TIDMALGW

RNS Number : 9229R

Alpha Growth PLC

06 March 2023

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulation (EU) No. 596/2014 as it forms part of UK domestic

law by virtue of the European Union (Withdrawal) Act 2018 (as

amended). Upon the publication of this announcement, this inside

information is now considered to be in the public domain.

Alpha Growth plc

(" Alpha " or the "Company")

2022 BlackOak Alpha Growth Fund performance update and recap of

the year

Alpha Growth Plc (LSE: ALGW and OTCQB: ALPGF), a leading

financial services specialist in the growing longevity asset class

and insurance linked asset management, is pleased to provide a

general update on the Company's activities within its fund and

insurance business segments and a review of achievements in

2022.

2022 was yet another transformational year for Alpha Growth plc,

a year which saw the BlackOak Growth Fund deliver consistent

returns far in excess of major stock market indexes and where the

Company completed and successfully integrated two further

acquisitions into the group. The Company also launched a new Fund

during 2022 which introduced a new category of investor into the

group. In addition to the Company delivering on its strategic aims

for the year, it also increased assets under management ("AUM") to

circa $700m - a 70x increase from January 2020 and more than

doubling in the past 12 months alone.

Alpha Growth's 2B Plan

At the beginning of 2022, Alpha announced its strategic goal to

reach $2 billion in AUM by 2025. This ambitious but achievable

target demonstrates the Company's drive to establish itself as an

industry leader.

Over the last year, Alpha has made substantial progress towards

achieving its 2025 goal and demonstrated the efficacy of its

business model. Through its successfully completed acquisitions, a

strong pipeline of future acquisitions, and expected organic

growth, Alpha is positioning itself to surpass expectations in

growing its AUM and in doing so is creating an organisation of real

scale which the Board anticipates will be highly cash generative

once its goals are met.

Head of Affiliated Funds Appointment

On 26 September 2022 Chad Schafer began his new role as Head of

Affiliated Funds. Chad is a recognised expert in structured

securities and is responsible for the growth and strategic

direction of the Alpha funds.

Chad brings invaluable expertise and experience to the team and

has been making significant progress since his appointment.

Change of Adviser

In October 2022 the Company announced the appointment of Allenby

Capital Limited ("Allenby Capital") as the Company's sole

broker.

Allenby Capital advises or acts as a broker for more than 70

corporate clients who are listed on the AIM, Standard List or AQUIS

markets. This brings Alpha Growth access to a diverse range of

investors, including institutional investors, family offices,

private client brokers and high net worth individuals.

The appointment is an exciting development that marks a

significant shift in strategic opportunities, as Allenby Capital's

proactive approach and shared passion for Alpha Growth's future

promises to bring about positive change.

Broker Note

The Company is pleased to note that its new broker, Allenby

Capital, has recently initiated coverage of Alpha Growth with the

publication of a detailed research note. This research note

provides a very good overview of the Company and will be a useful

tool when introducing new investors to the Company. The note can be

found at:

https://www.allenbycapital.com/client/alpha-growth-plc

Warrants

The Company would like to confirm that, as announced on 11

February 2021, pursuant to a placing to raise GBP3.75 million, the

Company granted 187,500,000 warrants ("Warrants") to the placees,

exercisable at a price of 3 pence per share, for a period of 24

months following the date of grant, being 15 March 2021.

Due to circumstances whereby the prospectus was not published

and the admission for the shares issued was not completed until 21

December 2021, the Directors have resolved that, following the

statements made in announcements in relation to the same, the final

exercise date for the Warrants relating to the 2021 placing be

amended so that such references in the warrant instrument to the

final exercise date for the Warrants be fixed at 21 December 2023.

All other terms of the Warrants remain the same.

These Warrants can, if exercised by warrant holders, provide the

Company with a useful source of additional cash which may be used

to further accelerate the growth of Alpha.

The Alpha Funds

Alpha Alternative Assets Fund - Interval Fund

On 28 September 2022, the Company announced that its wholly

owned subsidiary Alpha Growth Management LLC ("AGM") had been named

investment manager of the Alpha Alternative Assets Fund with

current assets under management of $5 million. The Alpha

Alternative Assets Fund is a unique longevity-based interval fund,

providing access to institutional-grade assets for (US-Based)

mainstream investors through its low minimum investment size of

$2,500 and the ability for prospective investors to buy-in daily.

It offers a 5% annual dividend yield making it attractive to both

income and capital investors.

The fund charges a 1.5% management fee earned by AGM. Alpha's

team is actively repositioning the fund to focus on longevity

assets to ensure current and prospective investors into the fund

can enjoy the benefits of this uncorrelated and low volatility

asset class.

(Please note that this is not a solicitation to invest in the

Alpha Alternative Assets Fund and restrictions do apply for US and

non US investors)

BlackOak Alpha Growth Fund returns

The Company is pleased to report that the BlackOak Alpha Growth

Fund returned 7.20% during 2022. During this period it reported

positive returns every month and won multiple awards from Barclay

Hedge for its performance.

Since inception in September 2019 up until end December 2022,

the fund has produced returns of over 27% compared with the FTSE

100 which has only increased by circa 2% over the same period. Over

the same period the fund recorded positive returns in all but one

month with zero negative returns versus the much more volatile

FTSE100 which recorded losses in 5 months.

(Please note that this is not a solicitation to invest in The

BlackOak Alpha Growth Fund which only available to accredited and

institutional investors.)

Accretive Acquisitions to the Group

Guernsey Life Insurance Company

On 6 December 2022 the Company announced the successful

completion of the acquisition of Old Mutual International

(Guernsey) Ltd and this Guernsey based insurance company has since

been renamed Alpha International Life Assurance Company (Guernsey)

Ltd. which, at that time, added $275m of AUM to Alpha Growth.

This acquisition provides an excellent platform for Alpha to

offer both life insurance-based wealth management products and life

insurance linked funds, either originated by Alpha or through other

partners, to a broad base of European based UHNWI, family offices

and institutions.

Havelet Assignment Company Ltd

The Company reported on 12 December 2022 that it had

successfully finalised the acquisition of Havelet Assignment

Company Ltd. This Barbados based financial services company is a

strategic acquisition which has added $9m AUM to the Company.

This strategic acquisition not only expands Alpha's abilities to

accumulate assets under administration but also provides a

complementary source of business to Alpha's Providence Life

Assurance Company ("Providence").

This strategic acquisition carries a two-fold benefit to Alpha's

business. Firstly, it bolsters its ability to accumulate assets

under administration, thus expanding capabilities in this area.

Secondly, the acquisition brings with it a complementary source of

business which can serve as an additional revenue stream for

Providence. Overall, the acquisition has the potential to

contribute significantly to the growth and development of Alpha's

business.

Gobind Sahney, Executive Chairman, commented: "2022 was a very

productive year for Alpha Growth which saw AUM almost doubling to

circa $700m, bringing us significantly closer to achieving our

stated goal of managing over $2bn of AUM by 2025. During the year,

we completed two significant acquisitions and launched a

significant new fund which we expect to attract a new category of

investor into the Company."

"We start 2023 with a robust list of exciting opportunities

which will allow us to continue to rapidly scale the organization

both organically and through further acquisitions, none of these

opportunities are expected to require a raise. Throughout 2023, we

will also look to bolster our team of experts to support our 2B

plan and ensure we continue to grow AUM and revenue

significantly."

**S **

For more information, please visit www.algwplc.com or contact

the following:

+44 (0) 20 3959

Alpha Growth plc 8600

Gobind Sahney, Executive Chairman info@algwplc.com

+44 (0) 20 3328

Allenby Capital Limited 5656

Amrit Nahal (Sales and Corporate Broking)

Nick Athanas / Piers Shimwell (Corporate

Finance)

UK Investor Relations - Mark Treharne ir@algwplc.com

About Alpha Growth plc

Specialist in Longevity Assets

Alpha Growth plc is a financial advisory business providing

specialist consultancy, advisory, and supplementary services to

institutional and qualified investors globally in the multi-billion

dollar market of longevity assets. Building on its well-established

network, the Alpha Growth group has a unique position in the

longevity asset services and investment business, as a listed

entity with global reach. The group's strategy is to expand its

advisory and business services via acquisitions and joint ventures

in the UK and the US to attain commercial scale and provide

holistic solutions to alternative institutional investors who are

in need of specialised skills and unique access to deploy their

financial resource in longevity assets.

Longevity Assets and Non-correlation

As a longevity asset, it is non-correlated to the real estate,

equity capital and commodity markets. Its value is a function of

time because as time passes the value gets closer to the face value

of the policy. Hence creating a steady increase in the net asset

value of the investment. This makes it highly attractive to

investors wishing to counteract volatility within an investment

portfolio and add yield.

Note: The Company only advises on and manages Longevity Assets

that originate in the USA where the structured and life settlement

market is highly regulated.

Forward Looking Statements Disclaimer

Certain statements, beliefs and opinions in this document are

forward-looking, which reflect the Company's or, as appropriate,

the Company's directors' current expectations and projections about

future events. By their nature, forward-looking statements involve

a number of risks, uncertainties and assumptions that could cause

actual results or events to differ materially from those expressed

or implied by the forward-looking statements. These risks,

uncertainties and assumptions could adversely affect the outcome

and financial effects of the plans and events described herein.

Forward-looking statements contained in this document regarding

past trends or activities should not be taken as a representation

that such trends or activities will continue in the future. The

Company does not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. You should not place undue reliance on

forward- looking statements, which speak only as of the date of

this document. Readers should not treat the contents of this

document as advice relating to legal, taxation or investment

matters, and are to make their own assessments concerning these and

other consequences, including the merits of information and the

risks. Readers of this announcement are advised to conduct their

own due diligence and agree to be bound by the limitations of this

disclaimer.

Important Notice

The content of this announcement has not been approved by an

authorised person within the meaning of the Financial Services and

Markets Act 2000 (FSMA). This announcement has been issued by and

is the sole responsibility of the Company. The information in this

announcement is subject to change.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCJIMATMTTMBFJ

(END) Dow Jones Newswires

March 06, 2023 02:00 ET (07:00 GMT)

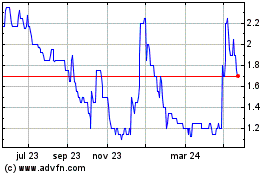

Alpha Growth (LSE:ALGW)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

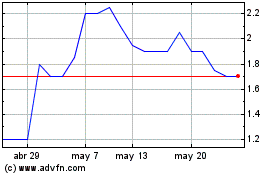

Alpha Growth (LSE:ALGW)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024