TIDMFEV

FIDELITY EUROPEAN TRUST PLC

Half-Yearly Results for the six months ended 30 June 2023 (unaudited)

Financial Highlights:

· The Board of Fidelity European Trust PLC (the "Company") declares an interim

dividend of 3.26 pence per share, an increase of 5.8% on the prior year.

· The net asset value ("NAV") of the Company increased by +11.1% for the six

months ending 30 June, outperforming the FTSE World Europe (ex UK) Index, which

returned +9.3%.

· The share priced matched the Benchmark Index, returning +9.3% over the

reporting period.

· The Company remains the top performer in the AIC peer group over one, five

and ten years*.

· The Company continues to focus on attractively valued companies with strong

balance sheets and consistent dividend growth.

*Data according to the AIC as at 24/07/23

Contacts

For further information, please contact:

Smita Amin

Company Secretary

01737 836347

Portfolio Managers' Half-Yearly Review

Performance Review

During the first six months of the year the net asset value ("NAV") total return

was +11.1% compared to a total return of +9.3% for the FTSE World Europe (ex UK)

Index which is the Company's Benchmark Index. The share price total return was

+9.3%, which is below the NAV total return because of a widening of the share

price discount to NAV. (All figures in UK sterling.)

Market Review

Continental European markets were unexpectedly strong in the first half of this

year, as investors concerns moderated regarding global economic growth and as

corporate earnings proved more resilient than feared. UK sterling appreciated by

+3% against the Euro during this six month period so in Euro terms, the

continental European benchmark rose +12% which is impressive, however much less

than the Nasdaq which rocketed +30% in equivalent terms!

The market recovery from the lows of October 2022 accelerated in January boosted

by confirmation that China would relax its strict COVID policies and "re-open".

This positive sentiment was tested by the collapse of the Silicon Valley Bank

(SVB) in early March, and the subsequent demise of Credit Suisse, but the market

shrugged these off and ended the first quarter at close to its highest levels

for the period. First quarter corporate results were better than anticipated

(despite a technical recession in Germany). There was also a flurry of

excitement regarding the likely long term impact of generative Artificial

Intelligence (AI) which boosted technology names (such as ASML), but overall,

the market stalled in the second quarter as investors worried that central banks

were still in tightening mode given the resilience of the global economy and the

stickiness of inflation. Like the US stock market, the continental European

markets were led higher by a narrow group of mega-cap companies, often in the

technology or luxury sectors. The energy sector was the main laggard, as

commodity prices fell from the elevated levels of 2022, despite China "re

-opening" and the continued war in Ukraine.

Portfolio Managers' Report

The Company's NAV total return outperformed the Company's Benchmark Index over

the six month period by almost 2%. Much of this outperformance was due to the

gearing of the Company which was maintained throughout the period at around 13%.

Shareholders of the Company will remember that, as mentioned in the 2021 Annual

Report, the Board endorsed an intention to maintain a relatively fixed level of

gearing within a range that is approximately double the 6% average gearing from

the end of the global financial crisis until the global pandemic. Gearing is, of

course, one of the great advantages of an investment trust, and although it may

amplify volatility in the short term, we expect it to enhance long term returns.

The agreed level of gearing takes into account our cautious investment approach

and allows considerable headroom before published limits are reached in the

event of a sharp sell-off in the markets.

The contribution from stock-picking was also positive during this period. The

stand-out performer during the half-year was 3i Group which continued to impress

with positive results updates and strong current trading figures from their

largest investment, the continental European discount retail group, Action.

Financials, which is the Company's largest sector overweight, was however rocked

by the bankruptcy of SVB. Bankinter suffered as investors worried that it was a

European equivalent of a US regional bank with a deposit base that might prove

less sticky than other European banks, given its recent growth and more

sophisticated customer base. Sampo, the Nordic insurance company, also performed

poorly following disappointing results and conservative guidance regarding

capital distributions to shareholders. Roche continued its lacklustre run,

hampered by disappointing guidance for 2023 due to a drop-off in COVID-related

revenues (in diagnostics and pharma) and the on-going impact of biosimilars

(comparable biological medicines) on Rituxan, Herceptin and Avastin. On a more

positive note, LVMH Moët Hennessy and Hèrmes International defied gravity, once

again, on the growing hope that the Chinese consumers were embarking on so

-called "revenge spending" that has been seen post "re-opening" in the US and

Europe.

Top Five Stock Sector Country %

Contributors (on a

relative basis)

3i Group Financials UK +0.9

ASML Information Technology Netherlands +0.5

Amadeus IT Group Consumer Discretionary Spain +0.5

Hèrmes International Consumer Discretionary France +0.5

L'Oréal Consumer Staples France +0.4

Top Five Stock Sector Country %

Detractors (on a

relative basis)

Sampo Financials Finland -0.6

TotalEnergies Energy France -0.6

Bankinter Financials Spain -0.4

Symrise Materials Germany -0.3

EQT Financials Sweden -0.3

Outlook

There are plenty of reasons to be bearish. More than a year ago, the two-year

treasury yields rose above the ten-year treasury yields in the US bond market

(it is normally the other way around). This `yield curve inversion' has,

historically, been a lead indicator of recession about 80% of the time, but the

lag between the date of inversion and recession can be six months to three

years. It is a bit like seeing a big dark cloud on the horizon and predicting it

will rain soon! To date, the global economy and corporate earnings have been

resilient while stock markets have recovered quite dramatically since the lows

in October, such that share prices are now back in the middle of their normal

valuation ranges. It is hard to imagine that this will not be tested in the

months ahead. Having said that, the pandemic and subsequent monetary and fiscal

policies have made this an unusual cycle. At present, investors seem to be

expecting a soft landing or no global recession at all. Earnings forecasts for

2023 are similar to earnings delivered for 2022 but analysts are still

forecasting growth in 2024. The capacity of consumers (the most important

contributors to GDP) to maintain spending levels has surprised many. But, in

general, they still have jobs and pandemic savings to burn. The cost-of-living

crisis may ease too as commodity prices lead general pricing downwards on goods

and services. This disinflation may also be helped along by governments

`encouraging' corporates to abandon `greedflation' (which might hinder company

margins). So maybe the consumer will keep the global economy bumbling along.

Having said that, credit conditions are tightening (post SVB) and the US Federal

Reserve and government are draining liquidity via quantitative tightening and

short term bond issuance, and there is a multi-year refinancing requirement

ahead for consumers and corporates alike. Geopolitical risks remain elevated too

with the war in Europe and continued tensions between the US and China. Whatever

our views on the outlook, we will maintain the current level of gearing and will

continue to focus on attractively valued companies with strong balance sheets

that should be resilient and able to grow dividends, even in a more difficult

economic environment.

SAM MORSE

Portfolio Manager

Marcel Stötzel

Co-Portfolio Manager

1 August 2023

Twenty Largest Holdings as at 30 June 2023

The Asset Exposures shown below measure exposure to market price movements as a

result of owning shares and derivative instruments. The Fair Value is the actual

value of the portfolio as reported in the Balance Sheet. Where a contract for

difference ("CFD") is held, the Fair Value reflects the profit or loss on the

contract since it was opened and is based on how much the share price of the

underlying share has moved.

Asset Exposure Fair

£'000 %1 Value

£'000

Long Exposures - shares unless

otherwise stated

Nestlé

Food Producers 102,451 6.8 102,451

ASML

Technology Hardware & Equipment 92,644 6.1 92,644

LVMH Moët Hennessy

Personal Goods 86,605 5.7 86,605

Novo Nordisk

Pharmaceuticals & Biotechnology 82,079 5.4 82,079

Roche

Pharmaceuticals & Biotechnology 69,925 4.6 69,925

TotalEnergies

Oil, Gas & Coal 64,304 4.3 64,304

L'Oréal

Personal Goods 63,203 4.2 63,203

EssilorLuxottica

Medical Equipment & Services 51,561 3.4 51,561

SAP (long CFD)

Software & Computer Services 51,231 3.4 (164)

Sanofi (long CFD)

Pharmaceuticals & Biotechnology 47,733 3.2 2,076

Legrand (long CFD)

Electronic & Electrical 45,085 3.0 (1,033)

Equipment

Hèrmes International

Personal Goods 44,523 2.9 44,523

MTU Aero Engines

Aerospace & Defense 44,225 2.9 44,225

Partners Group Holding

Investment Banking & Brokerage 42,805 2.8 42,805

Services

3i Group

Investment Banking & Brokerage 41,286 2.7 41,286

Services

Assa Abloy

Construction & Materials 40,720 2.7 40,720

Deutsche Börse Group

Investment Banking & Brokerage 38,606 2.6 38,606

Services

Sampo

Non-Life Insurance 36,170 2.4 36,170

Amadeus IT Group

Software & Computer Services 35,556 2.3 35,556

Linde (long CFD)

Chemicals 33,822 2.2 635

--------- --------------- ---------------

------

Twenty largest long exposures 1,114,534 73.6 938,177

Other long exposures 522,642 34.5 522,642

--------- --------------- ---------------

------

Total long exposures before long 1,637,176 108.1 1,460,819

futures2,3

========= ========= =========

Long Futures

Euro Stoxx 50 Future September 60,659 4.0 1,120

20233

--------- --------------- ---------------

------

Total long exposures after long 1,697,835 112.1 1,461,939

futures3

========= ========= =========

Short Exposures

Short CFDs (2 Holdings) 18,101 1.2 (396)

--------- --------------- ---------------

------

Gross Asset Exposure3,4 1,715,936 113.3

========= =========

Portfolio Fair Value5 1,461,543

Net current assets (excluding 53,000

derivative assets and

liabilities)

---------------

Shareholders' Funds (per the 1,514,543

Balance Sheet below)

=========

1Asset Exposure is expressed as a percentage of Shareholders' Funds.

2Total long exposures before long futures comprises investments of

£1,459,305,000 and long CFDs of £177,871,000.

3See Note 13 below.

4Gross Asset Exposure comprises market exposure to investments of £1,459,305,000

plus market exposure to all derivative instruments of £256,631,000. Derivative

instruments comprise long CFDs of £177,871,000, long futures of £60,659,000 and

short CFDs of £18,101,000.

5Portfolio Fair Value comprises investments of £1,459,305,000 plus derivative

assets of £3,919,000 less derivative liabilities of £1,681,000 (per the Balance

Sheet below).

Interim Management Report and Directors' Responsibility Statement

Interim Dividend

The Board does not influence the Portfolio Managers by imposing any income

objective in any particular period, and the investment focus on companies

capable of growing their dividends remains. The Board acknowledges that both

capital and income growth are components of performance, as reflected in the

investment objective of the Company. It therefore has a policy whereby it seeks

to pay a progressive dividend in normal circumstances and to pay dividends twice

yearly in order to smooth dividend payments for the reporting year. Unlike open

-ended funds, investment trusts can hold back some of the income they receive in

good years, thereby building up revenue reserves, which can then be used to

supplement dividends during difficult times. The Board has over the past few

years augmented revenue reserves by retaining a small proportion of earnings to

be used in difficult times, as in the case of the final dividend paid in May

2021.

The Company's revenue return for the six months to 30 June 2023 was 7.38 pence

per ordinary share (30 June 2022: 7.08 pence). The Board has declared an interim

dividend of 3.26 pence per ordinary share which is an increase of 5.8% on the

3.08 pence per ordinary share paid as the interim dividend in 2022. This will be

paid on 27 October 2023 to shareholders on the register at close of business on

22 September 2023 (ex-dividend date 21 September 2023).

Shareholders may choose to reinvest their dividends for additional shares in the

Company.

Discount Management and Treasury Shares

The Board has an active discount management policy, the primary purpose of which

is to reduce discount volatility. It seeks to maintain the discount in single

digits in normal market conditions. Buying shares at a discount also results in

an enhancement to the NAV per ordinary share.

In order to assist in managing the discount, the Board has shareholder approval

to hold ordinary shares repurchased by the Company in Treasury, rather than

cancel them. Shares in Treasury are then available to be re-issued at NAV per

ordinary share or at a premium to NAV per ordinary share, facilitating the

management of and enhancing liquidity in the Company's shares.

In the reporting period and up to the date of this report, the discount remained

in single digits and the Company did not repurchase any ordinary shares into

Treasury or for cancellation.

Principal Risks and Uncertainties

The Board, with the assistance of the Manager (FIL Investment Services (UK)

Limited), has developed a risk matrix which, as part of the risk management and

internal controls process, identifies the key existing and emerging risks and

uncertainties faced by the Company.

The Board considers that the principal risks and uncertainties faced by the

Company fall into the following categories: economic and geopolitical risks;

market risk; discount control risk; operational risk; cybercrime risk;

investment performance risk (including the use of derivatives and gearing);

environmental, social and governance (ESG) risks; key person risk; operational

resilience risk; and tax and regulatory risks. Information on each of these

risks is given in the Strategic Report section of the Annual Report for the year

ended 31December 2022. A copy of the Annual Report can be found on the Company's

pages of the Manager's website at www.fidelity.co.uk/europe.

While the principal risks and uncertainties are the same as those at the

previous year end, the uncertainty continues to be heightened by the ongoing

Russia and Ukraine conflict dominating political risks and industry concerns.

There is geopolitical and economic uncertainty, in particular concerns over

global economic growth, inflation and financial distress. Earlier in the year,

the collapse of Silicon Valley Bank and the buyout of Credit Suisse caused

turmoil in the global banking sector and volatility in the markets. The quantum

of risks continues to change, and the Board remains vigilant in monitoring such

risks.

Climate change continues to be a key emerging issue, as well as a principal

risk, that is confronting asset managers and their investors. The Board notes

that the Manager has integrated ESG considerations, including climate change,

into the Company's investment process. The Board will continue to monitor how

this may potentially impact the Company, the main risk being the impact on

investment valuations and shareholder returns.

Investors should be prepared for market fluctuations and remember that holding

shares in the Company should be considered to be a long term investment. Risks

are mitigated by the investment trust structure of the Company which means that

no forced sales need to take place to deal with any redemptions. Therefore,

investments in the Company's portfolio can be held over a longer time horizon.

The Manager has appropriate business continuity and operational plans in place

to ensure the uninterrupted provision of services, including investment team key

activities, including those of portfolio managers, analysts and trading/support

functions. It reviews its operational resilience strategies on an ongoing basis

and continues to take all reasonable steps in meeting its regulatory obligations

and protecting its ability to continue operating and to serve and support its

clients, including the Board.

The Company's other third-party service providers also have similar measures to

ensure that business disruption is kept to a minimum.

Transactions with the Manager and Related Parties

The Manager has delegated the Company's portfolio management and company

secretariat services to FIL Investments International. Transactions with the

Manager and related party transactions with the Directors are disclosed in Note

14 to the Financial Statements below.

Going Concern Statement

The Directors have considered the Company's investment objective, risk

management policies, liquidity risk, credit risk, capital management policies

and procedures, the nature of its portfolio and its expenditure and cash flow

projections. The Directors, having considered the liquidity of the Company's

portfolio of investments (being mainly securities which are readily realisable)

and the projected income and expenditure, are satisfied that the Company is

financially sound and has adequate resources to meet all of its liabilities and

ongoing expenses and can continue in operational existence for a period of at

least twelve months from the date of this Half-Yearly Report.

This conclusion also takes into account the Board's assessment of the ongoing

risks from the war in Ukraine, significant market events and regulatory changes.

Accordingly, the Financial Statements of the Company have been prepared on a

going concern basis.

Continuation votes are held every two years and the next continuation vote will

be put to shareholders at the Annual General Meeting in 2025.

BY ORDER OF THE BOARD

FIL INVESTMENTS INTERNATIONAL

1 August 2023

DIRECTORS' RESPONSIBILITY STATEMENT

The Disclosure and Transparency Rules ("DTR") of the UK Listing Authority

require the Directors to confirm their responsibilities in relation to the

preparation and publication of the Interim Management Report and Financial

Statements.

The Directors confirm to the best of their knowledge that:

a)The condensed set of Financial Statements contained within the Half-Yearly

Report has been prepared in accordance with the Financial Reporting Council's

Standard FRS 104: Interim Financial Reporting; and

b)The Portfolio Managers' Half-Yearly Review and the Interim Management Report

above, include a fair review of the information required by DTR 4.2.7R and

4.2.8R.

In line with previous years, the Half-Yearly Report has not been audited or

reviewed by the Company's Independent Auditor.

The Half-Yearly Report was approved by the Board on 1 August 2023 and the above

responsibility statement was signed on its behalf by Vivian Bazalgette,

Chairman.

Financial Statements

Income Statement for the six months ended 30 June 2023

Six Six

Year

months months

ended 31

ended 30 ended 30

December

June 2023 June 2022

2022

unaudited unaudited

audited

Notes Revenue Capital Total Revenue Capital

Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000

£'000 £'000 £'000 £'000

Gains/(losse - 94,641 94,641 - (172,868)

(172,868) - (63,812) (63,812)

s) on

investments

Gains/(losse - 36,841 36,841 - (29,395)

(29,395) - (22,034) (22,034)

s) on

derivative

instruments

Income 4 35,816 - 35,816 33,050 -

33,050 43,042 - 43,042

Investment 5 (1,303) (3,910) (5,213) (1,177) (3,533)

(4,710) (2,362) (7,087) (9,449)

management

fees

Other (507) - (507) (511) -

(511) (919) - (919)

expenses

Foreign - (2,599) (2,599) - 502 502

- (372) (372)

exchange

(losses)/gai

ns

--------- --------- --------- --------- --------- ----

----- --------- --------- ---------

------ ------ ------ ------ ------ ----

-- ------ ------ ------

Net 34,006 124,973 158,979 31,362 (205,294)

(173,932) 39,761 (93,305) (53,544)

return/(loss

)

on ordinary

activities

before

finance

costs and

taxation

Finance 6 (908) (2,724) (3,632) (31) (92)

(123) (196) (586) (782)

costs

--------- --------- --------- --------- --------- ----

----- --------- --------- ---------

------ ------ ------ ------ ------ ----

-- ------ ------ ------

Net 33,098 122,249 155,347 31,331 (205,386)

(174,055) 39,565 (93,891) (54,326)

return/(loss

)

on ordinary

activities

before

taxation

Taxation on 7 (2,916) - (2,916) (2,241) -

(2,241) (2,641) - (2,641)

return/(loss

) on

ordinary

activities

--------- --------- --------- --------- --------- ----

----- --------- --------- ---------

------ ------ ------ ------ ------ ----

-- ------ ------ ------

Net 30,182 122,249 152,431 29,090 (205,386)

(176,296) 36,924 (93,891) (56,967)

return/(loss

)

on ordinary

activities

after

taxation

for the

period

========= ========= ========= ========= =========

========= ========= ========= =========

Return/(loss 8 7.38p 29.91p 37.29p 7.08p (49.97p)

(42.89p) 9.00p (22.88p) (13.88p)

) per

ordinary

share

========= ========= ========= ========= =========

========= ========= ========= =========

The Company does not have any other comprehensive income. Accordingly the net

return/(loss) on ordinary activities after taxation for the period is also the

total comprehensive income for the period and no separate Statement of

Comprehensive Income has been presented.

The total column of this statement represents the Income Statement of the

Company. The revenue and capital columns are supplementary and presented for

information purposes as recommended by the Statement of Recommended Practice

issued by the AIC.

No operations were acquired or discontinued in the period and all items in the

above statement derive from continuing operations.

Statement of Changes in Equity for the six months ended 30 June 2023

Notes Share Share Capital Capital Revenue

Total

capital premium redemption reserve reserve

shareholders'

£'000 account reserve £'000 £'000

funds

£'000 £'000

£'000

Six months

ended

30 June 2023

(unaudited)

Total 10,411 58,615 5,414 1,271,996 34,559

1,380,995

shareholders'

funds at 31

December 2022

Net return on - - - 122,249 30,182

152,431

ordinary

activities

after

taxation

for the

period

Dividend paid 9 - - - - (18,883)

(18,883)

to

shareholders

--------- --------- ---------- --------- --------- --

-----------

------ ------ ----- ------ ------ --

Total 10,411 58,615 5,414 1,394,245 45,858

1,514,543

shareholders'

funds at 30

June 2023

========= ========= ========= ========= =========

=========

Six months

ended

30 June 2022

(unaudited)

Total 10,411 58,615 5,414 1,372,360 27,433

1,474,233

shareholders'

funds at 31

December 2021

Net - - - (205,386) 29,090

(176,296)

(loss)/return

on

ordinary

activities

after

taxation for

the

period

Dividend paid 9 - - - - (17,180)

(17,180)

to

shareholders

--------- --------- ---------- --------- --------- --

-----------

------ ------ ----- ------ ------ --

Total 10,411 58,615 5,414 1,166,974 39,343

1,280,757

shareholders'

funds at 30

June 2022

========= ========= ========= ========= =========

=========

Year ended 31

December 2022

(audited)

Total 10,411 58,615 5,414 1,372,360 27,433

1,474,233

shareholders'

funds at 31

December 2021

Net - - - (93,891) 36,924

(56,967)

(loss)/return

on

ordinary

activities

after

taxation for

the

year

Repurchase of 11 - - - (6,473) -

(6,473)

ordinary

shares

Dividends 9 - - - - (29,798)

(29,798)

paid

to

shareholders

--------- --------- ---------- --------- --------- --

-----------

------ ------ ----- ------ ------ --

Total 10,411 58,615 5,414 1,271,996 34,559

1,380,995

shareholders'

funds at 31

December 2022

========= ========= ========= ========= =========

=========

Balance Sheet as at 30 June 2023

Company Number 2638812

Notes 30 June 31 30 June

2023 December 2022

unaudited 2022 unaudited

£'000 audited £'000

£'000

Fixed assets

Investments 10 1,459,305 1,325,389 1,252,159

------- --------- --------- ---------------

------- ------ ------

-

Current assets

Derivative instruments 10 3,919 521 253

Debtors 12,141 8,128 13,706

Amounts held at futures 5,869 12,891 3,789

clearing houses and

brokers

Cash and cash equivalents 36,362 44,884 15,955

--------- --------- ---------------

------ ------

58,291 66,424 33,703

========= ========= =========

Current liabilities

Derivative instruments 10 (1,681) (9,633) (4,179)

Other creditors (1,372) (1,185) (926)

--------- --------- ---------------

------ ------

(3,053) (10,818) (5,105)

========= ========= =========

Net current assets 55,238 55,606 28,598

========= ========= =========

Net assets 1,514,543 1,380,995 1,280,757

========= ========= =========

Capital and reserves

Share capital 11 10,411 10,411 10,411

Share premium account 58,615 58,615 58,615

Capital redemption 5,414 5,414 5,414

reserve

Capital reserve 1,394,245 1,271,996 1,166,974

Revenue reserve 45,858 34,559 39,343

--------- --------- ---------------

------ ------

Total shareholders' funds 1,514,543 1,380,995 1,280,757

========= ========= =========

Net asset value per 12 370.55p 337.87p 311.61p

ordinary share

========= ========= =========

Notes to the Financial Statements

1 Principal Activity

Fidelity European Trust PLC is an Investment Company incorporated in England and

Wales with a premium listing on the London Stock Exchange. The Company's

registration number is 2638812, and its registered office is Beech Gate,

Millfield Lane, Lower Kingswood, Tadworth, Surrey KT20 6RP. The Company has been

approved by HM Revenue & Customs as an Investment Trust under Section 1158 of

the Corporation Tax Act 2010 and intends to conduct its affairs so as to

continue to be approved.

2 Publication of Non-statutory Accounts

The Financial Statements in this Half-Yearly Report have not been audited by the

Company's Independent Auditor and do not constitute statutory accounts as

defined in section 434 of the Companies Act 2006 ("the Act"). The financial

information for the year ended 31 December 2022 is extracted from the latest

published Financial Statements of the Company. Those Financial Statements were

delivered to the Registrar of Companies and included the Independent Auditor's

Report which was unqualified and did not contain a statement under either

section 498(2) or 498(3) of the Act.

3 ACCOUNTING POLICIES

(i) Basis of Preparation

The Company prepares its Financial Statements on a going concern basis and in

accordance with UK Generally Accepted Accounting Practice ("UK GAAP") and FRS

102: The Financial Reporting Standard applicable in the UK and Republic of

Ireland, issued by the Financial Reporting Council. The Financial Statements are

also prepared in accordance with the Statement of Recommended Practice:

Financial Statements of Investment Trust Companies and Venture Capital Trusts

("SORP") issued by the Association of Investment Companies ("AIC") in July 2022.

FRS 104: Interim Financial Reporting has also been applied in preparing this

condensed set of Financial Statements. The accounting policies followed are

consistent with those disclosed in the Company's Annual Report and Financial

Statements for the year ended 31 December 2022.

(ii) Going Concern

The Directors have a reasonable expectation that the Company has adequate

resources to continue in operational existence for a period of at least twelve

months from the date of approval of these Financial Statements. Accordingly, the

Directors consider it appropriate to adopt the going concern basis of accounting

in preparing these Financial Statements. This conclusion also takes into account

the Board's assessment of the risks faced by the Company as detailed in the

Interim Management Report above.

4 Income

Six Six Year

months months ended

ended ended 31.12.22

30.06.23 30.06.22 audited

unaudited unaudited £'000

£'000 £'000

Investment income

Overseas dividends 28,415 26,955 35,333

Overseas scrip dividends 957 729 1,052

UK dividends 965 1,075 1,910

--------- --------- ---------------

------ ------

30,337 28,759 38,295

========= ========= =========

Derivative income

Income recognised from futures 1,797 1,083 1,208

contracts

Dividends received on long CFDs 3,339 2,858 3,025

Interest received on CFDs1 61 347 422

--------- --------- ---------------

------ ------

5,197 4,288 4,655

========= ========= =========

Investment and derivative income 35,534 33,047 42,950

========= ========= =========

Other interest

Interest received on collateral, 276 3 88

bank deposits and money market

funds

Interest received on tax reclaims 6 - 4

--------- --------- ---------------

------ ------

282 3 92

--------- --------- ---------------

------ ------

Total income 35,816 33,050 43,042

========= ========= =========

1Due to negative interest rates in the prior periods, the Company received

interest on its long CFDs.

Special dividends of £710,000 have been recognised in capital during the period

(six months ended 30 June 2022 and year ended 31 December 2022: £1,115,000).

5 INVESTMENT MANAGEMENT FEES

Revenue Capital Total

£'000 £'000 £'000

Six months ended 30 June 2023 (unaudited)

Investment management fees 1,303 3,910 5,213

========= ========= =========

Six months ended 30 June 2022 (unaudited)

Investment management fees 1,177 3,533 4,710

========= ========= =========

Year ended 31 December 2022 (audited)

Investment management fees 2,362 7,087 9,449

========= ========= =========

FIL Investment Services (UK) Limited is the Company's Alternative Investment

Fund Manager and has delegated portfolio management to FIL Investments

International ("FII"). Both companies are Fidelity group companies.

FII charges investment management fees at an annual rate of 0.85% of net assets

up to £400 million and 0.65% of net assets in excess of £400 million. Fees are

payable monthly in arrears and are calculated on a daily basis.

Investment management fees have been allocated 75% to capital reserve in

accordance with the Company's accounting policies.

6 FINANCE COSTS

Revenue Capital Total

£'000 £'000 £'000

Six months ended 30

June 2023 (unaudited)

Interest paid on - - -

collateral and bank

deposits

Interest paid on CFDs 647 1,942 2,589

Costs recognised from 261 782 1,043

futures contracts

--------------- --------------- ---------------

908 2,724 3,632

========= ========= =========

Six months ended 30

June 2022 (unaudited)

Interest paid on 16 47 63

collateral and bank

deposits1

Interest paid on CFDs 15 45 60

--------------- --------------- ---------------

31 92 123

========= ========= =========

Year ended 31 December

2022 (audited)

Interest paid on 28 82 110

collateral and bank

deposits1

Interest paid on CFDs 168 504 672

--------------- --------------- ---------------

196 586 782

========= ========= =========

1 Due to negative interest rates in the prior periods, the Company paid interest

on its collateral and bank deposits.

Finance costs have been allocated 75% to capital reserve in accordance with the

Company's accounting policies.

7 TAXATION ON RETURN/(LOSS) ON ORDINARY ACTIVITIES

Six months Six months Year

ended ended ended

30.06.23 30.06.22 31.12.22

unaudited unaudited audited

£'000 £'000 £'000

Overseas taxation 2,916 2,241 2,641

========= ========= =========

8 RETURN/(LOSS) PER ORDINARY SHARE

Six months Six months Year

ended ended ended

30.06.23 30.06.22 31.12.22

unaudited unaudited audited

Revenue return per 7.38p 7.08p 9.00p

ordinary share

Capital 29.91p (49.97p) (22.88p)

return/(loss) per

ordinary share

--------------- --------------- ---------------

Total return/(loss) 37.29p (42.89p) (13.88p)

per ordinary share

========= ========= =========

The return/(loss) per ordinary share is based on the net return/(loss) on

ordinary activities after taxation for the period divided by the weighted

average number of ordinary shares held outside Treasury during the period, as

shown below:

£'000 £'000 £'000

Net revenue return on ordinary 30,182 29,090 36,924

activities after taxation

Net capital return/(loss) on 122,249 (205,386) (93,891)

ordinary activities after

taxation

--------- --------------- ---------------

------

Net total return/(loss) on 152,431 (176,296) (56,967)

ordinary activities after

taxation

========= ========= =========

Number Number Number

Weighted average number of ordinary 408,730,523 411,016,049 410,346,447

shares held outside Treasury during the

period

========== ========== ==========

9 DIVIDS PAID TO SHAREHOLDERS

Six Six Year

months months ended

ended ended 31.12.22

30.06.23 30.06.22 audited

unaudited unaudited £'000

£'000 £'000

Final dividend of 4.62 pence per ordinary 18,883 - -

share paid for the year ended 31 December

2022

Interim dividend of 3.08 pence per ordinary - - 12,618

share paid for the year ended 31 December

2022

Final dividend of 4.18 pence per ordinary - 17,180 17,180

share paid for the year ended 31 December

2021

--------- --------- ---------

------ ------ ------

18,883 17,180 29,798

========= ========= =========

The Company has declared an interim dividend for the six month period to 30 June

2023 of 3.26 pence per ordinary share (2022: 3.08 pence). The interim dividend

will be paid on 27 October 2023 to shareholders on the register on 22 September

2023 (ex-dividend date 21 September 2023). The total cost of this interim

dividend, which has not been included as a liability in these Financial

Statements, is £13,325,000 (2022: £12,659,000). This amount is based on the

number of ordinary shares held outside Treasury at the date of this report.

10 FAIR VALUE HIERARCHY

The Company is required to disclose the fair value hierarchy that classifies its

financial instruments measured at fair value at one of three levels, according

to the relative reliability of the inputs used to estimate the fair values.

Classification Input

Level 1 Valued using quoted prices in active markets for identical

assets.

Level 2 Valued by reference to inputs other than quoted prices

included in level 1 that are observable (i.e. developed using

market data) for the asset or liability, either directly or

indirectly.

Level 3 Valued by reference to valuation techniques using inputs that

are not based on observable market data.

Categorisation within the hierarchy has been determined on the basis of the

lowest level input that is significant to the fair value measurement of the

relevant asset. The table below sets out the Company's fair value hierarchy:

30 June 2023 (unaudited) Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Financial assets at fair

value through profit or loss

Investments 1,459,305 - - 1,459,305

Derivative instrument assets 1,120 2,799 - 3,919

--------- --------- --------- ---------

------ ------ ------ ------

1,460,425 2,799 - 1,463,224

========= ========= ========= =========

Financial liabilities at fair

value through profit or loss

Derivative instrument - (1,681) - (1,681)

liabilities

========= ========= ========= =========

31 December 2022 (audited) Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Financial assets at fair

value through profit or loss

Investments 1,325,389 - - 1,325,389

Derivative instrument assets - 521 - 521

--------- --------- --------- ---------

------ ------ ------ ------

1,325,389 521 - 1,325,910

========= ========= ========= =========

Financial liabilities at fair

value through profit or loss

Derivative instrument (2,454) (7,179) - (9,633)

liabilities

========= ========= ========= =========

30 June 2022 (unaudited) Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Financial assets at fair

value through profit or loss

Investments 1,252,159 - - 1,252,159

Derivative instrument assets - 253 - 253

--------- --------- --------- ---------

------ ------ ------ ------

1,252,159 253 - 1,252,412

========= ========= ========= =========

Financial liabilities at fair

value through profit or loss

Derivative instrument (348) (3,831) - (4,179)

liabilities

========= ========= ========= =========

11 SHARE CAPITAL

30 June 31 December 30 June

2023 2022 2022

unaudited audited unaudited

Number of £'000 Number of £'000 Number of

£'000

shares shares shares

Issued,

allotted

and

fully

paid

Ordinary

shares of

2.5

pence

each held

outside of

Treasury

Beginning 408,730,523 10,218 411,016,049 10,275 411,016,049

10,275

of

the period

Ordinary - - (2,285,526) (57) - -

shares

repurchased

into

Treasury

----------- ---------- ----------- ---------- ----------- ----

------

------ ------- ------ ------- ------ ----

---

End of the 408,730,523 10,218 408,730,523 10,218 411,016,049

10,275

period

========== ========== ========== ========== ==========

==========

Ordinary

shares of

2.5pence

each held

in

Treasury1

Beginning 7,717,387 193 5,431,861 136 5,431,861 136

of

the period

Ordinary - - 2,285,526 57 - -

shares

repurchased

into

Treasury

----------- ---------- ----------- ---------- ----------- ----

------

------ ------- ------ ------- ------ ----

---

End of the 7,717,387 193 7,717,387 193 5,431,861 136

period

========== ========== ========== ========== ==========

==========

Total share 10,411 10,411

10,411

capital

========== ==========

==========

1Ordinary shares held in Treasury carry no rights to vote, to receive a dividend

or to participate in a winding up of the Company.

There were no ordinary shares repurchased into Treasury during the period (year

ended 31 December 2022: cost of £6,473,000 and six months ended 30 June 2022:

cost of £nil).

12 NET ASSET VALUE PER ORDINARY SHARE

The calculation of the net asset value per ordinary share is based on the total

Shareholders' funds divided by the number of ordinary shares held outside of

Treasury.

30.06.23 31.12.22 30.06.22

unaudited audited unaudited

Total shareholders' funds £1,514,543,000 £1,380,995,000 £1,280,757,000

Ordinary shares held outside 408,730,523 408,730,523 411,016,049

of Treasury at the period end

Net asset value per ordinary 370.55p 337.87p 311.61p

share

============ ============ ============

It is the Company's policy that shares held in Treasury will only be reissued at

net asset value per ordinary share or at a premium to net asset value per

ordinary share and, therefore, shares held in Treasury have no dilutive effect.

13 CAPITAL RESOURCES AND GEARING

The Company does not have any externally imposed capital requirements. The

financial resources of the Company comprise its share capital and reserves, as

disclosed in the Balance Sheet above, and any gearing, which is managed by the

use of derivative instruments. Financial resources are managed in accordance

with the Company's investment policy and in pursuit of its investment objective.

The Company's gross gearing and net gearing at the end of the period is shown

below:

Gross Net

gearing gearing

Asset Asset

exposure exposure

£'000 %1 £'000 %1

30 June 2023

(unaudited)

Investments 1,459,305 96.4 1,459,305 96.4

Long CFDs 177,871 11.7 177,871 11.7

Long futures 60,659 4.0 60,659 4.0

--------- --------- --------- ---------

------ ------ ------ ------

Total long exposures 1,697,835 112.1 1,697,835 112.1

Short CFDs 18,101 1.2 (18,101) (1.2)

--------- --------- --------- ---------

------ ------ ------ ------

Gross asset 1,715,936 113.3 1,679,734 110.9

exposure/net market

exposure

========= ========= ========= =========

Shareholders' funds 1,514,543 1,514,543

========= =========

Gearing2 13.3 10.9

========= ========= =========

31 December 2022

(audited)

Investments 1,325,389 96.0 1,325,389 96.0

Long CFDs 152,446 11.0 152,446 11.0

Long futures 65,056 4.7 65,056 4.7

--------- --------- --------- ---------

------ ------ ------ ------

Total long exposures 1,542,891 111.7 1,542,891 111.7

Short CFDs - - - -

--------- --------- --------- ---------

------ ------ ------ ------

Gross asset 1,542,891 111.7 1,542,891 111.7

exposure/net market

exposure

========= ========= ========= =========

Shareholders' funds 1,380,995 1,380,995

========= =========

Gearing2 11.7 11.7

========= =========

1Asset exposure to the market expressed as a percentage of shareholders' funds.

2Gearing is the amount by which the gross asset exposure/net market exposure

exceeds shareholders' funds expressed as a percentage of shareholders' funds.

Gross Net gearing

gearing Asset exposure

Asset

exposure

£'000 %1 £'000 %1

30 June 2022

(unaudited)

Investments 1,252,159 97.8 1,252,159 97.8

Long CFDs 135,626 10.6 135,626 10.6

Long futures 32,215 2.5 32,215 2.5

--------- --------- --------------- ---------------

------ ------

Total long exposures 1,420,000 110.9 1,420,000 110.9

Short CFDs - - - -

--------- --------- --------------- ---------------

------ ------

Gross asset 1,420,000 110.9 1,420,000 110.9

exposure/net market

exposure

========= ========= ========= =========

Shareholders' funds 1,280,757 1,280,757

========= =========

Gearing2 10.9 10.9

========= =========

1Asset exposure to the market expressed as a percentage of shareholders' funds.

2Gearing is the amount by which the gross asset exposure/net market exposure

exceeds shareholders' funds expressed as a percentage of shareholders' funds.

14 TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES

FIL Investment Services (UK) Limited is the Company's Alternative Investment

Fund Manager and has delegated portfolio management and the role of company

secretary to FIL Investments International ("FII"), the Investment Manager. Both

companies are Fidelity group companies. Details of the fee arrangements are

given in Note 5 above.

During the period, fees for portfolio management services of £5,213,000 (six

months ended 30 June 2022: £4,710,000 and year ended 31 December 2022:

£9,449,000) were payable to FII. At the Balance Sheet date, fees for portfolio

management of £866,000 (31 December 2022: £832,000 and 30 June 2022: £754,000)

were accrued and included in other creditors. FII also provides the Company with

marketing services. The total amount payable for these services during the

period was £160,000 (six months ended 30 June 2022: £147,000 and year ended 31

December 2022: £209,000). At the Balance Sheet date, no fees for marketing

services were accrued and included in other creditors (31 December 2022 and 30

June 2022: £nil).

As at 30 June 2023, the Board consisted of five non-executive Directors (shown

in the Directory in the Half-Yearly Report), all of whom are considered to be

independent by the Board. None of the Directors have a service contract with the

Company. The Chairman receives an annual fee of £44,500, the Audit Committee

Chair an annual fee of £35,000, the Senior Independent Director an annual fee of

£31,500 and each other Director an annual fee of £29,000. The following members

of the Board hold ordinary shares in the Company: Vivian Bazalgette 30,000

shares, Fleur Meijs 28,970 shares, Milyae Park nil shares, Sir Ivan Rogers nil

shares and Paul Yates 32,000 shares.

The financial information contained in this Half-Yearly Results Announcement

does not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The financial information for the six months ended 30 June

2023 and 30 June 2022 has not been audited or reviewed by the Company's

Independent Auditor.

The information for the year ended 31 December 2022 has been extracted from the

latest published audited financial statements, which have been filed with the

Registrar of Companies, unless otherwise stated. The report of the Auditor on

those financial statements contained no qualification or statement under

sections 498(2) or (3) of the Companies Act 2006.

Neither the contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of, this announcement.

A copy of the Half-Yearly Report will shortly be submitted to the National

Storage Mechanism and will be available for inspection at

www.morningstar.co.uk/uk/NSM

The Half-Yearly Report will also be available on the Company's website at

www.fidelity.co.uk/europe where up to date information on the Company, including

daily NAV and share prices, factsheets and other information can also be found.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/fidelity-european-trust-plc/r/half-year-report,c3812351

END

(END) Dow Jones Newswires

August 02, 2023 02:00 ET (06:00 GMT)

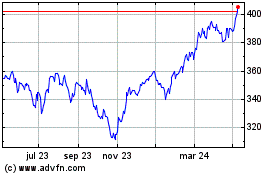

Fidelity European (LSE:FEV)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

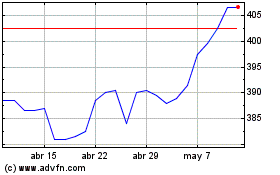

Fidelity European (LSE:FEV)

Gráfica de Acción Histórica

De May 2023 a May 2024