Caracal Gold PLC $1.55m Debt Funding Update (3049T)

14 Noviembre 2023 - 1:00AM

UK Regulatory

TIDMGCAT

RNS Number : 3049T

Caracal Gold PLC

14 November 2023

Caracal Gold plc

('Caracal' or the 'Company')

$1.55m Debt Funding Update

Caracal Gold plc, the East African gold producer with over

1,300,000 oz JORC-compliant gold resources, announces financing of

US $1,550,000 to support development of the Kilimapesa project. The

use of proceeds will include Phase 2 of the Minopex work program,

maintenance and expansion capex, costs related to the ongoing

expansion financing process and other operational expenses.

The Company has entered into a US $1,400,000 Financing Agreement

with Koenig Vermoegensverwal MBH. The Company shall make monthly

payments and each monthly payment shall be calculated as the higher

of US $50,000 and 50% of free cash flow of the Company. The total

repayment has been agreed as follows :

$1,750,000 if settled on or before 30 June 2024

$2,100,000 if settled on or before 31 December 2024

$2,450,000 if settled on or before 30 June 2025

$2,800,000 if settled on or before 31 December 2025

In addition, the Company has entered into a Loan Agreement with

Robbie McCrae, the CEO of Caracal. The principal amount of the loan

is $150,000. The final repayment date will be 31 December 2025,

accruing interest at 10% per annum above the Bank of England's Bank

Rate.

The funds will cover inter alia the following expansion project

scope of work:

-- Minopex Phase 2 Exploration and Grade Control Drilling;

-- Heap Leach Plant - Completion of Pad 4 construction;

-- Crushing and Screening Plant;

-- Milling Plant;

-- Thickener Plant;

-- CIL Plant; and

-- Gold Room.

Related Party Transaction

The loan from Robbie McCrae constitutes a Related Party

Transaction. The Board of Directors of the Company which were not

involved in the transaction considered the terms of the loan fair

and reasonable in so far as the shareholders are concerned.

Robbie McCrae, Chief Executive Officer of Caracal,

commented:

"The funds allow us to bring momentum back to the Kilimapesa

expansion project and to complete the expansion funding process.

The results of the 1st Phase work completed by Minopex have

confirmed the robust economics of the Kilimapesa expansion project

and the decision to push ahead with parts of the expansion whilst

we finalise the expansion funding is good news for Caracal and

Kilimapesa stakeholders."

Caracal Gold plc

Simon Grant Rennick

Robbie McCrae robbie@kilimapesa.com

VSA Capital Limited

Financial Adviser and Broker

Andrew Raca (Corporate Finance) +44 203 005 5000

------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKNBKDBDBFDD

(END) Dow Jones Newswires

November 14, 2023 02:00 ET (07:00 GMT)

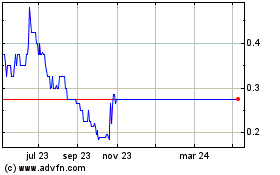

Caracal Gold (LSE:GCAT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Caracal Gold (LSE:GCAT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024