Ingenious Ent VCT 1 Half-yearly Report -4-

21 Agosto 2013 - 1:00AM

UK Regulatory

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gain - 31 31 - 4 4

on disposal

of investments

(Decrease)/increase - (96) (96) - 7 7

in fair

value

of investments

held

Investment 40 - 40 1 - 1

income

Arrangement - - - - - -

fees

Investment (48) (48) (96) (22) (22) (44)

management

fees

Other expenses (48) - (48) (24) - (24)

Loss (56) (113) (169) (45) (11) (56)

on ordinary

activities

before

taxation

Tax - - - - - -

on ordinary

activities

Loss (56) (113) (169) (45) (11) (56)

attributable

to

equity

shareholders

Basic and (0.8) (1.7) (2.5) (1.6) (0.4) (2.0)

diluted

return

per share

(pence)

F shares G shares

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gain - 5 5 - - -

on disposal

of investments

Increase in - 24 24 - 19 19

fair value

of investments

held

Investment 1 - 1 1 - 1

income

Arrangement - - - (39) - (39)

fees

Investment (12) (12) (24) (18) (18) (36)

management

fees

Other expenses (22) - (22) (26) - (26)

(Loss)/profit (33) 17 (16) (82) 1 (81)

on ordinary

activities

before

taxation

Tax - - - - - -

on ordinary

activities

(Loss)/profit (33) 17 (16) (82) 1 (81)

attributable

to

equity

shareholders

Basic and (2.1) 1.1 (1.0) (3.6) - (3.6)

diluted

return

per share

(pence)

H shares

Revenue Capital Total

GBP'000 GBP'000 GBP'000

Gain - - -

on disposal

of investments

Increase/(decrease) - - -

in fair

value

of investments

held

Investment - - -

income

Arrangement - - -

fees

Investment - - -

management

fees

Other expenses - - -

Profit/(loss) - - -

on ordinary

activities

before

taxation

Tax - - -

on ordinary

activities

Profit/(loss) - - -

attributable

to

equity

shareholders

Basic and - - -

diluted

return

per share

(pence)

The Company had no recognised gains and losses other than those

disclosed above.

The total column is the Income Statement per share class for the

period. The supplementary capital and revenue columns are prepared

following guidance published by the AIC.

The Company had no H shares in issue in the year to 31 December

2012.

CONDENSED BALANCE

SHEET

(UNAUDITED)

as at 30 June 2013

30 June2013(unaudited) 30 June2012(unaudited) 31 December2012(audited)

Note GBP'000 GBP'000 GBP'000

Fixed assets

Qualifying Investments 8,782 10,831 11,949

Current assets

Debtors 137 132 139

Non-qualifying 3 8,772 7,918 8,734

Investments

Cash at bank 2,894 2,631 1,225

and in hand

11,803 10,681 10,098

Creditors: amounts (54) (60) (87)

falling

due within one year

Net current assets 11,749 10,621 10,011

Net assets 20,531 21,452 21,960

Capital and reserves

Called-up share 294 269 277

capital

Share premium account 1,634 2,607 -

Other reserve account 20,361 19,949 23,277

Capital reserve (913) (617) (775)

Revenue reserve (845) (756) (819)

Shareholders' funds 20,531 21,452 21,960

Net asset value per 4 54.6 75.4 74.8

Ordinary share

Net asset value 4 63.4 70.0 68.8

per C share

Net asset value 4 73.0 79.5 78.5

per D share

Net asset value 4 80.0 87.1 86.1

per E share

Net asset value 4 82.5 87.5 87.2

per F share

Net asset value 4 87.0 93.8 93.3

per G share

Net asset value 4 93.8 - -

per H share

The accompanying notes form an integral part of these financial

statements.

The condensed set of financial statements were approved by the

Board of Directors on 20 August 2013 and signed on its behalf

by:

Keith TurnerDirectorCompany Registration Number: 6395011

(England & Wales)

NON-STATUTORY

ANALYSIS

(UNAUDITED)

BETWEEN

THE

ORDINARY,

C,

D, E, F,

G AND H

SHARE

FUNDS

CONDENSED

BALANCE

SHEET

(UNAUDITED)

As at 30 June 2013 (unaudited)

Ordinary C D E F G H

shares shares shares shares shares shares shares

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Fixed

assets

Qualifying 2,252 1,273 3,757 927 573 - -

Investments

Current

assets

Debtors 108 - 29 - - - -

Non-qualifying 417 491 1,130 1,353 725 3,040 1,616

Investments

Cash at 2,832 19 4 1 1 23 14

bank

and in

hand

3,357 510 1,163 1,354 726 3,063 1,630

Creditors: (35) (2) (6) (3) (2) (4) (2)

amounts

falling

due

within

one year

Net 3,322 508 1,157 1,351 724 3,059 1,628

current

assets

Net 5,574 1,781 4,914 2,278 1,297 3,059 1,628

assets

Capital

and

reserves

Called-up 102 28 68 28 16 35 17

share

capital

Share - - - - - - 1,634

premium

account

Other 6,060 2,071 5,340 2,409 1,329 3,152 -

reserve

account

Capital (534) (142) (227) (31) 34 (9) (4)

reserve

Revenue (54) (176) (267) (128) (82) (119) (19)

reserve

Shareholders' 5,574 1,781 4,914 2,278 1,297 3,059 1,628

funds

Net asset 54.6 63.4 73.0 80.0 82.5 87.0 93.8

value

excluding

distributions

to date

(pence

per

share)

Net asset 89.6 83.4 88.0 90.0 92.5 92.0 93.8

value

including

distributions

to date

(pence

per

share)

NON-STATUTORY

ANALYSIS

(UNAUDITED)

BETWEEN

THE

ORDINARY,

C,

D, E, F,

G AND H

SHARE

FUNDS

CONDENSED

BALANCE

SHEET

(UNAUDITED)

As at 30 June 2012 (unaudited)

Ordinary C D E F G H

shares shares shares shares shares shares shares

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Fixed

assets

Qualifying 6,608 1,716 2,257 125 125 - -

Investments

Current

assets

Debtors 132 - - - - - -

Non-qualifying 968 245 3,098 2,356 1,251 - -

Investments

Cash at 7 7 8 3 1 2,605 -

bank

and in

hand

1,107 252 3,106 2,359 1,252 2,605 -

Creditors: (21) (2) (11) (4) (2) (20) -

amounts

falling

due

within

one year

Net 1,086 250 3,095 2,355 1,250 2,585 -

current

assets

Net 7,694 1,966 5,352 2,480 1,375 2,585 -

assets

Capital

and

reserves

Called-up 102 28 68 28 16 27 -

share

capital

Share - - - - - 2,607 -

premium

account

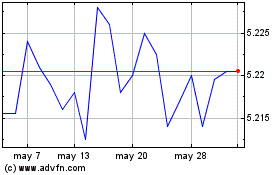

Ish � Cobd 1-5 (LSE:IE1G)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Ish � Cobd 1-5 (LSE:IE1G)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024