TIDMCNN

RNS Number : 9197U

Caledonian Trust PLC

31 March 2023

31 March 2023

Caledonian Trust plc

("Caledonian Trust", the "Company" or the "Group")

Unaudited interim results for the six months ended 31 December

2022

Caledonian Trust plc, the Edinburgh-based property investment

holding and development company, announces its unaudited interim

results for the six months ended 31 December 2022.

Enquiries:

Caledonian Trust plc

Douglas Lowe, Chairman and Chief Executive Officer Tel: 0131 220 0416

Mike Baynham, Finance Director Tel: 0131 220 0416

Allenby Capital Limited

(Nominated Adviser and Broker)

Nick Athanas Tel: 0203 328 5656

Alex Brearley

Dan Dearden-Williams

CHAIRMAN'S STATEMENT

Introduction

The Group made a pre-tax profit of GBP353,000 in the six months

to 31 December 2022 compared with a pre-tax loss of GBP196,000 for

the same period last year. The profit per share for the six months

to 31 December 2022 was 3.00p and the NAV per share as at 31

December 2022 was 200.3p compared with a loss per share of 1.66p

and a NAV per share of 206.7p last year. The Group's emphasis will

continue to be to secure, improve and realise the value in our

property portfolios.

Review of Activities

I provided a comprehensive review of activities in my December

statement accompanying our audited results for the year ended 30

June 2022.

On 24 February we released an announcement to the market,

stating that, as a result of strong interest, we had set a closing

date for indicative offers for St. Margaret's House ("SMH") on 23

February 2023 and had received non-binding proposals from three

separate parties. Careful consideration and analysis of each of the

proposals has led us to select a preferred bidder and enter into an

exclusivity agreement with them to enable them to undertake their

necessary due diligence and agree formal terms for the purchase by

the end of April 2023 with the intention that any such agreement

entered into would be conditional, inter alia, on the purchaser

obtaining the required amendments to the planning consent at SMH.

Whilst the Board is hopeful of a satisfactory outcome, there can be

no certainty that a sale of SMH will proceed, nor on its terms or

the timing of any sale.

A further announcement will be made when a formal sale agreement

has been entered into or the Company will otherwise provide an

update in relation to SMH in due course.

In the meantime, SMH continues to be fully let at a nominal

rent, presently just over GBP1.50/ft(2) of occupied space, to a

charity, Edinburgh Palette, who have reconfigured and sub-let all

the space to over 200 artists, artisans and galleries.

At Brunstane we completed the construction of the third phase of

development, comprising five new houses over 8,650ft(2) forming the

Steading Courtyard, at the beginning of July 2021 and this

development was completed in September 2022. We completed the sale

of three of the houses in October and November 2022 for an

aggregate GBP2m and a fourth in March 2023 for GBP725,000. Knight

Frank are marketing the remaining house at a fixed price of

GBP700,000. The application for 11 new houses (c.20,000ft(2) ),

"Upper Brunstane", in the Stackyard field to the east of the

steading was granted in November 2022. We intend to prepare the

site for development, take up the planning consent and secure the

requisite building warrant with a view to undertaking the

development as soon as appropriate. We have made an application to

modify the consent for "Plot 10", lying between Phase 3 and Upper

Brunstane, by replacing the single large (3,500ft(2) ) house with

two smaller houses of similar combined size which will complete the

small courtyard leading into Upper Brunstane.

At Wallyford we are currently finalising several minor but

important variations to the planning consent for six detached

houses and four semi-detached houses over 13,350ft(2) and we have

received detailed tender prices, but are reviewing when to start

construction in light of current conditions. The site lies within

400m of the East Coast mainline station, is near the A1/A720 City

Bypass junction and is contiguous with a completed development of

houses. To the south of Wallyford a very large development of new

houses is being built at St Clement's Wells on ground rising to the

south, affording extensive views over the Forth estuary to Fife.

Wallyford, no longer a mining village, is rapidly becoming another

leafy commuting Edinburgh suburb in the fertile East Lothian

coastal strip.

Economic Prospects

Winter came this Spring - a sudden icy blast. The economic

winter too has proved unseasonal, but is it, too, deferred?

Economic prospects, major world events excepted, depend upon

whether a long recession has been avoided or merely deferred, like

Winter.

The economic Winter has been unexceptionally mild and GDP is

0.8% higher than the OBR forecast in November 2023, having narrowly

avoided the forecast recession in December 2022, as output was

unchanged in Q4 2022 following the 0.2% contraction in Q3 2022.

After the Covid lockdown in late 2021 there was a robust recovery

of 4.2% in Q1 2022 followed by growth of 0.2% in Q2 resulting in

growth of 4.10% in 2022, but GDP is still 2.0% below the pre-Covid

level in 2019.

In 2023 the OBR expects GDP to contract 0.4% in Q1, to be nil in

Q2, but to rise 0.1% in each of Q3 and Q4, and to be -0.2% lower

overall in 2023. This forecast of -0.2% is 1.2 percentage points

higher than the OBR November forecast for 2023. A 0.5 percentage

point rise over the OBR's November 2022 forecast is forecast for

2024, but subsequent years are marked down 0.2, 0.3 and 0.4

percentage points respectively, resulting in the November 1.7

percentage point rise forecast changed to only 0.8% over five

years. The March forecast has reduced forecast growth and

effectively re-distributed it forward, such a change in timing

being convenient for the 2024 election.

While the OBR's forecast is that GDP will return to the

pre-Covid 2019 level in late 2024, real living standards - RHDI -

real household disposable income - per person does move in

proportion with GDP and is forecast to fall by 5.7% over the

financial years 2022-23 and 2023-24, the largest two-year fall on

record. In 2027-28 real living standards are expected to be 0.4%

lower than the pre-Covid level and are not expected to rise above

that level until 2029.

The UK's poor economic performance can be traced back to the

financial crisis of 2007/08 followed by an injudicious austerity

policy, then by Covid, and then quickly by the Ukraine war. Had the

growth rate experienced until 2007/08 continued at the same rate

until 2023, GDP per head would now have been 38.9% higher.

Moreover, the UK's economic recovery post Covid is strikingly poor,

as by 2025 the UK economy is forecast to have recovered only to the

pre-Covid level, whereas the EU area is forecast to have grown 6.0%

and the US 9.0%. From 1980 until the 2007/08 Great Recession the UK

enjoyed the highest annual real growth in GDP in the G7, but since

2016 it has had the second poorest performance of about 0.5%pa,

just above Japan's 0.3%.

Other commentators' forecasts are less optimistic than the OBR's

forecast of a cumulative growth of 1.6% by December 2024 and of

8.1% by December 2027 (6.2% by 2026). In contrast the mean of "new"

forecasts by economists surveyed in March by HMT is for a much

lower growth of 0.3% by end 2024. The NIESR's forecast of 6.4%

growth by 2027 is the highest of the other longer term forecasts.

The Bank's forecast until the end 2024 is even more pessimistic at

minus 1.0%, a pessimism that persists as it forecasts growth at

only 0.1% by end 2026, compared to 4.5%, NIESR, and 6.2%, OBR.

While the Bank's current forecast is pessimistic, it is

considerably better than its November 2022 forecast, only three

months ago, of a depression with a fall of 3.0% and a return to the

pre-depression output level only after 21 quarters. Now the Bank

forecasts a depression of less than 1.0% and a return to the

pre-depression level in 13 quarters.

The Bank's reduced pessimism is based on important reductions in

gas futures prices of over a third and, most significantly, in Bank

Rate, as implied by financial market interest rates (i.e. not

interest rates assumed or forecast by the Bank, but market" rates),

falling compared to their November report by 0.8 percentage points

to 4.4% in 2023, by 0.7 percentage points in 2024 to 3.7%, and by

0.3 percentage points in 2025 to 3.4%. Unlike the Bank, the OBR is

not constrained in its forecasts of future bank rate, forming their

own estimates rather than using the implied market rates. Over the

next three years its forecasts are based on interest rates of 0.25

percentage points lower than those of the Bank in February 2023.

Such lower interest rates would account for an important part of

the difference between the Bank and the OBR forecasts.

The implied interest rate used by the Bank and the forecast rate

used by the OBR are both likely to prove to be too high. The

interest rate rise (prior to the recent 0.25% rise) is

unprecedented - from 0.1% to 4.0% in 14 months. The cash cost of an

increase in interest from say 0.1% to 4.0% and from 4% to 7.9% is

the same. However, with low interest rates many organisations are

likely to have increased gearing, and if the gearing has been

increased so that the interest paid as a percentage of sales is the

same, then the effect of the same percentage point increase in

interest rates is quite different. If, for instance, interest costs

are 10% of revenue and the bank margin is 2.9%, then, with a gross

margin of 20%, a 3.9% percentage point rise in interest costs

results in a gross margin of 7%. If, however, in the higher

interest environment with the same interest cost of 10% of revenue

when the interest payable is 6.9% the gross margin is 20%, a 3.9%

percentage point rise in interest costs results in a gross margin

14.5%, a much lower reduction in gross margin. Thus, for the

same

interest cost as a proportion of sales, the same increase in

rate from a low base has much larger effect on profitability. Thus,

the effect of the same percentage point rises in interest costs

will have a larger impact on the economy than it would have had

from a higher base, and to the extent such an effect may be

unrecognised the extent of an interest rate rise required to bring

a given effect on the economy may be overstated. This effect will

only operate where low interest rates have induced higher gearing,

the likelihood of which will increase with the length of time low

interest rates have operated and been expected to continue to do

so, as has widely been the case in the UK.

There is another major uncertainty concerning the effect of

interest rate rises. There is a time lag before the full effect of

any interest rate rise becomes evident in the economy, typically

reaching its maximum only after a year, or even two, a phenomenon

dubbed by Milton Friedman as the "long and variable lags" of

interest rate policy. Some recent research suggests that, due to

the current more rapid transmission of central bank intentions, the

strongest impact may come after nine months. In that case, interest

rises from the late Spring may be exerting their full effect now,

but rate rises above 2.0% are now only six months old and the most

recent rise to 4.25% occurred only last week. Thus, even if rapid

transmission is now more likely, the majority of the full effect of

rate rises is yet to be reflected in the economy.

The Bank risks "overkill" if interest rates are raised in line

with the 4.4% for 2023 implied by the forward market interest rates

used by the MPC. Three months have already passed with interest

rates at 4% or 3.5%, the average of the remaining nine months would

have to 4.6% to reach the 4.4% level implied by the forward

markets.

A review of the causes of the high inflation suggests that not

only has the inflation rate just peaked, but it is likely to return

to "acceptable" levels. Firstly, commodity prices have fallen both

recently and over a year: the Economist all-items sterling index is

down 0.7% on the month and 11.2% on the year; the dollar indices

all-items are down 17.5%; food 16.4%; and non-food agriculturals

36.3%. Brent oil has fallen to $77.5, 21.9% lower than last year

and the price of gas, now $2.35 per MM Btu, is down from $5.41 last

year and from a peak price of $9.77. Secondly, the supply shortages

induced by the rapid recovery from Covid and the production

dislocation of Covid have reversed and, for example, there is now a

surplus, not a dire shortage, of "chips". Thirdly, supply chains

have adjusted and shipping rates returned to normal. Fourthly,

price rises caused by shortages of basic industrial imports caused

prices to rise throughout the economy "spilling" the rises

generally - interestingly even into second hand cars, for instance.

Fifthly, the flush of demand extended into the re-opening service

industries which, being short staffed, had a reduced supply

capability and so increased their prices, while, more generally,

the sudden demand for "labour" of all types raised wages. However,

prices in all sectors, including oil, have since stabilised with

the exception of wages where unemployment rates in the G7

countries, apart from Italy, are the lowest or close to the lowest

for 25 years. Clearly economies have adequate supplies of goods at

current prices but not of labour. Labour shortages are partly due

to a reduction in the labour force because of the large increase in

those employable not seeking employment, and, of course, a very low

rate of increased productivity augments such a shortage.

Unfortunately, until the supply shortages are resolved, demand must

be reduced if inflation is to be controlled. The delay in the

moderation of wages may be due to the lag effect of interest rate

rises, but the extent of the wage rises achieved or in

contemplation may be due to the increased political pressure for

rises after the particularly high inflation levels experienced by

those below the median wage, a pressure reinforced by the minimal

improvement in such living standards over many years.

A cardinal tenet of the models used by central banks to forecast

inflation is the level of employment and of vacancies: put more

simply, if the demand for labour is high, the price is unlikely to

fall. Fortunately, recent figures indicate a downturn in employment

and falling vacancies. As wage inflation is a lag indicator, the

effects of rising interest rates may now be being seen.

One dramatic effect of interest rate rises has just become

evident, being the reduced value Tier 1 equity, an early warning of

the possible wide effects on stability of large, sudden interest

rate rises on the banking sector over and above inflation.

Financial stability supersedes "normal" inflationary concerns and

ensuring stability may be a major determinant of future interest

rate changes. The rise in interest rates has caused a corresponding

drop in the value of all fixed interest securities, which form a

substantial part of many banks' assets. In the case of the Silicon

Valley Bank, the USA's 16(th) largest bank, they comprised so high

a proportion that SVB's Tier 1 equity fell from 12% to almost 0%.

This bank, and others have crashed as a consequence, throwing doubt

on the integrity of the whole banking sector. Even "strong" banks

like Bank of America's Tier 1 capital has halved to 6%, and Credit

Suisse has just been rescued by the Swiss National Bank and then

taken over for a relatively nominal amount by UBS. The crisis in

the banking sector would be worsened if rates were increased

further, but greatly ameliorated if the trend in rates was seen to

have peaked. This overriding consideration for stability will, at

least, moderate any further rate increase. I re-affirm my December

2022 statement that rates should peak at or about 4%, but decline

slowly to stabilise at around 3% over the next few years.

The failure of SVB, a bank outside the criterion of banks

considered "too big to fail", but with the rescue of its

depositors, has proved both that regulation must be extended and

the quality of the banks' executives must be improved or even

controlled. As I noted in my 2022 statement, of the many

depressions since the 14(th) century, financial policies or

irregularities have been responsible for a large proportion of

them. Recently many pension funds have had to be rescued when,

after securing their long-term bond holdings against equity

investments, the bond value fell leaving the security uncovered and

the consequent margin requirement unmet. These lacunae follow those

revealed in the Great Depression of widespread weak governance,

notably in the largest bank in the world, the RBS. These recent

financial crises originate because of a disregard of the basic

tenet of banking: when long-term lending is funded, even in part,

by short-term deposits, depositors must have confidence in the

liquidity of the bank. The Bank of England notes carried the

statement "... promise to pay the bearer on demand ...". True, but

what the Bank meant was, "provided not too many other people

require payment at the same time".

Writing in the FT, Martin Wolf put the position pithily: "The

marriage of risky and often illiquid assets with liabilities that

have to be safe and liquid within undercapitalised, profit-seeking

and bonus-paying institutions regulated by politically subservient

and often incompetent public sectors is a calamity waiting to

happen. Banking needs radical change."

Possibly, a more limited change in management might be

recommended also for the Bank whose timing of interest rate changes

both before the 2007 Recession and before the current inflationary

crisis has been suspect.

In Scotland, in contrast to previous forecasts, I close by

forecasting that the economic climate will improve significantly

over the next few years. The SNP has cracked: its aura of

integrity, its halo of purity, its selflessness in the common cause

and its solidarity are strewn publicly in pieces. In its place are

unedifying evidences of malfeasance, perverting the course of

justice, self-aggrandisement, undemocratic practices, the manifold

"sins" of all older parties. Thus, the cause of independence has

suffered a blow that may prove mortal. This benefit is complemented

by a possible "stay of execution" for the oil and gas sector,

Scotland's major non-state employer, and maybe assisted by a

possible reduction in the power of the Green alliance where a tiny

minority of MSPs has been responsible for obstructing economically

productive investments in Scotland at an economic and social cost

that far outweighs any measured benefit. Thus, I forecast

confidence in Scotland, its future and its economy will be greatly

improved, so lowering the cost of capital, increasing investment

and asset values and, most importantly, living standards.

Property Prospects

I reviewed property prospects comprehensively in my statement to

the year ended 30 June 2022 based on the forecasts made in the

autumn, but by December 2022 the forecast returns for 2022 had

deteriorated very considerably. The Investment Property Forum (IPF)

All Property return for 2022, previously forecast at 6.4%, is now

estimated at -2.3%, due almost entirely to forecast Capital Value

growth dropping from 2.3% to -6.4% and only the Retail Warehouse

sector is estimated to produce a positive return of 5.2%, although

down from 12.3%, but all other sectors are estimated to have

negative returns of from -1.9% (Shopping Centres) to -3.9% (City

Offices).

The MSCI(2) Monthly Property Index reported an even larger

negative return of -10.4% for 2022. The changes in capital value

reflect the spike in interest rates to over 5%, following the

economic and tax proposals made during the very brief period of Liz

Truss' leadership.

The IPF February forecast for 2023 forecasts a Total All

Property return of -0.6%, an improvement on the November forecast

of -2.4%. The only sector forecast to have a positive Total return

is Industrials (0.4%) and Offices are forecast to have a Total

return of -2.7% within which City Offices, with a -3.5% return, are

the worst performing sub-sector. All sectors, with the exception of

Industrials (2.9% gain), are forecast to have declines in rental

value of which Shopping Centres are forecast to have the greatest

fall of 2.8%, and Standard Retail 2.3% and City Offices 2.0%.

Capital value contraction is forecast as 5.5% with all sectors

falling in value. The IPF conducts its research in January (6

contributors) and February (11) and the figures quoted are averages

of these contributors. The January forecasts were for a Capital

Value growth of -6.6%, but the February forecasts were for a

Capital Value growth of -5.0%; reflecting a cautious return of

confidence following the establishment of the new Government.

Forecasts for later years are for a recovery to a Total return

of 7.2% in 2024 and of 8.0% in 2025. In 2024 average rental value

growth is only 1.0% but Shopping Centres and City Office sectors

are forecast to continue to decline in rental value. Shopping

Centres are forecast to decline also in Capital Value growth in

2024, but the Industrial sector is forecast to increase by 3.8%,

the largest rise in Capital Value, which averages 2.2%. In 2025 all

sectors are forecast to have higher Rental and Capital Value growth

than in 2024 to give an improved All property return of 8.0%. The

poor returns forecast for 2023 reduce the five year 2023/27

forecast Total return to 5.6% per annum.

The IPF forecasts are based on the mean of normally 20 forecasts

evenly divided into two groups - Property Advisors and Fund

Managers, whose individual forecasts are widely dispersed. Until

recently there has been little difference between the forecasts of

these two groups, but for 2023 there is a sharp distinction.

Whereas the nine Property Advisors mean forecast for total return

is -0.2%, the Fund Managers participating forecast was for -1.6%.

The total returns for subsequent years between the two groups of

forecasters had no similar disparities.

Colliers provide comprehensive forecasts which, interestingly,

as there is no averaging, normally have been very similar to the

IPF means. But currently, the Colliers forecasts are markedly

different to the IPF's forecasts, particularly for 2023 where the

total return is forecast as 5.3% in contrast to the IPF's -0.6%

with a corresponding difference of 5 percentage points for

Industrial and Office returns and 7.7 percentage points difference

in the Retail return (8.5% cf 0.8%). There is a similar disparity

in the five-year return forecast where Colliers forecast about a 3

percentage point increased return in all sectors. Exceptionally,

Colliers forecast Total return for Industrials is 10.5% whereas IPF

forecast 6.5%. In general, Colliers expect a higher growth in

rentals than the IPF, forecasting five-year rental growth of 4.3%pa

for Industrials (IPF 2.6%), 1.7% for Retail Warehouses (0.6%) and

Offices "averaging" 1.4% ("averaging" 0.7%). For Standard Retail

the forecasts agree: no increase in rental value over five

years!

Patently, returns as forecast by Colliers are greatly to be

desired, but consideration of the prospects for the individual

sectors gives little comfort. Most forecasters tend to project a

continuation of recent changes and very unusually are turning

points accurately forecast. Colliers forecasts, being less

pessimistic, may correctly be forecasting such an inversion!

However, both forecasts agree on the forecast for Standard

Retail: more of the same! They both forecast the Industrial /

Logistics sector as having the highest returns, based largely on

the expected continuing rise in online sales and the demand for

distribution facilities to meet demand. Online sales were 20.5% of

all retail sales in the three months before the Covid crisis in

late March 2020, rose considerably during that crisis, and in

January 2023 were 26.6% of all retail sales, having peaked at 37.8%

in January 2021. The average for the 12 months to January 2023 was

25.8%.

Online sales administration and the associated distribution

services appear to be becoming even more convenient and efficient.

However, several factors militate against a further expansion of

their proportion of retail sales: the "easiest", the low lying

fruit has been harvested; goods' returns are rising and are

probably increasingly expensive to resell, especially of "personal"

goods; working from home, while established, is declining; existing

retailers are adopting a hybrid system of online / collection /

in-store services; and retail services are becoming increasingly

"personal", for example, in areas of health and beauty, services

which cannot be delivered online! While online sales will continue

to expand, no significant change in their percentage of retail

sales seems likely. Although the retail sector is adjusting to the

extent of online sales, the total growth in retail sales will be

limited by low expected growth in Real Household Disposable

Income.

In 2022 there were 3,365 net store closures compared to 7,902 in

2021 and to a peak of 11,319 in 2020, but closures are expected to

increase slightly over the next two years before falling to 2,600

in 2025, in line with expected improvements then in the economy.

The 3,365 net closures in 2022 included net openings of 904 leisure

units and 430 convenience units and the net closure of 2,308

service units and 2,391 comparison units. The fastest declining

categories were Banks 676, Hairdressers 527 and Newsagents, Bookies

and Recruitment, each 268, and fastest growing categories were Fast

Food, Takeaways, Beauty Salons and Convenience Stores each

increasing by about 425, and "Bars" 347 units. The retail sector is

adapting quickly to changed economic circumstances, but, although

the rate of decline in shop units slows, returns to the retail

sector will be severely restricted, especially as the vacancy rate

of 18.2% remains above the pre-Covid level of 14.4%.

The office sector also faces reducing demand for its existing

premises, apart from the effect of the continuing slow growth in

the economy. Demand for existing offices has been significantly

diminished because of the changing work routines, especially "work

from home", which, however disadvantageous for some work

categories, seems likely to persist. Symptomatic of the change is

the recent announcement that Abrdn is closing its 100,000ft(2)

office in St. Andrews Square, Edinburgh and consolidating its

offices, and, anecdotally, it is reported that the Registers of

Scotland's 125,00ft(2) office in Edinburgh is currently only 20%

occupied. The office sector will suffer, not only from a reduced

demand but, from a different demand as a result of energy pricing

and ESG policies rendering much existing office stock outdated or

redundant and therefore effectively worthless. Thus, while values

will be high for the limited high-quality space, values will be

greatly impaired for all other space.

The industrial sector is the only main property sector where

demand continues to increase, a surprising volte-face from the

traditional position where it traded on low nearly static rents and

consistently high yields.

The prospects for Commercial Property are poor and depend

primarily on rental returns while capital values remain static. The

OBR, comparatively optimistic in economics prospects, forecasts

that "Commercial Property Prices" will decline 4.8% this year and

grow less than 0.5% pa for the next five years. The OBR forecasts

CPI to be 18.1% over the next five years, resulting in the real

value of Commercial Property falling by about 15%. The poor

performance of commercial property since 2007 will continue.

The anomalously high house price rises that I reported last

year, unsurprisingly, halted late last summer when monthly falls

became widely reported, the extent varying among surveys. In the

year to February 2023 rises were reported by Halifax 2.1%, Acadata

(E&W) 4.7%, Acadata (Scotland) 4.6% (January), Knight Frank

5.3% and ESPC 2.2%, but a fall was reported by Nationwide of 1.1%.

The divergence between Halifax and Nationwide is anomalous because

their figures are both derived from their own mortgages for

properties that are of similar values (10% approximately higher for

Halifax). The difference between these figures and Acadata figures

is also anomalous as both mortgage-based surveys are for a

"standardised" house product and include an upward Winter seasonal

adjustment. Acadata figures are actual figures including both cash

and mortgage sales, and therefore include more expensive properties

in the result. It seems likely more "expensive" properties have

been less affected by the more difficult mortgage market and have

continued to rise in value. Acadata report that, while overall

rises have continued, the rate of growth has slowed for six months,

and that prices in London have fallen.

Higher price rises continue to take place outside London and the

South-East: quite exceptionally in Blaenau Gwent prices have risen

30.3% - a narrow market! In Scotland where, in January, prices fell

0.9%, there was a noticeable difference between house types as flat

values fell 2.0%, terraces 1.6%, and semi-detached houses 0.6%,

while detached houses maintained their value. Acadata say,

"expensive detached properties tend to attract wealthy and more

resilient buyers who are less impacted by the rising cost of

mortgage finance".

The general decline in prices is reflected specifically in new

house sales in East Lothian (Wallyford) near one of the Company's

prospective development sites where, over the last few months,

prices generally have been reduced (or incentives given) equivalent

to 5% or occasionally to nearly 10% of the quoted price.

Recent surveyed price changes provide a background for forecasts

of changes in 2023. In January the Times newspaper summarised 13

forecasts from surveyors, economic research groups and the OBR, and

these ranged from -1%, Chestertons, to -10%, Savills. The OBR,

using fiscal not calendar years, forecast that prices would fall

4.6% in the year to April 2024 and would only grow about 1% by end

2027/28. This poor forecast is, however, higher than the equivalent

-7.8% OBR forecast in November 2022.

Comprehensive forecasts are given by Savills covering the next

five years. Mainstream UK prices are forecast to fall 10% in 2023

but rise 6.2% over the four years to 2027, but in London prices are

forecast to lose 1.7% over five years. Areas outside London and the

South-East have much improved five-year forecasts of over 10% for

Northern regions and Wales and of 9.5% for Scotland. In all cases

the greatest growth occurs in 2026 of 7.5% except in London and the

South-East and South-West. Prime UK prices are forecast not to have

as large price falls as the mainstream with English regional values

falling 6.5% in 2027 but rising by 9.9% over 5 years and Scottish

prime prices, while falling 5.0% in 2023, rise 12.7% over five

years, a better expected performance than Scottish

"mainstream".

The main determinants of the rate of change of house prices will

be how quickly interest rates fall and whether a recession occurs

that causes a severe rise in unemployment and a consequent increase

in "fire sales" and repossessions. On average the equity content of

mortgaged houses is now much greater than in previous downturns and

the resilience of mortgagors much higher due to MMR and other

financial controls. Thus, I expect any increase in forced sales to

be minimal. The forecast for interest rates is only for a gradual

fall to a level far above the abnormally low levels prevailing

since the 2008 Great Recession and this will moderate the

prospective rise in house prices.

I conclude that the current house price falls will not persist.

I forecast that, while over the short-term prices will fall, over

the next few years prices will be stable and then rise. In the long

term the major determinant of prices will revert to supply,

primarily land supply. The land supply is determined by centrally

set rules and regulations based on social and political objectives,

interpreted locally, which invariably restricts the supply of land,

raising its price. These supply restrictions are deeply entrenched

and closely guarded with considerable political influence and thus,

without equivocation, I repeat my previous forecast: "the key

determinant of the long-term housing market will be a shortage of

supply, resulting in higher prices".

Conclusion

The UK economy teeters on the cliff edge of a recession. Will

the delayed effect of the rise in interest rates push the economy

over that edge. Or, will the Bank, panicking that it has not raised

rates sufficiently to quell inflation, undermine the economy by

raising rates too far, causing the cliff to collapse, or, will a

standstill in rates prove ineffective in the short-term and lead to

even higher interest rate rises later, causing a landslide? My

conclusion is that a further rate rise above 4.25% would not be

optimal, as inflation is due to fall sharply as energy and food

inflation will drop out of the calculation as the base date

changes. The rise to 4% will allow the residual inflation to be

brought down and controlled at an acceptable level - say 2.5% to

3.5%. Many commentators consider that the 2.0% target rate of

inflation is not more beneficial than a slightly higher target rate

of inflation. Such higher target rates would allow a more rapid and

less behaviourally difficult adjustment to changing economic

circumstances and, in a recession, allow a greater range of cuts

before becoming progressively less effective, and so are more

advantageous than the current 2.0% target. A return to economic

stability would be very welcome, but an unexciting one as living

standards would continue to lag expectations which depend on

improved economic growth.

Higher economic growth than has occurred since 2007 is a

function of many independent changes, but would be severely limited

by recurring recessions. While wars, plagues and famine are often a

common, largely unavoidable (wars at times excepted) cause of

recession, economic or financial mismanagement has often been the

cause. Financial or economic mismanagement caused or accentuated

the post WWI recession, the Great Depression, Black Wednesday, the

Great Recession, the post-Covid recession and the recession now

threatening and, most recently, the UK pensions crisis and the

failure of the SVB and associated banks and Credit Suisse. To

remedy such unnecessary economic setbacks, change in regulation is

required. With a change in regulation perhaps a change in

regulators is required as evidenced by the Bank's decision to put

up interest rates on the eve of the Great Depression and then to

maintain low interest rates into the current "Great Inflation".

The obviation of unnecessary causes of stagnation or recession

by improved financial management would remove a recurring

impediment to growth for which the vitally important requirement is

improved productivity. Since 2015/16 UK productivity has increased

only by about 5.0% or 0.8% per year. Prior to 2008 productivity

improved by about 2.25% pa, about 1.5 percentage points above the

post 2008 level, and had it been maintained at the 2.25% pre-2008

level, would have resulted in current output being around 25%

higher than at present. In its analysis of productivity the NIESR

concludes:-

"The UK has one of the poorest productivity performances among

the OECD's 38 advanced economies and this has been made worse by

Covid-19. If policymakers return to the same economic structures

post-pandemic that failed to resolve the productivity problem

pre-pandemic, then the UK is set for another decade of a

low-growth, low-productivity and low-wage economy". Of this Martin

Wolf says "The biggest problem for the UK remains its dismal

underlying productivity growth". This is dramatically illustrated

by the NIESR's recent analysis of Public Sector productivity -

where it says: "inputs rising by 19% since 2019 and output by only

about half that".

The downturn in the economy delayed a possible sale of St.

Margaret's House but, being in one of the very few sectors where

demand is growing and supply is limited, prospects for its sale

have, in the Board's view, greatly improved.

The Steading phase of the Brunstane development has sold well

with three houses above the UK House Price Index level (HPI), one

at HPI level and the fifth remaining on the market. The market for

houses near the City Centre remains strong as this segment of the

market is less effected by finance affordability and availability.

We now have permission for the next 12 houses there at Upper

Brunstane which, even at current prices, provides a very attractive

development which we will undertake once all remaining regulatory

hurdles are cleared.

Our development at Wallyford, although sufficiently profitable

at current costs and prices, has been delayed to allow the pursuit

of opportunities likely to provide higher returns. The delay to our

Belford Road development is not caused by market conditions but by

the continuing delay in obtaining suitable non-material variations

to planning to meet changed insulation, servicing and building

control requirements and by the time being taken to obtain

desirable changes to the internal layout to meet market

requirements and to effect small changes to the facade to improve

the appearance of the building and an enhancement to the already

high amenity of the area.

The development opportunities in our existing portfolio have

continued to improve and I conclude, as previously, "In our

existing portfolio, most development properties are valued at cost,

usually based on existing use, and when these sites are developed

or sold, I expect their considerable upside will be realised. Some

investment properties also have considerable development value, as

we expect to realise eventually at St Margaret's".

I D LOWE

Chairman

30 March 2023

Consolidated income statement for the six months ended 31

December 2022

__________________________________________________________________________________

Note 6 months 6 months Year

ended ended ended

31 Dec 31 Dec 30 Jun

2022 2021 2022

GBP000 GBP000 GBP000

Revenue

Revenue from development property 1,990 - -

sales

Gross rental income from investment

properties 195 167 306

---------------- ---------------- -----------------

Total Revenue 2,185 167 306

Cost of development property (1,393) - -

sales

Property charges (35) (47) (90)

---------------- ---------------- -----------------

Cost of Sales (1,428) (47) (90)

---------------- ---------------- -----------------

Gross Profit 757 120 216

Administrative expenses (294) (254) (887)

Other income - - 8

---------------- ---------------- -----------------

Net operating profit/(loss)

before investment property

disposals and valuation movements 463 (134) (663)

---------------- ---------------- -----------------

Valuation gains on investment

properties 5 - - 190

Valuation losses on investment

properties 5 - - (690)

---------------- ---------------- -----------------

Net (losses) on investment

properties - - (500)

---------------- ---------------- -----------------

Operating profit/(loss) 463 (134) (1,163)

---------------- ---------------- -----------------

Financial expenses (110) (62) (139)

---------------- ---------------- -----------------

Profit/(loss) before taxation 353 (196) (1,302)

Income tax 6 - - -

Profit/(loss) and total comprehensive

income

for the financial period attributable

to equity

holders of the parent Company 353 (196) (1,302)

Earnings per share

Basic and diluted earnings

per share (pence) 7 3.00p (1.66p) (11.05p)

Consolidated statement of changes in equity as at 31 December

2022

__________________________________________________________________________________

Share Capital Share Retained Total

Capital redemption premium earnings

reserve account

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 July 2022 2,357 175 2,745 17,976 23,253

Profit and total

comprehensive income

for the period - - - 353 353

At 31 December 2022 2,357 175 2,745 18,329 23,606

At 1 July 2021 2,357 175 2,745 19,278 24,555

Loss and total

comprehensive expenditure

for the period - - - (196) (196)

At 31 December 2021 2,357 175 2,745 19,082 24,359

At 1 July 2021 2,357 175 2,745 19,278 24,555

Loss and total

comprehensive expenditure

for the period - - - (1,302) (1,302)

At 30 June 2022 2,357 175 2,745 17,976 23,253

Consolidated balance sheet as at 31 December 2022

__________________________________________________________________________________

31 Dec 31 Dec 30 Jun

2022 2021 2022

Note GBP000 GBP000 GBP000

Non-current assets

Investment property 8 16,610 17,110 16,610

Plant and equipment 10 11 8

Investments 1 1 1

Total non-current assets 16,621 17,122 16,619

Current assets

Trading properties 9,840 9,896 10,672

Trade and other receivables 159 121 134

Cash and cash equivalents 2,367 2,322 1,317

Total current assets 12,366 12,339 12,123

Total assets 28,987 29,461 28,742

Current liabilities

Trade and other payables (1,001) (722) (1,109)

Interest bearing loans and

borrowings (360) (360) (360)

Total current liabilities (1,361) (1,082) (1,469)

Non-current liabilities

Interest bearing loans and

borrowing (4,020) (4,020) (4,020)

Total liabilities (5,381) (5,102) (5,489)

Net assets 23,606 24,359 23,253

Equity

Issued share capital 10 2,357 2,357 2,357

Capital redemption reserve 175 175 175

Share premium account 2,745 2,745 2,745

Retained earnings 18,329 19,082 17,976

----------------- ----------------- --------------

Total equity attributable

to equity

holders of the parent Company 23,606 24,359 23,253

NET ASSET VALUE PER SHARE 200.3p 206.7p 197.3p

Consolidated cash flow statement for the six months ended 31

December 2022

__________________________________________________________________________________

6 months 6 months Year

ended ended ended

31 Dec 31 Dec 30 Jun

2022 2021 2022

GBP000 GBP000 GBP000

Cash flows from operating

activities

Profit/(loss) for the period 353 (196) (1,302)

Adjustments for:

Net loss/(gain) on revaluation

of investment properties - - 500

Depreciation and Loss on sale

of fixed assets - - 5

Net finance expense 110 62 139

Operating cash flows before

movements 463 (134) (658)

in working capital

Decrease/(increase) in trading

properties 832 (583) (1,359)

(Increase)/decrease in trade

and other receivables (25) 14 1

(Decrease)/increase in trade

and other payables (218) 73 574

Cash generated from/(absorbed

by) operations 1,052 (630) (1,442)

Interest paid - (60) (251)

Net cash inflow/(outflow)

from operating activities 1,052 (690) (1,693)

Investment activities

Proceeds from sale of investment - - -

properties

Proceeds from sale of fixed - - -

assets

Acquisition of plant and equipment (2) (8) (10)

Cash flows (absorbed by)

investing activities (2) (8) (10)

Net increase/(decrease) in

cash and cash equivalents 1,050 (698) (1,703)

Cash and cash equivalents

at beginning of period 1,317 3,020 3,020

Cash and cash equivalents

at end of period 2,367 2,322 1,317

================= ================= ==============

Notes to the interim statement

1 This interim statement for the six-month period to 31 December

2022 is unaudited and was approved by the directors on 30 March

2023. Caledonian Trust PLC (the "Company") is a company

incorporated in England and domiciled in the United Kingdom. The

information set out does not constitute statutory accounts within

the meaning of Section 434 of the Companies Act 2006.

2 Going concern basis

The Group and parent Company finance their day to day working

capital requirements through related party loans and bank and other

funding for specific development projects. The directors have

assessed the group cash flow forecasts and expect that current

rental streams and property sales in the normal course of business

will provide sufficient cash inflows to allow the Group to continue

to trade. In addition, the related party lender has indicated its

willingness to continue to provide financial support and not to

demand repayment of its principal loan during 2023.

Accordingly, the directors continue to adopt the going concern

basis in preparing this interim statement.

3 Basis of preparation

The consolidated interim financial statements of the Company for

the six months ended 31 December 2022 are in respect of the Company

and its subsidiaries, together referred to as the "Group". The

financial information set out in this announcement for the year

ended 30 June 2022 does not constitute the Group's statutory

accounts for that period within the meaning of Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 30 June

2022 are available on the Company's website at

www.caledoniantrust.com and have been delivered to the Registrar of

Companies. The accounts for the year ended 30 June 2022 have been

prepared in accordance with UK-adopted International Accounting

Standards. The auditors have reported on those financial

statements; their reports were (i) unqualified, (ii) did not

include references to any matters to which the auditors drew

attention by way of emphasis without qualifying their reports, and

(iii) did not contain statements under Section 498 (2) or (3) of

the Companies Act 2006.

The financial information set out in this announcement has been

prepared in accordance with International Accounting Standard IAS34

"Interim Financial Reporting". The financial information is

presented in sterling and rounded to the nearest thousand.

The interim financial statements have been prepared based

UK-adopted International Accounting Standards that are expected to

exist at the date on which the Group prepares its financial

statements for the year ending 30 June 2023. To the extent that

IFRS at 30 June 2023 do not reflect the assumptions made in

preparing the interim statements, those financial statements may be

subject to change.

In the process of applying the Group's accounting policies,

management necessarily makes judgements and estimates that have a

significant effect on the amounts recognised in the interim

statement. Changes in the assumptions underlying the estimates

could result in a significant impact to the financial information.

The most critical of these accounting judgement and estimation

areas are included in the Group's 2022 consolidated financial

statements and the main areas of judgement and estimation are

similar to those disclosed in the financial statements for the year

ended 30 June 2022.

Notes to the interim statement (continued)

4 Accounting policies

The accounting policies used in preparing these financial

statements are the same as those set out and used in preparing the

Group's audited financial statements for the year ended 30 June

2022 .

5 Valuation (losses)/gains on investment properties

31 Dec 31 Dec 30 Jun

2022 2021 2022

GBP000 GBP000 GBP000

Valuation gains in investment

properties - - 190

Valuation losses on investment

properties after transaction

costs - - (690)

Net valuation (losses)/gains

on investment properties - - (500)

6 Income tax

Taxation for the six months ended 31 December 2022 is based on

the effective rate of taxation which is estimated to apply to the

year ending 30 June 2023. Due to the tax losses incurred there is

no tax charge for the period.

In the case of deferred tax in relation to investment property

revaluation surpluses, the base cost used is historical book cost

and includes allowances or deductions which may be available to

reduce the actual tax liability which would crystallise in the

event of a disposal of the asset. At 31 December 2022 there is a

deferred tax asset which is not recognised in these accounts.

Notes to the interim statement (continued)

7 Profit or loss per share

Basic profit or loss per share is calculated by dividing the

profit or loss attributable to ordinary

shareholders by the weighted average number of ordinary shares

outstanding during the period as follows:

6 months 6 months Year

ended ended ended

31 Dec 31 Dec 30 Jun

2022 2021 2022

GBP000 GBP000 GBP000

Profit/(loss) for financial

period 353 (196) (1,302)

No. No. No.

Weighted average no. of

shares:

For basic and diluted profit

or

loss per share 11,783,577 11,783,577 11,783,577

Earnings per share 3.00p (1.66p) (11.05p)

Earnings per share 3.00p (1.66p) (11.05p)

8 Investment Properties

31 Dec 31 Dec 30 Jun

2022 2021 2022

GBP000 GBP000 GBP000

Valuation

Opening valuation 16,610 17,110 17,110

Revaluation in period - - (500)

Closing valuation 16,610 17,110 16,610

The fair value of investment property at 31 December 2022 was

determined by the directors' taking cognisance of the independent

valuation by Montagu Evans, Chartered Surveyors as at 30 June 2022

having made adjustments for changes in leases and market

conditions.

Notes to the interim statement (continued)

9 Financial instruments

Fair values

Fair values versus carrying amounts

The fair values of financial assets and liabilities, together

with the carrying amounts shown in the balance sheet, are as

follows:

31 Dec 2022 31 Dec 2021 30 Jun 2022

Fair Carrying Fair Carrying Fair Carrying

value amount value amount value amount

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Trade and other

receivables 144 144 86 86 103 103

Cash and cash

equivalents 2,367 2,367 2,322 2,322 1,317 1,317

2,511 2,511 2,408 2,408 1,420 1,420

------- --------- ------- --------- ------- ---------

Loans from related

parties 4,380 4,380 4,380 4,380 4,380 4,380

Trade and other

payables 992 992 722 722 1,100 1,100

5,372 5,372 5,102 5,102 5,480 5,480

======= ========= ======= ========= ======= =========

Estimation of fair values

The following methods and assumptions were used to estimate the

fair values shown above:

Trade and other receivables/payables - the fair value of

receivables and payables with a remaining life of less than one

year is deemed to be the same as the book value.

Cash and cash equivalents - the fair value is deemed to be the

same as the carrying amount due to the short maturity of these

instruments.

Other loans - the fair value is calculated by discounting the

expected future cashflows at prevailing interest rates.

Notes to the interim statement (continued)

10 Issued share capital

31 Dec 2022 31 Dec 2021 30 Jun 2022

No. No. No.

000 GBP000 000 GBP000 000 GBP000

Issued and

Fully paid

Ordinary shares

of 20p each 11,784 2,357 11,784 2,357 11,784 2,357

11 Seasonality

Investment property sales by the Group are not seasonal and

sales of completed houses on development sites are driven more by

completion of construction projects than by season.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DFLBXXXLLBBX

(END) Dow Jones Newswires

March 31, 2023 03:30 ET (07:30 GMT)

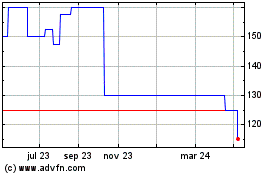

Caledonian (LSE:CNN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

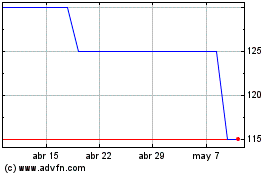

Caledonian (LSE:CNN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025