A2Dominion Housing Group Ltd A2Dominion Housing Group's Half Yearly Performance (6132U)

24 Noviembre 2023 - 3:30AM

UK Regulatory

TIDM54XE

RNS Number : 6132U

A2Dominion Housing Group Ltd

24 November 2023

A2Dominion Housing Group's Half Yearly Performance Update

covering the period to 30 September 2023

A2Dominion Housing Group announces the following update for the

period to 30 September 2023.

Financial Performance

The Group's performance for the first six months to 30 September

2023, shows a GBP9.4m increase in surplus when compared to the

performance over the same period for last year.

6 Months 6 Months

to to

30-Sep-23 30-Sep-22

GBPm GBPm

Turnover 204.6 192.5

Cost of Sales (42.0) (39.5)

Operating Costs (120.6) (116.8)

Share of Joint Venture Surplus 1.1 0.4

Surplus on Sale of Fixed Assets 4.7 7.9

Operating Surplus 47.8 44.5

Operating Margin 23.4% 23.1%

Interest (27.7) (33.8)

Surplus for the Period 20.1 10.7

Turnover has increased year on year by GBP12.1m. This is due to

a GBP14.9m increase in rental and service charge income to

GBP142.5m (2022 - GBP127.6m ). Rents increased by GBP7.6m, a 6.2%

year on year increase with a further GBP7.4m increase from service

charge income, which is primarily the recovery of service charge

costs incurred. The service charge income was impacted by high

inflation on the underlying service charge costs incurred over the

previous 18 months, with GBP2.5m relating to the prior year.

At 23.4%, the operating margin is marginally higher than the

prior year. Operating costs have increased across the board due to

the impact of inflation. An increase in responsive repair costs of

GBP4.2m is also in part due to a rise in the volume of work being

delivered. Service charge and housing management costs have

increased by GBP6.4m, particularly in utilities and decanting

costs. These increases have been offset by the phasing of the

planned maintenance programme, which is weighted more to the second

half, which resulted in a lower spend for the first six months in

planned maintenance of GBP6.5m when compared to 2022. Included in

interest is a one-off gain of GBP5.3m due to an early repayment of

a loan.

Higher spend is budgeted for the second half of the year so the

year-to-date surplus is expected to fall in line with full year

budget.

Unaudited Consolidated Statement of Financial

Position

30-Sep-23 30-Sep-22

GBPm GBPm

Other Fixed Assets and Investments 3,655.5 3,607.4

Current Assets 226.3 322.0

Total Creditors including loans and borrowings (2,821.6) (2,892.6)

Total Reserves 1,060.2 1,036.8

Through continued investment in maintaining existing stock and

the development of new homes the Group's fixed asset base continues

to increase year on year. The drop in current assets is due to a

decrease in the level of stock as well as a lower level of debtors

compared to last year. Debtors have reduced due to a reduction in

sales debtors, prepayments and accrued income and loans to joint

ventures. Total creditors have reduced reflecting a combination of

decreases in borrowings, deferred grant, and pension liability.

Total reserves show an increase compared to the previous year

through positive movement in cashflow hedge reserve at yearend and

the improved surplus for the six months to September 2023 compared

to 2022.

Operational Performance

Customer : As a housing association the Group puts customers'

needs first. Their new corporate strategy prioritises a high-level

of operational performance to provide customers with homes and

neighbourhoods that are safe, affordable, and well maintained.

Performance for customers is assessed through a variety of key

measures. For the first six months of the year, customer effort

measure improved on the 4.0 target with a score of 3.8, and their

'would you recommend the Group' for our new homes measure is at

93.0%, versus a target of 92%. However, customer satisfaction is at

78.0% at the half year, which is short of the 82.0% target, and

improvements have already been actioned to bring this closer to the

end of year target. Median repair days stand at 14 days, which is

ahead of a target of 15 days.

The Group's social impact value is standing at GBP7.7m, with a

full year target of GBP12.0m. Arrears levels are running at 4.1%,

which is slightly better than the target of 4.3% and continues to

be in the upper quartile of A2Dominion's peer group. As the

cost-of-living crisis continues the Group continues to focus on

supporting and signposting customers to the help available to them,

to enable them to continue to manage their financial obligations,

particularly given the cost pressures on households today.

Development: The Group's development team have successfully

handed over 245 units during the first six months of the year of

which 50.6% (124 units) are for our affordable tenures, and 757

units are forecasted to be handed over by 31 March 2024. The

current development pipeline from 2023/24 onwards totals 2,612

units.

Treasury:

As at 30 September, the Group's loan facilities and borrowings

are summarised as follows:

Arranged Drawn

GBPm GBPm

Revolving Credit Facilities 505.9 190.5

Term Loans 503.6 503.6

Capital Market Issues (including 'Club' bonds) 898.5 898.5

1,908.0 1,592.6

In addition to the GBP316m of undrawn facilities, the Group had

GBP16m of cash.

As at 30 September 2023, the Group's overall fixed rate ratio

was 84.5% (September 2022: 94.8%) and the average borrowing rate is

4.74% (September 2022: 4.46%).

There are over 16,000 unallocated or unencumbered properties

across the Group with a security value of around GBP1.9bn.

Further Information

An Investor Update presentation is available on our website:

https://www.a2dominiongroup.co.uk/content/doclib/152.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGRGGUPWUBC

(END) Dow Jones Newswires

November 24, 2023 04:30 ET (09:30 GMT)

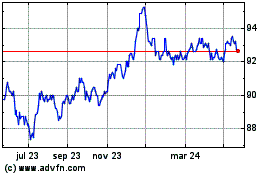

A2dominion 28 (LSE:54XE)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

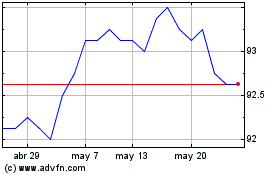

A2dominion 28 (LSE:54XE)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025