TIDMFCRM

RNS Number : 8375J

Fulcrum Utility Services Ltd

21 August 2023

This announcement contains inside information

21 August 2023

FULCRUM UTILITY SERVICES LIMITED

("Fulcrum", the "Company") or "the Group")

Proposed cancellation of admission of Ordinary Shares to trading

on AIM

Adoption of Amended and Restated Memorandum and Articles of

Association

and

Notice of General Meeting

The Company announces the proposed cancellation of admission to

trading on AIM of its ordinary shares of 0.1p each ("Ordinary

Shares") (the "Cancellation"), and the adoption of amended and

restated memorandum and articles of association (the "Amended

Articles") (together, the "Proposals").

The Directors have undertaken a review to evaluate the

advantages and disadvantages to the Company and its Shareholders of

retaining the admission to trading on AIM of the Company's Ordinary

Shares. This review has included, amongst other matters, the

Company's limited prospects of raising additional equity financing

on AIM given its current investor base, the limited trading in the

Company's Ordinary Shares, the significant cost associated with

maintaining the Company's admission to trading on AIM and the

management time and the legal and regulatory burden associated with

being a quoted company. As a result, the Directors have concluded

that the Proposals are in the best interests of the Company and its

Shareholders as a whole. Further details of the background and

reasons for the Proposals are set out in Appendix 1 to this

announcement.

The Proposals are subject to Shareholder approval and

accordingly, a circular will be sent to Shareholders and will be

made available on the Company's website today, setting out the

background to and reasons for the Proposals (the "Circular") and

which will contain a notice convening a general meeting (the

"General Meeting") at which Shareholders will be invited to

consider and, if thought fit, approve the resolutions to implement

the Proposals. Extracts of the Circular can be found in Appendix 1

to this announcement.

To be passed, Resolution 1 (the "Cancellation Resolution")

requires, pursuant to AIM Rule 41 of the AIM Rules, the consent of

not less than 75 per cent. of votes cast by the Company's

shareholders at the General Meeting. Resolution 2, to approve the

adoption of the Amended Articles is a special resolution and as

such requires a vote of not less than two thirds of Shareholders

who vote in person or by proxy at the General Meeting. The

Resolutions are inter-conditional, meaning that each of the

Resolutions is conditional on the other Resolution being

passed.

As of today's date, the Company has received irrevocable

undertakings from certain shareholders representing approximately

57.31 per cent. of the Company's issued share capital, to vote in

favour of the Resolutions.

The General Meeting will be held at the offices of Addleshaw

Goddard, Milton Gate, 60 Chiswell Street, London EC1Y 4AG on 26

September 2023 at 11.30am.

To facilitate future Shareholder transactions in Ordinary

Shares, JP Jenkins has been appointed to provide a Matched Bargain

Facility, which is expected to be available from 4 October 2023.

Shareholders wishing to trade these securities can do so through

their stockbroker. Trades will be conducted at a level that JP

Jenkins is able to match a willing seller and a willing buyer.

Trades can be conducted, and limits can be accepted, during normal

business hours. Shareholders or potential investors can place

limits via their existing UK regulated stockbroker.

A copy of the Circular and the Amended Articles will be made

available later today on the Company's website at

https://investors.fulcrum.co.uk

Expected timetable of principal events(1)

Announcement of the proposed Cancellation 21 August 2023

pursuant to AIM Rule 41

Posting of the Circular to Shareholders 21 August 2023

Time and date of General Meeting 11.30 a.m. on 26 September

2023

Anticipated date to announce results of 26 September 2023

the General Meeting

Last day of dealings in the Ordinary Shares 3 October 2023

on AIM

Cancellation of admission of the Ordinary 7.00 a.m. on 4 October

Shares to trading on AIM 2023

Matched Bargain Facility for Ordinary 4 October 2023

Shares commences

(1) All times are references to London times. Each of the above

times and dates is based on the Company's expectations as at the

date of this announcement. If any of the above times and/or dates

change, the revised times and/or dates will be noti ed to

Shareholders by an announcement through a Regulatory Information

Service

Unless otherwise stated, capitalised terms in this announcement

have the meanings ascribed to them in Appendix II of this

announcement.

Enquiries:

Fulcrum Utility Services Limited +44 (0)114 280

Jonathan Jager, Chief Financial Officer 4150

Cenkos Securities plc (Nominated adviser and broker)

Camilla Hume / Callum Davidson (Nomad) / Michael +44 (0)20 7397

Johnson (Sales) 8900

Notes to Editors:

Fulcrum is a multi-utility infrastructure and services provider.

The Group operates nationally with its head office in Sheffield,

UK. It designs, builds, owns and maintains utility.

https://investors.fulcrum.co.uk

Appendix 1 - Extracts from the Circular to Shareholders

Letter from the Chair

1 Introduction

1.1 The Board announces that the Company intends to seek

Shareholder approval for the cancellation of the admission of the

Company's Ordinary Shares to trading on AIM (the

"Cancellation").

1.2 This Circular sets out the background to and reasons for the

Cancellation and why the Directors believe the Proposals, to be in

the best interests of the Company and its Shareholders as a

whole.

1.3 The Company is seeking Shareholder approval of the Proposals

at a General Meeting to be held at the offices of Addleshaw

Goddard, Milton Gate, 60 Chiswell Street, London EC1Y 4AG on 26

September 2023 at 11.30 a.m. The notice of the General Meeting is

set out in Part III of this Circular. Shareholders should note that

unless all of the Proposals are approved at the General Meeting the

Cancellation will not occur as currently proposed.

2 Background to the Cancellation

2.1 The Company's Ordinary Shares have been admitted to trading

on AIM since July 2009 following a reverse takeover of Fulcrum

Group Holdings Limited by Marwyn Capital I Limited. The Board has

conducted a review of the bene ts and drawbacks to the Company

retaining the admission of the Ordinary Shares to trading on AIM.

The Board believes that the Cancellation is in the best interests

of the Company and its Shareholders as a whole. In reaching this

conclusion, the Board has considered the following key factors:

2.1.1 the Directors believe that one of the main bene ts of a

company's shares being admitted to trading on AIM is the potential

to issue new shares to raise additional funds for investment or to

issue new shares as consideration for acquisitions. However, the

Directors believe that an equity fundraise through the public

markets would not be available to the Company in the near or medium

term at an appropriate valuation, if at all. Accordingly, the Board

is of the view that the public markets do not provide the optimal

platform to raise such funds;

2.1.2 given the share price performance and low trading volumes

of the Ordinary Shares, the Directors have concluded that the only

realistic source of funding will likely be through private capital.

Following the limited support from investors for the Company's

equity fundraising on AIM in December 2021 it is the Directors'

opinion that the admission of the Ordinary Shares to trading on AIM

no longer provides the fundamental benefit of giving access to the

required investor base for the Company to raise growth capital;

2.1.3 the Board believes, with a lack of liquidity, that the

Company's current share price and therefore the market

capitalisation of the Company, does not accurately re ect the

Company's value and adversely affects the ability of the Board to

pursue certain strategic objectives. The Board's experience and

opinion is that many smaller publicly traded companies do not

attract suf cient institutional or retail investor attention which

often leads to share price erosion and consequently impacts, inter

alia, the ability to use fairly valued shares for acquisitive

growth;

2.1.4 the Company estimates that it could save annualised costs

of circa GBP250,000 within the 2024 financial year and savings of

circa GBP500,000 per annum from 2025 financial year onwards, being

incremental costs resulting from the Company being a public limited

company admitted to trading on AIM - this includes fees payable to

its professional advisers, including the nominated adviser and

broker, AIM fees payable to the London Stock Exchange as well as

incremental legal, insurance, accounting and auditing fees. These

speci c annualised costs are signi cant, especially in the context

of the Company's nancial results and this supports the Board's

effort to return the Group to a breakeven position in respect of

its EBITDA in 2024 financial year, following an adjusted EBITDA

loss of GBP6,200,000 in 2023 financial year. The Board believes

that these funds invested in the legal and regulatory burden

associated with maintaining the Company's AIM quotation is

disproportionate to the benefits that it brings to the Company and

that the Company's resources could be better utilised for the bene

t of the Company and its Shareholders;

2.1.5 the Board believes that there would be additional cost

benefits which could be realised through the removal of any

perceived 'premium' that some suppliers might apply to a listed

business, including in respect of insurance premiums, advisers

costs, rent, vehicles and other services providers. While it is

difficult to quantify such a premium, it is hoped that a further

reduction of costs could be achieved if the Cancellation were to

proceed; and

2.1.6 accordingly, the disadvantages associated with maintaining

the AIM quotation are considered by the Directors to be

disproportionately high when compared to the bene ts of being

listed on AIM, even though the absolute costs have been, so far as

reasonably possible, controlled and minimised by the Company.

2.2 Following careful consideration, the Directors believe that

it is in the best interest of the Company and Shareholders to seek

the proposed Cancellation at the earliest opportunity.

3 Principal effects of the Cancellation

3.1 The Directors are aware that certain Shareholders may be

unable or unwilling to hold Ordinary Shares in the event that the

Cancellation is approved and becomes effective. Such Shareholders

may consider selling their Ordinary Shares in the market prior to

the Cancellation becoming effective.

3.2 Under the AIM Rules, the Company is required to give at

least 20 clear Business Days' notice of the Cancellation.

Additionally, the Cancellation will not take effect until at least

5 clear Business Days have passed following the passing of the

Cancellation Resolution. If the Cancellation Resolution is passed

at the General Meeting, it is proposed that the last day of trading

in the Ordinary Shares on AIM will be 3 October 2023 and that the

Cancellation will take effect at 7.00 a.m. on 4 October 2023.

3.3 The principal effects of the Cancellation will be that:

3.3.1 Shareholders will no longer be able to buy and sell

Ordinary Shares through a public stock market;

3.3.2 whilst the Ordinary Shares will remain freely

transferable, it is possible that the liquidity and marketability

of the Ordinary Shares will, in the future, be even more

constrained than at present and the value of such shares may be

adversely affected as a consequence;

3.3.3 in the absence of a formal market and quote, it may be

more difficult for Shareholders to determine the market value of

their investment at any given time;

3.3.4 the Company will no longer be required to announce

material events or full year or interim results through a

regulatory news service, although the Company may continue to

release important news through its website;

3.3.5 the Company will adopt the Amended Articles (if approved

by the Shareholders) upon the Cancellation becoming effective, but

will otherwise no longer be required to comply with many of the

corporate governance requirements applicable to companies whose

shares are traded on AIM;

3.3.6 the regulatory and financial reporting regime applicable

to companies whose shares are admitted to trading on AIM will no

longer apply;

3.3.7 the Company will no longer be subject to the Disclosure

Guidance and Transparency Rules and will therefore no longer be

required to disclose signi cant shareholdings in the Company;

3.3.8 the Company will no longer be subject to the AIM Rules,

with the consequence that the Shareholders will no longer be

afforded the protections provided by the AIM Rules. Such

protections include a requirement to obtain shareholder approval

for reverse takeovers and fundamental changes in the Company's

business and to announce, inter alia, certain substantial and/or

related party transactions;

3.3.9 the Company will cease to have an independent nominated adviser and broker; and

3.3.10 the Cancellation may have taxation consequences for

Shareholders. Shareholders who are in any doubt about their tax

position should consult their own professional independent tax

adviser.

3.4 The Takeover Code does not apply to the Company.

Shareholders should note that the Takeover Code provisions

previously adopted by the Company will cease to apply to the

Company following the adoption of the Amended Articles. However,

the Company will continue to be bound by the Companies Act (As

Revised) of the Cayman Islands (which requires Shareholders'

approval for certain matters) following the Cancellation.

3.5 The Resolutions to be proposed at the General Meeting

include the adoption of the Amended Articles with effect from the

Completion of the Cancellation. A summary of the principal changes

being made by the adoption of the Amended Articles is included in

Part II of the Circular.

The above considerations are not exhaustive, and Shareholders

should seek their own independent advice when assessing the likely

impact of the Cancellation on them.

4 Cancellation process

4.1 Under Rule 41 of the AIM Rules, it is a requirement that the

Cancellation must be approved by not less than 75 per cent. of

votes cast by Shareholders at a general meeting. In addition, any

AIM quoted company that wishes for the London Stock Exchange to

cancel the admission of its shares to trading on AIM is required to

notify shareholders and to separately inform the London Stock

Exchange of its preferred cancellation date at least 20 Business

Days prior to such date.

4.2 Accordingly, the Board is sending a notice of meeting to

Shareholders to convene a General Meeting to vote on the

Cancellation Resolution and has notified the London Stock Exchange

of the Company's intentions, subject to the Cancellation Resolution

being passed at the General Meeting to cancel the Company's

admission of the Ordinary Shares to trading on AIM on 4 October

2023. The Cancellation will not take effect until at least ve clear

Business Days have passed following the passing of the Cancellation

Resolution and a dealing notice has been issued by the London Stock

Exchange.

4.3 If the Cancellation Resolution is passed at the General

Meeting, it is expected that the last day of trading in Ordinary

Shares on AIM will be 3 October 2023 and that the Cancellation will

take effect at 7.00 a.m. on 4 October 2023.

4.4 Following the Cancellation, there will be no market facility

for dealing in the Ordinary Shares (save in respect of the Matched

Bargain Facility described below, which will provide a limited

mechanism to facilitate the trading of Ordinary Shares off-market),

no price will be publicly quoted for the Ordinary Shares and the

transfer of Ordinary Shares will be subject to the provisions of

the Amended Articles.

4.5 Upon the Cancellation becoming effective, the Company

proposes to adopt corporate governance practices and the New

Memorandum and Articles which are suitable for an unlisted company.

The proposed New Memorandum and Articles will be available to

download from the Company's website www.fulcrum.co.uk and further

details on the New Articles are set out in Part II of the

Circular.

4.6 The Board intends to retain the Company's Audit,

Remuneration and Nomination Committees following the

Cancellation.

5 Transactions in Ordinary Shares following Cancellation

5.1 Shareholders should note that they are able to continue

trading in the Ordinary Shares on AIM prior to the date of the

Cancellation.

5.2 The Company is making arrangements for a Matched Bargain

Facility to assist Shareholders to trade in the Ordinary Shares to

be put in place from the date of Cancellation, if the Resolutions

are passed. The Matched Bargain Facility will be provided by J P

Jenkins. J P Jenkins is an appointed representative of Prosper

Capital LLP, which is authorised and regulated by the Financial

Conduct Authority.

5.3 Under the Matched Bargain Facility, Shareholders or persons

wishing to acquire or dispose of Ordinary Shares will be able to

leave an indication with J P Jenkins, through their stockbroker (J

P Jenkins is unable to deal directly with members of the public),

of the number of Ordinary Shares that they are prepared to buy or

sell at an agreed price. In the event that J P Jenkins is able to

match that order with an opposite sell or buy instruction, it would

contact both parties and then effect the bargain (trade). Should

the Cancellation become effective and the Company puts in place the

Matched Bargain Facility, details will be made available to

Shareholders on the Company's website at www.fulcrum.co.uk.

5.4 The Matched Bargain Facility will operate for a minimum of

twelve months after Cancellation. The Directors' current intention

is that it will continue beyond that time but Shareholders should

note that it could be withdrawn and therefore inhibit the ability

to trade the Ordinary Shares. Further details will be communicated

to the Shareholders at the relevant time.

5.5 If Shareholders wish to buy or sell Ordinary Shares on AIM,

they must do so prior to the Cancellation becoming effective. As

noted above, in the event that Shareholders approve the

Cancellation, it is anticipated that the last day of dealings in

Ordinary Shares on AIM will be 3 October 2023 and that the

effective date of the Cancellation will be 4 October 2023 at 7.00

a.m.

6 General Meeting

6.1 In order to comply with applicable company law and the AIM

Rules, the Proposals require the approval of Shareholders at a

general meeting of the Company. The Company is convening a general

meeting for 11.30 a.m. on 26 September 2023, to be held at the

offices of Addleshaw Goddard, Milton Gate, 60 Chiswell Street,

London EC1Y 4AG to consider and, if thought t, pass:

6.1.1 a shareholder resolution for the Cancellation ("Resolution 1"); and

6.1.2 a special resolution relating to the adoption of the Amended Articles ("Resolution 2").

6.2 To be passed the Resolution 1 (the "Cancellation

Resolution") requires, pursuant to AIM Rule 41 of the AIM Rules,

the consent of not less than 75 per cent. of votes cast by the

Company's shareholders at the General Meeting. Resolution 2, to

approve the adoption of the Amended Articles is a special

resolution and as such requires a vote of not less than two thirds

of Shareholders who vote in person or by proxy at the General

Meeting. The Resolutions are inter-conditional, meaning that each

of the Resolutions is conditional on the other Resolution being

passed.

6.3 As at the date of this Circular, the Company has received

irrevocable undertakings from each of those persons set out in

paragraph 8, representing approximately 57.31 per cent. of the

Company's issued share capital, to vote in favour of the

Resolutions.

7 The Takeover Code and the Articles of Association

7.1 The Takeover Code does not apply to the Company although

certain provisions of the Takeover Code have been adopted in the

Company's articles of association. Shareholders should note these

adopted provisions of the Takeover Code will cease to apply to the

Company following the adoption of the Amended Articles. However,

the Company will continue to be bound by the Companies Act (As

Revised) of the Cayman Islands (which requires shareholders'

approval for certain matters) following the Cancellation. Further

details on the effects of the Amended Articles are set out in Part

II of this Circular.

8 Irrevocable undertakings

8.1 The Company has received irrevocable undertakings from

Harwood Capital and Bayford Group Shareholders holding in aggregate

228,416,332 Ordinary Shares (representing approximately 57.20 per

cent. of the existing issued ordinary share capital of the Company)

to vote in favour or the Resolutions. These Shareholders wish to

continue to support the Company's growth strategy as ongoing

Shareholders and therefore do not wish to sell their current

shareholdings. They have therefore irrevocably undertaken to vote

in favour of the Resolutions.

8.2 The Company has received an irrevocable undertaking from

each of the Directors holding in aggregate 458,294 Ordinary Shares

(being all shareholdings held by Directors) and representing

approximately 0.11 per cent. of the existing issued ordinary share

capital of the Company to vote in favour of the Resolutions. The

Directors are fully supportive of the Company's growth strategy and

intend to continue to support the Company as Shareholders.

9 Actions to be taken before the General Meeting

Form of Proxy

Shareholders may complete a proxy online by visiting

https://www.signalshares.com. To be valid, your online proxy

appointment must be received by Link Group by no later than 11.30

a.m. on 22 September 2023 (being at least 48 hours prior to the

General Meeting). Completion and return of a Form of Proxy will not

preclude a Shareholder from attending and voting in person at the

General Meeting.

Electronic Form of Direction

Depository Interest Holders may complete a form of direction

online by visiting https://www.signalshares.com. To be valid, your

online instructions must be received by Link Group no later than

11.30 a.m. on 21 September 2023 (being at least 72 hours prior to

the General Meeting).

Hard Copy Form of Proxy or Form of Direction

You may request a hard copy form of proxy or form of direction,

directly from our Registrar, Link Group by emailing

shareholderenquiries@linkgroup.co.uk or on Tel. 0371 664 0300.

Calls are charged at the standard geographic rate and will vary by

provider. Calls outside the United Kingdom will be charged at the

applicable international rate. Lines are open between

9.00am-5.30pm, Monday to Friday excluding public holidays in

England and Wales.

CREST members may use the CREST electronic appointment service

to submit the Form of Direction in respect of the General Meeting.

The Form of Direction should be submitted to Link Group (RA10)

using the procedures described in the CREST Manual. Further details

are set out in note 7 to the Notice of General Meeting.

On receipt of the Form of Direction, the Depository will vote at

the General Meeting on the Depository Interest holder's behalf, as

directed by the Depository Interest holder in the Form of

Direction.

If you are an institutional investor you may also be able to

direct the Depository how to vote electronically via the Proxymity

platform, a process which has been agreed by the Company and

approved by the Registrar. For further information regarding

Proxymity, please go to www.proxymity.io.

You are advised to read all of the information contained in this

Circular before deciding on the course of action you will take in

respect of the General Meeting.

10 Recommendations

The Board believes that the Proposals, including the

Cancellation, are in the best interests of the Company and its

Shareholders as a whole, and unanimously recommends that

Shareholders vote in favour of the Resolutions.

If you are in any doubt as to the action you should take, you

are recommended to seek your own independent advice.

Yours faithfully

Jennifer Babington

Fulcrum Utility Services Limited

Chair and Independent Non- Executive Director

Appendix II

The following de nitions apply throughout this Announcement,

unless stated otherwise:

"Admission" admission of the entire issued

share capital of the Company to

trading on AIM;

"AIM" a market operated by the London

Stock Exchange;

"AIM Rules" the rules applicable to companies

governing their admission to AIM,

and following admission their

continuing obligations to AIM,

as set out in the AIM Rules for

Companies published by the London

Stock Exchange from time to time;

"Amended Articles" the amended and restated memorandum

of association and the articles

of association of the Company

to be adopted following the passing

of Resolution 2;

"Articles" the articles of association of

the Company from time to time;

"Bayford Group" Bayford & Co Ltd;

"Board" the board of the Company comprising

the Directors;

"Business Day" any day other than a Saturday,

Sunday or public holiday on which

banks are open in the City of

London for the transaction of

general commercial business;

"Cancellation" the cancellation of Admission

of the Ordinary Shares to trading

on AIM;

"Circular" the circular, containing further

details of the Cancellation and

notice of the General Meeting

to, inter alia, approve the Resolutions,

which is expected to be published

and dispatched to Shareholders

on or around 21 August 2023;

"Companies Act 2006" the Companies Act 2006, as amended

from time to time;

"Company" Fulcrum Utility Services Limited;

"Depository" Link Market Services Trustees

Limited, a company incorporated

in England and Wales;

"Depository Interests" the dematerialised depository

interests of the Company created

pursuant to and issued on the

terms of the deed poll dated 18

December 2009 between the Depository

and the Company;

"Directors" the directors of the Company;

"DTRs" the Disclosure Guidance and Transparency

Rules of the FCA Rules;

"Euroclear" Euroclear UK & International Limited,

the operator of CREST;

"FCA" the Financial Conduct Authority;

"Form of Direction" the form of direction to be submitted

electronically or requested in

hard copy by Depository Interest

holders in respect of the AGM;

"FSMA" Financial Services and Markets

Act 2000 (as amended);

"General Meeting" or "GM" the general meeting of the Company

to be held at the offices of Addleshaw

Goddard, Milton Gate, 60 Chiswell

Street, London, ECIY 4AG and on

26 September 2023 at 11.30 a.m.,

or any adjournment thereof, notice

of which is set out in Part III

of the Circular;

"Group" means the Company and subsidiary

undertakings from time to time;

"Harwood Capital" Harwood Private Equity LLP and

Harwood Capital Management (Gibraltar)

Limited;

" Link" or "Registrar" Link Group, a trading name of

Link Market Services Limited;

"London Stock Exchange" London Stock Exchange plc;

"Matched Bargain Facility" the trading facility operated

by J P Jenkins to facilitate trading

in the Ordinary Shares on a matched

bargain basis following Cancellation,

details of which are set out in

the Circular;

"Notice of General Meeting" or the notice of the General Meeting

"Notice of GM" which appears in Part III of the

Circular;

"Ordinary Shares" the ordinary shares of 0.1p each

in the capital of the Company;

"Overseas Shareholders" a Shareholder who is a resident

in, or a citizen of, a jurisdiction

outside the United Kingdom;

"Panel" the Takeover Panel;

"Proposals" the Cancellation and the adoption

of the Amended Articles, all as

described in the Circular;

"Register" the Company's register of members;

"Regulatory Information Service" as de ned in the AIM Rules;

"Resolutions" the resolutions numbered 1 and

2 to be proposed at the General

Meeting, as set out in the Notice

of General Meeting;

"Restricted Jurisdiction" each of the United States, Australia,

Canada, Japan, New Zealand and

South Africa and any other jurisdiction

where the mailing of the Circular

or the accompanying documents

into or inside such jurisdiction

would constitute a violation of

the laws of such jurisdiction;

"Shareholders" the holders of the Ordinary Shares;

"subsidiary" a subsidiary as that term is de

ned in section 1159 of the Companies

Act 2006;

"Takeover Code" the City Code on Takeovers and

Mergers;

"uncerti cated form" recorded on the Register as being

held in uncerti cated form in

CREST and title to which, by virtue

of the Uncerti ed Securities Regulations,

may be transferred by means of

CREST; and

"United Kingdom or UK" the United Kingdom of Great Britain

and Northern Ireland.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCQVLFFXVLEBBZ

(END) Dow Jones Newswires

August 21, 2023 02:00 ET (06:00 GMT)

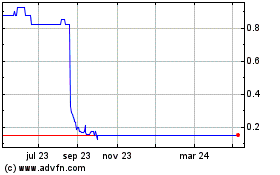

Fulcrum Utility Services... (LSE:FCRM)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

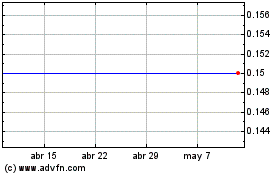

Fulcrum Utility Services... (LSE:FCRM)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025