(Decrease)/increase (33) 7 34

in payables

Net cash flow from (206) (300) (545)

operating

activities

Reconciliation of

net cash flow

to movement in

net funds

GBP'000 GBP'000 GBP'000

Increase in cash 1,669 2,450 1,044

in the period

Purchase/(disposal) 317 (1,925) (1,412)

of Non-qualifying

investments

Fair value adjustment 11 20 30

on Non-qualifying

investments

Change in net funds 1,997 545 (338)

Opening net funds 9,666 10,004 10,004

Closing net funds 11,663 10,549 9,666

Net funds comprise of cash of GBP2,894k (31 December 2012:

GBP1,225k; 30 June 2012: GBP2,631k) and Non-qualifying assets,

excluding Investment in Investee Companies, of GBP8,769k (31

December 2012: GBP8,441k; 30 June 2012: GBP7,918k).

NOTES TO THE FINANCIAL STATEMENTS (UNAUDITED)

for the six months ended 30 June 2013

1. Accounting Policies

a) Basis of Accounting

The financial statements for the Reporting Period have been

prepared in compliance with UK Generally Accepted Accounting

Practice, and with the Statement of Recommended Practice (the SORP)

entitled "Financial Statements of Investment Trust Companies and

Venture Capital Trusts" (with the exception of paragraph 80 of the

SORP regarding detailed disclosure of financial and operational

performance of the Company's unquoted investments due to their

confidential nature) which was issued in January 2009.

These financial statements, which have not been audited or

reviewed by the Auditors, have been prepared on a going concern

basis under the historical cost convention, except for the

measurement at fair value for investments. The principal accounting

policies have remained unchanged from those set out in the

Company's 2012 Annual Report and Accounts.

b) Valuation of Investments

The Company's business is investing in financial assets with a

view to profiting from their total return in the form of income and

capital growth. As set out in the International Private Equity and

Venture Capital Valuation Guidelines below, all investments are

designated at fair value.

International Private Equity and Venture Capital Valuation

Guidelines

Unquoted investments, including equity and loan investments, are

designated at fair value through profit and loss and are valued in

accordance with the International Private Equity and Venture

Capital Guidelines and Financial Reporting Standard 26 "Financial

Instruments: Recognition and Measurement" (FRS 26). Investments are

initially recognised at cost. The investments are subsequently

re-measured at fair value, as estimated by the Directors.

Investment holding gains or losses arising from the revaluation of

investments are taken directly to the Income Statement. Fair value

is determined as follows:

-- Fair value is the amount for which an asset could be exchanged between

knowledgeable, willing parties in an arm's length

transaction.

-- In estimating the fair value for an investment, the Manager will apply

a methodology that is appropriate in light of the nature, facts

and

circumstances of the investment and its materiality in the

context of

the total investment portfolio and will use reasonable

assumptions

and estimates.

-- An appropriate methodology incorporates available information about

all factors that are likely to materially affect the fair value

of the

investment. The valuation methodologies are applied consistently

from

period to period, except where a change would result in a

better

estimate of fair value. Any changes in valuation methodologies

will be

clearly disclosed in the financial statements.

The most widely used methodologies are listed below. In

assessing which methodology is appropriate, the Directors are

predisposed towards those methodologies that draw upon market-based

measures of risk and return.

-- Price of recent investment

-- Discounted cash flows/earnings multiple

-- Net assets

-- Available market prices

Of these, the two methodologies most applicable to the Company's

investments are:

1 - Price of recent investment

Where the investment being valued was made recently, its cost

will generally provide a good indication of value. It is generally

considered that this would only apply for a limited period; in

practice a period up to the start of the first live event or

entertainment content which forms the investment is often applied

as the long stop date for such a valuation.

2 - Discounted cash flows/earnings of the underlying

business

Investments can be valued by calculating the net present value

of expected future cashflows of the Investee Companies. In relation

to the Company's investments, anticipating future cashflows in

excess of the guaranteed amounts would clearly require highly

subjective judgements to be made in the early stage of each

investment and therefore would not be an appropriate methodology to

apply at such an early stage of the investment.

In the period prior to the second live event or entertainment

content it is considered appropriate to use the price paid for the

recent investment as the latest available information. Thereafter,

the portfolio of investments is fair valued on the discounted cash

flow/earnings basis using the latest available information on the

performance of the live event or entertainment content. Gains or

losses arising from changes in the fair value of the 'financial

assets at fair value through profit or loss' category are presented

in the Income Statement in the period in which they arise.

As a result of the above basis of valuation, there is

significant judgement associated with the valuation of

investments.

Non-qualifying Investments - OEICs

The Company's Non-qualifying Investments in interest bearing

money market OEICs are valued at fair value which is mid price.

They have been designated as fair value through profit or loss for

the purposes of FRS 26.

Gains and losses arising from changes in fair value of

Qualifying and Non-qualifying Investments are recognised as part of

the capital return within the Income Statement and allocated to the

realised or unrealised capital reserve as appropriate. Transaction

costs attributable to the acquisition or disposal of investments

are charged to capital within the Income Statement.

c) Investment Income

Interest income is recognised in the Income Statement under the

effective interest method. The effective interest rate is the rate

required to discount the expected future income streams over the

life of the loan to its initial carrying amount. The main impact

for the Company in that regard is the accounting treatment of the

loan note premiums. Where those loan note premiums are charged in

lieu of higher interest then they are credited to income over the

life of the advance to the extent those premiums are anticipated to

be collected.

d) Dividend Income

Dividend income is recognised in the Income Statement once it is

declared by the Investee Companies.

e) Expenses

All expenses are accounted for on an accruals basis. Expenses

are charged to the revenue account within the Income Statement

except that:

-- expenses which are incidental to the acquisition or disposal of an

investment are charged to capital in the Income Statement as

incurred;

-- expenses are split and presented partly as capital items where a

connection with the maintenance or enhancement of the value of

the

investments held can be demonstrated; and

-- the management fee has been allocated 50% to revenue and 50% to

capital, which represents the expected split of the Company's

long

term returns.

General expenses are paid for by the Ordinary share class and

recharged on a quarterly basis to the other share classes based on

the proportional net asset value per share class as at the last day

of the previous quarter.

f) Deferred Taxation

Deferred taxation is recognised in respect of all timing

differences that have originated but not reversed at the Balance

Sheet date where transactions or events that result in an

obligation to pay more, or a right to pay less, tax in the future

have occurred at the Balance Sheet date. This is subject to

deferred tax assets only being recognised if it is considered more

likely than not that there will be suitable profits from which the

future reversal of the underlying timing differences can be

deducted. Timing differences are differences arising between the

Company's taxable profits and its results as stated in the

financial statements which are capable of reversal in one or more

subsequent periods.

g) Ordinary shares, C shares, D shares, E shares, F shares, G

shares and H shares

The Company has seven classes of shares: Ordinary shares, C

shares, D shares, E shares, F shares, G shares and H shares. Each

share class has a separate pool of income and expenses as well as

assets and liabilities attributable to it. All share classes rank

pari passu with each other in terms of voting and other rights.

2. Basic and Diluted Return per share

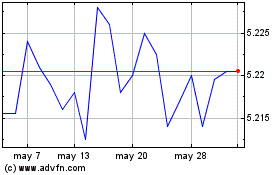

Ish � Cobd 1-5 (LSE:IE1G)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Ish � Cobd 1-5 (LSE:IE1G)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024