MPS Capital Services (MPS), a wholly owned subsidiary of Banca

Monte dei Paschi di Siena S.p.A., Barclays Capital, the investment

banking business of Barclays Bank plc, and LCH.Clearnet Ltd

(LCH.Clearnet) today announced that MPS has signed an agreement to

clear interest rate swaps on LCH.Clearnet’s SwapClear service

through Barclays Capital. The transaction represents the first

major client clearing mandate for backloaded trades.

Barclays Capital is the primary clearing broker for MPS’s

interest rate swap transactions under an agreement that includes

the backloading of a significant portion of MPS’s historical

interest rate swap transactions, a first for client clearing.

The total notional value of interest rate swaps to be backloaded

is in excess of $200 billion, with a material portion of that

backloading already undertaken, including dollar, sterling and euro

swaps with multiple counterparties.

“This agreement is an important step for MPS in developing a

leadership position in OTC Derivatives. MPS is fully supportive of

the expected EU regulatory reform towards central clearing,” said

Matteo Bertotti, Head of Fixed Income Derivatives at MPS Capital

Services. “Barclays Capital has displayed a clear commitment,

leadership and readiness to adapt to these new market developments.

MPS was pleased to extend its long history of working with Barclays

Capital through this transaction.”

By backloading and clearing future interest rate swap

transactions, MPS will benefit from reduced counterparty risk,

potential capital relief, a more efficient collateral management

process and lower overall operational risks.

“This is a clear milestone in the work to take the clearing of

OTC interest rate swap transactions beyond the dealer-to-dealer

level. OTC clearing represents a significant technology challenge

for the industry and we are proud to be able to extend our leading

position in clearing by being the first broker dealer to backload a

substantial portfolio,” said Ajay Nagpal, Head of Prime Services at

Barclays Capital.

Harry Harrison, head of Rates Trading at Barclays Capital,

added, “Central clearing will play a critical role in the

development of the rates market - and other asset classes - by

reducing counterparty risk, enhancing liquidity and bringing

greater transparency and efficiency. From our position as one of

the leading interest rates platforms in the industry, we see a

tremendous opportunity to introduce the benefits of central

clearing to our clients and hope that this transaction with MPS

will be the first of many.”

Michael Davie, CEO of the SwapClear service at LCH.Clearnet

said, “We congratulate our partners MPS and Barclays Capital for

this landmark transaction. This is an important step for the OTC

market and the buy-side community as a whole and reflects the

prevailing impetus to reduce systemic risk through central

clearing. In choosing SwapClear to clear their trades and legacy

portfolio, MPS will benefit from the proven experience, robustness

and scope of the service. Our goal is to continue to work with

clients and clearing members alike to reduce risk, reduce costs and

improve market transparency.”

Barclays Capital’s OTC Derivatives Clearing business is a

multi-asset class offering and part of the firm’s Prime Services

business. A dedicated team of professionals across the globe

provides clients with support for all OTC derivatives clearing

related requirements, in coordination with Barclays Capital’s

leading credit, interest rates, foreign exchange, equities and

commodities businesses. In December 2009, Barclays Capital was the

first broker to clear client credit default swaps (CDS) and

interest rate derivatives. Global Custodian recognized this

leadership by awarding the firm 106 ‘Best in Class’ awards in their

2010 OTC Derivatives Prime Brokerage Survey. Through BARX, Barclays

Capital’s online trading platform, clients can benefit from

straight-through processing, clearing and reporting of OTC

transactions.

About MPS Capital

Services

MPS Capital Services is the Investment Bank of Banca Monte dei

Paschi Spa, the third Italian Banking Group, created in 2007

through the integration of MPS Finance, the high reputated

Investment Bank, and MPS Banca per l’Impresa, the Bank for project

finance, corporate finance and special lending.

About Banca Monte dei Paschi

di Siena

Banca Monte dei Paschi di Siena, founded in 1472 is considered

to be the oldest bank in the world. Today’s parent company of

Italy’s third largest banking group, the bank holds significant

market shares in all areas of business.

The Montepaschi Group is present all over Italy and in the major

international financial centres, with operations ranging from

traditional banking activities to Private Banking (mutual funds,

wealth management, pension funds, and life insurance policies) and

Corporate Banking (project finance, merchant banking, and financial

advisory), with a special vocation for household accounts and small

and medium enterprises. With some 33,000 employees and over 3,000

branches, the Montepaschi Group offers its services to more than

six million customers.

About Barclays

Capital

Barclays Capital is the investment banking division of Barclays

Bank PLC. With a distinctive business model, Barclays Capital

provides large corporate, government and institutional clients with

a full spectrum of solutions to their strategic advisory, financing

and risk management needs. Barclays Capital has offices around the

world, employs over 25,000 people and has the global reach,

advisory services and distribution power to meet the needs of

issuers and investors worldwide. For further information about

Barclays Capital, please visit our website

www.barclayscapital.com.

About SwapClear

LCH.Clearnet’s SwapClear service is the global leader for over

the counter (OTC) Interest Rate Swaps clearing. It currently clears

more than 40% of the interest rate swap market, representing trades

with a total notional principal of $229 trillion*.

Launched in 1999 by LCH.Clearnet, SwapClear now clears swaps in

14 currencies; USD, EUR and GBP out to 50 years, AUD, CHF, SEK and

JPY out to 30 years and the remaining 6 currencies out to 10 years.

It also clears OIS out to 2 years in USD, EUR, GBP and CHF.

In December 2009, responding to market demand, SwapClear

extended its No. 1 clearing service to the buy-side.

*As of end of June 2010

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6421304&lang=en

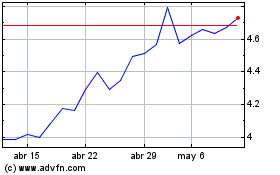

Banca Monte Dei Paschi D... (BIT:BMPS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

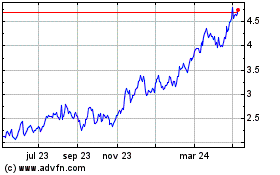

Banca Monte Dei Paschi D... (BIT:BMPS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024