TIDMASPL

RNS Number : 3159Z

Aseana Properties Limited

12 May 2023

12 May 2023

Aseana Properties Limited

("Aseana" or the "Company")

Posting of 2022 Annual Report, Notice of Annual General Meeting

and Notice of a General Meeting with a discontinuation

resolution

Aseana Properties Limited (LSE: ASPL), a property developer in

Malaysia, listed on the Main Market of the London Stock Exchange,

announces that its 2022 Annual Report, Notice of Annual General

Meeting and a Notice of a General Meeting with a discontinuation

resolution have been posted to shareholders.

The General Meeting and Annual General Meeting will be held on

Tuesday, 30 May 2023 at 4.00 p.m. and 4.30 p.m. respectively at 1st

Floor, Osprey House, Old Street, St. Helier, Jersey, JE2 3RG,

Channel Islands.

The 2022 Annual Report, Notice of Annual General Meeting and

Notice of a General Meeting can be obtained on the Company's

website at http://www.aseanaproperties.com/ and have been submitted

to the National Storage Mechanism to be made available for public

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

For further information:

Grant Thornton UK LLP

================================= ==================

Philip Secrett / George Grainger +44(0)20 7383 5100

Set out below is a reproduction of the Chairman's letter to

Shareholders which is contained within the Notice of a General

Meeting :

Letter from the Chairman

ASEANA PROPERTIES LIMITED

(Incorporated in Jersey under the Companies (Jersey) Law 1991

(as amended)

with registered number 94592)

Directors: Registered office:

Nicholas John Paris (Chairman) 1(st) Floor Osprey House, Old Street

Thomas Holland Monica Lai Voon Huey St. Helier

Hock Chye Tan Jersey

Helen Siu Ming Wong JE2 3RG

Channel Islands

12 May 2023

Dear Shareholder

RECOMMED PROPOSALS REGARDING THE FUTURE OF THE COMPANY

1 Introduction and background to the Proposals

When the Company was launched in 2007 the Board considered it

desirable that Shareholders should have an opportunity to review

the future of the Company at appropriate intervals. Accordingly, at

shareholder meetings held in 2015, 2018, 2019 and 2021, in

accordance with the Company's articles of association then in

force, the Board put forward resolutions to Shareholders to

determine if the Company should continue in existence.

Most recently, at the general meeting held on 28 May 2021,

Shareholders again voted for the Company to continue in existence,

continuing to operate in accordance with the divestment investment

policy adopted by the Company at the 2015 AGM to enable the

controlled, orderly and timely realisation of the Company's assets,

with the objective of achieving a balance between periodically

returning cash to Shareholders and maximising the realisation value

of the Company's investments (the "Divestment Investment Policy").

At that meeting, Shareholders also voted to approve certain

amendments to the Articles requiring a further resolution for

Shareholders to determine whether the Company should continue to be

proposed at a general meeting of the Company to be held in May 2023

(the "2023 Discontinuation Resolution").

The notice of general meeting appended to this circular convenes

that general meeting and this letter seeks to provide you with some

further updates and information in relation to the Company to help

inform your decision on how to vote on the Resolutions which are to

be proposed at the General Meeting.

2 Company update

Divestment Investment Policy

The Company adopted the Divestment Investment Policy in June

2015. In 2022, the Company exited its investment in City

International Hospital and International Healthcare Park located in

Vietnam. There remain five assets still to be sold, namely The RuMa

Hotel and the unsold RuMa residences in Kuala Lumpur, the hotel and

the shopping mall in Sandakan and one plot of undeveloped

beachfront land in Kota Kinabalu. The Net Asset Value of the

Company as at 31 December 2022 was US$67.8 million.

The disposal of the remaining assets in the portfolio has been

slower than anticipated since the last discontinuation vote in

2021, mainly attributed to the global pandemic and the resulting

lockdowns and Movement Control Orders in effect for most of 2020,

2021 and finally lifted in April 2022. Since the lifting of the

Covid restrictions, the recovery in Malaysia from Covid related

restrictions has been slower than expected.

To date, net sale proceeds from disposals have largely been used

to pay down project debts across the portfolio, to fund the

Company's working capital requirements and to finance the

construction of The RuMa Hotel and Residences, which was the

Company's final asset to have been developed and, although the

hotel was technically opened in 2018, handover of all the hotel

units to the hotel operator did not occur until late 2019. As a

result of the previous asset disposals, approximately US$10 million

was also returned to Shareholders via a share buyback conducted in

January 2017.

The Board is aware that Shareholders are eager for a more

expeditious disposal programme and it is this which prompted the

restructuring of the Board and the Company's management

arrangements in 2019 and 2020. With these new arrangements in

place, a new sales strategy was adopted and the Board has

prioritised the divestment of the Company's assets as soon as

possible to ensure that further capital can be returned to

Shareholders.

Since internalising the management and disposal process for the

remaining assets, the Board has revised all of the sale due

diligence processes and marketing documentation for each of the

Company's remaining assets, the result being that there is now

extensive information available in virtual data rooms for qualified

buyers interested in the assets in the portfolio. The Board has

identified those assets which it deems to be of highest priority to

sell, on the basis of those properties being more readily saleable

and that the proceeds of those sales would be sufficient to settle

the Company's most significant debt facilities. The early

settlement of those debt facilities would then enable the Company

to use the disposal proceeds of further asset sales thereafter to

return cash to Shareholders.

The new sales strategy for the Company's assets commenced

externally in mid-September 2019. Since then numerous prospective

investors have been approached and non-disclosure agreements have

been signed with interested buyers in respect of three of the

Company's principal assets and active sale discussions continue on

them. As a result, the Company's two assets in Vietnam were sold in

March 2022.

The Board is working to complete the next asset sales during

2023 and will be pragmatic in its approach. However, there can be

no guarantee that these sales will successfully conclude within

this timeframe. As a result, the Board is not currently able to

provide Shareholders with any indication as to when further capital

distributions can be expected from the Company, but re-iterates

that this is the Board's key objective.

The Board is keen to ensure that valuations of the Company's

assets are reflective of the current market environment and a

review of the value of all of the assets within the portfolio was

undertaken as part of the preparation of the 2022 Accounts. The

portfolio revaluation was being conducted using a number of

external valuers (each a specialist in the relevant market of the

relevant asset).

Debt facilities

The Group currently has, in aggregate, approximately US$32.9

million of outstanding bank loans from two different banking

arrangements which financed The RuMa Hotel and the two properties

in Sandakan. Each loan provides the relevant bank with security

over certain of the Group's assets and the Company has granted

corporate guarantees on the Sandakan loans.

The Board has re-negotiated certain of the Group's loan

facilities in order to amend their scheduled repayment dates to

make them coincide with the expected sale dates of the assets that

they have financed. This process is ongoing.

3 2023 Discontinuation Resolution

Notwithstanding the obligation on the Board to propose the 2023

Discontinuation Resolution pursuant to the Existing Articles, the

Board firmly believes that placing the Company into liquidation

(which could be the result of passing the 2023 Discontinuation

Resolution) would have a significant adverse impact on Shareholder

value for the reasons set out below.

Possible breach of banking covenants

The Company believes that, in the event that the 2023

Discontinuation Resolution is passed, an event of default under the

lending covenants of certain of the Company's facility arrangements

could be triggered. If an event of default is triggered, the

relevant loans would become immediately repayable and this could

result in security given to secure those loans being enforced. This

could lead to the banks foreclosing on the Group's loan facilities

and the Group's remaining assets being disposed of on behalf of the

banks rather than Shareholders at significantly lower prices than

anticipated. Further, this could force the Company to enter into

liquidation due to having insufficient liquid assets to repay the

facilities if proceeds from the security that has been enforced are

insufficient. The Group does not currently have sufficient

available cash to be able to repay the entirety of its loans in the

event they are accelerated.

Impact on asset sale values

The Company may not be able to achieve full value for the

Company's remaining assets if the 2023 Discontinuation Resolution

is passed as prospective buyers may seek a reduction to the prices

at which they are willing to acquire the assets in the knowledge

that (a) the Board would be under pressure to take steps to wind up

the Company as soon as practicable; and/or (b) if the passing of

the 2023 Discontinuation Resolution results in an event of default

under, and acceleration of, a loan secured by the Group's assets,

such security may be enforced and the assets may be realised at a

value lower than that which could be expected to be obtained if the

assets were sold/offered to the market in the Group's ordinary

course of business. Proposals

In light of the severity of the possible consequences for

Shareholder value, the Directors are unanimously recommending that

you vote AGAINST the 2023 Discontinuation Resolution.

Instead, the Board recommends that Shareholders allow the

Company to continue for a further 2 years in order to allow the

divestment strategy to deliver results and sell the majority of the

Company's assets. The Board therefore proposes that the next

discontinuation vote take place at a general meeting to be held in

May 2025.

The Board is clear that enabling the Company to continue to

pursue the Divestment Investment Policy, rather than placing the

Company into liquidation or seeking a "fire sale" of the Company's

portfolio at potentially significantly depressed prices, is in the

best interests of the Company and Shareholders as a whole.

In order to implement this proposal, the Existing Articles will

need to be amended. A blacklined version of the proposed amendment

to the Existing Articles is set out in the Appendix to this

circular. The Existing Articles and the Amended Articles (together

with a comparison document showing the changes between the two) are

available for inspection on the Company's website at

www.aseanaproperties.com and during normal business hours on any

weekday (public holidays excepted) at the registered office of the

Company at 1st Floor, Osprey House, 5-7 Old Street, St. Helier,

Jersey, JE2 3RG, Channel Islands.

The Directors are unanimously recommending that you vote FOR the

resolution to amend the Existing Articles which will allow the

Company to continue until May 2025, which will be proposed as a

special resolution.

4 Additional considerations for Shareholders

In connection with the Proposals, Shareholders should be aware

of the following additional considerations:

-- there can be no guarantee that the result of implementing the

Proposals will provide the returns or realise the capital sought by

Shareholders. The Company's investments are illiquid. Accordingly,

they may be disposed of at a discount to their current valuations.

The eventual disposal price of the Company's remaining assets is

unknown and it is possible that the Company may not be able to

realise some investments at any value; and

-- returns of cash will be made at the Directors' sole

discretion, as and when they deem that the Company has sufficient

assets available to return cash to Shareholders, subject to

applicable Jersey law. Shareholders will therefore have little

certainty as to when their capital will be returned. Distributions

pursuant to the orderly realisation programme are subject, amongst

other things, to the Board being able to give the necessary

declaration(s) of solvency required by Jersey law. Distributions

under the orderly realisation programme are subject to the Board

continuing to be satisfied, on reasonable grounds, that the Company

will, at the time of distribution and for a period of 12 months

thereafter, in respect of each distribution, continue to satisfy

the statutory solvency test. Returns of cash may also in certain

circumstances be subject, amongst other things, to the Company

obtaining the consent of one or more lenders to the Group.

5 General Meeting

The implementation of the Proposals is conditional on the

outcome of the votes cast by Shareholders in connection with the

Resolutions to be proposed at the General Meeting. A notice

convening the General Meeting, which is to be held at 4 p.m. on 30

May 2023, is set out at the end of this document.

At the General Meeting, Resolution 1 (the 2023 Discontinuation

Resolution) will be proposed as an ordinary resolution and will

require a vote in favour by Shareholders holding a majority of the

Shares represented at the General Meeting, either in person or by

proxy, and voting on Resolution 1, to be validly passed. The

Directors are unanimously recommending that you vote AGAINST

Resolution 1.

Resolution 2 (the proposed amendment to the Existing Articles to

allow the Company to continue until May 2025) will be proposed,

conditional on the failure of Resolution 1 (the 2023

Discontinuation Resolution), as a special resolution and will

require a vote in favour by Shareholders holding not less than two

thirds of votes cast in order to be validly passed. The Directors

are unanimously recommending that you vote FOR Resolution 2.

Action to be taken by Shareholders

Shareholders are strongly encouraged to exercise their votes on

the matters of business at the General Meeting, either by attending

the meeting in person or by submitting a proxy appointment and

giving voting instructions as set out on the Form of Proxy. We also

encourage the submission of questions to us in writing in advance

of the General Meeting and, where appropriate, those questions, and

our answers to them, will be published on our website

https://www.aseanaproperties.com following the General Meeting.

6 Directors' recommendation

The Directors consider that the Proposals are in the best

interests of the Company and Shareholders as a whole.

Accordingly, the Directors unanimously recommend that you vote

(1) AGAINST Resolution 1 (the 2023 Discontinuation Resolution) to

be proposed at the General Meeting and (2) FOR Resolution 2 (to

amend the Existing Articles).

Yours faithfully

Nicholas John Paris

Chairman

for and on behalf of

Aseana Properties Limited

Set out below is a reproduction of the explanation of the

business we will consider at the AGM which is contained within the

Notice of Annual General Meeting:

Notice is hereby given that the Annual General Meeting of the

Shareholders of Aseana Properties Limited (the "Company") will be

held at 1st Floor, Osprey House, Old Street, St. Helier, Jersey,

JE2 3RG, Channel Islands on

Tuesday, 30 May 2023 at 4:30pm for the following purposes:

Ordinary business

1. To receive and consider the Company's Audited Financial

Statements, together with the Reports of the Directors and the

Auditor for the financial year ended 31 December 2022.

2. To re-elect Monica Lai, who retires by rotation, as a Director.

3. To re-elect Nicholas John Paris as a Director.

4. To elect Hock Chye Tan, who was appointed by the Board on 3 March 2023, as a Director.

5. To re-appoint PKF Littlejohn LLP as Auditor to hold office

from the conclusion of this meeting until the conclusion of the

next annual general meeting of the Company.

6. To authorise the Directors to determine the Auditor's remuneration.

Special business

7. To consider and, if thought fit, to pass the following

resolution which will be proposed as a special resolution:

"THAT the Company be and is hereby generally and unconditionally

authorised for the purposes of Articles 55 and 57 of the Companies

(Jersey) Law 1991 (as amended) to make one or more purchases on the

Main Market operated by the London Stock Exchange plc, of its own

Ordinary Shares provided that:

(a) the maximum aggregate number of Ordinary Shares hereby

authorised to be purchased is 29,783,780 (representing

approximately 14.99 per cent. of the Company's issued ordinary

share capital (excluding ordinary shares held in treasury));

(b) unless a tender offer is made to all holders of Ordinary

Shares, the maximum price to be paid per Ordinary Share must not be

more than the higher of:

(i) 105 per cent. of the average of the middle market quotations

for an Ordinary Share taken from the London Stock Exchange's Main

Market for listed securities for the five Business Days immediately

preceding the date of repurchase; or

(ii) the higher of the price of the last independent trade and

the highest current bid on the trading venues where the purchase is

carried out;

(c) the minimum price to be paid per Ordinary Share must not be

less than US$0.05 or the Sterling equivalent;

(d) unless otherwise renewed, varied or revoked, the authority

hereby conferred shall expire on the later of (i) 12 months from

the date of passing of this resolution; and (ii) the Company's

Annual General Meeting in 2024; and

(e) the Company may make a contract or contracts to purchase the

Ordinary Shares under the authority hereby conferred prior to the

expiry of such authority which will or may be executed wholly or

partly after the expiry of such authority and may make a purchase

of the Ordinary Shares in pursuance of any such contract or

contracts."

8. To consider and, if thought fit, to pass the following

resolution which will be proposed as an ordinary resolution:

"THAT, subject to the provisions of its Articles of Association,

the Company be and is hereby generally and unconditionally

authorised for the purposes of Article 58A of the Companies

(Jersey) Law 1991 (as amended) to hold any Ordinary Shares

repurchased under the share buyback authority set out above as

treasury shares."

by order of the Board of Directors of

Aseana Properties Limited

ICECAP (Secretaries) Limited

Secretary to the Company

Dated: 12th May 2023

Registered Office Address:

1(st) Floor, Osprey House, Old Street, St. Helier, Jersey, JE2

3RG, Channel Islands

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMNKBBNPBKDPPD

(END) Dow Jones Newswires

May 12, 2023 12:03 ET (16:03 GMT)

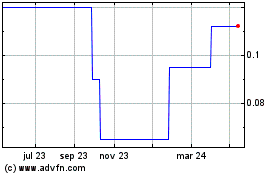

Aseana Prop (AQSE:ASPL.GB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Aseana Prop (AQSE:ASPL.GB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025