- Revenue came to €2,949.4 million1, equating to total growth

of 3.8% and organic growth2 of 0.3%. Q2 revenue equated to organic

growth of 0.5%.

- Operating profit on business activity up 13.6% to €285.3

million; operating margin of 9.7%, up 0.9 points from H1

2023.

- Net profit attributable to the Group from continuing

operations was up 50.5% at €169.3 million, generating a margin of

5.7%. Net profit attributable to the Group, including net profit

from discontinued operations, was up 9.5% at €123.2

million.

- Free cash flow totalled €44.0 million, in keeping with

historical seasonal effects excluding a delay in the collection of

tax credit receivables.

- Finalisation of the sale of Sopra Banking Software

activities in early September confirmed.

- Full-year targets: revenue relatively stable on an organic

basis; operating margin on business activity of at least 9.7%; free

cash flow of around €350 million.

Regulatory News:

Sopra Steria (Paris:SOP):

At its meeting on 24 July 2024, Sopra Steria’s Board of

Directors, chaired by Pierre Pasquier, approved the financial

statements for the first half of 2024; the Statutory Auditors have

conducted a limited review of the financial statements.

Cyril Malargé, Chief Executive Officer of Sopra Steria Group,

commented:

“Despite the market having adopted a wait-and-see stance,

prompting us last week to adjust our full-year organic revenue

growth guidance for the current financial year, our first-half

results are robust. They provide tangible evidence of the

business’s shift towards higher-added-value. This shift is intended

to position Sopra Steria as a trusted, credible European

alternative to global players, harnessing technology and artificial

intelligence to help our clients deliver on their transformation

objectives.

Our priorities fall into three key areas: upscaling in

consulting; moving our tech offerings higher up the value chain;

and upgrading our operating model.

Integration of companies acquired in 2023 has proceeded in line

with the roadmap and is generating tangible commercial and

operational synergies. Profitability at CS Group and the Benelux

reporting unit improved significantly in the first half, confirming

our full-year guidance.

Furthermore, most of the steps in the sale of banking software

activities to Axway have been successfully completed3. As such, the

sale will be finalised in early September.

Lastly, we have improved operating profitability across each of

our reporting units and confirm our guidance of achieving a Group

operating margin of close to 10% in full-year 2024.”

Presentation of the 2024 interim financial statements

The planned sale of most of the activities of Sopra Banking

Software, announced on 21 February 2024, was reflected in the

first half of the year in the legal carve-out of the Sopra Banking

Software activities to be sold and the transfer to various Group

entities of the activities to be retained. Since the carved-out

activities constituted a separate major line of business at 31

December 2023, they have been classified as a discontinued

operation (in accordance with IFRS 5, Non-Current Assets Held for

Sale and Discontinued Operations). The financial statements for the

first half of 2024 are presented in accordance with this standard

as of 1 January 2024, as are the restated comparative financial

statements for 2023.

Moreover, as part of the review of assets acquired and

liabilities assumed, the Group harmonised the method used to

recognise revenue at Ordina. It considered that Ordina acted as

an “agent” in the Netherlands and Belgium, in contracts involving

the sale of external expertise. Revenue recognised for certain

contracts now corresponds to a net amount equivalent to its margin

or its commission rather than being recognised on a gross basis

together with the recognition of an operating expense (IFRS 15).

The 2023 baseline has been restated for the purposes of calculating

organic revenue growth.

After taking these two factors into account, restated Q1 2024

revenue came to €1,484.6 million, equating to organic growth of

0.2% (vs €1,587.4m reported, equating to organic growth of

0.3%).

Sopra Steria: 2024 Half-year results

H1 2024

S1 2023 restated*

S1 2023 reported

Amount

Margin

Change vs 2023 (rep'd)

Amount

Margin

Amount

Margin

Key income statement items

Revenue €m

2,949.4

3.8%

2,676.7

2,840.1

Organic growth % +0.3%

-

Operating profit on business activity €m

285.3

9.7%

13.6%

249.9

9.3%

251.1

8.8%

Profit from recurring operations €m

251.2

8.5%

20.9%

216.7

8.1%

207.8

7.3%

Operating profit €m

229.7

7.8%

29.7%

188.5

7.0%

177.1

6.2%

Net profit from continuing activities attributable to the Group €m

169.3

5.7%

50.5%

128.8

4.8%

112.5

4.0%

Net profit attributable to the Group €m

123.2

4.2%

9.5%

112.5

4.2%

112.5

4.0%

Weighted average number of shares in issue excl. treasury shares m

20.16

20.2

20.20

Basic earnings per share €

6.11

9.8%

5.57

5.57

Recurring earnings per share €

8.45

24.4%

7.60

6.80

Key balance sheet items

6/30/2024

31/12/2023 restated*

31/12/2023 reported

Net financial debt €m

1,057.0

11.7%

946.0

946.0

Equity attributable to the Group €m

1,949.9

3.9%

1,876.7

1,876.7

* On a 2024 accounting standards basis (IFRS 5)

Detailed breakdown of operating performance in H1

2024

Sopra Steria revenue totalled €2,949.4 million, an increase

of 3.8% relative to H1 2023 reported. The positive impact of

changes in scope was €295.8 million, arising from the consolidation

of CS Group and Tobania since 1st March 2023, and of Ordina since

1st October 2023. Currency fluctuations had a positive impact of

€8.3 million. The classification of activities of Sopra Banking

Software as assets held for sale generated a €163.5 million

negative impact. Lastly, harmonisation of the method used to

recognise revenue at Ordina generated a €41.1 million negative

impact. At constant exchange rates, scope and accounting standards,

revenue grew 0.3%.

The Group’s operating profit on business activity rose 13.6%

to €285.3 million, equating to a margin of 9.7%, up 0.9 points

from H1 2023 reported. The classification of certain activities of

Sopra Banking Software as assets held for sale is estimated to have

a positive 0.5-point impact over the half‑year period (positive

0.2-point impact on a full-year basis).

In France (42% of total Group revenue), revenue grew 4.4%

to €1,251.3 million. This figure reflects the consolidation of CS

Group for two extra months compared with the first half of 2023 and

the reallocation of €21.6 million of revenue4 from activities that

previously fell within the scope of Sopra Banking Software. At

constant scope, revenue was down 1.6%, with the second quarter

showing an improvement (down 0.1%) relative to the first quarter

(down 3.0%). The defence and transport verticals both posted growth

in the half-year; the public sector and financial services held

steady; and other verticals – notably aeronautics – declined. The

operating margin on business activity (9.5%) was up 0.4 points from

the first half of 2023. The reallocation of activities previously

within the scope of Sopra Banking Software boosted revenue by 0.2

points. CS Group’s profitability increased by around 2 points.

Revenue for the United Kingdom (17% of total Group

revenue) came in at €487.3 million, equating to organic growth of

3.1%, after declining slightly in the second quarter, notably as a

result of the electoral context, which particularly affected SSCL’s

business. The most buoyant business areas were financial services,

government and transport. The operating margin on business activity

was once again high (11.6%), up 0.2 points from the first half of

2023.

The Europe reporting unit (36% of total Group revenue)

generated revenue of €1,050.5 million, representing total growth of

28.1%. This change reflects the consolidation of Ordina and

Tobania, the reallocation of €15.0 million of revenue4 from

activities previously within the scope of Sopra Banking Software

and a €41.1 million decline in revenue resulting from the

harmonisation of the method used to recognise revenue at Ordina.

Growth at constant scope, exchange rates and accounting standards

came in at 1.5%. The most buoyant growth was in Scandinavia, Spain

and Italy. The operating margin on business activity came in at

9.3%, up 0.4 points compared with the first half of 2023, including

the dilutive effect of the reallocation of activities previously

within the scope of Sopra Banking Software (-0.1 points).

Profitability at the Benelux reporting unit, into which three

companies are in the process of being integrated, increased by

around 2 points.

The Solutions reporting unit (5% of total Group revenue)

generated revenue of €160.3 million, up 12.6% in total following

the reallocation of €17.9 million in revenue4 from activities

previously falling within the scope of Sopra Banking Software.

Excluding changes in scope, revenue held steady. Human Resources

Solutions posted growth of 5.2%. Property Management Solutions

contracted by 5.3%. The reporting unit’s operating margin on

business activity came to 7.6%, down 2.4 points from its level in

the first half of 2023. The reallocation of activities previously

within the scope of Sopra Banking Software had a negative impact of

3.1 points. Excluding the impact of changes in scope, the reporting

unit’s operating margin on business activity improved by 0.7

points.

Comments on the components of net profit for H1 2024

Profit from recurring operations came to €251.2 million,

up 20.9% relative to the first half of 2023. It included a €13.2

million share-based payment expense (versus €28.4 million in the

first half of 2023) and a €20.9 million amortisation expense on

allocated intangible assets (versus €14.9 million in the first half

of 2023).

Operating profit was €229.7 million, up 29.7%, after a

net expense of €21.5 million for other operating income and

expenses (compared with a net expense of €30.7 million in the first

half of 2023).

Net interest expense was €18.2 million (versus €12.5

million in the first half of 2023).

The tax expense was €33.3 million in the half‑year

period, versus €42.5 million in the first half of 2023, translating

to a Group‑wide tax rate of 15.7% following the recording of

non‑recurring tax income in the United Kingdom. For the 2024

financial year as a whole, the tax rate is estimated at around

23%.

Net profit/(loss) from associates came in at a €1.4

million loss (compared with a €0.1 million loss in the first half

of 2023).

Net profit from continuing operations came in at €176.9

million, up 45.0%, giving a margin of 6.0%.

Net profit/(loss) from discontinued operations came in at

a loss of €46.1 million.

Consolidated net profit came to €130.7 million, up 7.2%

relative to the first half of 2023.

After deducting €7.6 million in non‑controlling

interests, net profit attributable to the Group came to €123.2

million, up 9.5% (compared with €112.5 million in the first half of

2023), representing a net profit margin of 4.2%.

Basic earnings per share came to €6.11 (up 9.7%),

compared with €5.57 per share in the first half of 2023.

Financial position at 30 June 2024

Free cash flow in the first half of 2024 came in at €44.0

million, in keeping with historical seasonal effects excluding the

delay until July of the collection of tax credit receivables. This

compares with €122.9 million in the first half of 2023, which

included net receipts in advance of around €50 million.

Net financial debt totalled €1,057.0 million at 30 June

2024. This included €93.9 million in dividend payments. At

end-June, it equated to 1.6x5 pro forma 12‑month rolling EBITDA

before the impact of IFRS 16 (with the financial covenant

stipulating a maximum of 3x).

Workforce

The Group’s net headcount stood at 56,001 employees at 30

June 2024 (compared with 56,273 employees at 31 March 2024).

Excluding headcount corresponding to the parts of Sopra Banking

Software currently in the process of being sold, the net headcount

at end-June was 52,413 employees. A total of 9,182 staff were

employed at international service centres (India, Poland, Spain,

etc.).

The workforce attrition rate was 15.2% (vs 15.7% in the

first half of 2023).

Targets for 2024

- Revenue relatively stable on an organic basis

- Operating margin on business activity of at least 9.7%

- Free cash flow of around €350 million (previously in excess of

€350 million)

Presentation meeting

The results for the first half of 2024 will be presented to

financial analysts and investors in a French/English webcast on

Wednesday, 24 July 2024 at 6:30 p.m. (Paris time).

- Register for the French-language webcast

here - Register for the English-language webcast here

Or by phone:

- French-language phone number: +33 (0)1 70

37 71 66 - English-language phone number: +44 (0)33 0551 0200

Practical information about the presentation and webcast can be

found in the ‘Investors’ section of the Group’s website:

https://www.soprasteria.com/investors

Upcoming financial releases

Thursday, 31 October 2024 (before market opening): Publication

of Q3 2024 revenue

Glossary

- Basic recurring earnings per

share: This measure is equal to basic earnings per share

before other operating income and expenses net of tax.

- Downtime: Number of days

between two contracts (excluding training, sick leave, other leave

and pre-sales) divided by the total number of business days.

- EBITDA: This measure, as

defined in the Universal Registration Document, is equal to

consolidated operating profit on business activity after adding

back depreciation, amortisation and provisions included in

operating profit on business activity.

- Free cash flow: Free cash

flow is defined as the net cash from operations; less investments

(net of disposals) in property, plant and equipment, and intangible

assets; less lease payments; less net interest paid; and less

additional contributions to address any deficits in defined-benefit

pension plans.

- Operating profit on business

activity: This measure, as defined in the Universal

Registration Document, is equal to profit from recurring operations

adjusted to exclude the share-based payment expense for stock

options and free shares and charges to amortisation of allocated

intangible assets.

- Organic revenue growth:

Increase in revenue between the period under review and restated

revenue for the same period in the prior financial year.

- Profit from recurring

operations: This measure is equal to operating profit

before other operating income and expenses, which includes any

particularly significant items of operating income and expense that

are unusual, abnormal, infrequent or not foreseeable, presented

separately in order to give a clearer picture of performance based

on ordinary activities.

- Restated revenue: Revenue

for the prior year, expressed on the basis of the scope and

exchange rates for the current year.

Disclaimer

This document contains forward-looking information subject to

certain risks and uncertainties that may affect the Group’s future

growth and financial results. Readers are reminded that licence

agreements, which often represent investments for clients, are

signed in greater numbers in the second half of the year, with

varying impacts on end-of-year performance. Actual outcomes and

results may differ from those described in this document due to

operational risks and uncertainties. More detailed information on

the potential risks that may affect the Group’s financial results

can be found in the 2023 Universal Registration Document filed with

the Autorité des Marchés Financiers (AMF) on 15 March 2024 (see

pages 40 to 46 in particular). Sopra Steria does not undertake any

obligation to update the forward-looking information contained in

this document beyond what is required by current laws and

regulations. The distribution of this document in certain countries

may be subject to the laws and regulations in force. Persons

physically present in countries where this document is released,

published or distributed should enquire as to any applicable

restrictions and should comply with those restrictions.

About Sopra Steria

Sopra Steria, a major player in the European tech sector with

56,000 employees in nearly 30 countries, is recognised for its

consulting, digital services and software development. It helps its

clients drive their digital transformation and obtain tangible and

sustainable benefits. The Group provides end-to-end solutions to

make large companies and organisations more competitive by

combining in-depth knowledge of a wide range of business sectors

and innovative technologies with a fully collaborative approach.

Sopra Steria places people at the heart of everything it does and

is committed to putting digital to work for its clients in order to

build a positive future for all. In 2023, the Group generated

revenue of €5.8 billion.

The world is how we shape it.

Sopra Steria (SOP) is listed on Euronext Paris (Compartment A) –

ISIN: FR0000050809

For more information, visit us at www.soprasteria.com

Annexes

Sopra Steria: Impact on revenue of changes in scope and exchange

rates – H1 2024 €m H1 2024 H1 2023

Growth Revenue

2,949.4

2,840.1

+3.8%

Changes in exchange rates

8.3

Revenue at constant exchange rates

2,949.4

2,848.4

+3.5% Changes in scope

295.8

Change in scope - Application of IFRS 15

-41.1

Classification as assets held for sale - IFRS 15

-163.5

Revenue at constant exchange rates, scope and accounting

standards

2,949.4

2,939.7

+0.3%

Sopra Steria: Changes in exchange rates – H1 2024 For €1

/ % Average rateH1 2024 Average rateH1 2023

Change Pound sterling

0.8546

0.8764

+ 2.5%

Norwegian krone

11.4926

11.3195

- 1.5%

Swedish krona

11.3914

11.3329

- 0.5%

Danish krone

7.4580

7.4462

- 0.2%

Swiss franc

0.9615

0.9856

+ 2.5%

Sopra Steria: Revenue by reporting unit (€m / %) – Q1 2024

Q1 2024restated(A) Q1 2024reported Q1

2023restated*(B) Q1 2023reported Organic

growth(A/B) Totalgrowth France

633.6

624.6

653.5

589.9

-3.0%

+7.4% United Kingdom

240.0

240.0

223.5

216.7

+7.4% +10.7% Europe

531.9

547.7

525.1

410.4

+1.3% +29.6% Solutions

79.0

71.2

79.5

70.6

-0.6%

+11.9% Sopra Banking Software

-

103.8

-

107.7

-

-

Sopra Steria Group

1,484.6

1,587.4

1,481.6

1,395.4

+0.2% +6.4% * Revenue at 2024 scope, exchange rates

and accounting policies (IFRS 5 & 15)

Sopra Steria: Revenue

by reporting unit (€m / %) – Q2 2024 Q2 2024 Q2

2023restated* Q2 2023reported Organic growth

Totalgrowth France

617.7

618.5

609.0

-0.1%

+1.4% United Kingdom

247.3

249.0

244.3

-0.7%

+1.2% Europe

518.6

509.7

409.4

+1.7% +26.7% Solutions

81.3

80.9

71.8

+0.6% +13.3% Sopra Banking Software

-

-

110.3

-

-

Sopra Steria Group

1,464.8

1,458.1

1,444.7

+0.5% +1.4% * Revenue at 2024 scope, exchange rates

and accounting policies (IFRS 5 & 15)

Sopra Steria: Revenue

by reporting unit (€m / %) – H1 2024 H1 2024 H1

2023restated* H1 2023reported Organic growth

Totalgrowth France

1,251.3

1,272.0

1,198.9

-1.6%

+4.4% United Kingdom

487.3

472.5

461.0

+3.1% +5.7% Europe

1,050.5

1,034.8

819.8

+1.5% +28.1% Solutions

160.3

160.3

142.4

-0.0%

+12.6% Sopra Banking Software

-

-

218.0

-

-

Sopra Steria Group

2,949.4

2,939.7

2,840.1

+0.3% +3.8% * Revenue at 2024 scope, exchange rates

and accounting policies (IFRS 5 & 15)

Sopra Steria:

Performance by reporting unit – H1 2024 H1 2024 S1

2023restated* H1 2023reported €m % €m % €m %

France Revenue

1,251.3

1,220.5

1,198.9

Operating profit on business activity

119.2

9.5%

113.3

9.3%

108.8

9.1%

Profit from recurring operations

106.6

8.5%

97.4

8.0%

90.1

7.5%

Operating profit

99.4

7.9%

89.7

7.3%

84.2

7.0%

United Kingdom Revenue

487.3

461.0

461.0

Operating profit on business activity

56.7

11.6%

52.4

11.4%

52.4

11.4%

Profit from recurring operations

49.8

10.2%

45.5

9.9%

45.5

9.9%

Operating profit

48.2

9.9%

38.2

8.3%

38.2

8.3%

Other Europe Revenue

1,050.5

834.8

819.8

Operating profit on business activity

97.3

9.3%

73.1

8.8%

72.8

8.9%

Profit from recurring operations

84.2

8.0%

66.0

7.9%

66.0

8.1%

Operating profit

72.6

6.9%

53.3

6.4%

56.2

6.9%

Solutions Revenue

160.3

160.3

142.4

Operating profit on business activity

12.2

7.6%

11.1

6.9%

14.3

10.0%

Profit from recurring operations

10.6

6.6%

7.8

4.9%

12.4

8.7%

Operating profit

9.5

5.9%

7.4

4.6%

12.0

8.5%

Sopra Steria: Consolidated income statement – H1 2024 H1

2024 H1 2023restated* H1 2023reported €m % €m %

€m %

Revenue

2,949.4

2,676.7

2,840.1

Staff costs

-1,862.9

-1,637.3

-1,755.0

Operating expenses

-727.1

-731.1

-768.8

Depreciation, amortisation and provisions

-74.2

-58.4

-65.2

Operating profit on business activity

285.3

9.7%

249.9

9.3%

251.1

8.8%

Share-based payment expenses

-13.2

-22.9

-28.4

Amortisation of allocated intangible assets

-20.9

-10.3

-14.9

Profit from recurring operations

251.2

8.5%

216.7

8.1%

207.8

7.3%

Other operating income and expenses

-21.5

-28.2

-30.7

Operating profit

229.7

7.8%

188.5

7.0%

177.1

6.2%

Cost of net financial debt

-8.8

2.4

-6.4

Other financial income and expenses

-9.4

-4.9

-6.1

Tax expense

-33.3

-47.6

-42.5

Net profit from associates

-1.4

-0.1

-0.1

Net profit of continuing activities

176.9

6.0%

138.3

5.2%

122.0

4.3%

Net profit of discontinued activities

-46.1

-16.3

-

Consolidated net profit

130.7

4.4%

122.0

4.6%

122.0

4.3%

Attributable to the Group

123.2

4.2%

112.5

4.2%

112.5

4.0%

Non-controlling interests

7.6

9.5

9.5

Weighted avg nb of shares in issue excl. treasury shares (m)

20.16

20.20

20.20

Basic earnings per share (€)

6.11

5.57

5.57

* On a 2024 accounting standards basis (IFRS 5)

Sopra Steria:

Change in net financial debt (€m) – H1 2024 H1 2024

H1 2023restated*

H1 2023reported Operating profit

on business activity

285.3

249.9

251.1

Depreciation, amortisation and provisions (excl. allocated

intangible assets)

74.1

59.4

67.0

EBITDA

359.4

309.2

318.1

Non-cash items

-4.1

5.3

1.6

Tax paid

-35.2

-41.8

-46.8

Change in operating working capital requirement

-152.3

-61.9

-14.0

Reorganisation and restructuring costs

-18.1

-27.2

-29.9

Net cash flow from operating activities

149.7

183.6

229.0

Lease payments

-62.7

-41.8

-46.2

Change relating to investing activities

-28.0

-35.8

-47.2

Net interest

-9.4

3.1

-5.8

Additional contributions related to defined-benefit pension plans

-5.7

-6.9

-6.9

Free cash flow

44.0

102.2

122.9

Capital increase

-180.0

-0.5

-

Impact of changes in scope

-91.8

-435.9

-428.6

Financial investments

12.8

-6.7

-6.7

Dividends paid

-93.9

-87.5

-87.5

Dividends received

0.3

2.7

2.7

Purchase and sale of treasury shares

-13.4

-3.1

-3.1

Impact of changes in foreign exchange rates

-0.7

-4.5

-6.6

Impact of SBS net financial debt classified under discontinued

operations

211.7

26.4

-

Change in net financial debt

-111.0

-406.9

-406.9

* On a 2024 accounting standards basis (IFRS 5)

Net financial

debt at beginning of period

946.0

152.0

152.0

Net financial debt at end of period

1,057.0

558.9

558.9

Sopra Steria: Simplified balance sheet (€m) – 30/06/2024

6/30/2024 31/12/2023restated*

31/12/2023reported Goodwill

2,334.2

2,586.2

2,668.9

Allocated intangible assets

185.8

232.1

124.8

Other fixed assets

250.8

307.9

304.3

Right-of-use assets

417.6

457.1

457.1

Equity-accounted investments

97.0

185.9

185.9

Fixed assets

3,285.4

3,769.2

3,740.9

Net deferred tax

79.5

70.0

98.3

Trade accounts receivable (net)

1,359.0

1,372.4

1,372.4

Other assets and liabilities

-961.0

-1,556.4

-1,556.4

Working capital requirement (WCR)

398.0

-184.0

-184.0

Assets + WCR

3,762.9

3,655.2

3,655.2

Equity

2,007.6

1,925.1

1,925.1

Pensions – Post-employment benefits

138.8

167.8

167.8

Provisions for contingencies and losses

97.5

113.3

113.3

Lease liabilities

462.0

503.0

503.0

Net financial debt

1,057.0

946.0

946.0

Capital invested

3,762.9

3,655.2

3,655.2

* On a 2024 accounting standards basis (IFRS 5)

Sopra Steria:

Workforce breakdown – 30/06/2024 6/30/2024

6/30/2023 France

20,917

22,363

United Kingdom

7,218

7,693

Other Europe

15,999

13,943

Rest of the World

235

555

X-Shore

8,044

9,400

Total (continuing operations)

52,413

53,954

Activities classified as assets held for sale ∼ 3,600 ∼

4,000

__________________________________________________

1 The activities of Sopra Banking Software currently in

the process of being sold are recognised in assets held for sale

(in accordance with IFRS 5). Methods used to recognise revenue from

a certain type of contract at Ordina have been harmonised (in

accordance with IFRS 15). 2 Alternative performance measures

are defined in the glossary at the end of this document. 3 The

increase in Axway’s share capital to help finance the purchase will

take place between 26 July and 20 August 2024 (inclusive). 4

Baseline : 2023 5 Leverage calculated on the basis of net financial

debt before IFRS 5 of €1,048 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724608880/en/

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16

Press Relations Caroline Simon (Image 7)

caroline.simon@image7.fr +33 (0)1 53 70 74 65

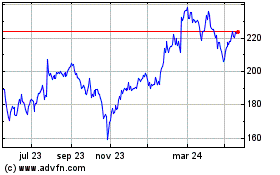

Sopra Steria (EU:SOP)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

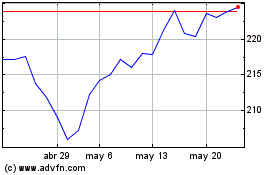

Sopra Steria (EU:SOP)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024