Aram Resources PLC - Final Results

30 Junio 1999 - 5:37AM

UK Regulatory

RNS No 6369q

ARAM RESOURCES PLC

30 June 1999

CHAIRMAN'S STATEMENT

I am pleased to report on the positive progress we achieved in 1998, our first

full year since flotation in September 1997. Operating profits for the period

were #667,000 on sales of #3,226,000, with profit before taxation of #363,000

giving earnings per share of 6.01p. The Board is recommending a final

dividend of 1p per share which, if approved, will be paid on 29 July 1999 to

those shareholders registered at the close of business on 16 July 1999. This

proposed dividend, together with the interim dividend of 1p brings the

total dividend in respect of the year to 2p per share.

Review

Considerable progress was made in 1998 in translating the strategy set out at

the time of our flotation into reality. As of today's date we have secured a

total of 6 wharf locations for the introduction of satellite coating plants to

be supplied by sea from the West of England Quarry and from third party

sources. At the time of flotation it was envisaged that 2 such sites would be

secured. Our detailed surveys proved that suitable wharves were even more

limited in availability than we had previously considered so we moved quickly

to secure these important resources. Having now secured a good strategic base

we will spend the next twelve months in developing and generating profits from

it.

To facilitate the development of our satellite coating plants on our wharves,

we have been successful in securing long term contracts to supply the

necessary raw materials to complement those from our own West of England

quarry. The materials concerned are secondary aggregates, a further example

of our commitment to basing strategy on environmental sustainability.

Offer letters were accepted for two government grants totalling some #1.3

million during 1998 to assist in our capital expenditure programme. This

fully justified our decision to delay development of the West of England

quarry pending the outcome of the grant applications. We were pleased to be

the first British company to be awarded a water freight facilities grant in

excess of #1 million. Grant assistance is available in the form of freight

facilities grants from the Department of Environment, Transport and the

Regions (DETR) to encourage companies to utilise water borne Transportation

to ease congestion on the already crowded road network. The environmental

objectives of the freight facilities grants are complementary to our strategy

of utilising sea transport to carry bulk commodities and as a result we

believe that further grant aid will be forthcoming for our wharf sites as

they are developed. Moreover, increasing taxes on road diesel will further

enhance our competitiveness. The possibility of an aggregates tax and the

integrated transport policy being followed by the government are both

areas which also offer us many advantages with our strategy of environmental

sustainability, our resource base and the locations of our sites.

Turnover at the long established Carnsew Quarry saw a growth of some 28% over

the previous year, aided by the introduction mid-year of a concrete plant. In

addition in the second half we also benefited from a contract to supply the

materials for the St Austell North East Distributor Road, the major new road

project in Cornwall last year. At the same time, stocks of raw materials were

built up to support the planned continued growth of the operation.

Trading in the second half of the year was in line with expectations.

The operating quarries were revalued to #15.6 million. The surplus arising

from the revaluation of #14.7 million has been transferred to reserves. Other

non-operational quarries have been retained at cost. These accounts do not

include any material value relating to our wharves. Formal valuations have

been conducted since the year end which indicate the open market value of

these wharves in their current stage of development is in excess of #7

million.

In March 1999 we acquired the issued share capital of Tregunnon Quarry

Limited. Tregunnon Quarry, based near Launceston, Cornwall, provides us with

an in-house strategic source of high PSV aggregate. It will also allow us to

increase our geographical spread in the South West and reduce our purchases of

imported materials.

In December 1998 we submitted a planning application to utilise the void space

created by our operations in the first part of Carnsew Quarry as a landfill

site suitable for domestic and commercial refuse. The planning process is

expected to take up to twelve months. The existing landfill sites in Cornwall

have limited remaining useful lives. We are currently in discussion with a

specialist landfill operator to exploit the potential of this considerable

opportunity. These proposed operations do not affect the continuing operation

of the quarry and its associated activities.

People

At the end of April we had to accept the resignation of one of our non-

executive directors, Darryl Whitehead. Darryl has accepted a senior position

with Grant Thornton, our company auditors, and as such was obliged to resign

by the rules of the Institute of Chartered Accountants in England and Wales.

He made a significant contribution to the group, both during the flotation and

thereafter, and on behalf of the Board I both thank him for this and wish him

every success in his new appointment.

In April 1999 Edward Dilley was appointed as non executive director. Edward

spent 40 years with Barclays Bank where in his final appointment he was the

Business centre Director of their Strand Branch. Since 1996 he has been

employed by Cable & Wireless plc in the role of Director Corporate Financial

Services.

We are pleased to announce today the appointment of Tom Baty as business

development director and Clive Scott as finance director. Tom joins us from

the Manchester Ship Canal Company Limited. He has a wealth of experience in

business development and wharfing operations. Clive, a Chartered Management

Accountant, joined us in January 1998 as financial controller following five

years with the TI Group plc.

The period of growth we are nurturing provides a demanding and stimulating

environment in which to work. I would like to take this opportunity of

thanking our loyal work force for the contribution they have made to this

growth.

Outlook

Trading in 1999 to date has been broadly in line with expectations. Quarried

material sales in the first quarter have been ahead of the same period last

year by some 23%. Trading conditions in the South West are currently

favourable and with the satellite plants planned to contribute to profits in

the second half, we look forward with confidence to the remainder of 1999.

GILES NIXON

Chairman

30 June 1999

ARAM RESOURCES PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the year ended 31 December 1998

Year to Nine months to

31 December 1998 31 December 1997

# #

Turnover 3,225,607 1,759,259

Cost of sales (2,038,253) (1,317,487)

___________ ___________

Gross profit 1,187,354 441,772

Administrative expenses (520,588) (246,928)

___________ ___________

Operating profit 666,766 194,844

Net interest (303,342) (169,359)

___________ ___________

Profit on ordinary activities

before taxation 363,424 25,485

Tax on profit on ordinary activities - (22,000)

___________ ____________

Profit for the financial period 363,424 3,485

Dividends (157,000) (14,647)

___________ ____________

Profit/(loss) transferred

to/(from) reserves 206,424 (11,162)

___________ ____________

Basic earnings per share 6.01p (0.23)p

___________ ____________

ARAM RESOURCES PLC

CONSOLIDATED BALANCE SHEET AT 31 DECEMBER 1998

1998 1997

# #

Fixed assets

Tangible assets 19,591,491 2,924,435

Current assets

Stocks 1,732,466 526,079

Debtors 463,227 225,721

Cash at bank and in hand 408,598 720,368

__________ __________

2,604,291 1,472,168

Creditors: amounts falling due

within one year (2,537,141) (1,492,808)

__________ __________

Net current assets/(liabilities) 67,150 (20,640)

__________ __________

Total assets less current liabilities 19,658,641 2,903,795

Creditors: amounts falling

due after more than one year (3,519,142) (1,623,943)

__________ __________

16,139,499 1,279,852

___________ __________

Capital and reserves

Called up share capital 963,500 963,500

Share premium account 31,212 44,337

Revaluation reserve 14,666,348 -

Profit and loss account 478,439 272,015

___________ __________

Shareholders' funds 16,139,499 1,279,852

___________ __________

Equity shareholders funds 15,227,499 367,852

Non-equity shareholders funds:

Convertible preference shares 900,000 900,000

Deferred shares 12,000 12,000

___________ __________

16,139,499 1,279,852

___________ __________

The financial statements were approved by the Board of directors

on 30 June 1999.

R DAVID BINNS E C DILLEY

Director Director

NOTES:

1.Earnings per share

The figures for earnings per share are calculated on earnings

attributable to ordinary shareholders of #309,424 (1997: loss #11,162).

The basic earnings per share calculation is based on a weighted average

number of ordinary shares of 1p each in issue during the year of 5,150,000

(1997: 4,917,000).

2. The results contained in this preliminary statement do not constitute

statutory accounts as defined in section 240 of the Companies Act 1985, but

have been extracted from the statutory accounts for the financial year ended

31 December 1998. Comparative information is extracted from the statutory

accounts for the financial year ended 31 December 1997, which have been

delivered to the Registrar of Companies with an unqualified audit report

thereon.

3. The financial statements for the year ended 31 December 1998 will be

posted to shareholders today and filed with the Registrar of Companies in due

course.

END

FR ARORKKRKNOAR

Aura Renewable Acquisiti... (LSE:ARA)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

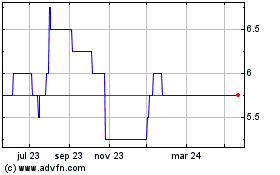

Aura Renewable Acquisiti... (LSE:ARA)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024