Safe announces the reverse stock split of 1 new share for 3,700

existing shares

Safe announces the reverse stock split of 1

new share for 3,700 existing shares

► Consolidation by way of exchange of

3,700 existing shares for 1 new share

- Start of the reverse split on Thursday, January 26,

2023

- Consolidation takes effect on Monday, February 27,

2023

- Suspension of the right to exercise the securities

giving access to the capital from Tuesday, January 10, 2023

(inclusive) to Friday, February 24, 2023 (inclusive)

Éragny-sur-Oise, France, January 12,

2023, 5:30 p.m. - Safe (FR0013467123 - ALSAF), a group

specializing in the design, manufacture and marketing of

ready-to-use technologies for orthopedic surgery, particularly for

back surgery (the "Company") announces today that its Board of

Directors has decided, at its meetings held on December 21, 2022

and January 9, 2023, to implement a reverse stock split of the

Company's share capital, in the ratio of 1 new share with a par

value of 37 euro for 3. 0.01, as authorized by the General

Shareholders' Meeting of December 16, 2022 in its first resolution

(following an amendment made during the meeting of the General

Shareholders' Meeting).

This consolidation is intended to reduce the

volatility of the Safe share price and to promote its

stabilization.

Translated with www.DeepL.com/Translator (free

version)

The reverse split is a share exchange

transaction, without any impact on the amount of the share capital:

only the par value of the shares and, consequently, the number of

outstanding shares, are modified.

The reverse stock split will begin on Thursday,

January 26, 2023 and end on Friday, February 24, 2023, and the new

consolidated shares will be listed as from Monday, February 27,

2023.

All other things being equal, this transaction

will have no impact on the overall value of the Safe shares held by

the shareholders, with the exception of fractional shares (see

section Fractional shares).

The main characteristics of this consolidation

are, as of the date of this press release, as follows

- Basis of the reverse split: exchange of three

thousand seven hundred (3,700) old ordinary shares with a par value

of one euro cent (€0.01) per share for one (1) new share with a par

value of thirty-seven euros (€37) per share and current dividend

rights.

- Number of shares subject to the reverse split:

one billion four hundred and fifteen million two hundred and

thirty-six thousand nine hundred and eighteen (1,415,236,918)

shares of €0.01 par value each.

Number of shares to be issued as a result of the

reverse split: three hundred and eighty-two thousand four hundred

and ninety-six (382,496) shares with a par value of € 37

each. It is indicated that a shareholder of the Company

has expressly waived the consolidation of one thousand seven

hundred and eighteen (1,718) old shares in order to allow the

application of the exchange ratio to a whole number of shares. Its

one thousand seven hundred and eighteen (1,718) old shares will

therefore be cancelled.

- Date of the reverse split: the reverse split

will take effect on February 27, 2023, i.e. 30 days after the date

of commencement of the reverse split operations

-

Exchange period: thirty (30) days as from the date

of commencement of the consolidation operations, i.e. from January

26, 2023 to February 24, 2023 inclusive

-

Fractional shares: the conversion of the old

shares into new shares will be carried out according to the

automatic procedure.

- Fractional shares: the shareholders who do not

have a number of old shares corresponding to a whole number of new

shares will have to make their own purchase or sale of the old

shares forming fractional shares in order to obtain a multiple of

three thousand seven hundred (3,700) until February 24, 2023.

After this period, the shareholders who would

not have been able to obtain a multiple of three thousand seven

hundred (3,700) shares will be compensated within thirty (30) days

as from February 27, 2023 by their financial intermediary.

In application of articles L. 228-6-1 and R.

228-12 of the French Commercial Code, at the end of a period of

thirty (30) days as from January 26, 2023, the new shares which

could not be allotted individually and corresponding to fractional

shares will be sold on the stock exchange by the account holders

and the sums resulting from the sale will be distributed in

proportion to the fractional rights of the holders of these

shares.

The ungrouped shares will be delisted at the end

of the regrouping period.

- Voting rights: the new shares will immediately

benefit from double voting rights, subject to being held in

registered form, if on the date of the reverse split of the old

shares from which they originate, each of these old shares

benefited from double voting rights. In the event of a reverse

split of old shares that have been registered since different

dates, the period used to assess the double voting rights of the

new shares will be deemed to begin on the most recent date on which

the old shares were registered.

- Centralization: all transactions relating to

the reverse stock split will take place at Uptevia (ex. CACEIS

Corporate Trust), 12 place des États-Unis CS 40083 - 92549

Montrouge Cedex, appointed as agent for the centralization of the

reverse stock split.

The shares subject to the reverse split will be

admitted to trading on the Euronext Growth Paris market until

February 24, 2023, the last day of trading.

The shares resulting from the consolidation will

be admitted to trading on the Euronext Growth Paris market as from

February 27, 2023, the first day of trading. Suspension

of the rights of holders of securities giving access to the

Company's capital: in order to facilitate the consolidation

operations, as permitted by the provisions of Article L. 225-149-1

of the French Commercial Code and in accordance with the delegation

of powers granted by the General Meeting of December 16, 2022, the

Board of Directors decided unanimously at its meetings of December

21, 2022 and January 9, 2023 to suspend the right to exercise the

rights attached to all (i) the bonds convertible into new shares of

the Company (the "OCEANE") issued under the financing agreement

entered into with European High Growth Opportunities Securitization

Funds on December 10, 2021 (ii) warrants to subscribe for shares

("BSA") issued by the Company between 2012 and 2018, (iii) warrants

to subscribe for business creators' shares ("BSPCE") issued between

2010 and 2018 by the Company and (iv) free share allocation plans

in force, if any (the "AGAs" and, together with the OCEANEs, the

BSAs and the BSPCEs, the "Securities"), and to give full powers to

the Chairman to publish a notice of suspension in the BALO. The

Board of Directors decided, at the same meeting, that the

suspension of the Securities will take effect as from January 10,

2023 (inclusive) and will end on February 24, 2023 (inclusive).

- Adjustment of the exercise parity of the Securities

issued by the Company: in order to preserve the rights of

the holders of the Securities issued by the Company, it is already

foreseen that the exercise parity of the OCEANEs, of the BSAs, of

the BSPCEs and of the AGAs will be adjusted by the Board of

Directors of the Company following the reverse stock split.

- Timetable of the operations :

|

PERIOD OF SUSPENSION OF THE EXERCISE OF SECURITIES GIVING

ACCESS TO THE CAPITAL |

|

| Opening

of the suspension period for the exercise of

securities |

January 10th 2023

(included) |

|

Closing of the suspension period for the exercise of

securities |

February 24th 2023 (included) |

|

| SHARE

EXCHANGE PERIOD |

|

| Start of

exchange operations |

January 26th2023 |

|

|

End of exchange operations |

February 24th2023 (included) |

|

| GROUPING

OPERATIONS |

|

| Last

quotation of the old shares |

February 24th2023

(included) |

|

| First

quotation of the new shares |

February 27th

2023 |

|

| Record

date |

February

28th2023 |

|

|

Allocation of the new shares |

March 1st 2023 |

|

| BREAKAGE

MANAGEMENT |

|

| Start

date for compensation of fractional shares by financial

intermediaries |

March 1st

2023 |

|

| Deadline

for compensation by financial

intermediaries |

March

30th 2023 (included) |

|

The notice relating to the reverse stock split

was published in the Bulletin des Annonces Légales Obligatoires on

January 11, 2023 and is available on the website

https://www.journal-officiel.gouv.fr/pages/balo/ and on the

Company's website (section Investors > Press Release).

About Safe GroupSafe Group is a

French medical technology group that brings together Safe

Orthopaedics, a pioneer in ready-to-use technologies for spine

pathologies, and Safe Medical (formerly LCI Medical), a medical

device subcontractor for orthopaedic surgery. The group employs

approximately 150 people.

Safe Orthopaedics develops and manufactures kits

combining sterile implants and single-use instruments, available at

any time to the surgeon. These technologies are part of a minimally

invasive approach aimed at reducing the risks of contamination and

infection, in the interest of the patient and with a positive

impact on hospitalization times and costs. Protected by 18

patent families, SteriSpineTM kits are CE marked and FDA approved.

Safe Orthopaedics is headquartered in the Paris region (95610

Eragny-sur-Oise) and has subsidiaries in the United Kingdom,

Germany, the United States and the Lyon region

(Fleurieux-sur-l'Arbresle).

For more information:

www.safeorthopaedics.com

Safe Medical produces implantable medical

devices and ready-to-use instruments. It has an innovation center

and two production sites in France (Fleurieux-sur-l'Arbresle,

69210) and in Tunisia, offering numerous industrial services:

design, industrialization, machining, finishing and sterile

packaging.

For more information: www.safemedical.fr

Contacts

Safe

Group

François-Henri Reynaud

Chief Financial and Administrative Officer

Tél. : +33 (0)1 34 21 50

00

investors@safeorthopaedics.com

Press RelationsUlysse

CommunicationPierre-Louis Germain / +33 (0)6 64 79

97 51 / plgermain@ulysse-communication.com

Bruno Arabian / +33 (0)6 87 88 47 26 /

barabian@ulysse-communication.com

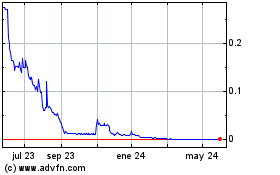

SAFE (EU:ALSAF)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

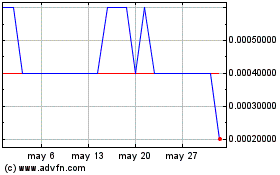

SAFE (EU:ALSAF)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025