Crypto Market Analysis: December 6, 2021

07 Diciembre 2021 - 12:25PM

NEWSBTC

Bitcoin and ether suffered a major flash crash over the weekend,

sending cryptoasset values down by some 20% at points. Prices have

now recovered somewhat but both cryptos remain trading well below

pre-weekend levels. Bitcoin began last week trading in the $57,000

range, with some movement during the week, but nothing remarkable.

This changed on Friday however as the cryptoasset began to fall

precipitously. BTC declined to a low of $45,412 in a matter of

hours – a near 20% collapse. Ether likewise fell victim to the

flash crash. Having traded up toward $4,700 midweek ETH began to

fall in trading on Friday from around $4,600 to a low of $3,652 – a

fall of over 20%. Both cryptoassets have regained a measure of

stability since, with prices rebounding modestly. BTC is now

trading around $47,900 while ETH is trading around $4,000.

Speculation has been rife over what caused the flash crash, with

some analysts citing the expiry of leveraged positions. Other

evidence meanwhile points to significant increased activity with

investors moving cryptoassets from wallets to exchanges – making

reaction to price movement more precipitous when it comes. The

wider backdrop of investment market fears over Omicron seems to be

in play too however. Bitcoin spot ETF launches in Canada Major

asset manager Fidelity Investments has a bitcoin spot ETF in

Canada. The ETF – named the Fidelity Advantage Bitcoin ETF invests

directly in bitcoin or through derivative instruments. At least 98%

of the ETF’s holdings will be stored in cold wallets. The fund is

listed on the Toronto stock exchange with the ticker FBTC. The fund

will have a 0.4% management fee for investors with customers given

the option of investing via Canadian or US dollars. Canada is a

popular destination for crypto ETFs with more than 20 available to

Canadian investors. Fidelity’s offering however is unique among

crypto ETFs in offering physical holdings of bitcoin rather than

trading on futures. MercadoLibre to accept cryptoassets Major Latin

American online marketplace MercadoLibre now allows customers in

Brazil to exchange and pay for products in cryptoassets. The firm

has announced users in Brazil will be able to buy, hold and sell

bitcoin, ether and a U.S Dollar based stablecoin, Pax Dollar. The

combination of two major cryptoassets and a stablecoin on

MercadoPago, the payments platform of MercadoLibre, will enable

customers to conduct transactions for products priced in fiat

currency using their cryptoassets. MercadoPago is authorised by

Brazil’s central bank, making it easier for the firm to begin its

crypto operations there. But MercadoLibre more generally operates

in many Central and South American countries, suggesting a

potential customer base for new crypto payments of millions as it

expands its offering. Square rebrands in wake of Dorsey Twitter

departure Payments firm Square has announced it is rebranding to

‘Block’, days after its chief executive Jack Dorsey stepped down as

head of Twitter. The company said in its announcement the new name

had many associations, but among them was the use of Blockchain

technology in some of its projects. Square Crypto, a separate

initiative of the firm which aims to promote the use of bitcoin is

also changing its name to Spiral. The Square brand won’t be

disappearing though – Square remains the name of the firm’s seller

business, which is among a stable of brands that now also includes

Cash App, TIDAL and TBD54566975. Jack Dorsey announced his sudden

departure from Twitter last week, with many speculating he would

move to focus more of his time on crypto and blockchain projects,

with his now rebranded firm Block at the forefront of this. Meta

crypto head departs firm The head of Meta’s (formerly Facebook)

crypto arm is departing the firm as the launch of stablecoin Diem

remains in doubt. David Marcus announced he would be departing the

firm after seven years, having worked on Meta’s financial offering

since May 2018, when the company’s Libra crypto project was first

announced. The project later morphed into a payments wallet called

Novi with the cryptoasset to go with it called Diem. The crypto

wallet has since launched, but the launch of Diem remains elusive.

Meta has faced significant hurdles in the launch of its crypto

products. Commenting on the departure, Meta chief executive Mark

Zuckerberg commented on Marcus’s post: “We wouldn’t have taken such

a big swing at Diem without your leadership, and I’m grateful

you’ve made Meta a place where we make those big bets.” This

is a marketing communication and should not be taken as investment

advice, personal recommendation, or an offer of, or solicitation to

buy or sell, any financial instruments. This material has been

prepared without having regard to any particular investment

objectives or financial situation, and has not been prepared in

accordance with the legal and regulatory requirements to promote

independent research. Any references to past performance of a

financial instrument, index or a packaged investment product are

not, and should not be taken as a reliable indicator of future

results. All contents within this report are for informational

purposes only and does not constitute financial advice. eToro makes

no representation and assumes no liability as to the accuracy or

completeness of the content of this publication, which has been

prepared utilizing publicly-available information. Cryptoassets are

volatile instruments which can fluctuate widely in a very short

timeframe and therefore are not appropriate for all investors.

Other than via CFDs, trading cryptoassets is unregulated and

therefore is not supervised by any EU regulatory framework. Your

capital is at risk. Image: Pixabay

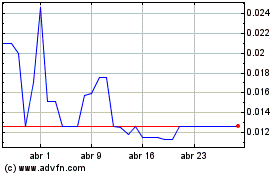

Rally (COIN:RLYUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

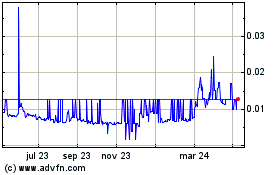

Rally (COIN:RLYUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024

Real-Time news about Rally (Criptodivisas): 0 recent articles

Más de Rally Artículos de Noticias