STMicroelectronics Announces Completion of its 2021 Share Buy-back

Programs and Launch of a new 3 Year $1,100 million Share Buy-Back

Plan in 2024

PR N° C3267C

STMicroelectronics Announces Completion

of its2021 Share Buy-back Programs and Launch of a

new 3 Year $1,100 million Share Buy-Back Plan in 2024

AMSTERDAM – June 21st, 2024 --

STMicroelectronics N.V. (the “Company” or “STMicroelectronics”), a

global semiconductor leader serving customers across the spectrum

of electronics applications, announces: (A) the completion of the

3Y share buy-back programs of $1,040 million (the "Completed

Buy-Backs") initiated in 2021 and (B) the launch of a new share

buy-back plan comprising two programs, totalling up to $1,100

million to be executed within a 3-year period (subject to

shareholder and other approvals from time to time) (the "New

Buy-Backs").

The Completed Buy-Backs were carried out, and

the New Buy-Backs will be carried out, in accordance with the

authorization of the Supervisory Board and the provisions of the

Market Abuse Regulation (EU) 596/2014 (the "Market Abuse

Regulation") and Commission Delegated Regulation (EU)

2016/1052.

Details of the Completed Buy-Backs

The Completed Buy-Backs were launched on July 1,

2021 and their duration was approximately 3 years.

The Company carried out the Completed Buy-Backs

and held the shares bought back as treasury stock for the purposes

of (1) meeting the Company’s obligations in relation to its

employee stock award plans and (2) meeting the Company's

obligations arising from debt financial instruments that are

exchangeable into equity instruments. The shares were held or are

being held in treasury prior to being used for each such purpose

and, to the extent that they were not or are not ultimately needed

for such purpose, they may have been or may be used for any other

lawful purpose under article 5(2) of the Market Abuse

Regulation.

Through the Completed Buy-Backs, the Company

repurchased a total of 24,880,267 shares, on a weighted average

purchase price of €38.67 per share, for a total of €962,050,015

equivalent to $1,040 million.

There are 911,281,920 issued shares in the

Company’s capital and as of June 17th, 2024, the Company holds

7,874,440 treasury shares, representing approximately 0.9 percent

of its issued share capital.

Purchases of shares were made through the

regulated market of Euronext Paris.

Details of the New Buy-Backs

Each of the New Buy-Backs may be commenced at

any time following the publication of this press release and again

are for the purposes of, respectively, (1) meeting the Company’s

obligations in relation to its employee stock award plans,

totalling up to $989 million; and (2) supporting the potential

settlement of its outstanding convertible bonds, for approximately

$111 million, at the NYSE closing price of June 18th, 2024. Taken

together the two programs have therefore been authorised for a

total of up to $1,100 million. The Company intends to hold the

repurchased shares as treasury stock.

The shares when repurchased will be recorded as

under one or the other buy-back program. Once purchased, the shares

may be held in treasury prior to being used for either purpose and,

to the extent that they are not ultimately needed for such purpose,

they may be used for any other lawful purpose under Article 5(2) of

the Market Abuse Regulation (EU) 596/2014 including the purpose of

any other buy-back program.

The Company will appoint one or more brokers to

execute the New Buy-Backs in accordance with all applicable

regulations. The brokers will make their decisions relating to the

purchase of Company shares independently, including with respect to

the timing of any purchases, and all purchases effected will be in

compliance with daily limits on prices and volumes.

The Company’s closing share price on the New

York Stock Exchange on June 18th, 2024, was $43.08 and, at such

price the current maximum number of shares that could be acquired

for $1,100 million would be approximately 25.5 million, which

represents approximately 2.8 percent of the Company’s issued share

capital.

Purchases of shares will be made on one or more

trading venues, which may include the regulated market of Euronext

Paris, the Borsa Italiana S.p.A. and the New York Stock

Exchange.

The price paid for any share purchased pursuant

to the New Buy-Backs shall be subject to:

- a minimum of €1.04 per share;

- a maximum of 110 percent of the average

of the highest price per common share on each of the five trading

days prior to the purchase date, on each of the regulated market of

Euronext Paris, the Borsa Italiana S.p.A. and New York Stock

Exchange;

- a maximum of the greater of (i) the price

of the last independent trade and (ii) the highest current

independent purchase bid on the trading venue where the purchase is

carried out; and

- all other applicable rules.

The actual timing, number and value of Company

shares repurchased under the New Buy-Backs will depend on a number

of factors, including market conditions, general business

conditions and applicable legal requirements. The Company is not

obligated to carry out either of the share buy-back programs, and,

if commenced, either share buy-back program may be suspended and

discontinued at any time, for any reason and without previous

notice, in accordance with applicable laws and regulations.

The New Buy-Backs implement the resolution of

the Company’s shareholders pursuant to its annual shareholders’

meeting held on May 22nd, 2024 to repurchase shares in accordance

with the authorisation of the Supervisory Board. Continuation of

the New Buy-Backs will be subject to future shareholder approval at

the Company’s 2025 annual shareholders’ meeting.

The Company will announce details of any share

purchases effected pursuant to the share buy-back plan, as required

by applicable laws and regulations. The costs that the Company may

incur in connection with the purchase of the shares pursuant to the

New Buy-Backs will depend on the price and the terms on which

actual purchases are made.

This announcement contains inside information

for the purposes of Article 7 of the Market Abuse Regulation (EU)

596/2014. The person submitting this information on behalf of

STMicroelectronics N.V. is Lorenzo Grandi, Chief Financial Officer

and President, Finance, Purchasing, ERM and Resilience.

About STMicroelectronics

At ST, we are over 50,000 creators and makers of

semiconductor technologies mastering the semiconductor supply chain

with state-of-the-art manufacturing facilities. An integrated

device manufacturer, we work with more than 200,000 customers and

thousands of partners to design and build products, solutions, and

ecosystems that address their challenges and opportunities, and the

need to support a more sustainable world. Our technologies enable

smarter mobility, more efficient power and energy management, and

the wide-scale deployment of cloud-connected autonomous things. We

are committed to achieving our goal to become carbon neutral on

scope 1 and 2 and partially scope 3 by 2027. Further information

can be found at www.st.com.

For further information, please

contact:INVESTOR RELATIONS:Céline BerthierGroup VP,

Investor RelationsTel: +41.22.929.58.12celine.berthier@st.com

MEDIA RELATIONS:Alexis BretonCorporate External

CommunicationsTel: + 33 6 59 16 79 08alexis.breton@st.com

- C3267C - PR 2021 Share Buyback Completion and launch of a new

plan 2024 - FINAL FOR PUBLICATION

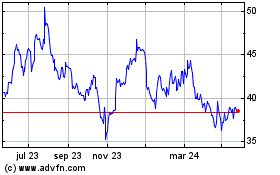

ST Microelectronics (EU:STMPA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

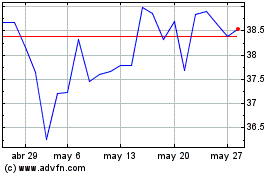

ST Microelectronics (EU:STMPA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024