ABC arbitrage: Results 2022

21 Marzo 2023 - 12:00AM

ABC arbitrage: Results 2022

2022 Results:

M€29.2

2022 ROE: 18% - 2022 Distributions: €0.41

(83%)

The Board of Directors of ABC arbitrage,

presided by the Chairman Dominique Ceolin, met on March 16, 2023 to

approve the consolidated financial statements for fiscal year

2022.

|

In EUR millions |

Dec. 31, 2022 IFRS |

Dec. 31, 2021 IFRS |

Dec. 31, 2020 IFRS |

|

Net revenues |

€61.2m |

€64.1m |

€68.8m |

|

Net income |

€29.2m |

€28.0m |

€35.1m |

|

Earnings per share (EPS) |

€0.49 |

€0.48 |

€0.60 |

|

Return On Equity (ROE) |

18.0% |

17.5% |

23.9% |

|

Equity |

€162m |

€160m |

€154m |

- Context - 2022 has been a complex year around the world

and in the financial markets. The war in Ukraine, very European

from an economic point of view, created major international

de-correlations across markets, initially leaving the European

continent struggling alone. Ultimately, global inflation tensions,

even beyond energy, drove global indices significantly down.

Volatility, the main market parameter favorable to the group's

activities, was sustainably above its historical average in 2022.

Nonetheless, the M&A market suffered, coherently, from this

global situation as the main global indices fell by nearly

20%.

- Business Performance - In 2022, ABC arbitrage has closed

its strategic plan ABC 2022 for the years 2020, 2021 and 2022. The

group had defined quantitative and qualitative objectives, most of

which were achieved2..

- ➢ With €92m,

the cumulative net income over the 3 years exceeds the stated

objectives, with annual ROE significantly above the threshold of

15%, the level of out-performance defined by the group.

- ➢ The dividend

policy has been confirmed with a cumulative distribution of €1.29

and a share of added value at more than 40% for the group’s

employees.

- ➢ An evolution

of the governance and a new RH policy have been achieved with

success.

- ➢ Target assets

under management (“AUM”), in contrast, has not been achieved, with

client assets standing at €372m as at March 1st 2023

- Dividend Policy - A quarterly distribution policy has

been in place for over two years.

- ➢ Distribution

of €0.10 per share in October 2022;

- ➢ Distribution

of €0.10 per share in December 2022;

- ➢ Interim

dividend of €0.10 per share on April 18, 2023 for payment on

April 20;

- ➢ Proposition

at the General Meeting of June 9, 2023 of a final dividend of

€0.11 per share. The total distribution for fiscal year 2022

will amount to €0.41 per share, i.e. a payout ratio of more

than 83%.

Retained earnings will be invested in the

development of new products with significant performance prospects.

The terms and timetable of this final dividend will be presented at

a later date.

- Outlook - The group presents its new strategic plan

Springboard 2025 for the 3 years to come. This plan has been built

based on the conclusions of the plan ABC 2022 and the the long term

needs of the group:

- ➢ To

generate cumulative net income over 3 years of more than

€100m with an annual ROE above 15%.

- ➢ To maintain a

payout ratio of approximately 80%, implying a potential cumulative

distribution of more than €1.3 per share over the three years.

- ➢ To develop

investment management capacity to facilitate accommodating 1

billion euros of AUM, with €800m from external clients of the group

with a profitability above 2% on those external assets.

- ➢ To continue

with the necessary hires for the group's ambitions, reaching almost

140 employees in 2025 (+33% compared to 2022).

- ➢ To continue

significant IT investment, in service the group’s trading

strategies.

- ➢ To continue

evolving the group’s organizational and governance structure to

serve productivity.

The first quarter of 2023 saw markets rise

significantly, despite the geopolitical and economical context,

until the bankruptcies of Silvergate and Silicon Valley Bank during

the week of March 6th. Even if it’s too early to define all the

forward looking scenarios around these bankruptcies, the group's

rhythm of activity for the first quarter 2023, as in 2022, is below

that of 2021 due to the low volatility of the first weeks. The

group continues to develop its know-how to extract the best

possible performances from the current situations, in particular

with the significant increase of current volatility.

1 At this date, the audit procedures carried out

by the statutory auditors are still in progress. 2 The details of

the ABC 2022 plan and the Springboard 2025 plan will be available

on March 21st 2023, at 11:30 AM on the ABC arbitrage group

website

|

ontacts :

abc-arbitrage.comRelations actionnaires :

actionnaires@abc-arbitrage.comRelations presse: VERBATEE /

v.sabineu@verbatee.com |

EURONEXT Paris - Compartiment BISIN :

FR0004040608Reuters BITI.PA / Bloomberg ABCA

FP |

- 2023 ABCA CP Resultats 2022 VEng

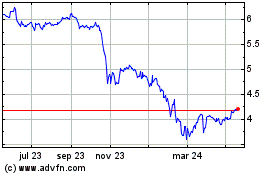

ABC Arbitrage (EU:ABCA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

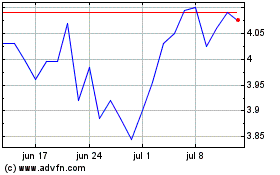

ABC Arbitrage (EU:ABCA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025