TIDMARK

RNS Number : 9532D

Arkle Resources PLC

27 June 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

27 June 2023

Arkle Resources PLC

("Arkle", the "Group" or the "Company")

Final Results for the Year Ended 31 December 2022

Arkle Resources PLC (LON: ARK), the Irish gold and zinc

exploration and development company, is pleased to announce its

audited results for the year ending 31 December 2022.

Chairman's Statement

Despite the market for junior exploration companies being

friendless Arkle had a good exploration year. We discovered lithium

bearing rocks on our Wicklow / Wexford ground and drilling by our

partners, Group Eleven, on our Stonepark zinc licences identified a

significant geological fault, while we expanded our overseas search

for new projects in Battery Metals and Platinum Group Metals (PGMs)

with the grant of three small licences in Zimbabwe.

During the period we raised GBP200,000 mainly from directors and

associates. In recent months the Arkle share price has been

volatile mainly due to one investor who purchased over 25 million

shares equal to 6.8% of the issued equity only to sell off the

block in large chunks a short time later.

Zinc

The main focus in the period under review was the Stonepark zinc

project where seven holes were drilled. The drilling discovered a

major fault zone in the south of the block of six licences and

identified a significant and extensive zinc target.

Ireland is highly prospective for zinc. Over the past 60 years a

number of world class large zinc mines have been brought into

production and it is believed that more deposits remain to be

discovered.

In the Stonepark area of Limerick, Arkle is in a joint venture

with Group Eleven Resources Corp., a listed Canadian junior, where

Arkle owns 23.44% and Group Eleven, 76.56%. Earlier drilling

discovered an inferred resource of 5.1 million tons at a combined

11.3% zinc / lead. Though zinc / lead metal prices have come back

from highs of over $4,000 a tonne to the current $2,000 plus, the

value the ground is over $200 per ton of ore.

The licence block contains six licences covering 184sq km. In

2022 seven holes were drilled, including four early stage

exploration holes which identified new mineralised trends. Three

additional holes were targeted on previously identified areas,

Carrickittle West, Carrickittle North and Stonepark West. A new

major fault structure was identified at Carrickittle West. This is

now a high priority zinc target at depth. Arkle has indicated to

Group Eleven that it will contribute its share to the drilling on

this block.

Stonepark remains a central asset in the Arkle portfolio. It

lies adjacent to the massive Pallas Green zinc discovery estimated

to contain over 40 million tons and also adjacent to the ongoing

discoveries at Carrickittle made by our partner Group Eleven. Zinc

is a critical metal in economic development. We believe the

deposits in Limerick will be developed in the future.

Gold

Turning to our five licences at Wexford / Wicklow, covering

2,135 km, where we have been exploring the ground looking for

commercial grades and quantities of gold. Significant sampling,

trenching and drilling have repeatedly identified high grade veins.

Getting continuity is the issue. The principal gold target is the

Tombreen area now outlined as 1.5km long and 750 metres wide.

Grades in this area have been up to 50 g/t.

Drilling in Wicklow is complicated. The gold is contained in

veins and is "nuggety". Drilling can miss the veins and / or hit

the veins and miss the nuggets. The answer is more drilling.

Ideally Arkle would find a partner to take detailed exploration to

the next level.

In 2016 Arkle discovered gold on a block of licences in Donegal.

The block was licenced because the geology was similar to that of

the large Dalradian gold deposit in adjacent Tyrone and it was

believed, later confirmed, that there is a gold bearing trend from

Northwest Ireland, through Ulster into Scotland. Drilling found

exciting results. Some high grades but the gold is nuggety making

analysis difficult.

The focus is on the Meenaragh prospect where drill ready targets

have been identified in good grade gold bearing veins. Delays in

renewing our licence application, meant the loss of two drilling

seasons.

Lithium

Though our focus has been on zinc and gold, we are alive to

other opportunities on our licence holdings. The rapid growth in

the demand for batteries containing lithium has stretched the

supply. Rising prices mean that previously uneconomic hard rock

deposits of lithium containing rocks become commercial. It had long

been known that the ground in Wexford / Wicklow area contained

pegmatites which can contain lithium.

Companies immediately to the west of our ground have been

actively searching for lithium for some time including Ganfeng, the

world's leader in lithium. Arkle undertook a Proof of Concept

sampling programme in the Southwest of our licence block. We were

very pleased to discover pegmatites in a number of locations.

Lithium was present though grades were not high.

A short follow up programme on a different part of the block

found indicator minerals but no lithium. The data is being reviewed

to decide on the next steps while we have applied for additional

ground. The programme is at an early stage.

Overseas Interests

The lack of investor interest in Irish exploration led the board

to look at overseas projects particularly in Battery Metals and

PGMs and initially in sub-Saharan Africa where your directors have

experience. We obtained ground in Zimbabwe, a major lithium

producer but have faced delays in expanding the holding.

We reviewed a number of investment opportunities in the past

year and in particular we are pursuing grassroot opportunities in

lithium.

John Teeling

Chairman

26 June 2023

Enquiries:

Arkle Resources PLC

John Teeling, Chairman +353 (0) 1 833 2833

Jim Finn, Finance Director +353 (0) 1 833 2833

SP Angel Corporate Finance LLP

Nominated Adviser & Joint Broker

Matthew Johnson/Adam Cowl +44 (0) 203 470 0470

First Equity Limited

Joint Broker

Jason Robertson +44 (0) 207 374 2212

BlytheRay

Megan Ray +44 (0) 207 138 3204

Teneo

Luke Hogg

ARKLE RESOURCES PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE FINANCIAL YEARED 31 DECEMBER 2022

2022 2021

EUR EUR

Administrative expenses (303,195) (320,266)

- -

---------- ----------

Loss from operations (303,195) (320,266)

Profit/(loss) due to fair value volatility of warrants 3,981 746,526

---------- ----------

Profit/(loss) before tax (299,214) 426,260

Tax expense - -

---------- ----------

Profit/(loss) for the year (299,214) 426,260

Total comprehensive income (299,214) 426,260

========== ==========

Earnings per share attributable to the ordinary equity holders of the parent

cents cents

Profit/(Loss) per share - Basic & Diluted (0.09) 0.14

========== ==========

ARKLE RESOURCES PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2022

2022 2021

EUR EUR

Assets

Non-current assets

Intangible assets 3,991,023 3,831,080

------------ ------------

Current assets

Other receivables 6,928 32,635

Cash and cash equivalents 199,990 79,678

------------ ------------

206,918 112,313

------------ ------------

Total assets 4,197,941 3,943,393

------------ ------------

Liabilities

Current liabilities

Trade and other liabilities (325,799) (233,872)

Warrants (155,690) (159,672)

------------ ------------

Total liabilities (481,489) (393,544)

------------ ------------

Net assets 3,716,452 3,549,849

============ ============

Equity

Called-up Share capital - Deferred 992,337 992,337

Called-up Share capital - Ordinary 988,456 764,956

Share premium reserve 6,922,562 6,680,245

Share based payments reserve 156,494 156,494

Retained deficit (5,343,397) (5,044,183)

------------ ------------

Total Equity 3,716,452 3,549,849

============ ============

ARKLE RESOURCES PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE FINANCIAL

YEARED 31 DECEMBER 2022

Called up Share

Capital Called up Share Share Share Based Payment Retained

Deferred Capital Ordinary Premium Reserve Deficit Total

EUR EUR EUR EUR EUR EUR

At 1 January 2021 992,337 742,612 6,605,681 127,199 (5470,443) 2,997,386

Shares issued - 22,344 74,564 - - 96,908

Share-based payment - - - 29,295 - 29,295

Profit for the year - - - - 426,260 426,260

---------------- ------------------ ---------- -------------------- ------------ ----------

At 31 December 2021 992,337 764,956 6,680,245 156,494 (5,044,183) 3,549,849

---------------- ------------------ ---------- -------------------- ------------ ----------

Shares issued - 223,500 242,317 465,817

Share-based payment - - - - - -

Loss for the year (299,214) (299,214)

---------------- ------------------ ---------- -------------------- ------------ ----------

At 31 December 2022 992,337 988,456 6,922,562 156,494 (5,343,397) 3,716,452

================ ================== ========== ==================== ============ ==========

ARKLE RESOURCES PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE FINANCIAL YEARED 31 DECEMBER 2022

2022 2021

EUR EUR

Cash flows from operating activities

Profit / (loss) for the year (299,214) 426,260

Adjustments for

Share based payments charge - 29,295

Fair Value movement of warrants (3,981) (746,526)

Foreign exchange 12,250 (25,527)

---------- ----------

(290,945) (316,498)

Movements in working capital:

Decrease/(Increase) in trade and other receivables 25,707 (10,712)

Increase in trade and other payables 91,926 57,208

---------- ----------

Net cash used in operating activities (173,312) (270,002)

---------- ----------

Cash flows from investing activities

Payments for exploration and evaluation (159,943) (457,592)

---------- ----------

Net cash used in investing activities (159,943) (457,592)

---------- ----------

Cash flows from financing activities

Proceeds from issue of equity shares 465,817 96,908

Share issue expenses - -

---------- ----------

Net cash generated from financing activities 465,817 96,908

---------- ----------

Net cash increase/(decrease) in cash and cash equivalents 132,562 (630,686)

Cash and cash equivalents at the beginning of year 79,678 684,837

Exchange gains on cash and cash equivalents (12,250) 25,527

---------- ----------

Cash and cash equivalents at the end of the year 199,990 79,678

========== ==========

Notes:

1. Accounting Policies

There were no changes in accounting policies from those used to

prepare the Group's Annual Report for financial year ended 31

December 2021. The financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union and in accordance with the

Companies Act 2014.

2. Earnings per Share

Basic earnings per share is computed by dividing the loss after

taxation for the year attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the profit or loss after taxation for the year by the

weighted average number of ordinary shares in issue, adjusted for

the effect of all dilutive potential ordinary shares that were

outstanding during the year.

The following table sets forth the computation for basic and

diluted earnings per share (EPS):

2022 2021

EUR EUR

Numerator

For basic and diluted EPS Loss after taxation (299,214) 426,260

================ ===============

Denominator No. No.

For basic and diluted EPS 343,481,056 305,517,186

================ ===============

Basic EPS (0.09c) 0.14c

Diluted EPS (0.09c) 0.14c

================ ===============

Basic and diluted loss per share are the same as the effect of the outstanding share options

and warrants is anti-dilutive.

3. Going Concern

The Group incurred a loss for the financial year of EUR299,214

(2021: profit EUR426,260) and had net current liabilities of

EUR274,571 (2021: net current liabilities EUR281,231) at the

statement of financial position date leading to concern about the

Company and Group's ability to continue as a going concern.

The Group had a cash balance of EUR199,990 (2021: EUR79,678) at

the statement of financial position date.

Included in current liabilities is an amount of EUR217,500

(2021: EUR172,500) owed to key management personnel in respect of

remuneration due at the balance sheet date. Key management have

confirmed that they will not seek settlement of these amounts in

cash for a period of at least one year after the date of approval

of the financial statements or until the Group has generated

sufficient funds from its operations after paying its third-party

creditors.

The directors have prepared cashflow projections for a period of

at least twelve months from the date of approval of these financial

statements. As the Group and the Company are not revenue or cash

generating they rely on raising capital from the public market. The

cash flow projections prepared by the Group and Company indicate

that additional finances will be required to meet the obligations

of the Group and Company for a period of at least twelve months

from the date of approval of these financial statements. The

directors are confident that additional capital can be raised as

required. The Group raised GBP397,000 during the year from warrant

exercises and a placing.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include any adjustment to the carrying

amount, or classification of assets and liabilities, if the Company

or Group was unable to continue as a going concern.

4. Intangible Assets

2022 2021

EUR EUR

Exploration and evaluation assets:

Cost:

At 1 January 3,831,080 3,373,488

Additions 159,943 457,592

Impairment - -

------------ ----------

At 31 December 3,991,023 3,831,080

------------ ----------

Carrying amount:

At 31 December 3,991,023 3,831,080

============ ==========

In 2007 the Group entered into an agreement with Teck Cominco

which gave Teck Cominco the option to earn a 75% interest in a

number of other licences held by the Group. Teck Cominco had to

spend CAD$3m to earn the interest. During 2012 the relevant

licences were transferred to a new company, TILZ Minerals Limited,

which at 31 December 2022 was owned 23.44% (2021: 23.44%) by

Limerick Zinc Limited (subsidiary of Arkle Resources plc) and

76.56% (2021: 76.56%) by Group Eleven Resources Corp (third

party).

On 13 September 2017 the board of Arkle Resources plc were

informed that Group Eleven Resources Corp. a private company, has

acquired the 76.56% interest held by Teck Ireland in TILZ Minerals.

Arkle Resources plc owns the remaining 23.44%.

The Group's share of expenditure on the licences continues to be

capitalised as an exploration and evaluation asset. The Group is

subject to cash calls from Group Eleven Resources Corp. in respect

of the financing of the ongoing exploration and evaluation of these

licences. In the event that the Group decides not to meet these

cash calls its interest in TILZ Minerals Limited may be diluted

accordingly.

On 23 June 2022 the Company announced it had been granted three

licences covering 163 hectres to prospect for Lithium in the Insiza

District of the Matabeleland South Province of Zimbabwe. The

Directors believe that these licences, which cover a small area,

represent a low-cost entry into one of the largest lithium

producing countries in the world.

The realisation of the intangible assets is dependent on the

discovery and successful development of economic reserves which is

subject to a number of risks as outlined below:

- uncertainties over development and operational risks;

- compliance with licence obligations;

-ability to raise finance to develop assets;

- liquidity risks; and

- going concern risks.

Should this prove unsuccessful the carrying value included in

the statement of financial position would be written off to the

statement of comprehensive income.

The directors are aware that by its nature there is an inherent

uncertainty in such exploration and evaluation expenditure as to

the value of the asset. Having reviewed the carrying value of

exploration and evaluation of assets at 31 December 2022 the

directors are satisfied that the value of the intangible asset is

not less than carrying value.

Segmental Analysis

2022 2021

EUR EUR

Limerick 1,705,480 1,600,424

Rest of Ireland 2,273,502 2,230,656

Zimbabwe 12,041 -

---------- ----------

3,991,023 3,831,080

========== ==========

5. Trade payables

2022 2021

EUR EUR

Current assets:

Trade and other payables 96,299 42,872

Accruals 229,500 191,000

-------- --------

325,799 233,872

======== ========

It is the Group's normal practice to agree terms of

transactions, including payment terms, with suppliers and provided

suppliers perform in accordance with the agreed terms, it is the

Group's policy that payment is made between 30 - 45 days.

Included in accruals are amounts due for directors' remuneration

of EUR217,500 (2021: EUR172,500) accrued but not paid at year

end.

The carrying value of trade and other payables approximates to

their fair value.

6. Share Capital and Share Premium

2022 2021

Authorised EUR EUR

1,000,000,000 Ordinary shares of EUR0.0025 each 2,500,000 2,500,000

500,000,000 Deferred shares of EUR0.0075 each 3,750,000 3,750,000

---------- ----------

6,250,000 6,250,000

========== ==========

Deferred Shares - nominal value of EUR0.0075

Number Share Share Premium

Capital EUR

EUR

At 1 January 2021 and 2022 132,311,591 992,337 -

------------- -------------- --------------

At 31 December 2021 and 2022 132,311,591 992,337 -

============= ============== ==============

Ordinary Shares - nominal value of EUR0.0025

Allotted, called-up and fully paid:

Number Share Capital Share Premium

EUR EUR

At 1 January 2021 297,044,926 742,612 6,605,681

Issued during the year 8,937,500 22,344 74,564

------------- -------------- --------------

At 31 December 2021 305,982,426 764,956 6,680,245

Issued during the year 89,400,000 223,500 242,317

------------- -------------- --------------

At 31 December 2022 395,382,426 988,456 6,922,562

============= ============== ==============

Deferred share capital

The deferred share reserve comprises of the value of the

deferred shares that arose when the company divided the ordinary

shares via special resolution on 22 April 2020 the shares into

500,000,000 deferred shares of 0.75 cent each and 500,000,000

ordinary shares of 0.25 cent each.

Called up ordinary share capital

The called up ordinary share capital reserve comprises of the

nominal value of the issued share capital of the company.

Share premium

The share premium reserve comprises of a premium arising on the

issue of shares. Share issue expenses are deducted against the

share premium reserve when incurred.

Movement in shares

On 22 February 2022, a total of 30,080,000 shares were issued on

the exercise of 30,080,000 warrants at a price of 0.5p per share to

provide additional working capital and future development

costs.

On 28 April 2022, a total of 9,320,000 shares were issued on the

exercise of 9,320,000 warrants at a price of 0.5p per share to

provide additional working capital and future development

costs.

On 21 November 2022, a total of 50,000,000 shares were issued at

a price of 0.4p per share to provide additional working capital and

fund development costs. For each share subscribed for, the

investors also received one warrant to subscribe for an additional

ordinary share at a price of 0.5p per share until 24 November

2024.

7. Share Based Payments

Equity-settled share-based payments are measured at fair value

at the date of grant.

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of

grant.

Share Options

31 December 2022 31 December 2021

Options Weighted average exercise Options Weighted average exercise

price in pence price in pence

Outstanding at beginning of

year 16,100,000 1.32 13,100,000 1.22

Granted during the year - - 3,000,000 1.80

Expired during the year - - - -

----------- ----------------------------- ----------- -----------------------------

Outstanding at end of year 16,100,000 1.32 16,100,000 1.32

=========== ============================= =========== =============================

Exercisable at end of year 16,100,000 1.32 16,100,000 1.32

=========== ============================= =========== =============================

On 9 March 2021 a total of 3,000,000 options with an exercise

price of 1.8p per option were granted to the directors with a fair

value of EUR29,295. The fair value was calculated using the

Black-Scholes valuation model.

Expected volatility was determined by management based on their

cumulative experience of the movement in share prices.

The terms of the options granted do not contain any market

conditions within the meaning of IFRS 2.

8. Warrants

2022 2021

EUR EUR

Fair Value

At 1 January 159,672 906,198

FV of warrants issued during the year at grant date 155,690 -

FV of warrants exercised during the year (72,192) (68,010)

Movement in fair value (87,480) (678,516)

--------- ----------

At 31 December 155,690 159,672

========= ==========

2022 2021

EUR EUR

Profit/(Loss) due to Fair Value Volatility of Warrants

Fair Value at 1 January 159,672 906,198

Less Fair Value at 31 December 155,690 159,672

Movement for the year 3,981 746,526

======== ========

31 December 2022 31 December 2021

Number of Warrants Weighted average Number of Warrants Weighted average

exercise price in pence exercise price in pence

Outstanding at

beginning of year 110,462,500 0.90 119,400,000 0.90

Granted during the year 50,000,000 0.50 - -

Expired during the year (71,062,500) 0.90 - -

Exercised during the

year (39,400,000) 0.50 (8,937,500) 0.50

------------------- ------------------------ ------------------- ------------------------

Outstanding and

exercisable at the end

of the year 50,000,000 0.50 110,462,500 0.90

=================== ======================== =================== ========================

On 22 February 2022 a total of 30,080,000 warrants and on 28

April 2022 a total of 9,320,000 warrants with an exercise price of

0.5p per warrant were exercised with a fair value of EUR72,192. The

movement in fair value of EUR72,192 was included to the

Consolidated Statement of Comprehensive Income.

The balance of 2,000,000 warrants expired on 22 April 2022. On 7

September 2022 a total of 69,062,500 warrants with an exercise

price of 1.2p per warrant expired. The movement in fair value of

EUR87,480 was included to the Consolidated Statement of

Comprehensive Income.

On 21 November, a total of 50,000,000 warrants with an exercise

price of 0.5p per warrant were granted as part of the placing. The

fair value was expensed to the Consolidated Statement of

Comprehensive Income. The fair value was calculated using the

Black-Scholes valuation model.

9. Other Reserves

Share Based Payment Reserve

EUR

Balance at 1 January 2021 127,199

Granted during the year 29,295

----------------------------

Balance at 31 December 2021 156,494

Granted during the year -

----------------------------

Balance at 31 December 2022 156,494

============================

Share Based Payment Reserve

The share based payment reserve arises on the grant of share

options under the share option plan. Share options expired are

reallocated from the share based payment reserve to retained

deficit at their grant date fair value .

10. Retained Deficit

2022 2021

GBP GBP

Opening Balance (5,044,183) (5,470,443)

Profit/(Loss) for the year (299,214) 426,260

------------ ------------

Closing Balance (5,343,397) (5,044,183)

============ ============

Retained Deficit

Retained deficit comprises of accumulated profits and losses

incurred in the current and prior years.

11. Post Balance Sheet Events

There were no material post balance sheet events affecting the

Group.

12. Annual General Meeting

The Company's Annual General Meeting will be held at held at the

Hotel Riu Plaza The Gresham, 23 O'Connell Street Upper, North City

Dublin, D01 C3W7, Ireland on 27 July 2023 at 10.00am.

General Information

The financial information set out above does not constitute the

Company's financial statements for the year ended 31 December 2022.

The financial information for 2021 is derived from the financial

statements for 2021 which have been delivered to the Companies

Registration Office. The auditors have reported on 2021 statements;

their report was unqualified. The financial statements for 2022

will be delivered to the Companies Registration Office.

A copy of the Company's Annual Report and Accounts for 2022 will

be mailed to all shareholders shortly and will also be available

for collection from the Company's registered office, 162 Clontarf

Road, Dublin 3, Ireland. The annual report will shortly be

available for viewing at Arkle's website at

www.arkleresources.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUMGQUPWGQQ

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

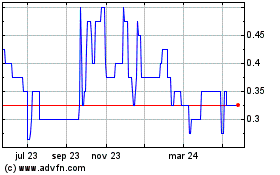

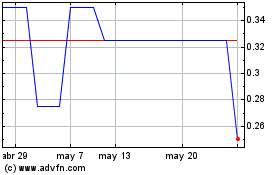

Arkle Resources (AQSE:ARK.GB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Arkle Resources (AQSE:ARK.GB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024