Jade Road Investments Limited Partial divestment in Meize Energy Industries (7646P)

22 Junio 2022 - 1:39AM

UK Regulatory

TIDMJADE

RNS Number : 7646P

Jade Road Investments Limited

22 June 2022

22 June 2022

JADE ROAD INVESTMENTS LIMITED

("Jade Road Investments ", " JADE ", the "Company" or the

"Group")

Jade Road Investments Limited (AIM: JADE), the London quoted

pan-Asian diversified investment vehicle focused on providing

shareholders with attractive uncorrelated, risk-adjusted long-term

returns, is pleased to announce that the Company has successfully

negotiated a partial divestment in Meize Energy Industries Holdings

Limited ("Meize"), one of the leading privately-owned wind turbine

blade manufacturing companies in China, currently the third-largest

holding in the Company's portfolio (7.7% of NAV as at

announcement).

On the 23(rd) of November 2011, the Company , through its

wholly-owned subsidiary Swift Wealth Investments Limited,

subscribed to USD7.5MM of Series B Preferred Shares. This

investment equates to a shareholding of approximately 7.2% in

Meize.

The Company is pleased to announce that it has entered into a

share purchase agreement ("SPA") for 112,500 shares of the Series B

Preferred Equity in Meize for consideration of USD1.2 million (the

"Transaction Price"). The Transaction Price will be received by the

Company in three equal tranches. The number of shares sold in this

partial divestment represents 12.0% of the Company's holding in

Meize. The Company will hold approximately 6.3% interest in Meize

post this divestment.

Before the release of this RNS, the Company received the First

Tranche Price of USD400,000. The Company expects to receive the

Second and Third Tranche Price in late July and August 2022 as

agreed in the SPA.

The Transaction Price implies a valuation of USD10.0 million for

the Company's investment in Meize, which indicates a 22.0% premium

to the carrying value as at the 30(th) of June 2021 (USD8.2

million). The profit from this disposal is USD0.3 million.

This divestment, of which the sale consideration is settled

offshore, marks the culmination of a lengthy and successful

turnaround effort by the Company for private investment in

China.

John Croft, Chairman of Jade Road commented : "Exiting private

equity positions held in Chinese companies requires patience as

well as persistence, but as demonstrated by this announcement,

exits can be achieved, and in this case, at a premium to the value

of the asset held in our books. Whilst having no direct connection

with other privately held Chinese assets in our portfolio, it does

provide clear evidence that these assets have real value and that

in time realisations can be made delivering cash returns into the

Company."

For further information on JADE, please visit the Company's

website at www.jaderoadinvestments.com and follow the Company on

Twitter (@ JadeFinance ).

FOR FURTHER INFORMATION, PLEASE CONTACT:

Jade Road Investments Limited +44 (0) 778 531 5588

John Croft

WH Ireland Limited - Nominated

Adviser +44 (0) 20 7220 1666

James Joyce

Andrew de Andrade

Hybridan LLP - Corporate Broker +44 (0) 203 764 2341

Claire Noyce

Lionsgate Communications - Communications

Adviser +44 (0) 779 189 2509

Jonathan Charles

About Jade Road Investments

Jade Road Investments Limited is quoted on the AIM Market of the

London Stock Exchange and is committed to providing shareholders

with attractive uncorrelated, risk-adjusted long-term returns from

a combination of realising sustainable capital growth and

delivering dividend income.

The Company is focused on providing growth capital and financing

to emerging and established Small and Medium Enterprises (SME)

sector throughout Asia, well-diversified by national geographies,

instruments and asset classes. This vital segment of the economy is

underserved by the traditional banking industry for regulatory and

structural reasons.

The Company's investment manager, Harmony Capital, seeks to

capitalise on its team's established investment expertise and broad

networks across Asia. Through rigorous diligence and disciplined

risk management, Harmony Capital is dedicated to delivering

attractive income and capital growth for shareholders with

significant downside protection through selectively investing in

assets and proactively managing them.

Harmony Capital is predominately sourcing private opportunities

and continues to create a strong pipeline of attractive

income-generating assets from potential investments in growth

sectors across Asia, including healthcare, fintech, hospitality, IT

and property.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCQLLBLLQLXBBQ

(END) Dow Jones Newswires

June 22, 2022 02:39 ET (06:39 GMT)

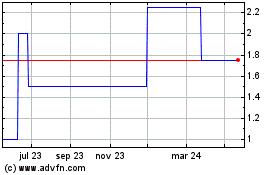

Jade Road Investments (AQSE:JADE.GB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

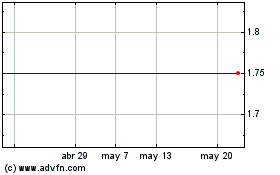

Jade Road Investments (AQSE:JADE.GB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025