Fund Group Provides Institutional-Quality

Investment Expertise for Financial Professionals and Individual

Clients

AXA Equitable, a leading financial protection company, announced

today its 1290 Funds have reached a significant performance

milestone, achieving a three-year track record and earning a

four-star Morningstar Rating™ for three of its funds based on

risk-adjusted returns.

The 1290 Funds provide institutional-quality investment

expertise for financial professionals and all types of individual

investors, through a thoughtfully designed lineup. The four-star

rated funds are as follows (as of December 11, 2017):

• 1290 GAMCO Small/Mid Cap Value Fund (TNVIX): A small- and

mid-capitalization strategy. As of 11/30/2017, this Fund (I Shares)

had an Overall Morningstar Rating™ of four stars out of 653 US

Small Blend funds that are rated by Morningstar.

• 1290 High Yield Bond Fund (TNHIX): An actively-managed high

yield strategy combining bottom-up security selection with macro

perspective. As of 11/30/2017, this Fund (I Shares) had an Overall

Morningstar Rating™ of four stars out of 612 US High Yield Bond

funds that are rated by Morningstar.

• 1290 SmartBeta Equity Fund (TNBIX): A strategy that seeks to

avoid full participation in speculative bubbles and exhibit less

extreme downturns during market shocks. As of 11/30/2017, this Fund

(I Shares) had an Overall Morningstar Rating™ of four stars out of

711 US World Large Stock funds that are rated by Morningstar.

AXA’s 1290 Funds launched in November of 2014 and has a total of

18 funds. Most recently, in 2016, the group added a new

low-volatility equity fund and a suite of nine target-date funds

which invest extensively in ETFs.

For nearly 20 years, 1290 Asset Managers, the investment advisor

to 1290 Funds, has delivered a multi-asset-class investment

portfolio through an open-architecture platform of well-known

subadvisors. The group leverages AXA’s global resources and

footprint to bring institutional asset management expertise to the

U.S. market in high-growth investment niches, such as high yield

and smart beta.

Mutual fund investing involves risk; Principal loss is

possible.

Please consider the charges, risks, expenses, and investment

objectives carefully before purchasing a mutual fund. For a

prospectus containing this and other information, please contact a

Financial Professional. Read it carefully before you invest or send

money.

Investments in small/mid cap companies may involve greater risks

than investments in larger, more established issuers. An investor’s

principal value in a target-date fund is not guaranteed at any

time, including at the fund’s target date. Investment

diversification does not guarantee a profit or protection against

loss. Past investment performance is no indication or guarantee of

future performance or results.

1290 Funds® is a registered service mark of AXA Equitable Life

Insurance Company, New York, NY 10104. AXA Equitable Funds

Management Group, LLC (FMG LLC), doing business as 1290 Asset

Managers, serves as investment adviser to the 1290 Funds. AXA S.A.

is a French holding company for a group of international insurance

and financial services companies, including AXA Equitable Life

Insurance Company (NY, NY) and its wholly owned subsidiary, FMG

LLC. The 1290 Funds are distributed by ALPS Distributors, Inc.,

which is not affiliated with FMG, LLC, AXA Equitable, AXA Advisors

or the subadvisors.

ALPS Distributors, Inc., is not affiliated with the investment

advisor or subadvisors. ALPS, A DST Company, 1290 Broadway, Suite

1100, Denver, CO 80203.

Securities products are offered through AXA Advisors, LLC

(member FINRA and SIPC) 1290 Avenue of the

Americas, NY, NY 10104 (212) 314-4600

© 2017 Morningstar. All Rights Reserved. The information

contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is

not warranted to be accurate, complete or timely. Neither

Morningstar nor its content providers are responsible for any

damages or losses arising from any use of this information.

The Morningstar Rating for funds, or "star rating", is

calculated for managed products (including mutual funds, variable

annuity and variable life subaccounts, exchange-traded funds,

closed-end funds, and separate accounts) with at least a three-year

history. Exchange-traded funds and open-ended mutual funds are

considered a single population for comparative purposes. It is

calculated based on a Morningstar Risk-Adjusted Return measure that

accounts for variation in a managed product's monthly excess

performance, placing more emphasis on downward variations and

rewarding consistent performance. The top 10% of products in each

product category receive 5 stars, the next 22.5% receive 4 stars,

the next 35% receive 3 stars, the next 22.5% receive 2 stars, and

the bottom 10% receive 1 star. The Overall Morningstar Rating for a

managed product is derived from a weighted average of the

performance figures associated with its three-, five-, and 10- year

(if applicable) Morningstar Rating metrics. The 1290 GAMCO

Small/Mid Cap Value Fund (I Share) was rated 4 stars out of 653 US

Small Blend Funds. The 1290 High Yield Bond Fund (I Share) was

rated 4 stars out of 612 US High Yield Bond Funds. The 1290

SmartBeta Equity Fund (I Share) was rated 4 stars out of 711 US

World Large Stock Funds.

Past performance is no guarantee of future results.

About AXA

“AXA”(or AXA in the U.S.) is a brand name of AXA Equitable

Financial Services, LLC and its family of companies, including AXA

Equitable Life Insurance Company (NY, NY), MONY Life Insurance

Company of America (AZ stock company, administrative office: Jersey

City, NJ), AXA Advisors, LLC, and AXA Distributors, LLC. In

business since 1859, AXA Equitable Life Insurance Company is a

leading financial protection company and one of the nation’s

premier providers of life insurance and annuity products

distributed to individuals and business owners through its retail

distribution channel, AXA Advisors, LLC (member FINRA, SIPC) and to

the financial services market through its wholesale distribution

channel, AXA Distributors, LLC.

AXA S.A. (also referred to as “AXA Group”) is a

Paris-headquartered holding company for a group of international

insurance and financial services companies, including AXA Equitable

Financial Services, LLC companies. AXA S.A. is a worldwide leader

in financial protection strategies and wealth management with 107

million clients in 64 countries as of Dec. 31, 2016. AXA S.A. has

been ranked the No. 1 insurance brand in the world by Interbrand

for nine consecutive years as of Sept. 25, 2017.

The obligations of AXA Equitable Life Insurance Company and MONY

Life Insurance Company of America are backed solely by their

claims-paying ability. Find AXA on Facebook, Twitter and LinkedIn.

For more information, visit www.axa.com. GE-131949(12/17)(exp.

12/19)

About 1290 Asset Managers:

1290 Asset Managers® serves as the investment advisor to the

1290 Funds, managing approximately $108.9 billion in total assets

under management in insurance separate accounts, U.S. mutual funds

and offshore funds as of 10/31/17. 1290 Asset Managers® serves as

the trade name of AXA Equitable Funds Management Group, LLC (FMG),

a wholly owned subsidiary of AXA Equitable Life Insurance

Company.

1290 Funds is part of the AXA family in the U.S. The 1290 Funds

were named after AXA’s corporate headquarters building at 1290

Avenue of the Americas in Manhattan, the heart of New York City. To

learn more about the 1290 Funds and see detailed profiles of each

mutual fund, please visit: www.1290funds.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171211005747/en/

AXAMedia:John Cline,

212-314-2010mediarelations@axa.us.comorJennifer Recine,

212-314-2010mediarelations@axa.us.com

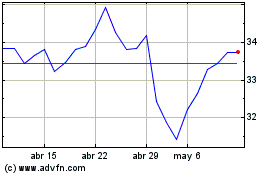

Axa (EU:CS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Axa (EU:CS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024