Caracal Gold PLC Mine Plan for Kilimapesa expansion (3044R)

26 Octubre 2023 - 1:00AM

UK Regulatory

TIDMGCAT

RNS Number : 3044R

Caracal Gold PLC

26 October 2023

Caracal Gold plc / EPIC: GCAT / Market: Main / Sector:

Mining

Caracal Gold plc ('Caracal' or the 'Company')

Mine Plan for Kilimapesa expansion

Caracal Gold plc, the East African gold producer with over

1,300,000oz JORC-compliant gold resources, announces the completion

of Phase 1 of the work program which was to review and update the

geological model and mining plan for the Kilimapesa Hill

deposit.

The work included the review of the geological model,

mineralization model, grade models, producing the Whittle

optimisations, pit designs and a project evaluation. This is an

important milestone in the Kilimapesa expansion project financing

process.

Work Program

Minopex Advisory (Pty) Ltd, a DRA Global Group Company, are

carrying out the work program on behalf of Caracal. The scope of

work/phases are as follows:

-- Phase 1: 3-year mine plan to support Kilimapesa expansion financing;

-- Phase 2: Full remodeling of Kilimapesa Hill deposit including

additional drilling;

-- Phase 3: Update the MRE (JORC) for Kilimapesa Hill deposit;

-- Phase 4: Completion of 10 year mine plan for Kilimapesa Hill deposit.

Highlights from the Phase 1 work are as follows:

-- Independent Technical report providing 36 month mine plan for Kilimapesa Hill deposit;

-- 49,155oz forecast production;

-- AISC US $1,055 per oz;

-- Gross Revenue + US $83.5m;

-- Total Free Cash + US $31.7m;

-- Gold Price US $1.700 per oz.

The Phase 1 mining plan has 2,427,279t of ore mined over the 36

month period at an average grade of 1.06g/t. 529,756t at an average

grade of 1.8g/t are processed through the Milling/CIL plant with

1,897,524t at an average grade of 0.86g/t processed by the Heap

Leach plant. The plan assumes a 75% recovery by the Milling/CIL

plant for 23,002oz recovered and a 50% recovery through the Heap

Leach plant for a total of 26,153oz recovered. Combined Milling/CIL

and Heap Leach production over the 36 months is 49,155oz.

The current capital cost to complete the Kilimapesa expansion

project is approximately US $10.5m based on the results from the

Phase 1 work. A reduction in the capital is expected and this plan

will now be costed and an updated capital cost for the expansion

project calculated and announced.

This capital cost, along with the revised operating costs, will

be used to update the financial model and agree the terms of the

expansion funding.

The construction and commissioning program for the project is 6

months from when the funds are drawn down.

Robbie McCrae, Chief Executive Officer of Caracal,

commented,

"We are delighted with the results of the 1(st) Phase work

completed by Minopex. The 3 year mine plan and project valuation

provide robust economics and validate our confidence in the

Kilimapesa expansion project.

We see further upside in Milling circuit recoveries and in the

gold price used versus what we are currently getting for our gold

sales.

We look forward to commencing the Phase 2 program with Minopex

and to updating the market on the progress. Phase 2 will provide

full understanding of the size of the Kilimapesa Hill resource

(increased and updated MRE) and to the Life of Mine plan and

project valuation.

The 3 year revised Mine plan will now be incorporated into the

financial model allowing us to finalize the terms of the expansion

financing. We look forward to providing an update for the expansion

funding process in the near future."

**ENDS**

Caracal Gold plc robbie@kilimapesa.com

Robbie McCrae

VSA Capital Limited

Financial Adviser and Joint Broker

Andrew Raca (Corporate Finance) +44 203 005 5000

----------------------

DGWA, the German Institute for info@dgwa.org

Asset and

Equity Allocation and Valuation

European Investor and Corporate

Relations Advisor

Katharina Löckinger

----------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKPBQPBDDKKB

(END) Dow Jones Newswires

October 26, 2023 02:00 ET (06:00 GMT)

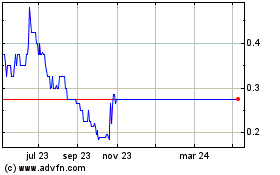

Caracal Gold (LSE:GCAT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Caracal Gold (LSE:GCAT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024