Regulatory News:

Gecina (Paris:GFC):

| Key takeaways

- Strong, continuous polarization favoring

central areas on both the leasing and investment markets -

Continuous rental income growth materialized (+6.7%

like-for-like), reflecting a strong contribution by

indexation (+5.4%), as well as reversion (+1.0%) -

Significant reversion captured on new leases (average

increase of +14% between expired leases and newly signed

leases, with +18% in central areas for the office portfolio and

+16.5% for the residential portfolio) - Excellent GRESB

score achieved again (95/100), with Gecina first in its peer

group - 2024 Recurrent Net Income (Group share) guidance

upgraded: now expected to reach around €6.40 per share

| Beñat Ortega, Chief Executive Officer: “We achieved a

strong Q3 in a context of the rental market’s bifurcation, with a

growing focus on centrality among companies and a slowdown in

rental activity due to a wait-and-see attitude linked to the

Olympic Games and the electoral sequence in France. Our

achievements in terms of delivering repositioned buildings and on

the leasing side mean that we are able to raise our 2024 guidance,

with a recurrent net income (Group share) expected to around €6.40

per share”.

| Rental income: continuous growth materialized

Gross rental income

Sep 30, 2023

Sep 30, 2024

Change (%)

In million euros

Current basis

Like-for-like

Offices

398.3

422.9

+6.2%

+6.9%

Residential

98.5

95.6

-2.9%

+6.0%

Total gross rental

income

496.9

518.5

+4.4%

+6.7%

- Gross rental income up +6.7%

like-for-like, driven primarily by the continued impact of

indexation (+5.4%) as well as the reversion captured on

new leases (+1.0%) - Solid rental growth on a current basis

(+4.4%, with +6.2% for the offices) - (further details appended) -

Significant reversion on new office leases (+14%), with an

+18% uplift in central locations and +28% in Paris City, on 41,000

sq.m signed over the first three quarters, as well as on the

residential portfolio (+16.5%) - Occupancy rate up

slightly (93.7% vs 93.6% (Q3 2023))

| Non-financial excellence confirmed

- Excellent GRESB score achieved again

(95/100), with Gecina first in its peer group - 100% of

drawn and undrawn debt now green (following the greening of the

latest credit line in Q3 2024)

| Pipeline update: Q3 deliveries as scheduled

- Mondo, a 30,100 sq.m office asset in

Paris CBD (17th arrondissement), which was fully pre-let one

year in advance to the Publicis Group and benefits from the highest

environmental certification standards (HQE Excellent, LEED Gold,

BiodiverCity, BBCA (low carbon construction)), as well as the WELL

and WiredScore labels with a Gold rating - 35 Capucines, a

6,400 sq.m office asset in Paris CBD (2nd arrondissement),

fully pre-let to various luxury industry companies and a law firm,

also benefiting from high environmental certification standards

(HQE Excellent, BBCA (low carbon construction) and Effinergie

Renovation), as well as the WiredScore labels with a Silver rating

- Dareau (5,500 sq.m, 92 apartments), following the

conversion of an office building into residential units in Paris

(14th arrondissement), targeting ambitious certifications (NF

HQE Excellent (Habitat High Environmental Quality), BBCA,

BiodiverCity)

| 2024 Recurrent Net Income (Group share) guidance upgraded:

around €6.40 per share now expected

Appendices

| Gross rental income: +6.7% like-for-like

Gross rental income

Sep 30, 2023

Sep 30, 2024

Change (%)

In million euros

Current basis

Like-for-like

Offices

398.3

422.9

+6.2%

+6.9%

Residential

98.5

95.6

-2.9%

+6.0%

Total gross rental

income

496.9

518.5

+4.4%

+6.7%

Like-for-like: +6.7%

- Acceleration in gross rental income on a

like-for-like basis (+6.7%), with +6.9% for the office

portfolio - Still driven primarily by the continued impact of

indexation (+5.4%), as well as the reversion captured on

new leases (+1.0%)

Current basis: +4.4% (with +6.2% for offices)

- Strongly supported by like-for-like

rental growth (see above) - Positive contribution by the

deliveries in 2023 and 2024, including Boétie (Paris

CBD), 35 Capucines (Paris CBD), Porte Sud (Montrouge), a

residential building in Ville d’Avray and the Montsouris student

residence (Paris), helping to offset the impact of the

historically significant volume of sales completed in 2023

(€1.3bn) as well as the impact of the restructuring and renovation

of our assets (incl. Carreau de Neuilly)

| Offices: +6.9% like-for-like

Gross rental income - Offices

Sep 30, 2023

Sep 30, 2024

Change (%)

In million euros

Current basis

Like-for-like

Offices

398.3

422.9

+6.2%

+6.9%

Central areas (Paris,

Neuilly, Southern Loop)

289.0

309.9

+7.3%

+8.4%

Paris City

228.4

243.9

+6.8%

+8.8%

Core Western Crescent

60.6

66.0

+9.0%

+6.7%

La Défense

53.6

57.7

+7.6%

+7.6%

Other locations

(Peri-Défense, Inner/ Outer Rims and Other regions)

55.7

55.3

-0.8%

-1.2%

- Continued contribution from

indexation on office leases (+6.0%). - Impact of

leasing performance on the like-for-like scope, with the

impact of reversion (+0.7%), with Q3 deals in central areas

as well as in the Core Western Crescent and La Défense: 3,350 sq.m

for a communications company in Boulogne-Billancourt, c.2,000 sq.m

for a university in Paris’ 7th arrondissement and c.1,350 sq.m for

a consulting firm in Courbevoie

| Residential: +6.0% like-for-like

Gross rental income

Sep 30, 2023

Sep 30, 2024

Change (%)

In million euros

Current basis

Like-for-like

Residential

98.5

95.6

-2.9%

+6.0%

YouFirst Residence

82.7

76.7

-7.3%

+3.8%

YouFirst Campus

15.8

18.9

+19.6%

+15.4%

- All the components of our residential portfolios show

positive trends in like-for-like growth - Like-for-like rental

income growth of +6.0%, benefiting from positive indexation

(+2.7%), the impact of significant rental reversion (+2.2%)

and the reduction in the financial vacancy rate

| Occupancy rate: up slightly (93.7%) vs Q3 2023, at a high

level

Average financial occupancy rate

Sep 30, 23

Dec 31, 23

Mar 31, 24

Jun 30, 24

Sep 30, 24

Offices

93.6%

93.7%

93.9%

93.8%

93.7%

Residential

93.6%

94.7%

96.7%

95.2%

93.6%

Group total

93.6%

93.9%

94.3%

94.1%

93.7%

Financial agenda

2024 Earnings press release: February 13, 2025, after market

close

About Gecina

As a specialist for centrality and uses, Gecina operates

innovative and sustainable living spaces. A real estate investment

company, Gecina owns, manages and develops a unique portfolio at

the heart of the Paris Region’s central areas, with more than 1.2

million sq.m of offices and more than 9,000 housing units, almost

three-quarters of which are located in Paris City or

Neuilly-sur-Seine. These portfolios are valued at 17.1 billion

euros at end-June 2024.

Gecina has firmly established its focus on innovation and its

human approach at the heart of its strategy to create value and

deliver on its purpose: “Empowering shared human experiences at the

heart of our sustainable spaces”. For our 100,000 clients, this

ambition is supported by our client-centric brand YouFirst. It is

also positioned at the heart of UtilesEnsemble, our program setting

out our solidarity-based commitments to the environment, to people

and to the quality of life in cities.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, CAC Next 20, CAC Large

60 and CAC 40 ESG indices. Gecina is also recognized as one of the

top-performing companies in its industry by leading sustainability

benchmarks and rankings (GRESB, Sustainalytics, MSCI, ISS-ESG and

CDP).

www.gecina.fr

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016617420/en/

Gecina Financial communications Nicolas BROBAND

Tel.: +33 (0)1 40 40 18 46 nicolasbroband@gecina.fr Attalia NZOUZI

Tel.: + 33 (0)1 40 40 18 44 attalianzouzi@gecina.fr Press

relations Glenn DOMINGUES Tel.: + 33 (0)1 40 40 63 86

glenndomingues@gecina.fr Armelle MICLO Tel.: + 33 (0)1 40 40 51 98

armellemiclo@gecina.fr

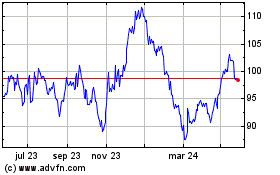

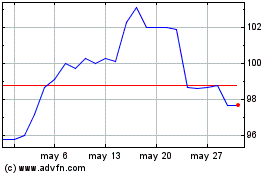

Gecina Nom (EU:GFC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Gecina Nom (EU:GFC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024