Harvest Minerals Limited Q3 2023 KP Fértil(R) Sales Update (9420Q)

23 Octubre 2023 - 1:04AM

UK Regulatory

TIDMHMI

RNS Number : 9420Q

Harvest Minerals Limited

23 October 2023

Harvest Minerals Limited / Index: LSE / Epic: HMI / Sector:

Mining

23 October 2023

Harvest Minerals Limited

('Harvest' or the 'Company')

Q3 2023 KP Fértil(R) Sales Update

Harvest Minerals Limited, the AIM listed fertiliser producer,

provides the following update on Q3 2023 sales of its organic,

multi-nutrient, direct application fertiliser, KP Fértil(R), from

its 100% owned Arapuá Fertiliser Project in Brazil (' Arapuá'

).

OVERVIEW

-- Orders to the end of September 2023 totalled 40,000 tonnes,

of which 22,500 tonnes has been invoiced for payment and 17,500

tonnes is forecast to be invoiced for payment by end December

2023

-- Further orders forecast to be placed during Q4 2023 total 30,000 tonnes

-- 2023 full year orders target therefore 70,000 tonnes, the

majority of which is expected to be invoiced by the end of December

2023

-- Fertilizer demand expected to improve during 2024, but the

uncertain market conditions are expected to continue throughout

2023 and at least the early stages of 2024

Brian McMaster, Chairman of Harvest, said: "2023 continues to be

a challenging year for fertilizer companies globally as prices of

fertilizer fell. Sales of KP Fértil(R) have been impacted by

farmers reducing spending on fertilizer in anticipation of further

price drops and hopes for improved crop conditions. The volatility

being experienced by the Company is a macroeconomic issue and

outside of our control. While ultimately, we expect fertilizer

demand to improve in 2024, given the level of uncertainty

experienced year to date, we do not have a sensible read on when

that turnaround in conditions might come. The Company has done all

it can in terms of reducing overheard and OPEX costs and will keep

the market updated on our progress."

REVIEW OF OPERATIONS

Sales at Arapuá Fertiliser Project

In Q3 2023, Harvest received new orders totalling 13,000 tonnes

of its KP Fértil(R) produced at its Arapuá Fertiliser Project in

Brazil bringing the total orders to the end of September 2023 to

40,000 tonnes, of which 22,500 has been invoiced for payment. The

remaining 17,500 tonnes is forecast to be invoiced during Q4 2023.

In terms of revenue recognition in the interim and annual financial

statements, accounting regulations that the Company is subject to

require that delivery of the product has also occurred, which can

lead to a timing mismatch between tonnes reported as invoiced in

trading updates, and the tonnes reported as sold as the financial

statements.

Cash is gradually being received for the 33,000 tonnes order

invoiced in 2022 as deliveries of that product occur. To date,

approximately 10,000 tonnes of this product has been delivered and

we continue to work with these customers regarding delivery of the

balance, although we forecast that not all 33,000 tonnes will be

delivered before year end.

Following the record high global fertilizer prices seen in 2022,

fertilizer stocks returned to normal levels in 2023 causing the

price of fertilizers to drop. Simultaneously, the price of the

soybean, the main crop planted in Brazil, also dropped, reaching

levels below the expectations of the farmers and, in some cases,

close to the cost of production. Accordingly, farmers have

postponed the sale of grains in 2023 in anticipation of a price

increase and postponed the purchase of fertilizers in anticipation

of a price drop.

While the Company expects fertilizer demand will improve at some

point during 2024, the Company reports that it continues to

experience volatile and uncertain buying patterns form

customers.

**ENDS**

For further information, please visit www.harvestminerals.net or

contact:

Harvest Minerals Limited Brian McMaster Tel: +44 (0)20 3940

(Chairman) 6625

Strand Hanson Limited Ritchie Balmer Tel: +44 (0)20 7409

Nominated & Financial James Spinney 3494

Adviser

T avira Securities J onathan Evans Tel: +44 (0)20 3 192

Broker 1733

St Brides Partners Ltd A na Ribeiro harvest@stbridespartners.co.uk

Financial PR I sabel de Salis

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUOSVROWURURA

(END) Dow Jones Newswires

October 23, 2023 02:04 ET (06:04 GMT)

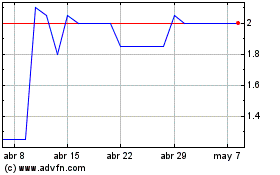

Harvest Minerals (LSE:HMI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Harvest Minerals (LSE:HMI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024