TIDMSVEN

RNS Number : 9545H

S-Ventures PLC

11 April 2022

11 April 2022

S-Ventures PLC

("S-Ventures", "Group" or the "Company")

S-Ventures, the Company investing in and growing exciting brands

across the natural, wellness and food-tech category, will hold its

Annual General Meeting ("AGM") today at 11am at its headquarters in

London; 5 Old Bailey, London EC4M 7BA.

Ahead of the meeting S-Ventures would like to share the

following update which David Mitchell, the Company's Non-Executive

Chairman will read at the AGM today:

AGM Statement

S-Ventures has made considerable progress developing its

business. Over the past six months, the Group has completed the

acquisition of Livia's Health Foods Limited business ("Livia's")

and Market Rocket Limited ("Market Rocket") together with the

accelerated investment in a new logistics centre at Brockworth.

This new centre has allowed the Company to streamline the Ohso and

We Love Purely businesses by merging their operations into this new

centre which became operational in January 2022.

In common with many businesses in the food sector, the Company

has been affected by headwinds in the economy which has impacted

sales plans. However, our brands are well positioned to benefit

from the structural change in the food market addressing present

trends which deal with concerns for obesity/health and the

composition of foods. As such we continue to invest in food

technology to develop and bring forward new brands.

On a like for like basis our sales for the first half year are

10% ahead of last year, with considerable further growth

anticipated. The Board is pleased to report that Market Rocket,

which completed on Friday 8 April 2022, has already impacted the

Amazon revenue very positively, with growth of 45% in the last

quarter over the previous quarter, before they were acquired.

We Love Purely , the plantain crisp business, continues to grow

well and is expected to double its last year revenues by the end of

September. Margins are slightly lower due to freight costs and

packaging costs. The growth includes recently awarded new contracts

with Holland & Barrett and Co-op.

Ohso, the probiotic chocolate company, has had a recent re-brand

and management is very excited about its repositioning. This should

provide an impetus to its trade sales but has necessarily taken a

little time to arrange. As a consequence, in the current year,

Ohso's performance is below our internal expectations.

Pulsin, which formulates and produces high quality plant-based

products, has been impacted by a period of investment and

reorganisation but despite this, sales in H1 grew by 10%

(year-on-year) and are expected to be significantly ahead of last

year on a full year basis (c.GBP9m v GBP6.4m). The Board is pleased

with this strong growth although this has been less than previously

expected. Sales price rises are now being implemented across our

Pulsin product range.

We now have a portfolio of brands that are strongly positioned

to address the market opportunities.

As noted above, the Group has had a number of cost increases

beyond its control - freight rates and packaging costs, for

instance, and more recently, as has been widely reported, a

doubling in whey prices. In addition, some of the unit costs have

been impacted by labour shortages and operational inefficiencies,

but these have been mitigated by the commissioning of our new

warehouse.

Management is addressing these cost issues in a variety of ways.

Firstly, the merger of the operations of Ohso and Purely into

Pulsin's premises is beginning to bear fruit. Secondly, the Board

has reviewed the cost structure that it inherited at Pulsin and

have undertaken an investment programme which will remove not only

c.GBP0.3m of operating costs per annum but also enable us to

accelerate growth. Some selling costs have been increased to gain

more product and brand awareness.

Livia's: the Board is pleased to report that the Livia's

business, which was acquired in February 2022, has been absorbed

well into the Pulsin operation and will generate positive EBITDA

for the coming period. The Company has been able to retain all the

trade customers of the business. The costs of integration have been

lower than expected and the alliance with Pulsin has allowed it to

reconfigure the range over these two brands.

Other overheads have remained under control despite incurring

acquisition costs for Livia's and Market Rocket.

The investment in Vegan Punk Ventures Limited, a 50% start-up

joint venture focussed on plant-based foods, is expected to show a

small profit in the current half year before considerable growth

next year after promising trials and tasting so far this year.

The Group remains well-resourced after its GBP3m fund raise last

December. Further acquisitions will largely be satisfied by share

issues, together with specific loans required to finance any

balance of consideration and working capital needs.

Overall, the Directors are pleased with the progress to date and

are anticipating a significant increase in sales for the full year

on a year-on-year basis - although below the market forecast.

Consequently, Group losses for the current year are expected to be

reduced significantly. The steps that have been taken and those

being implemented at present will lay firm foundations for next

year where the Group plans to deliver considerable growth.

We look forward to updating shareholders on progress in due

course.

Enquiries:

The Company

Robert Hewitt (Chief Financial

Officer) +44 (0) 1932 400 224

Scott Livingston (Chief Executive

Officer)

AQSE Corporate Adviser and Broker:

VSA Capital Limited +44 (0) 20 3005 5000

Andrew Raca/Pascal Wiese - Corporate

Finance

Andrew Monk - Corporate Broking

IFC Advisory (Financial PR) + 44 (0) 20 3934 6630

Graham Herring

Tim Metcalfe

Florence Chandler

About S-Ventures

S-Ventures is listed on UK AQUIS Exchange (Ticker Code "SVEN").

The Company seeks to identify investment opportunities in the

health & wellness, organic food and wellbeing sectors within

the UK and Europe, adding value by providing capital and expertise

to the target companies. The experience and operational skills of

the Board led by Scott Livingston (CEO) are intended to act as an

accelerator to smaller brands that have a solid foundation and

platform but may lack the skills and capital. The main objectives

are to cross-fertilise opportunities between the target companies

and scale the individual entities and look for exit opportunities

and/or synergistic collaborations through scaling we seek to create

significant value for all stakeholders. Since listing on AQSE in

September 2020, the Company has acquired significant interests in

seven companies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXGPUUUCUPPUBG

(END) Dow Jones Newswires

April 11, 2022 06:00 ET (10:00 GMT)

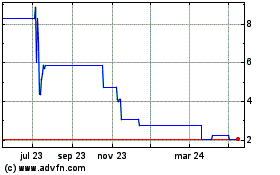

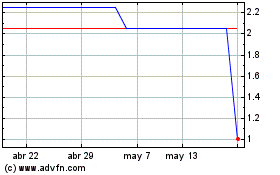

SVentures (AQSE:SVEN)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

SVentures (AQSE:SVEN)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024