIES :

ANANDA DEVELOPMENTS PLC +44 (0)7463 686 497

ir@anandadevelopments.com

Chief Executive Officer

Melissa Sturgess

Finance Director

Jeremy Sturgess-Smith

SP ANGEL CORPORATE FINANCE

LLP +44 (0)20 3470 0470

Corporate Finance

Richard Morrison

Harry Davies-Ball

Corporate Broking

Abigail Wayne

Rob Rees

Statement of Comprehensive Income

Group

31 Jan 31 Jan

2023 2022

GBP GBP

Administrative expenses (862,778) (970,038)

Depreciation (178,230) -

Interest payable (247,983) -

Loss from operations (1,288,991) (970,038)

Loss before taxation (1,288,991) (970,038)

Other Comprehensive Income

R&D repayment 161,385 -

Foreign Exchange Translation

Gain/(Loss) - (305)

Total comprehensive loss

for the year (1,127,606) (970,343)

============ ==========

Statement of Financial Position

Group

31 Jan 31 Jan

2023 2022

GBP GBP

Non-Current assets

Tangible Assets 1,756,522 -

Intangible Assets 3,095,751 -

Investments in subsidiaries - 2,252,192

------------ ------------

Total non-current assets 4,852,273 2,252,192

Current assets

Cash and cash equivalents 18,837 -

Assets under construction 47,080 -

Trade and other receivables 203,776 110,938

Total current assets 269,693 110,938

------------ ------------

Current liabilities

Trade and other payables 1,564,420 1,487,254

Convertible loan notes 2,924,812 587,860

Total current liabilities 4,489,232 2,075,114

------------ ------------

Total assets less current

liabilities 632,734 288,016

============ ============

Capital and reserves

Share capital 2,341,110 1,597,031

Share premium 1,806,544 876,347

Share options reserve 30,216 18,788

Retained earnings (3,545,136) (2,204,150)

Total equity and liabilities 632,734 288,016

============ ============

Statement of Changes in Equity

GROUP Share Share Share Retained Total

Capital Premium Options Earnings

Reserve

GBP GBP GBP GBP

As at 1 February 2022 1,597,031 876,347 18,788 (2,204,150) 288,016

Total comprehensive

loss for the year - - - (1,127,606) (1,127,606)

------------------------ ---------- ---------- --------- ------------ ------------

Restated prior year

retained earnings (213,380) (213,380)

Proceeds from share

issue 744,079 930,197 - - 1,674,276

Issue of share options - - 11,428 - 11,428

Balance at 31 January

2023 2,341,110 1,806,544 30,216 (3,545,136) 632,734

========== ========== ========= ============ ============

Statement of Cash Flows

Group

31 Jan 31 Jan

2023 2022

GBP GBP

Cash flows from operating

activities

Loss for the year (1,127,606) -

Adjustments for:

Depreciation 178,230 -

Share based payment expense 11,427 -

Net finance expense 247,983 -

(Increase) / Decrease in (139,918) -

trade and other receivables

Increase / (Decrease) in 295,262 -

trade and other payables

Net cash outflow from operating ( 534,622 -

activities )

------------ ---------

Investing activities

Investment in DJT - -

Amounts owed by subsidiary - -

Intangible assets (1,213,140) -

Purchase of property, plant (1,756,522) -

and equipment

Net cash (outflow) / inflow/ (2,969,662 -

from investing activities )

------------ ---------

Financing activities

Proceeds from issue of convertible 2,336,952 -

loans

Proceeds from issue of ordinary 1,674,276 -

shares

Proceeds from loans and borrowings (240,124) -

Interest paid (247,983) -

-

------------ ---------

Net cash inflow from financing 3,523,121 -

activities

------------ ---------

Net (Decrease) / Increase 18,837 -

in cash and cash equivalents

Cash and cash equivalents - -

at beginning of year

Cash and cash equivalents 18,837 -

at end of year

============ =========

Going Concern

For the year ended 31 January 2023, the Group recorded a loss of

GBP 1,127,606 and had net cash outflows from operating activities

of GBP534,622. An operating loss is expected in the year subsequent

to the date of these accounts. The ability of the entity to

continue as a going concern is dependent on the Group generating

positive operating cash flows and/or securing additional funding

through the raising of debt or equity to fund its projects.

These conditions indicate a material uncertainty that may cast a

significant doubt about the entity's ability to continue as a going

concern and, therefore, that it may be unable to realise its assets

and discharge its liabilities in the normal course of business.

The financial statements have been prepared on the basis that

the entity is a going concern, which contemplates the continuity of

normal business activity, realisation of assets and settlement of

liabilities in the normal course of business for the following

reasons:

-- The Company secured additional funding by way of a GBP427,200

subscription for ordinary shares in March 2023;

-- The Directors are confident that they will be able to raise

additional funds to satisfy its immediate cash requirements;

and

-- The Directors have the ability to reduce expenditure in order to preserve cash if required.

Should the entity not be able to continue as a going concern, it

may be required to realise its assets and discharge its liabilities

other than in the ordinary course of business, and at amounts that

differ from those stated in the financial statements. In the

unlikely event that the Company will not be able to raise the

required funds for the foreseeable future, the Directors will

institute a programme of cuts to directors' and consultant's

remuneration along with other non-fixed and operational costs. The

financial report does not include any adjustments relating to the

recoverability and classification of recorded asset amounts or

liabilities that might be necessary should the entity not continue

as a going concern.

The Directors of the Company accept responsibility for the

contents of this announcement.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information. Upon the publication

of this announcement via a Regulatory Information Service, this

inside information is now considered to be in the public

domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXGPUBGMUPWUBW

(END) Dow Jones Newswires

July 13, 2023 05:22 ET (09:22 GMT)

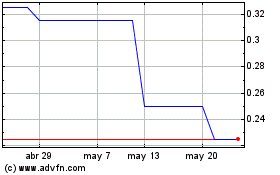

Ananda Developments (AQSE:ANA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ananda Developments (AQSE:ANA)

Gráfica de Acción Histórica

De May 2023 a May 2024