TIDMDEMG

RNS Number : 6799M

Deltex Medical Group PLC

18 September 2023

The information contained within this announcement was deemed by

the Company to constitute inside information as stipulated under

the UK Market Abuse Regulation

18 September 2023

Deltex Medical Group plc

("Deltex Medical", the "Company" or the "Group")

Interim results to 30 June 2023

Deltex Medical Group plc (AIM: DEMG) today announces its

unaudited interim results for the six months ended 30 June 2023

(the "Period").

HIGHLIGHTS

Financial

-- Revenues of GBP1.1m (H1 2022: GBP1.2 million).

-- Adjusted EBITDA loss of GBP361,000 (H1 2022: loss of

GBP418,000).

-- Operating loss of GBP0.5 million (H1 2022: GBP0.6

million).

-- Gross margin of 69% (H1 2022: 74%).

-- Cash at hand on 30 June 2023 of GBP0.1 million (H1 2022:

GBP0.6 million).

-- Fundraise completed in August 2023, raising new cash for the

business of GBP1.89 million and GBP350,000 debt converted to equity

to strengthen the Company's balance sheet.

Commercial

-- New TrueVue monitor CE marked and released in the UK and EU

and revenues expected in November 2023.

-- The restructuring has now been successfully completed. Net

proceeds of the fundraise have been used to strengthen the balance

sheet and implement the Group's restructuring plan to remove

c.GBP1.0m from the cost base.

-- Commercial activities in the UK and the USA modified to focus

on selling the new TrueVue monitor into existing accounts and

increase existing single-use oesophageal doppler monitoring ("ODM")

probe usage.

-- Subject to regulatory approvals, clinical evaluation in a

leading UK hospital has now been approved to commence this year in

relation to the new non-invasive Doppler-based haemodynamic

monitoring device.

-- Government released funding for the national tender in Latin

America at the end of August 2023 and hospitals are now in the

process of choosing which equipment to purchase.

Nigel Keen, Chairman of Deltex Medical, said:

"It has been a challenging first half, but the successful

completion of the fundraise in August 2023 has strengthened the

balance sheet and subsequently enabled the Board and management to

focus on driving the business forward by delivering growth with a

streamlined cost base."

"The launch of the new next generation TrueVue monitor is

anticipated to increase activity levels in the UK and EU ahead of

other international regulatory approvals being obtained. In

anticipation of starting to fulfil orders before the end of the

year, we are manufacturing the new TrueVue monitors."

"The new TrueVue monitor will be used as the platform for the

new non-invasive ultrasound device and clinical evaluations for

this are planned to start before the end of 2023."

For further information, please contact:

Deltex Medical Group plc 01243 774 837

Nigel Keen, Chairman investorinfo@Deltexmedical.com

Andy Mears, Chief Executive

Natalie Wettler, Group Finance Director

Allenby Capital Limited - Nominated

Adviser

& Broker 020 3328 5656

Jeremy Porter / Vivek Bhardwaj (Corporate info@allenbycapital.com

Finance)

Tony Quirke / Stefano Aquilino (Sales

& Corporate Broking)

Notes for Editors

Deltex Medical's technology

Deltex Medical's TrueVue System uses proprietary haemodynamic

monitoring technology to assist clinicians to improve outcomes for

patients as well as increase throughput and capacity for

hospitals.

Deltex Medical has invested over the long term to build a unique

body of peer-reviewed, published evidence from a substantial number

of trials carried out around the world. These studies demonstrate

statistically significant improvements in clinical outcomes

providing benefits both to patients and to the hospital systems by

increasing patient throughput and expanding hospital capacity.

The Group's flagship, world-leading, ultrasound-based

oesophageal Doppler monitoring ("ODM") is supported by 24

randomised control trials conducted on anaesthetised patients. As a

result, the primary application for ODM is focussed on guiding

therapy for patients undergoing elective surgery, although sedated

patients in intensive care are still an important part of our

business. The Group's new, next generation monitor makes the use of

the ODM technology more intuitive and provides augmented data on

the status of each patient.

Deltex Medical's engineers and scientists carried out successful

research in conjunction with the UK's National Physical Laboratory

("NPL"), which has enabled the Group's 'gold standard' ODM

technology to be extended and developed so that it can be used

completely non-invasively. This will significantly expand the

application of Deltex Medical's technology to non-sedated patients.

This new technological enhancement, which will be released on the

new next generation monitor, will substantially increase the

addressable market for the Group's haemodynamic monitoring

technologies and is complementary to the long-established ODM

evidence base.

Deltex Medical's new non-invasive technology has potential

applications for use in a number of healthcare settings,

including:

-- Accident & Emergency for the rapid triage of patients,

including the detection and diagnosis of sepsis;

-- in general wards to help facilitate a real-time, data-driven

treatment regime for patients whose condition might deteriorate

rapidly; and

-- in critical care units to allow regular monitoring of

patients post-surgery who are no longer sedated or intubated.

One of the key opportunities for the Group is positioning this

new, non-invasive technology for use throughout the hospital.

Deltex Medical's haemodynamic monitoring technologies provide

clinicians with beat-to-beat real-time information on a patient's

circulating blood volume and heart function. This information is

critical to enable clinicians to optimise both fluid and drug

delivery to patients.

Deltex Medical's business model is to drive the recurring

revenues associated with the sale of single-use disposable ODM

probes which are used in the TrueVue System and to complement these

revenues with a new incremental revenue stream to be derived from

the Group's new non-invasive technology.

Both the existing single-use ODM probe and the new, non-invasive

device will connect to the same, next generation monitor launched

in July 2023. Monitors are sold or, due to hospitals' often

protracted procurement times for capital items, loaned in order to

encourage faster adoption of the Group's technology.

Deltex Medical's customers

The principal users of Deltex Medical's products are currently

anaesthetists working in a hospital's operating theatre and

intensivists working in ICUs. This customer profile will change as

the Group's new non-invasive technology is adopted by the market.

In the UK the Group sells directly to the NHS. In the USA the Group

sells directly to a range of hospital systems. The Group also sells

through distributors in more than 40 countries in the European

Union, Asia and the Americas.

Deltex Medical's objective

To see the adoption of Deltex Medical's next generation TrueVue

System, comprising both minimally invasive and non-invasive

technologies, as the standard of care in haemodynamic monitoring

for all patients from new-born to adult, awake or anaesthetised,

across all hospital settings globally.

For further information please go to www.deltexmedical.com

Chairman's statement

Financial results

Revenues for the six months ended 30 June were GBP1.1 million

(2022: GBP1.2 million). This reflects subdued activity levels in

elective surgery across the UK and the US as well as a combination

of delays in the launch of the new TrueVue monitor and the award of

the national tender for haemodynamic monitoring in Latin America,

as originally stated in the Company's announcement on 6 July

2023.

The Group's gross margin decreased to 69% (2022: 74%). This

decrease was linked to excess capacity within production. The

Company is pleased to note that this excess capacity has since been

reduced as part of the Company broader restructuring which

completed in September 2023.

Adjusted EBITDA, which comprises the operating loss adjusted for

depreciation, amortisation, equity-settled non-executive directors'

fees, share-based payments and certain other items, was a loss of

GBP361,000 (2022: GBP(418,000)).

The Group's overheads have reduced to GBP1.2 million (2022:

GBP1.5 million). This is as a result of a decrease in sales and

marketing expenditure of GBP130,000, due to a reduction in

personnel and their associated costs, as well as an increase in

sales activity in relation to the new monitor leading to higher

capitalisation in H1 2023. There was also a decrease in

administration expenses as a result of lower share based payment

charges in H1 2023, as well as a modification gain of GBP89,000 on

the extension of the convertible loan note.

Loss before taxation was GBP536,000 (2022: GBP(662,000)).

Cash at hand at 30 June 2023 was GBP0.1 million (2022: GBP0.6

million).

Commercial activities

Unexpected delays in releasing the new TrueVue monitor and in

the award of a national tender for haemodynamic monitoring with one

of the Group's Latin American distributors significantly impacted

the Group's financial position in the first half of the year. As a

result, on 26 June 2023 the Group's ordinary shares were suspended

from trading on AIM, pending clarification of the Group's financial

position.

As announced on 2 August 2023 the Group successfully completed a

GBP1.89 million fundraise and capital reorganisation. Proceeds of

the fundraise have been used to strengthen the balance sheet and

implement the Group's cost cutting and restructuring plan, the

objective being to reduce approximately GBP1.0 million from the

cost base. The restructuring has now been completed and the cost

savings will be fully effective from October 2023.

During the period, our business plan had anticipated that the UK

and US healthcare markets would recover, with improved access for

our sales and clinical teams. Whilst access has begun to improve,

it is a long way from pre-Covid 19 access levels. Accordingly, we

have concluded that access to hospitals, especially in the UK, will

remain very challenging for the foreseeable future. We also

continue to see disruption in the UK from shortages in clinical

staff, as well as the knock-on effect from industrial action, which

disrupts and delays elective surgery. All of these issues

collectively reduce the opportunity for our sales and clinical

teams to meet face to face with clinicians in a clinical

environment. It's for these reasons that we have, amongst other

areas, concentrated on reducing the Company's direct sales

personnel headcount in the UK and US in order to streamline the

business following completion of the fundraise in August 2023.

With reduced sales and clinical teams, it's now more important

than ever to be able to promote our technology across digital

platforms. In 2022 we established our on-line training programme,

the TrueVue Advanced Learning Academy (the "Academy"), which

provides clinicians with a comprehensive training programme on

haemodynamics, including details on the published evidence base,

and how best to use TrueVue Doppler-based monitoring device. The

Academy provides detailed information on how to manage a patient's

haemodynamic status during surgery as well as while in intensive

care. The Academy is proving to be well received and works as a

very good resource to deliver training remotely.

Sales in our international division were suppressed due to

delays in the award of the national tender for haemodynamic

monitoring with one of the Group's Latin American distributors.

Originally, the Group's expectation was that this contract would be

announced before the end of the Period. We now understand that the

government released funding for the national tender at the end of

August 2023 and hospitals are now in the process of choosing which

equipment to purchase. We remain confident that this national

tender may potentially result in significantly increased revenues

being generated from this region.

Product development: new, next generation TrueVue monitor

As announced on 10 July 2023, the new next generation TrueVue

monitor has been released in the UK and EU and can now be deployed

into UK hospitals for final marketing evaluations to ensure there

are no teething issues, with revenues forecasted for the Group from

new monitor sales to commence in November 2023.

The new TrueVue monitor is expected to help drive activity

levels in the UK and EU, with existing customers and distributors

upgrading from the existing device to the new next generation

TrueVue monitor.

We continue to develop the new non-invasive Doppler-based

haemodynamic monitoring device that is complementary to our

existing product range and which will also run on the new TrueVue

platform. Our prototype new non-invasive Doppler-based haemodynamic

monitoring device is anticipated to be completed in Q4 2023. We

believe this new device will form a very important part of our

future growth and long-term strategy. This non-invasive device will

also benefit from the substantial body of published evidence that

demonstrates that the appropriate use of the TrueVue Doppler gives

rise to improved clinical outcomes and reduced patient

length-of-stay. Improved clinical outcomes and reduced patient

length-of-stay are going to remain critically important goals for

hospitals in the foreseeable future, particularly as hospitals face

increased governmental pressure to improve healthcare

infrastructure for an ever-growing population.

The development work for the non-invasive device is supported by

an Innovate UK Grant and completion of this development cycle is

scheduled for the end of September 2023. A clinical evaluation in a

leading UK hospital has now been approved to commence this year,

subject to the non-invasive device gaining the necessary regulatory

approvals. This evaluation process is anticipated to last six

weeks.

Current trading and prospects

Following completion of the restructuring, the Group is fully

focused on generating positive monthly EBITDA at high gross

margins. The Group anticipates achieving this by the end of the

calendar year having significantly reduced Group headcount and

therefore reducing overheads by approximately GBP1.0 million.

Our international division is well positioned for growth. We are

confident that the Latin American national tender for haemodynamic

monitoring will progress in the Group's favour and that as a

result, we will be well positioned to further increase revenues

across the region.

The launch of the new next generation TrueVue monitor will

significantly increase the Group's pipeline for capital purchases

from existing customers and distributors, who are anticipated to

replace their legacy monitors. It will also help to underpin

existing probe revenues whilst providing the platform for the

development of the new non-invasive Suprasternal device.

We look forward to reporting further progress in due course, as

the Board is confident that the strategy and restructuring has

positioned the Group for growth and success.

Nigel Keen

Chairman

15s September 2023

Condensed Consolidated Statement of Comprehensive Income

For the period ended 30 June 2023

Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

---------------------------------------------- ------ ----------- ----------- -------------

Revenue 4 1,059 1,158 2,482

Cost of sales (331) (306) (643)

---------------------------------------------- ------ ----------- ----------- -------------

Gross profit 728 852 1,839

Administrative expenses (642) (779) (1,560)

Sales and distribution expenses (427) (554) (1,027)

Research and Development, Quality and

Regulatory (116) (120) (231)

Impairment loss on trade receivables - - (39)

Total costs (1,185) (1,453) (2,857)

---------------------------------------------- ------ ----------- -----------

Other gain 7 40 30 71

---------------------------------------------- ------ ----------- -----------

Operating loss (417) (571) (947)

---------------------------------------------- ------ ----------- ----------- -------------

Finance costs (119) (91) (199)

---------------------------------------------- ------ ----------- ----------- -------------

Loss before taxation (536) (662) (1,146)

Tax credit adjustment 7 (1) - 1

---------------------------------------------- ------ ----------- ----------- -------------

Loss for the period/year (537) (662) (1,145)

---------------------------------------------- ------ ----------- ----------- -------------

Other comprehensive income/(expense)

Items that may be reclassified to profit

or loss:

Net translation differences on overseas

subsidiaries 6 15 35

---------------------------------------------- ------ ----------- ----------- -------------

Other comprehensive income/(expense)

for the period/year, net of tax 6 15 35

---------------------------------------------- ------ ----------- ----------- -------------

Total comprehensive loss for the period/year (531) (647) (1,110)

---------------------------------------------- ------ ----------- ----------- -------------

Total comprehensive loss for the period/year

attributable to:

Owners of the Parent (532) (651) (1,114)

Non-controlling interests 1 4 4

---------------------------------------------- ------ ----------- ----------- -------------

(531) (647) (1,110)

---------------------------------------------- ------ ----------- ----------- -------------

Loss per share - basic and diluted 8 (0.08)p (0.10)p (0.17p)

---------------------------------------------- ------ ----------- ----------- -------------

Condensed Consolidated Balance Sheet

As at 30 June 2023

Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

-------------------------------------- ------ --------- --------- ------------

Assets

Non-current assets

Property, plant and equipment 237 274 269

Intangible assets 3,986 3,419 3,769

Financial assets at amortised cost 159 171 164

-------------------------------------- ------ --------- --------- ------------

Total non-current assets 4,382 3,864 4,202

Current assets

Inventories 9 824 835 821

Trade receivables 440 540 456

Financial assets at amortised cost 15 15 15

Other current assets 136 92 140

Current income tax recoverable 40 99 72

Cash and cash equivalents 10 107 611 471

-------------------------------------- ------ --------- --------- ------------

Total current assets 1,562 2,192 1,975

-------------------------------------- ------ --------- --------- ------------

Total assets 5,944 6,056 6,177

Liabilities

Current liabilities

Borrowings 11 (1,147) (700) (935)

Trade and other payables 12 (1,744) (1,419) (1,704)

Total current liabilities (2,891) (2,119) (2,639)

-------------------------------------- ------ --------- --------- ------------

Non-current liabilities

Borrowings 11,13 (998) (1,048) (1,069)

Trade and other payables 12 (148) (203) (177)

Provisions (67) (60) (64)

-------------------------------------- ------ --------- --------- ------------

Total non-current liabilities (1,213) (1,311) (1,310)

-------------------------------------- ------ --------- --------- ------------

Total liabilities (4,104) (3,430) (3,949)

-------------------------------------- ------ --------- --------- ------------

Net assets 1,840 2,626 2,228

-------------------------------------- ------ --------- --------- ------------

Equity

Share capital 14 7,091 6,991 6,990

Share premium 33,682 33,672 33,672

Capital redemption reserve 17,476 17,476 17,476

Other reserve 559 632 527

Translation reserve 174 148 168

Convertible loan note reserve 82 82 82

Accumulated losses (57,104) (56,254) (56,566)

-------------------------------------- ------ --------- --------- ------------

Equity attributable to owners of the

Parent 1,960 2,747 2,349

Non-controlling interests (120) (121) (121)

-------------------------------------- ------ --------- --------- ------------

Total equity 1,840 2,626 2,228

-------------------------------------- ------ --------- --------- ------------

Condensed Consolidated Statement of Changes in Equity for the

six months ended 30 June 2023 (unaudited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest Total

capital premium reserve reserve reserve reserve losses Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

1 January 2023 6,990 33,672 17,476 527 82 168 (56,566) 2,349 (121) 2,228

Comprehensive

income

Loss for the

period - - - - - - (538) (538) 1 (537)

Other

comprehensive

income for the

period - - - - - 6 - 6 - 6

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Total

comprehensive

income for the

six-month

period - - - - - 174 (538) (532) 1 (531)

Transactions

with owners

of the Group

Shares issued

during the

year 101 10 - - - - - 111 - 111

Issue expenses - - - - - - - - - -

Equity-settled

share-based

payment - - - 32 - - - 32 - 32

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

30 June 2023 7,091 33,682 17,476 559 82 174 (57,104) 1,960 (120) 1,840

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity for the

six months ended 30 June 2022 (unaudited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest Total

capital premium reserve reserve reserve reserve losses Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

1 January 2022 5,849 33,502 17,476 573 82 133 (55,588) 2,027 (125) 1,902

Comprehensive

income

Loss for the

period - - - - - - (666) (666) 4 (662)

Other

comprehensive

income for the

period - - - - - 15 - 15 - 15

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Total

comprehensive

income for the

six-month

period - - - - - 15 (666) (651) 4 (647)

Transactions

with owners

of the Group

Shares issued

during the

year 1,142 285 - - - - - 1,427 1,427

Issue Expenses - (115) - - - - - (115) (115)

Equity-settled

share-based

payment - - - 59 - - - 59 - 59

Balance at

30 June 2022 6,991 33,672 17,476 632 82 148 (56,254) 2,747 (121) 2,626

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity for the

year ended 31 December 2022 (audited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest

capital premium reserve reserve reserve reserve losses Total Total

equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ --------- ---------------- ---------

Balance at 1

January 2022 5,849 33,502 17,476 573 82 133 (55,588) 2,027 (125) 1,902

Comprehensive

income

Loss for the

period - - - - - - (1,149) (1,149) 4 (1,145)

Other

comprehensive

income for the

period - - - - - 35 - 35 - 35

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ --------- ---------------- ---------

Total

comprehensive

income for

year - - - - - 35 (1,149) (1,114) 4 (1,110)

Transactions

with owners

of the Group

Shares issued

during the

year 1,141 285 - - - - - 1,426 - 1,426

Issue expenses - (115) - - - - - (115) - (115)

Equity-settled

share-based

payment - - - 125 - - - 125 - 125

Transfers - - - (171) - - 171 - - -

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ --------- ---------------- ---------

Balance at

31 December

2022 6,990 33,672 17,476 527 82 168 (56,566) 2,349 (121) 2,228

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ --------- ---------------- ---------

Condensed Consolidated Statement of Cash Flows

For the period ended 30 June 2023

Unaudited Audited

Six months Six months Year

ended ended ended 31

30 June 30 June December

2023 2022 2022

GBP'000 GBP'000 GBP'000

-------------------------------------------- ----------- ----------- ----------

Cash flows from operating activities

Loss before taxation (536) (662) (1,146)

Adjustments for:

Net finance costs 119 91 199

Depreciation of property, plant and

equipment 38 36 88

Amortisation of intangible assets 20 20 40

Share-based payment expense 32 59 125

Gain on convertible loan note modification (89)

Other tax income (40) (30) (71)

Effect of exchange rate fluctuations 6 15 35

--------------------------------------------- ----------- ----------- ----------

(450) (471) (730)

(Increase)/decrease in inventories (3) (39) (48)

(Increase)/decrease in trade and other

receivables 25 (100) (57)

Increase in trade and other payables 147 24 306

Increase in provisions 3 3 7

Net cash (used in)/from operations (278) (583) (522)

Interest paid (98) (69) (153)

Income taxes received 71 - 69

--------------------------------------------- ----------- ----------- ----------

Net cash used in operating activities (305) (652) (606)

Cash flows from investing activities

Purchase of property, plant and equipment (6) (46) (70)

Capitalised development expenditure

(net of grants) (236) (304) (674)

Net cash used in investing activities (242) (350) (744)

Cash flows from/(used in) financing

activities

Issue of ordinary share capital - 1,341 1,340

Expenses in connection with share

issue - (115) (115)

Net movement in invoice discounting

facility (38) (2) (17)

Standby loan facility repayment - - (500)

Standby loan facility drawdown 250 - 750

Principal lease payments (22) (22) (45)

--------------------------------------------- ----------- ----------- ----------

Net cash generated from/(used in)

financing activities 190 1,202 1,413

--------------------------------------------- ----------- ----------- ----------

Net increase/(decrease) in cash and

cash equivalents (357) 200 63

Cash and cash equivalents at beginning

of the period 471 413 413

Exchange loss on cash and cash equivalents (7) (2) (5)

--------------------------------------------- ----------- ----------- ----------

Cash and cash equivalents at the

end of the period 107 611 471

--------------------------------------------- ----------- ----------- ----------

Notes to the condensed consolidated interim financial

statements

1. Reporting Entity

These condensed consolidated interim financial statements

('Interim Financial Statements') are the consolidated financial

statements of Deltex Medical Group plc, a public company limited by

shares registered in England and Wales, and its subsidiaries ('the

Group'). Deltex Medical Group plc is quoted on the AIM market of

the London Stock Exchange. The address of the registered office is

Deltex Medical Group plc, Terminus Road, Chichester, PO19 8TX,

registered number 03902895. These Interim Financial Statements are

as at and for the period ended 30 June 2023.

The Group is principally involved with the manufacture and sale

of advanced haemodynamic monitoring technologies.

2. Basis of accounting

These interim financial statements are for the six months ended

30 June 2023 and have been prepared in accordance with IAS 34,

'Interim Financial Reporting'. They do not include all of the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

should be read in conjunction with the Group's last annual

consolidated financial statements as at and for the year ended 31

December 2022 (Annual Report & Accounts 2022).

These interim financial statements do not constitute statutory

accounts within the meaning of Section 434 of the Companies Act

2006. The summary of results for the year ended 31 December 2022 is

an extract from the published consolidated financial statements of

the Group for that year which have been reported on by the Group's

auditors and delivered to the Registrar of Companies. The

Independent Auditors' Report on the Annual Report & Accounts

for 2022 was unqualified.

These interim financial statements have been prepared applying

the accounting policies and presentation that were applied in the

preparation of the Group's published consolidated financial

statements for the year ended 31 December 2022 and are expected to

be applied in the preparation of the financial statements for the

year ending 31 December 2023. There are no accounting

pronouncements which have become effective from 1 January 2023 that

have a significant impact on the Group's interim financial

statements. The Group has not early adopted any other standard,

interpretation or amendment that has been issued but is not yet

effective.

The interim financial statements were approved for issue by the

Board of Directors on 15 September 2023.

3. Use of judgements and estimates

In preparing these interim financial statements, management has

had to make judgements and estimates that affect the application of

the Group's accounting policies and the reported amounts of assets,

liabilities, income and expenses. Although these estimates are

based on the directors' best knowledge of the amount, event or

actions, it should be noted that actual results may differ from

those estimates.

The significant judgements and estimates made by the directors

in applying the Group's accounting policies and key sources of

estimation uncertainty were the same as those disclosed in Annual

Report & Accounts 2022.

4. Revenue

The following table provides an analysis of the Group's sales by

revenue stream and markets. This information is regularly provided

to the Group's CODM:

For the six months ended 30 June 2023 (Unaudited)

Direct markets Indirect markets

Probes Monitors Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- -------- -------- --------- --------- --------

UK 212 113 15 - - - 340

USA 156 4 20 - - - 180

France - - - 248(1) - 2 250

Scandinavia - - - 49 - 1 50

Latin America - - - 37 - - 37

Hong Kong - - - 6 62 - 68

Portugal - - - 63 - - 63

Other countries 5 - 1 39 22 4 71

----------------- -------- --------- -------- -------- --------- --------- --------

373 117 36 442 84 7 1,059

----------------- -------- --------- -------- -------- --------- --------- --------

1. Total revenue for this segment relates to a single external customer

For the six months ended 30 June 2022 (Unaudited)

Direct markets Indirect markets

Probes Monitors Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- -------- -------- --------- --------- --------

UK 222 59 42 - - - 323

USA 241 15 24 - - - 280

France - - - 235(1) 6 2 243

Scandinavia - - - 34 49 2 85

South Korea - - - 78 - - 78

Other countries 17 26 - 84 18 4 149

----------------- -------- --------- -------- -------- --------- --------- --------

480 100 66 431 73 8 1,158

----------------- -------- --------- -------- -------- --------- --------- --------

1. Total revenue for this segment relates to a single external customer

For the year ended 31 December 2022 (Audited)

Direct markets Indirect markets

Probes Monitors Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- -------- -------- --------- --------- --------

UK 461 106 75 - - - 642

USA 463 122 51 - - - 636

France - - - 464(1) 15 8 487

Latin America - - - 90 212 2 304

South Korea - - - 132 - - 132

Hong Kong - - - 13 32 3 48

Austria - - - 44 - 2 46

Cayman Islands - - - 24 18 1 43

Other countries 19 30 - 90 2 3 144

----------------- -------- --------- -------- -------- --------- --------- --------

943 258 126 857 279 19 2,482

----------------- -------- --------- -------- -------- --------- --------- --------

1. Total revenue for this segment relates to a single external

customer

The Group's revenue disaggregated between the sale of goods and

the provision of services is set out below. All revenues from the

sale of goods are recognised at a point in time; maintenance income

is recognised over time.

Period ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------- ------------------- ------------------- ------------------------

Sale of goods 1,038 1,131 2,430

Maintenance income 21 27 52

1,059 1,158 2,482

------------------------------- ------------------- ------------------- ------------------------

The following table provides information about trade receivables

and contract liabilities from contracts with customers. There were

no contract assets at either 30 June 2023 or 1 January 2023.

30 June 1 January

2023 2023

GBP'000 GBP'000

------------------------------------------------------------ ------------------- ---------------------

Trade receivables which are in 'Trade and other

receivables' 440 456

Contract liabilities (48) (36)

------------------------------------------------------------ ------------------- ---------------------

The following aggregated amounts of transaction prices relate to

the performance obligations from existing contracts that are

unsatisfied or partially unsatisfied as at 30 June 2023:

2023 2024 2025 2026 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Revenue

expected

to be

recognised 9 28 2 9 48

----------------------- ------------------- ------------------- ------------------- ------------------- -------------------

5. Segmental analysis

Assessment of performance and the allocation of resources are

made on the basis of results derived from the sale of probes,

monitors and other products analysed by territory, of which

revenues and gross margins are regularly reported to the Group's

Chief Executive Officer, who has been identified as the Chief

Operating Decision Maker (CODM). The CODM also monitors a profit

measure described internally as 'adjusted earnings before interest,

tax, depreciation and amortisation, share-based payments,

non-executive directors' fees, as well as any exceptional items'

(Adjusted EBITDA). However, this measure is reported at a Group

level rather than an operating segment which is based on the nature

of the goods provided rather than the geographical market in which

they are sold.

The unaudited operating segment results for the six months ended

30 June 2023 are:

Probes(1) Monitors Other Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ----------- ---------- -------- ------------- --------

Revenues 815 201 43 - 1,059

------------------------ ----------- ---------- -------- ------------- --------

Adjusted gross

profit(2) 572 145 21 - 738

------------------------ ----------- ---------- -------- ------------- --------

Sales and marketing

costs - - - - (425)

Administration

costs - - - - (587)

R&D costs - - - - (1)

Quality and regulation

costs - - - - (86)

------------------------ ----------- ---------- -------- ------------- --------

Adjusted EBITDA - - - - (361)

------------------------ ----------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

(GBP10,000)

The unaudited operating segment results for the six months ended

30 June 2022 were:

Probes(1) Monitors Other Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------- ---------- -------- ------------- --------

Revenues 912 173 73 - 1,158

-------------------------- ----------- ---------- -------- ------------- --------

Adjusted gross profit(2) 675 128 52 - 855

-------------------------- ----------- ---------- -------- ------------- --------

Sales and marketing

costs - - - - (554)

Administration costs - - - - (618)

R&D costs - - - - (2)

Quality and regulation

costs(3) - - - - (99)

-------------------------- ----------- ---------- -------- ------------- --------

Adjusted EBITDA - - - - (418)

-------------------------- ----------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

The audited operating segment results for the year ended 31

December 2022 were:

Probes(1) Monitors Other Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------- ---------- -------- ------------- --------

Revenues 1,800 537 145 - 2,482

-------------------------- ----------- ---------- -------- ------------- --------

Adjusted gross profit(2) 1,323 416 107 - 1,843

-------------------------- ----------- ---------- -------- ------------- --------

Sales and marketing

costs - - - (1,027) (1,027)

Administration costs - - - (1,192) (1,192)

R&D costs - - - (36) (36)

Quality and regulation

costs - - - (195) (195)

-------------------------- ----------- ---------- -------- ------------- --------

Adjusted EBITDA - - - - (607)

-------------------------- ----------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

(GBP4,000)

The reconciliation of the profit measure used by the Group's

CODM to the result reported in the Group's consolidated SOCI is set

out below:

Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------------------------- --------- --------- ------------

Adjusted EBITDA (361) (418) (607)

Non-cash items:

Depreciation of property, plant and equipment (38) (36) (88)

Amortisation of development costs (20) (20) (40)

Impairment loss on trade receivables - - (39)

Non-executive directors' fees and employer's

social security costs (71) (68) (136)

Share-based payment expense (32) (59) (125)

Change in accumulated absence cost liability (24) - 17

Gain on convertible loan note 89 - -

Cash item: Other tax income 40 30 71

----------------------------------------------- --------- --------- ------------

(56) (153) (340)

----------------------------------------------- --------- --------- ------------

Operating loss (417) (571) (947)

Finance costs (119) (91) (199)

----------------------------------------------- --------- --------- ------------

Loss before tax (536) (662) (1,146)

Tax credit on loss (1) - 1

----------------------------------------------- --------- --------- ------------

Loss for the period/year (537) (662) (1,145)

----------------------------------------------- --------- --------- ------------

6. Dividends

The Directors cannot recommend the payment of a dividend for

2023 (2022: nil).

7. Tax credit on loss

Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------------------------ ------------------- ------------------- -----------------------

Research and development tax credit

adjustment 1 - (1)

Total tax credit adjustment 1 - (1)

------------------------------------------------ ------------------- ------------------- -----------------------

The other gain amount for six months to 30 June 2023 of

GBP40,000 (six months to 30 June 2022: GBP30,000) comprises tax

income arising from the Research and Development Expenditure Credit

scheme which is accounted for as a government grant.

8. Loss per share

Basic loss per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares issued during the year.

The loss per share calculation for six months to 30 June 2023 is

based on the loss of GBP538,000 and the weighted average number of

shares in issue of 703,227,881.

For the six months to 30 June 2022, the loss per share

calculation is based on the loss of GBP666,000 and the weighted

average number of shares in issue of 672,175,129.

For the year ended 31 December 2022, the loss per share

calculation is based on the loss of GBP1,149,000 and the weighted

average number of shares in issue of 685,490,974.

While the Group is loss-making, the diluted loss per share and

the loss per share are the same.

9. Inventories

Inventories at 30 June 2023 include the following finished

Goods: 16,800 probes (30 June 2022: 14,894) and 113 monitors (30

June 2022: 176).

10. Cash at bank

Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------- ------------------- ------------------- -----------------------

Cash at bank 107 611 471

------------------------- ------------------- ------------------- -----------------------

11. Borrowings

Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

Current Non-current Current Non-current Current Non-current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

Invoice

discount

facility 147 - 200 - 185 -

Standby loan

facility 750 - 500 - 750 -

Bridging 250 - - - - -

loan

facility

Convertible

loan

note - 998 - 1,048 - 1,069

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

1,147 998 700 1,048 935 1,069

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

On 2 August 2023, as part of a fundraising and capital

reorganisation, GBP100,000 of the Standby loan facility was

converted into 50,000,000 loan conversion shares at a price of 0.2

pence per share. As part of this transaction, the remaining

GBP650,000 Standby loan facility has had the maturity extended to

GBP250,000 repayable by 30 June 2025 and GBP400,000 repayable by 31

December 2025. The interest rate remains at 8% per annum.

In April 2023, a bridging loan facility provided by Imperialise

Limited, a company controlled by Nigel Keen, was put in place for

GBP250,000 with a minimum term of three months. The interest rate

on the facility was 12% per annum, and the facility was unsecured.

On 2 August 2023, as part of a fundraising and capital

reorganisation, the bridging loan facility was converted into

125,000,000 loan conversion shares at a price of 0.2 pence per

share.

12. Trade and other payables

Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

Current Non-current Current Non-current Current Non-current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

Trade

payables 600 - 338 - 507 -

Other

payables 249 - 280 - 258 -

Social

security

and other

taxes 145 - 120 - 158 -

Lease

obligations 55 148 49 203 52 177

Contract

liabilities 48 - 52 - 39 -

Employee

short-term

benefits 48 - 41 - 24 -

Accrued

expenses 599 - 540 - 666 -

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

1,744 148 1,419 203 1,704 177

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

13. Convertible loan note

The convertible loan note recognised in the Condensed

Consolidated Balance Sheet is calculated as:

Financial Equity

liability component Total

GBP'000 GBP'000 GBP'000

---------------------------------------- ---------------- ---------------- -------------

Carrying amount at 1 January 2023 1,069 82 1,151

Modification gain (89) - (89)

Interest expense 61 - 61

Interest paid (43) - (43)

---------------------------------------- ---------------- ---------------- -------------

Carrying amount at 30 June 2023 998 82 1,080

---------------------------------------- ---------------- ---------------- -------------

The convertible loan note falls due for repayment in June 2026.

The convertible loan note is, at the option of the loan note

holder, convertible at any time into new ordinary shares of 1 penny

each at a conversion price of 4 pence per share.

14. Share capital

In April 2023, 9,993,805 new ordinary shares were issued at a

price of 1.1 pence per share to satisfy certain deferred

non-executive directors' fees for the year ended 31 December

2021.

There were no share options exercised during the six months

ended 30 June 2023 or the six months ended 30 June 2022.

15. Seasonal fluctuations

Revenues in our Distributor markets are traditionally higher in

the second half of the financial year due to the purchasing

patterns of customers.

16. Foreign exchange rates

The following are the principal foreign exchange rates that have

been used in the preparation of the condensed consolidated interim

financial statements:

Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

Average Closing Average Closing Average Closing

rate rate rate rate rate rate

------------------------------ ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Sterling/US dollar 1.23 1.27 1.30 1.22 1.24 1.21

Sterling/Euro 1.14 1.16 1.19 1.16 1.17 1.13

Sterling/Canadian

dollar 1.67 1.68 1.65 1.57 1.61 1.64

------------------------------ ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

17. Subsequent events

On 2 August 2023, the Company raised GBP1.89m before expenses,

through subscription for 207,500,000 subscriptions shares,

625,500,000 placing shares and 110,629,270 retail offer shares, all

at 0.2 pence per share.

On the same date, a capital reorganisation to change the nominal

value of the Company's ordinary shares to 0.01p per share was

completed.

On the same date, as part of a fundraising and capital

reorganisation, GBP100,000 of the Standby loan facility was

converted into 50,000,000 loan conversion shares at a price of 0.2

pence per share. As part of this transaction, the remaining

GBP650,000 Standby loan facility has had the maturity extended to

GBP250,000 repayable by 30 June 2025 and GBP400,000 repayable by 31

December 2025. The interest rate remains at 8% per annum.

In April 2023, a bridging loan facility provided by Imperialise

Limited, a company controlled by Nigel Keen, was put in place for

GBP250,000 with a minimum term of three months. The interest rate

on the facility was 12% per annum, and the facility was unsecured.

On 2 August 2023, as part of a fundraising and capital

reorganisation, the bridging loan facility was converted into

125,000,000 loan conversion shares at a price of 0.2 pence per

share.

Furthermore, on 2 August 2023, 18,966,477 new ordinary shares

were issued at a price of 0.2 pence per share to Imperialise

Limited, a company controlled by Nigel Keen, to satisfy the

Chairman's fees of GBP33,333 plus employer national insurance

contributions for the year ended 31 December 2022.

18. Distribution of the announcement

Copies of this announcement are sent to shareholders on request

and will be available for collection free of charge from the

Group's registered office at Terminus Road, Chichester, PO19 8TX,

United Kingdom. This announcement is available, free of charge,

from the Company's website at www.deltexmedical.com

19. Cautionary statement

This announcement contains forward-looking statements which are

made in good faith based on the information available at the time

of its approval. It is believed that the expectations reflected in

these statements are reasonable, but they may be affected by

several risks and uncertainties that are inherent in any

forward-looking statement which could cause actual results to

differ materially from those currently anticipated. Nothing in this

document should be considered to be a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAPNKFFXDEEA

(END) Dow Jones Newswires

September 18, 2023 02:00 ET (06:00 GMT)

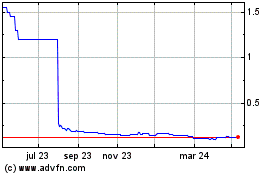

Deltex Medical (LSE:DEMG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

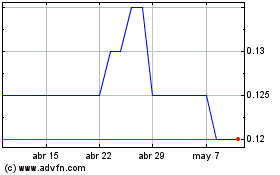

Deltex Medical (LSE:DEMG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024