Caracal Gold PLC Subscription to raise GBP140,000 (6201A)

23 Enero 2024 - 3:30AM

UK Regulatory

TIDMGCAT

RNS Number : 6201A

Caracal Gold PLC

23 January 2024

Caracal Gold Plc

('Caracal' or the 'Company')

Subscription to raise GBP140,000

Caracal Gold PLC, the expanding East African gold producer with

over 1,300,000oz JORC compliant gold resources, is pleased to

announce the following funding update.

Subscription:

The Company has raised GBP140,000 by way of a Subscription

("Subscription"), through the issue of 46,666,667 new Ordinary

Shares of GBP0.001 in the Company ("Subscription Shares") at a

price of GBP.0.003 per Subscription Share.

The subscribers from the Subscription will be issued with one

warrant ("Warrants") for every new Subscription Share subscribed

for, with an exercise price of GBP0.0042 per Warrant. The Warrants

will expire in three years from issue.

The admission of the Subscription Shares to trading is

conditional upon approval of a prospectus by the Financial Conduct

Authority ("FCA"). Caracal continues to progress the prospectus

through the FCA.

The funds will be used for working capital at the Company's

Kilimapesa Gold Mine and for various corporate costs including

annual audit, prospectus costs and funding related costs.

Status of the Subscription Shares and Total Voting Rights:

The Subscription Shares, when issued, will be fully paid and

will rank pari passu in all respects with the existing ordinary

shares, including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

Following issuance of the Subscription Shares the total number

of ordinary shares with voting rights in issue in the Company will

be 2,223,245,258.

The above figure may be used by shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR") and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

* * ENDS * *

For further information visit www.caracalgold.com or contact the

following:

Caracal Gold plc

Robbie McCrae robbie@kilimapesa.com

VSA Capital Ltd

Financial Adviser and Joint Broker

Andrew Raca (Corporate Finance) +44 203 005 5000

------------------------

DGWA, the German Institute for info@dgwa.org

Asset and

Equity Allocation and Valuation

European Investor and Corporate

Relations Advisor

Katharina Löckinger

------------------------

Notes:

Caracal Gold plc is an expanding East African focused gold

producer with a clear path to grow production and resources both

organically and through strategic acquisitions. Its aim is to

rapidly increase production to +50,000ozs p.a. and build a JORC

compliant resource base of +3Moz. The Company is progressing a

well-defined mine optimisation strategy at its 100% owned

Kilimapesa Gold Mine in Kenya, where there is significant mid-term

expansion potential and the ability to increase gold production to

24,000oz p.a. and the resource to +2Moz (current JORC compliant

resources of approx. 706,000oz). Alongside this, Caracal is

undertaking a targeted exploration programme at the Nyakafuru

Project in Tanzania, which has an established high-grade shallow

gold resource of 658,751oz at 2.08g/t contained within four

deposits over 280 km2 and appears amenable to development as a

large scale conventional open pit operation.

Caracal's experienced team has a proven track record in

successfully developing and operating mining projects throughout

Africa.

The Company is a responsible mining and exploration company and

supports the positive social and economic change that it

contributes to the communities in the regions that it operates. It

is a proudly East African-focused company: it buys locally, employs

locally, and protects the environment and its employees and their

families' health, safety, and wellbeing.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGCGDBIDDDGSX

(END) Dow Jones Newswires

January 23, 2024 04:30 ET (09:30 GMT)

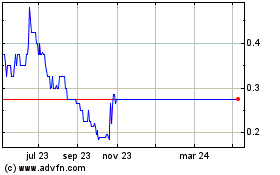

Caracal Gold (LSE:GCAT)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Caracal Gold (LSE:GCAT)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025