TIDMARA

RNS Number : 5102Y

Aura Renewable Acquisitions PLC

07 September 2022

Aura Renewable Acquisitions plc

("Aura" or "Company")

Interim Results for the period ended 30 June 2022

7 September 2022 - Aura Renewable Acquisitions plc, a UK-based

company, whose objective is to invest in the global renewable

energy sector supply chain and thereby build shareholder value,

announces its maiden interim results for the period from the date

of incorporation on 4 November 2021 to 30 June 2022.

Highlights

-- Raised an initial GBP1m on the Standard Segment of the Main

Market of the London Stock Exchange.

-- The costs of the IPO process and minimal overheads resulted

in a loss before tax of GBP164,065, EPS (4p loss).

-- Targeting acquisitions operating in the Global Renewable Energy Sector Supply Chain.

-- A very experienced board with extremely strong sector

experience and expertise and a clear expansion strategy.

-- Low-cost base and good visibility towards potential targets.

-- Best practice ESG policies will be put in place to support

and encourage sustainability across our business.

John Croft, the Chairman of Aura commented:

"During this initial financial period the Company joined the

Standard Segment of the Main Market of the London Stock Exchange on

8th April 2022 and raised gross proceeds of GBP1,000,000 from a

placing and subscription.

"Since listing, Aura has begun to explore a range of potential

targets in the UK and overseas which could offer the opportunity

for significant growth in this exciting and fast-moving market

sector. We have also been in discussions with the Board's extensive

professional and business networks to raise the Company's profile

and highlight its intentions and objective to this large potential

introducer base.

"The current worldwide economic and political uncertainty caused

by supply chain issues, inflation, interest rate rises, hostilities

in Europe and further afield, the lingering impact of Covid and

climate change, have had a dampening impact on capital market

activity and fund raisings during 2022.

"Despite these uncertainties, the growth in renewable capacity

continues, with solar capacity leading the way. Installed renewable

energy capacity around the world increased by 6% in 2021, despite

post-Covid delays and rising raw material costs of 15%-25%. The

International Energy Agency (IEA) expects 2022 to create further

growth of 8% in installed capacity, not least as countries that

have relied upon oil and gas from Russia are now accelerating the

expansion in renewable energy capacity in response to the war in

Ukraine.

"As a result of these market forces, we are more confident than

ever that the renewable energy sector will offer excellent

opportunities for acquisitive and organic growth for the

foreseeable future, and we are committed to ensuring that the

Company and its stakeholders have the chance to share in these

opportunities."

Enquiries

Aura Renewable Acquisitions Plc

John Croft (Non-Exec Chairman) 07785315588

Robin Stevens (Non-Exec Director) 07787112059

Media enquiries

Allerton Communications

Peter Curtain 020 3633 1730

aurarenewables@allertoncomms.co.uk

Notes to Editors

Aura was established to acquire and then act as the holding

company for targeted businesses operating in the Global Renewable

Energy Sector Supply Chain, particularly participants in the wind,

solar, biomass, hydropower, carbon capture, waste management, smart

grids and green hydrogen supply chain, and their sub-sectors. These

potential targets could range from raw materials resourcing to

power generation, energy storage and recycling.

Inside Information

The information contained within this announcement is deemed by

Aura to constitute inside information as stipulated under the

Market Abuse Regulation (EU) no. 596/2014. On the publication of

this announcement via a Regulatory Information Service, this inside

information is now considered to be in the public domain.

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

The unaudited condensed interim statement of comprehensive

income of the Company from the date of incorporation on 4 November

2021 to 30 June 2022 is stated below:

Period

ended

30 June

2022

(unaudited)

Note GBP

--------------

Revenue -

Administrative expenses 6 (164,065)

Operating loss (164,065)

Finance costs -

Loss before taxation (164,065)

Income tax 8 -

Total comprehensive loss for the period attributable

to the equity holders (164,065)

Basic and diluted earnings per ordinary share

attributable to the equity holders (GBP) 9 (0.04)

There was no other comprehensive income in the period. All

activities relate to continuing operations.

CONDENSED STATEMENT OF FINANCIAL POSITION

The unaudited condensed interim statement of financial position

of the Company at 30 June 2022 is stated below:

At 30 June

2022

(unaudited)

Note GBP

ASSETS

Current assets

Cash and cash equivalents 10 845,445

Total assets 845,445

LIABILITIES

Current liabilities

Trade and other payables 966

Accruals 3,544

Total liabilities 4,510

EQUITY

Equity attributable to owners

Ordinary share capital 11 150,000

Share premium 855,000

Retained losses (164,065)

--------------

Total equity attributable to Shareholders 840,935

Total equity and liabilities 845,445

The Interim Condensed Financial Statements were approved and

authorized for issue by the Board of Directors on 6 September

2022.

CONDENSED STATEMENT OF CASH FLOWS

The unaudited condensed interim statement of cash flows of the

Company from the date of incorporation on 4 November 2021 to 30

June 2022 is stated below:

Period

ended

30 June

2022

(unaudited)

GBP

Cash flows from operating activities

Loss before income tax (164,065)

Increase in payables 4,510

Net cash flow from operating activities (159,555)

Cash flows from financing activities

Net proceeds from issue of ordinary shares 1,005,000

Net cash inflow from financing activities 1,005,000

Net increase in cash and cash equivalents 845,445

Cash and cash equivalents at beginning of period -

Cash and cash equivalents at end of period 845,445

CONDENSED STATEMENT OF CHANGES IN EQUITY

The unaudited condensed interim statement of statement of

changes in equity of the Company from the date of incorporation on

4 November 2021 to 30 June 2022 is stated below:

Ordinary

share Share premium Retained

capital earnings Total equity

GBP GBP GBP GBP

Balance at incorporation - - - -

Loss for the period - - (164,065) (164,065)

Comprehensive loss for the

period

--------- ---------------- ---------- -------------

Total comprehensive loss for

the period - - (164,065) (164,065)

Transactions with owners

in the period

Issue of ordinary shares 150,000 900,000 - 1,050,000

Share issue costs - (45,000) - (45,000)

--------- ---------------- ---------- -------------

Total transactions with owners 150,000 855,000 - 1,005,000

At 30 June 2022 150,000 855,000 (164,065) 840,935

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1 General information

The Company was incorporated on 4 November 2021 as Aura

Renewable Acquisitions Plc in England and Wales with company number

13723431 under The Companies Act 2006.

The address of its registered office is 5 Chancery Lane, London.

WC2A 1LG.

The principal activity of the Company is to act as the holding

company for various target businesses operating in the Global

Renewable Energy Sector Supply Chain.

The entire issued ordinary share capital of 10,500,000 ordinary

shares of GBP0.01 each was admitted to listing on the standard

segment of the Official List of the Financial Conduct Authority and

to trading on the main market for listed securities of London Stock

Exchange plc under the TIDM "ARA" on 8 April 2022.

2 Basis of preparation

The principal accounting policies applied in the preparation of

the Company's Financial Statements are set out below. These

policies have been consistently applied to the period presented,

unless otherwise stated, and are consistent with those used in the

financial information contained with the Company's Prospectus.

The unaudited condensed interim financial statements have been

prepared in accordance with the Disclosure and Transparency Rules

of the Financial Conduct Authority and International Accounting

Standard 34 "Interim Financial Reporting" (IAS 34). These financial

statements have been prepared under the historical cost

convention.

These condensed financial statements do not include all of the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Company's financial position

and performance during the period from incorporation to 30 June

2022.

The condensed interim financial statements are unaudited and

have not been reviewed by the auditors and were approved by the

Board of Directors on 6 September 2022.

The Financial Statements are presented in GBP unless otherwise

stated which is the Company's functional and presentational

currency. The business is not currently subject to seasonal

variations.

Comparative figures

No comparative figures have been presented as the Financial

Statements cover the period from incorporation on 4 November

2021.

Going concern

The Financial Statements has been prepared on a going concern

basis. The Directors have a reasonable expectation that the Company

has adequate resources to continue in operational existence for the

foreseeable future. Thus, they continue to adopt the going concern

basis of accounting in preparing the Financial Statements.

The financial position of the Company, its cash flows and

liquidity position are set out in these financial statements. As at

30 June 2022, the Company had cash and cash equivalents of

GBP845,445.

The Company has prepared monthly cash flow forecasts based on

estimates of key variables to expenditure through to December 2023

that supports the conclusion of the Directors that they expect

sufficient funding to be available to meet the Company's

anticipated cash flow requirements to this date.

3 Significant accounting policies

The Company's Financial Statements are based on the following

policies which have been consistently applied:

Cash and cash equivalents

The Directors consider any cash on short-term deposits and other

short-term investments to be cash equivalents.

Trade and other receivables

Trade and other receivables are recognised initially at fair

value and subsequently measured at amortised cost using the

effective interest method, less provision for impairment.

Trade and other payables

Trade payables are recognised initially at their fair value and

subsequently measured at amortised cost.

Financial instruments

Initial recognition

A financial asset or financial liability is recognised in the

statement of financial position of the Company when it arises or

when the Company becomes part of the contractual terms of the

financial instrument.

Classification

Financial assets at amortised cost

The Company measures financial assets at amortised cost if both

of the following conditions are met:

-- the asset is held within a business model whose objective is

to collect contractual cash flows; and

-- the contractual terms of the financial asset generating cash

flows at specified dates only pertain to capital and interest

payments on the balance of the initial capital.

Financial assets which are measured at amortised cost, are

measured using the Effective Interest Rate Method (EIR) and are

subject to impairment. Gains and losses are recognised in profit or

loss when the asset is derecognised, modified or impaired.

Financial liabilities at amortised cost

Financial liabilities measured at amortised cost using the

effective interest rate method include current borrowings and trade

and other payables that are short term in nature. Financial

liabilities are derecognised if the Company's obligations specified

in the contract expire or are discharged or cancelled.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the effective interest rate ("EIR"). The EIR amortisation

is included as finance costs in profit or loss. Trade payables

other payables are non-interest bearing and are stated at amortised

cost using the effective interest method.

Derecognition

A financial asset is derecognised when:

-- the rights to receive cash flows from the asset have expired, or

-- the Company has transferred its rights to receive cash flows

from the asset or has undertaken the commitment to fully pay the

cash flows received without significant delay to a third party

under an arrangement and has either (a) transferred substantially

all the risks and the assets of the asset or (b) has neither

transferred nor held substantially all the risks and estimates of

the asset but has transferred the control of the asset.

Earnings per share

The Company presents basic and diluted earnings per share

("EPS") data for its ordinary shares. Basic EPS is calculated by

dividing the profit or loss attributable to ordinary shareholders

of the Company by the weighted average number of ordinary shares

outstanding during the period. Diluted EPS is calculated by

adjusting the earnings and number of shares for the effects of

dilutive potential ordinary shares.

Equity

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new ordinary shares or

options are shown in equity as a deduction from the proceeds.

Taxation

Income tax for the period is based on the taxable income for the

period. Taxable income differs from profit as reported in the

statement of comprehensive income for the period as there are some

items which may never be taxable or deductible for tax and other

items which may be deductible or taxable in other periods. Income

tax for the period is calculated on the basis of the tax laws

enacted or substantively enacted at the end of the reporting

period. Current and deferred tax is recognised in profit or to the

extent that it relates to items recognised in other comprehensive

income or directly in equity. In this case, the tax is also

recognised in other comprehensive income or directly in equity,

respectively.

Deferred income tax is recognised, using the liability method,

on temporary differences arising between the tax bases of assets

and liabilities and their carrying amounts in the Financial

Statements. Deferred income tax is determined using tax rates (and

laws) that have been enacted, or substantially enacted, by the end

of the reporting period and are expected to apply when the related

deferred income tax asset is realised, or the deferred income tax

liability is settled.

Deferred income tax assets are recognised only to the extent

that it is probable that future taxable profit will be available

against which the temporary differences can be utilised.

4 Standards and interpretations issued and not yet effective:

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective and, in

some cases, have not yet been adopted by the UK. The Directors do

not expect that the adoption of these standards will have a

material impact on the Company's Financial Statements.

During the period, the Company has adopted the following new

IFRSs (including amendments thereto) and IFRIC interpretations that

became effective for the first time.

Standard Effective date, annual

period beginning on

or after

Amendments to IFRS 9, IAS 39 and IFRS 1 January 2021

17 - Interest Rate Benchmark Reform

(Phase 2)

Amendments to IFRS 3: Business Combinations 1 January 2022

-Reference to the Conceptual Framework

Annual Improvements to IFRS Standards 1 January 2022

2018-2020 Cycle

Standards issued but not yet effective:

At the date of authorisation of these interim financial

statements, the following standards and interpretations relevant to

the Company and which have not been applied in these financial

statements, were in issue but were not yet effective. In some

cases, these standards and guidance have not been endorsed for use

in the UK.

Standard Effective date, annual

period beginning on

or after

Amendments to IAS 1 - Classification TBC

of liabilities as current or non-current

Amendments to IAS 1 and IFRS Practice TBC

Statement 2 - Disclosure of accounting

policies

Amendments to IAS 8 - Definition of TBC

accounting estimate

Amendments to IFRS 10 and IAS 28 - Postponed

Sale or contribution of assets between

an investor and its associate or joint

venture

Amendments to IAS 12: Income Taxes TBC

-Deferred Tax related to Assets and

Liabilities arising from a Single Transaction

The directors are evaluating the impact that these standards

will have on the financial statements of Company.

5 Critical accounting estimates and judgments

In preparing the Financial Statements, the Directors have to

make judgments on how to apply the Company's accounting policies

and make estimates about the future. The Directors do not consider

there to be any critical judgments that have been made in arriving

at the amounts recognised in the Financial Statements.

6 Operating expenses by nature

Period ended 30 June 2022

Administrative expenses GBP

Legal and professional costs 92,602

LSE fees 40,855

Website costs 10,422

Company secretarial 8,914

Company set-up 492

Other expenses 10,780

Total administrative expenses 164,065

==========================

No provision for share-based payment arrangements (in respect of

warrants) has been made as the amounts involved are immaterial.

7 Directors

None of the directors received any remuneration during the

period.

8 Taxation

The Company has made no provision for taxation as it has not yet

generated any taxable income. A reconciliation of income tax

expense applicable to the loss before taxation at the statutory tax

rate to the income tax expense at the effective tax rate of the

Company is as follows:

Period ended 30 June 2022

GBP

Loss before taxation (164,065)

Tax calculated at the statutory rate of 19% (31,172)

Tax effects of:

Unrecognised tax losses 31,172

--------------------------

Tax expense -

==========================

The UK Government enacted changes to the UK tax rate in 2020,

resulting in the rate remaining at 19% (instead of the previously

intended reduction from 19% to 17%). In the 2021 Budget, the UK

Chancellor announced that legislation would be proposed to increase

the main rate of corporation tax to 25% from 1 April 2023.

Tax has been calculated based on the rate of 19% which was

effective for the period. The taxation charge in future periods

will be affected by any changes to the corporation tax rates in

force in the countries in which the Company operates.

As at 30 June 2022, the Company had estimated unutilised tax

losses of GBP164,065 available for relief against future profits.

No relating deferred tax asset has been provided for in the

accounts based on the uncertainty as to when profits will be

generated against which to relieve said asset.

9 Earnings per ordinary share

Basic earnings per ordinary share is calculated by dividing the

earnings attributable to Shareholders by the weighted average

number of ordinary shares outstanding during the period. Diluted

earnings per share is calculated by dividing earnings by the

weighted average number of shares in issue and potential dilutive

shares outstanding during the period.

Because the Company was in a net loss position, diluted loss per

share excludes the effects of ordinary share equivalents consisting

of warrants, which are anti-dilutive.

Period ended 30 June 2022

Earnings Per-share amount

Basic and diluted EPS GBP Weighted average number of shares GBP

Basic earnings attributable to Shareholders (164,065) 3,945,834 (0.04)

10 Cash and cash equivalents

At 30 June

2022

GBP

Cash at bank 845,445

Cash in hand -

-----------

845,445

-----------

11 Share capital and warrants

Number of Deferred Shares Ordinary

Number of Shares

Ordinary Shares GBP

On incorporation (Ordinary Shares of GBP1.00 each) 1 - 1

Issue of Ordinary Shares of GBP1.00 each 49,999 - 49,999

----------------- -------------------------- ---------

Share conversion 500,000 45,000 50,000

----------------- -------------------------- ---------

Subscription for Ordinary Shares of GBP0.01 each 1,000,000 - 10,000

----------------- -------------------------- ---------

Placing of Ordinary Shares of GBP0.01 each 9,000,000 - 90,000

----------------- -------------------------- ---------

At 30 June 2022 10,500,000 45,000 150,000

================= ========================== =========

Share capital

On incorporation, the Company issued one ordinary share of GBP1

at par for a cash consideration of GBP1.

On 30 November 2021, 49,999 ordinary shares of GBP1 in the

capital of the Company were subscribed for and allotted at par for

a cash consideration of GBP49,999. The proceeds from the allotment

of these shares were received on 1 December 2021.

On 25 January 2022, by a shareholder's resolution, the 50,000

ordinary shares of GBP1.00 in issue were converted into 500,000

Ordinary Shares of GBP0.01 each and 45,000 non-voting deferred

shares of GBP1 each.

On 25 January 2022, a loan agreement was entered into between

the Company and Harmony Capital Investments Limited, under which

Harmony Capital Investments Limited agreed to lend up to GBP100,000

to the Company on an interest free basis.

Harmony Capital Investments Limited agreed to subscribe for

1,000,000 Ordinary Shares of GBP0.01 each for an aggregate

subscription price of GBP100,000, creating a share premium of

GBP90,000. satisfied by the release of the Company's obligation to

repay such loan, conditional only on Admission taking place on or

before 29 April 2022. The subscription for shares was completed on

7 April 2022. By subscribing for the subscription shares, Harmony

Capital Investments Limited was entitled to be issued with

1,500,000 Freely Transferable Warrants and 1,050,000 Founder

Shareholder Warrants upon Admission.

On 7 April 2022, the Company completed a placing of 9,000,000

Ordinary Shares of GBP0.01 each for a cash consideration of

GBP900,000, creating a share premium of GBP810,000.

The Deferred Shares do not entitle holders to receive any

dividend or other distribution or to receive notice of or speak or

vote at general meetings of the Company and are not freely

transferrable. The Company has the right at any time to purchase

all of the Deferred Shares in issue for an aggregate consideration

of GBP1.

Warrants

The Company granted a total of 12,780,000 unlisted Warrants, on

Admission, in relation to the share capital of the Company as

follows:

i) "Freely Transferable Warrants" granted to Investors

subscribing for New Ordinary Shares under the placing and to

Harmony Capital under the terms of the Shareholder Loan Agreement

on the basis of one Freely Transferable Warrant for every one

Existing Ordinary Share and New Ordinary Share subscribed for. No

consideration was payable for the issue of these Warrants. Each

Freely Transferable Warrant enables the holder to subscribe for one

Ordinary Share for 15 pence (a 50 per cent. premium to the Issue

Price). These Freely Transferable Warrants are freely transferable

and may be held and dealt with separately from the Ordinary Shares

subscribed for and are exercisable for a period of 3 years

following Admission. Up to 10,500,000 Ordinary Shares in aggregate

may be subscribed for under the Freely Transferable Warrants, equal

to 100 per cent. of the Enlarged Issued Ordinary Share Capital;

ii) "Director Warrants", granted to Directors at the discretion

of the Nomination and Remuneration Committee for no consideration.

Each Director Warrant enables the holder to subscribe for one

Ordinary Share for 15 pence (a 50 per cent. premium to the Issue

Price). The Director Warrants will vest on the completion of the

first Acquisition and will be exercisable during the period of

three years from the vesting date. The Director Warrants are freely

transferable, provided that they may not be transferred during the

period of the holder's appointment as Director or, if longer,

during the period up to completion of the first Acquisition. Should

a Director resign within 12 months of Admission, they will forfeit

their Director Warrants, which will be reallocated between the

Directors by the Board. Up to 1,050,000 Ordinary Shares in

aggregate may be subscribed for under the Director Warrants, equal

to 10 per cent. of the Enlarged Issued Ordinary Share Capital;

iii) "Broker Warrants", granted to Shard Capital as part of its

consideration for arranging the Placing, in an aggregate number

equal to 2 per cent. of the total number of Placing Shares

subscribed for under the Placing. Each Broker Warrant enables the

holder to subscribe for one Ordinary Share for 15 pence (a 50 per

cent. premium to the Issue Price). These Broker Warrants are

exercisable for a period of 3 years following Admission and are

freely transferable. Up to 180,000 Ordinary Shares in aggregate may

be subscribed for under the Broker Warrants, equal to approximately

1.7 per cent. of the Enlarged Issued Ordinary Share Capital;

and

iv) "Founder Shareholder Warrants", granted to Harmony Capital

as founder shareholder of the Company under the terms of the

Shareholder Loan Agreement. No consideration is payable for the

issue of these Warrants. Each Founder Shareholder Warrant enables

the holder to subscribe for one Ordinary Share at a price of one

pence per Ordinary Share. These Founder Shareholder Warrants will

vest on satisfaction of the following conditions: (a) the first

Acquisition has been completed; and (b) the 30-day Volume Weighted

Average Price of the Company's Ordinary Shares exceeds GBP0.15 per

share at any time. The Founder Shareholder Warrants are exercisable

for a period of 3 years following the vesting date and are freely

transferable from the date the first Acquisition has been

completed. Up to 1,050,000 Ordinary Shares in aggregate may be

subscribed for under the Founder Shareholder Warrants, equal to 10

per cent. of the Enlarged Issued Ordinary Share Capital.

12 Related party transactions

On incorporation on 4 November 2021, the Company issued 1

ordinary share of GBP1 at par value to Suresh Withana. This share

was transferred to Harmony Capital Investments Limited, a company

wholly owned by Suresh Withana, on 29 November 2021 .

On 30 November 2021, the Company issued 49,999 ordinary shares

of GBP1 at par value to Harmony Capital Investments Limited.

Harmony Capital Investments Limited subscribed for 1,000,000

Ordinary Shares of GBP0.01 each on 7 April 2022, as described in

Note 11.

13 Post balance sheet events

No events subsequent to 30 June 2022 have occurred which require

disclosure in these financial statements.

14 Ultimate controlling party

At 30 June 2022, the Company did not have any single

identifiable controlling party.

15. Half Year Report

A copy of this half year interim report is available on the

Company's website http:www.aurarenewables.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUUPBUPPGMQ

(END) Dow Jones Newswires

September 07, 2022 02:00 ET (06:00 GMT)

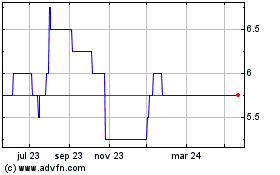

Aura Renewable Acquisiti... (LSE:ARA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

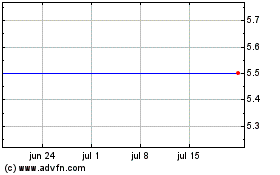

Aura Renewable Acquisiti... (LSE:ARA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024