TIDMDKL

RNS Number : 3178Z

Dekel Agri-Vision PLC

11 January 2024

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

11 January 2024

Dekel Agri-Vision Plc / Index: AIM / Epic: DKL / Sector: Food

Producers

Dekel Agri-Vision Plc

('Dekel' or the 'Company')

Full Year 2023 Operational Update

Dekel Agri-Vision Plc (AIM: DKL) , the West African agriculture

company focused on building a portfolio of sustainable and

diversified projects, is pleased to provide its unaudited full year

production update for the year ending 31 December 2023 ('FY-2023')

for the Ayenouan palm oil project in Côte d'Ivoire ('Palm Oil

Operation') and the cashew processing plant at Tiebissou, Côte

d'Ivoire (the 'Cashew Operation').

Palm Oil Operation Update

-- The Palm Oil operation performed very well during FY 2023

driven by close to record Crude Palm Oil ('CPO') production and

relatively high historical CPO prices as outlined in the table

below.

FY-2023 FY-2022 Change

FFB processed (tonnes) 182,362 116,733 56.2%

CPO Extraction Rate 21.4% 22.1% -3.2%

CPO production (tonnes) 39,073 25,751 51.7%

CPO Sales (tonnes) 38,896 26,016 49.5%

Average CPO price per tonne EUR869 EUR1,025 -15.2%

Palm Kernel Oil ('PKO')

production (tonnes) 2,420 1,824 32.7%

PKO Sales (tonnes) 2,404 1,991 20.7%

Average PKO price per tonne EUR828 EUR1,381 -40.0%

-- Fresh Fruit Bunch ('FFB') volumes and Crude Palm Oil ('CPO')

production increased 56.1% and 51.7% respectively compared to FY

2022.

o December 2023 FFB and CPO was 11.8% and 4.8% respectively

higher than December 2022. CPO sales were up 48.3% in December 2023

compared to December 2022.

-- The strong 2023 production performance of the Palm Oil

operation was driven by ten consecutive months of higher

like-for-like production from March 2023 onwards.

-- CPO sales quantities increased 49.5% in FY 2023 compared to

last year, which was consistent with the higher CPO production. In

addition, PKO production increased 32.7% in FY 2023 compared to

last year.

-- The FY 2023 average CPO sales price achieved was historically

strong at EUR869 per tonne, albeit 15.2% below the record H1 2022

CPO sales prices. As the FY 2023 year progressed, local CPO prices

traded below international CPO prices but in turn, our FFB purchase

prices also decreased resulting in healthy gross margins being

achieved. International CPO prices ended 2023 at c.EUR850 per tonne

which remains supportive for the performance of the Palm Oil

Operation in 2024.

-- The CPO extraction rate for FY 2023 of 21.4% was slightly

lower than FY 2022 of 22.1% but remained well in line with

expectations.

Cashew Operation Update

-- FY 2023 was the first year of commercial production from the

Cashew Operation and a summary of the key performance indicators

('KPIs') are outlined in the table further below.

-- Whilst it was pleasing to commence commercial production, the

anticipated ramp up of daily production rates during FY-2023 was

hampered by ongoing technical issues primarily in the shelling and

peeling sections due to underperforming machinery provided by our

supplier.

-- Alternate machinery including additional shelling machines

were ordered in Q4 2023, which have been tested and commissioned.

However, as the Company started to ramp up production, the

percentage of unpeeled cashews remained high creating a bottleneck

in the process. During Q4, an independent expert was appointed to

assess the equipment performance and full production chain. This

expert is currently finalising recommendations which includes

replacement of parts of the shelling and peeling section which

requires a modest investment of c.EUR250,000 from existing cash

resources. Whilst daily production and quality should improve

during Q1 2024, any significant uplift in production and quality is

more likely during Q2 2024 when the recommendations of the external

expert can be fully implemented.

-- The successful completion of the BRC Global Food standard

assessment which took place in Q2 2023 and other key KPIs including

raw material prices, extraction rates meeting expectations was a

positive.

FY-2023

Raw Cashew Nut ('RCN')

Inventory

Opening RCN Inventory (tonnes) 1,841

RCN Purchased (tonnes) 1,419

RCN Processed (tonnes) 1,509

Closing RCN Inventory (tonnes) 1,751

Cashew Processing

Opening Cashews (tonnes) 111

RCN Processed (tonnes) 1,509

Cashew Extraction Rate 21.9%

Cashew Produced (tonnes) 330

Cashew Sales (tonnes) 265

Closing Cashews (tonnes) 176

Average Sales prices per

tonne

* Unpeeled Cashews EUR3,200

* Peeled Cashews EUR3,900

Lincoln Moore, Dekel 's Executive Director , said: "Ten

consecutive months of stronger like for like CPO production

resulted in a 51.7% increase in 2023 CPO production compared to

last year which was an excellent outcome. Coupled together with

continued relatively high CPO prices compared to historical levels,

FY2023 has been one of the best annual financial performances

delivered by the Palm Oil operation.

The Cashew Operation achieved a number of key milestones during

its first year of commercial production, however, daily production

rates continues to be impacted by the performance of the shelling

and peeling sections. Solutions are being implemented and we will

continue to update the market as we increase production."

** ENDS **

For further information, please visit the Company's website

www.dekelagrivision.com or contact:

Dekel Agri-Vision Plc

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

WH Ireland Ltd (Nomad and Joint Broker)

James Joyce

Darshan Patel

Isaac Hooper +44 (0) 20 7220 1666

Optiva Securities Limited (Joint Broker)

Christian Dennis

Daniel Ingram +44 (0) 203 137 1903

Notes:

Dekel Agri-Vision Plc is a multi-project, multi-commodity

agriculture company focused on West Africa. It has a portfolio of

projects in Côte d'Ivoire at various stages of development: a fully

operational palm oil project in Ayenouan where fruit produced by

local smallholders is processed at the Company's 60,000tpa capacity

crude palm oil mill and a cashew processing project in Tiebissou,

which is currently transitioning to full commercial production.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDURORRSSUAAUR

(END) Dow Jones Newswires

January 11, 2024 02:00 ET (07:00 GMT)

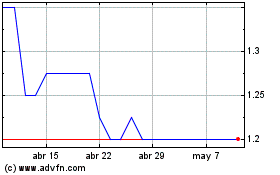

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024