AXA Research Uncovers Opportunity for

Financial Professionals to Discuss Growth Protection and Lifetime

Income Options with Clients

Healthcare Costs Continue to Weigh Heavily

on Savers’ Minds

AXA, a leading financial protection company, today unveiled new

research which found retirement savers actively want to discuss

ways to protect their assets during periods of volatility and

ensure they have enough income in retirement.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20180501005969/en/

Retirement Risks: Understanding and

Expectations (Graphic: Business Wire)

Public opinion and market research company, Greenwald &

Associates, conducted the research on behalf of AXA US and The

Insured Retirement Institute (IRI), surveying more than 1,000

individuals and 300 financial professionals.

The results uncovered several opportunities for financial

professionals to drive deeper client satisfaction by proactively

discussing protection against stock market downturns, guaranteed

lifetime income options and by planning for healthcare

expenses.

Key research findings include:

- Nearly 80 percent of individuals are

interested in learning about an option that offers principal

protection and the potential for growth.

- Fifty-six percent of individuals rate

their financial professional highly when lifetime income is

discussed, versus 34 percent who do so when lifetime income is not

discussed.

- However, only 50 percent of individuals

say they discuss guaranteed lifetime income with their financial

professional, compared to nearly 80 percent who discuss risk

tolerance.

“Financial professionals play a key role in supporting their

clients in reaching their retirement goals,” said Kevin Kennedy,

head of the Individual Retirement business at AXA US. “Clients want

their financial professionals to move beyond the standard risk

tolerance questionnaire and engage them in a thorough discussion of

options, including income planning for healthcare expenses.”

“There is also an opportunity,” Kennedy continued, “for

financial professionals to explore options with their clients that

can help give them access to market appreciation over the long-term

while providing some protection from downside risk.”

The research also found that saving for retirement healthcare

costs creates an additional opportunity for financial professionals

to discuss principal protection options. Nearly 60 percent of

individuals believe they are only somewhat or not very well

prepared for a major health event. However, less than 20 percent of

individuals reported they have worked with their financial

professionals to estimate retirement healthcare costs.

Concerns over healthcare costs are compounded by the potential

for inflation to chip away at their spending power. Ninety-two

percent of individuals recognize inflation is likely to have an

impact on expenses during retirement.

“This research underscores financial professionals’ pivotal role

in helping retirement savers to gain comfort around their ability

to withstand market volatility and the potential role of high

quality annuity products in helping to achieve financial security,”

said Catherine Weatherford, President and CEO, Insured Retirement

Institute. “In return, financial professionals will be rewarded

with higher client satisfaction.”

AXA US’s variable annuity portfolio includes principal

protection features and guaranteed income solutions that can help

financial professionals give their clients options to address their

long-term needs. Depending on each unique need, these strategies

can help individuals protect their wealth, help ensure an income

source they cannot outlive and better weather large expenditures

such as healthcare costs, while mitigating the impact of

inflation.

- Structured Capital Strategies is a

variable and index-linked deferred annuity contract designed for

investors looking to protect their assets against a loss of up to

30 percent as well as invest for growth, up to a cap1.

- Retirement Cornerstone variable

deferred annuity gives investors the ability to accumulate assets

and protect retirement income, tax-deferred.

- Investment Edge variable deferred

annuity offers tax-deferred growth potential, and tax-efficient

distribution options.

Greenwald & Associates conducted the research in the fourth

quarter of 2017. For more information, please see the white paper,

Protection, Growth and Income: Helping Consumers Reach Retirement

Goals, which includes the full research methodology, results and

additional findings.

ABOUT AXA

As leading providers of retirement, insurance and investment

strategies, the companies under the AXA U.S. brand name help

empower their customers to live better lives. Established in 1859,

AXA Equitable now has approximately 2.8 million customers

nationwide. More than 4,700 AXA Advisors Financial Professionals

create strategies to help individuals, families and small business

owners move forward with confidence on their road to financial

security. AXA U.S. is a brand name of AXA Equitable Financial

Services, LLC and its family of companies, including AXA Equitable

Life Insurance Company (AXA Equitable), MONY Life Insurance Company

of America (MLOA) (AZ stock company, administrative office: Jersey

City, NJ), AXA Advisors, LLC (member FINRA, SIPC) and AXA

Distributors, LLC. AXA U.S. is part of the global AXA Group, a

worldwide leader in financial protection strategies and wealth

management, with 107 million clients in 64 countries. The

obligations of AXA Equitable and MLOA are backed solely by their

claims-paying ability. Find AXA on Facebook, Twitter

and LinkedIn. For more information, visit

www.axa.com.

IMPORTANT LEGAL INFORMATION AND CAUTIONARY STATEMENTS

CONCERNING FORWARD-LOOKING STATEMENTS

Annuities are long-term financial products designed for

retirement purposes. In essence, annuities are contractual

agreement in which payment(s) are made to an insurance company,

which agrees to pay out an income or lump sum amount at a later

date. There are contract limitations and fees and charges

associated with annuities, administrative fees, and charges for

optional benefits. A financial professional can provide cost

information and complete details. Variable annuities are subject to

fluctuation in value and market risk, including loss of principal.

Structured Capital Strategies®, Retirement Cornerstone® and

Investment Edge® variable annuities are issued by AXA Equitable

Life Insurance Company, New York, NY 10104. Co-distributed by

affiliates AXA Advisors, LLC and AXA Distributors, LLC (members

FINRA, SIPC). Please consider the charges, risk, expenses, and

investment objectives carefully before purchasing a variable

annuity. For a prospectus containing this and other information,

please contact a financial professional. Read it carefully before

investing or sending money.

GE-135989 (4/18)(Exp. 4/20)

1 The investor will absorb the loss in excess of the protection

limit, so there is a risk of substantial loss of principal.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180501005969/en/

AXAAbby Aylman Cohen,

212-314-2010mediarelations@axa.us.com

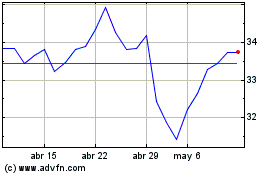

Axa (EU:CS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Axa (EU:CS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024