TIDMMNL

MANCHESTER AND LONDON INVESTMENT TRUST PLC

(the "Company")

ANNUAL FINANCIAL REPORT FOR THE YEARED 31 JULY 2022

The full Annual Report and Financial Statements for the year ended 31 July 2022

can be found on the Company's website at www.mlcapman.com/

manchester-london-investment-trust-plc.

STRATEGIC REPORT

Financial Summary

Total Return Year to Year to Percentage

31 July 31 July increase/

2022 (decrease)

2021

(61,162) 22,222 (375.2%)

Total return (£'000)

(151.62p) 57.10p (365.5%)

Return per Share

(4.13p) (4.77p) 13.4%

Total revenue return per Share?

21.00p 14.00p 50.00%

Dividend per Share

Capital As at As at Percentage

31 31 increase

July July

2022 2021

198,546

Net assets attributable to equity 269,686 (26.4%)

Shareholders(i) (£'000)

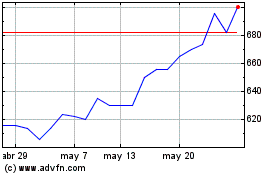

493.04p 665.43p

Net asset value ("NAV") per Share (25.9%)

(23.0%) 8.7%

NAV total return(ii)? .

7.3% 26.1%

Benchmark performance - total return basis .

(iii)

389.00p 574.00p

Share price (32.2%)

(21.1%) (13.7%)

Share price (discount)/premium to NAV? .

(i) NAV as at 31 July 2022 includes a net £1,509,000 decrease in respect of

share buybacks (2021: £26,946,000 increase in respect of share issues).

(ii) Total return including dividends reinvested, as sourced from Bloomberg.

(iii) The Company's benchmark is the MSCI UK Investable Market Index ("MXGBIM"

or the "benchmark"), as sourced from Bloomberg.

Ongoing Charges Year to Year to

31 July 31 July

2022 2021

Ongoing charges as a percentage of

average net assets*? 0.67% 0.78%

* Based on total expenses, excluding finance costs and certain non-recurring

items for the year and average monthly NAV.

? Alternative performance measure. Details provided in the Glossary below.

CHAIRMAN'S STATEMENT

Results for the year ended 31 July 2022

The portfolio remains focused on larger capitalisation, intellectual property

rich companies listed in developed markets which are investing for growth.

Manchester and London Investment Trust plc's (the "Company") portfolio

performance for the financial year under review has led to a NAV total return

per Share of -23.0%* (2021: 8.7%*).

The North American Software sector, whose constituents represent a significant

proportion of the Company's portfolio, had a -16.0% total return in GBP over

the period (S&P North American Expanded Technology Software Index). The Company

entered the period with 22.7% of its portfolio listed on the Hong Kong market.

Up to 15 March 2022, the date at which the Company sold its remaining Chinese

exposure, the Hang Seng Tech Index had a total return of -45.8% in GBP hence

the contribution from Chinese Technology positions was -12.3% in GBP (including

costs). The contribution in GBP over the financial year from non-Chinese

Technology positions was -10.7% in GBP (including costs) which is materially

better than the North American Software sector hence our acute disappointment

with our Chinese Technology positions. The Manager's Report sets out in more

detail specific contributions to the overall period performance.

The Company's benchmark had a positive total return of 7.3% over the period,

meaning that the Company has now underperformed the benchmark for the three

years to 31 July 2022 on a total return basis by 14.5%* (2021: 32.2%

outperformance*). It should be noted that in accordance with the variable

management fee arrangements, the Manager has received a lower management fee

percentage of 0.25% since the beginning of April due to this underperformance.

At the year end, the Shares traded at a 21.1% discount to their NAV per Share,

compared to a discount of 13.7% in 2021. A number of the larger technology

focused investments trusts listed in the UK also experienced widening discounts

over this period.

Outlook

Key variables for our next financial year's performance are likely to be

movements in the US sovereign yield curve and inflation & economic

expectations, the movements in energy prices, the functioning of supply chains,

how the Federal Reserve and other Central Banks respond to the aforementioned,

whether there is any further material events in the break down of relations

between the Chinese and US governments, and the regulation of Technology

companies globally.

Dividend

The Directors are proposing a final ordinary dividend of 7.0 pence per Share

for the financial year 2022 (31 July 2021: 7.0 pence per Ordinary Share).

Earlier in the year the Company paid a special dividend of 7.0 pence per

Ordinary Share in celebration of the 50th anniversary of the initial admission

of the Company to the London Stock Exchange which was in addition to an

ordinary interim dividend of 7.0 pence paid in May 2022 (31 January 2021: 7.0

pence per Ordinary Share). Accordingly, on a per Share basis, the dividends

proposed or paid out in respect of the 2022 financial year total 21.0 pence

(financial year 2021: 14.0 pence per Ordinary Share). Excluding the special

dividend, these dividends represent a yield of 3.6% on the Share price as at

the year-end (2021: 2.4%).

Share Buybacks

During the period the Company bought back 258,183 shares into Treasury (2021:

nil).

Board Succession

It was noted that more than 20% of votes were cast against the resolution to

re-elect David Harris as a Director the Company at the last AGM. The UK

Corporate Governance Code requires companies to provide an update within six

months of an AGM where more than 20% of votes were cast against a resolution.

To better understand shareholders' concerns with a view to identifying how such

concerns can be addressed, the Board of the Company reached out to shareholders

to gain an understanding of their concerns. No conclusive response was received

from shareholders of the Company.

David Harris retired from the Board during the period after over 12 years of

service. We are highly appreciative of David's contribution to the company's

growth from a Net Asset Value of approximately £42.1m when he joined the Board

to £285m when he resigned from the Board. Daren Morris joined the Board

following his appointment as Audit Committee Chairman on 10 December 2021.

Daren is a seasoned financial and PLC practitioner and brings a wealth of

knowledge and experience to our Board.

Annual General Meeting

Our fiftieth Annual General Meeting ("AGM") will be held virtually on 21

November 2022 at 12.00 noon. Please do read further details on this year's AGM,

which are contained within the AGM notice.

Daniel Wright

Chairman

20 October 2022

*Source: Bloomberg. See Glossary below.

MANAGER'S REVIEW

The portfolio's NAV total return per Share of -23.0%* represented a 30.3%*

underperformance against the benchmark.

Software, which represents a large percentage of the portfolio, had a tough

year with the North American software sector down 16% in GBP (S&P North

American Expanded Technology Software Index). This negative performance was

predominantly driven by rising yields which led to declines in the valuation of

high duration equities. Whilst we believe that the long-term secular growth

drivers in Technology are still intact, further rate rises from the Federal

Reserve, as it combats persistently high inflation, are likely to remain a

headwind to valuations whilst both the broader macro environment and the

geopolitical tensions between the US and China could also cause further

volatility.

As noted in the Chairman's Statement, we also entered the period with 22.7% of

the Portfolio directly exposed to China. The Chinese Technology sector declined

significantly during the first three quarters of our financial year due to a

broad regulatory clampdown from the Chinese Communist Party which was

compounded by concerns over China's alignment with Russia regarding the war in

Ukraine. The portfolio's Chinese exposure accounted for over half of the

portfolio's GBP negative return for the financial year. In March, we attended

the Morgan Stanley Technology Conference in the USA and it was apparent that

the US digital transformation story still had a long way to run. We believed an

opportunity was being presented to us to "switch horses" from a regulation

beaten and slowing economy driven Chinese Technology sector to a more upbeat US

Technology sector which had also seen material devaluations. We sold all

remaining direct Chinese exposure holdings in March as, regardless of the

potential returns that might be derived from China in the future, we believed

the risk of these positions had crossed a point that put these holdings outside

our preferred risk management boundaries. It is pertinent to note that we held

Tencent Holdings Ltd and Alibaba Group Holding Ltd because we believed that the

growth of Cloud Computing in China would be dramatic and these stocks were the

largest private providers of Cloud Technologies. Since our disposal of these

holdings, it has been reported in the financial press that further government

regulation has seen a shift in the market share from these private operators in

favour of state controlled operators hence our investment thesis for these two

stocks has materially deteriorated.

As we have noted on numerous occasions in Factsheets, during the final quarter

of our financial period we incrementally shifted the portfolio's exposure from

"Soft Technology" stocks to "Hard Technology", as evidenced by the smaller

sector weightings to Communication Services and Consumer Discretionary from the

prior year. This shift has generally been vindicated in recent earnings where

"Hard Technology" positions have broadly shown greater resilience to a

deteriorating macro-economic outlook compared to consumer exposed Technology

stocks.

The 12.5%* decrease in the value of Sterling against the US Dollar over the

year was a tailwind for performance due to the significant level of US Dollar

exposure in the portfolio. Overall, we estimate that the gain in portfolio

performance from Foreign Exchange movements was roughly 10.3%.

The Total Return of the portfolio broken down by sector holdings in local

currency (separating costs and foreign exchange) is shown below:

Total return of underlying sector holdings in local

currency 2022

(excluding costs and foreign exchange)

Information Technology (6.4%)

Communication Services (12.8%)

Consumer Discretionary (9.1%)

Other investments (including funds, ETFs and beta (3.3%)

hedges)

Foreign Exchange, operating costs & financing 8.7%

Total NAV per Share return (23.0%)

Total return of underlying sector holdings in local

currency 2021

(excluding costs and foreign exchange)

Information Technology 12.3%

Communication Services

7.9%

Consumer Discretionary (1.8%)

Other investments (including funds, ETFs and beta

hedges) (1.4%)

Foreign Exchange, operating costs & financing

(8.4%)

Total NAV per Share return 8.7%

Source: Bloomberg.

Information Technology

The Information Technology sector delivered 27.8% of the negative NAV total

return per Share for the financial period.

Material positive performers (>1% contribution to return) included Synopsys Inc

and Cadence Designs Systems Inc both of which were added to the portfolio after

the disposal of our Chinese positions (as discussed above).

Material negative contributors included Adobe Inc. and Salesforce.com Inc. (now

divested).

The portfolio's weighting to this sector (including options on a MTM basis) at

the year end was 58.9% of the net assets of the Company (2021: 42.1%).

Communication Services

The Communication Services sector delivered 55.7% of the negative NAV total

return per share for the financial period.

There were no material positive contributors.

Material negative contributors included Alphabet Inc., Meta Platforms Inc.,

Netflix Inc. and Tencent Holdings Ltd (now divested).

The portfolio's weighting to this sector (including options on a MTM basis) at

year end was 25.3% of the net assets of the Company (2021: 44.9%).

Consumer Discretionary

The Consumer discretionary sector delivered 39.6% of the negative NAV total

return per share for the financial period.

Alibaba Group Holding Ltd (now divested) and Amazon.com Inc were the material

negative contributors from this sector. We materially reduced exposure to

Amazon during the year because whilst we remain positive on the long-term

growth potential for AWS (Cloud Computing), the retail business has the

potential to remain a drag in the current macro environment.

The portfolio's weighting to this sector (including options on a MTM basis) at

year end was 8.3% of the net assets of the Company (2021: 25.9%).

Other (including funds, ETFs and beta hedges)

Other holdings delivered 14.3% of the negative NAV total return per Share for

the financial period.

The majority of the losses in this sector came from the CSOP Hang Seng TECH

Index ETF (now divested) outweighing smaller positive returns on short hedges

placed on the Nasdaq and S&P.

The portfolio's weighting to this sector (including options on a MTM basis and

including short equity swap hedges) at year end was -0.4% of the net assets of

the Company (2021: 18.4%).

Foreign Exchange, operating costs and financing delivered an offsetting

positive return of 37.8% of the NAV total return per share for the financial

period that was driven by a 14.1% decline in the value of GBP against USD

during the period.

Outlook

The second quarter (calendar) reporting season provided evidence that global

corporates see digitalisation as paramount to survival. We remain confident

that our investment approach, focused on software, digitalisation, cloud

computing, data management and AI offers more pricing power to ward off

inflationary threats and more significant secular growth than more traditional

sectors. We have repositioned the portfolio towards "Hard Technology" positions

to hedge against a material decline in global economic conditions being the

outturn for the next 12 months. We have reduced geopolitical risk with a

repositioning towards companies domiciled in the "Alliance of Democracy"

countries.

We remain confident in our dynamic investment framework and the quality of the

resultant underlying portfolio. In many ways, the outturn for Equity markets

over the last financial year validates our more cautious and hedged approach

during the "bubble bull" market of the previous financial year. However, we

were too optimistic during this financial year both with regards to China's

shifting political involvement in private enterprise and our increased

Portfolio Net Delta after an initial drop in the markets.

We enter the next period extremely positive on the secular growth drivers for

Technology but we remain wary of the significant risks that persist for Equity

markets. We see the two biggest risks for the forthcoming coming decade as a

geopolitical flashpoint leading to a 'hot' conflict, in the worst circumstance

between China and the US, and the threats of unmitigated Climate Change

provoking widespread social, political and economic upheavals. As such we will

be adding a statistic to our factsheets as follows: Est. weighted ave Sales

exp. to China & Taiwan which is currently 12.9%. We guess that this statistic

will become increasingly relevant for investment fund investors.

Keeping in Touch

May we remind shareholders that the best way to keep abreast of our views and

activities is via the Twitter feed @MLCapMan. In addition, subscription to our

Newsletter can be undertaken at www.mlcapman.com.

M&L Capital Management Limited

Manager

20 October 2022

*Source: Bloomberg. See Glossary below.

Equity exposures and portfolio sector analysis

Equity exposures (longs)

As at 31 July 2022

Company Sector * Exposure % of net

£'000 assets

Microsoft Corporation** Information Technology 59,907 30.3

Alphabet Inc.** Communication services 51,828 26.2

Amazon.com Inc. Consumer Discretionary 17,105 8.6

ASML Holding NV** Information Technology 15,781 7.9

Cadence Design Systems Inc.** Information Technology 14,913 7.5

Synopsys Inc.** Information Technology 12,008 6.0

NVIDIA Corporation Information Technology 6,756 3.4

Polar Capital Technology Trust plc Fund 6,175 3.1

GoDaddy Inc. Information Technology 5,512 2.8

Adobe Inc. Information Technology 3,826 1.9

Meta Platforms Inc. Communication Services 3,152 1.6

Intuitive Surgical Inc.** Health Care 2,800 1.4

Intuit Information Technology 2,062 1.0

Inc.

Total long positions 201,825 101.7

Other net assets and liabilities (3,279) (1.7)

Net assets 198,546 100.0

*GICS - Global Industry Classification Standard.

**Including equity swap exposures as detailed in note 13.

Portfolio sector analysis (excluding options and short equity swap hedges)

As at 31 July 2022

% of net

Sector assets

Information Technology 60.8%

Communication services 27.8%

Consumer Discretionary 8.6%

Fund

3.1%

Health Care 1.4%

Cash and other net assets and liabilities (1.7%)

Net assets 100.0

PRINCIPAL PORTFOLIO EQUITY HOLDINGS

Microsoft Corporation ("Microsoft")

Microsoft is a global enterprise software company and a leader in cloud

computing, business software, operating systems and gaming.

Alphabet Inc. ("Alphabet")

Alphabet is a global technology company with products and platforms across a

wide range of technology verticals, including online advertising, cloud

computing, autonomous vehicles, artificial intelligence and smart phones.

Amazon.com Inc. ("Amazon")

Amazon is the world's largest e-commerce platform. Amazon also provides other

large scale content and services platforms to consumers and businesses such as

Amazon Prime, Amazon Web Services ("AWS") and Amazon Logistics. AWS, which is a

cloud services offering, is arguably the most valuable part of the overall

business and is the main reason for our holding.

ASML Holding NV ("ASML")

ASML is a producer of Semiconductor manufacturing equipment, with a near

monopoly in advanced EUV lithography, which is one of the leading edge

production technologies in the industry's never ending quest to make smaller

and more advanced Semiconductor chips (Integrated Circuits used in a wide

variety of electronic devices).

Cadence Design Systems Inc. ("Cadence")

Cadence is a leading EDA (electronic design automation) company primarily

delivering software and Intellectual Property for electronic design in the

Semiconductor industry. EDA software is mission critical to Semiconductor chip

design, particularly as the demands on Semiconductor chip capabilities

continues to increase. The majority of the EDA market is controlled by three

players; Cadence, Synopsys and Siemens. Unlike the highly cyclical

Semiconductor manufacturers, the EDA software market has a very high degree of

recurring revenue and growth tends to be more correlated to Semiconductor R&D

than Capital or Operational Expenditure within the industry.

Synopsys Inc. ("Synopsys")

Similar to Cadence, Synopsys is an EDA company that focuses on Semiconductor

chip design software and verification tools (such as finding and resolving bugs

in Semiconductor chip designs).

Adobe Inc. ("Adobe")

Adobe is a software as a service company that provides cloud-based creative,

marketing and analytics tools to businesses, professionals and prosumers. Adobe

is perhaps best known for Photoshop - the imaging, design and photo-editing

software.

Meta Platforms Inc. ("Meta")

Meta is the largest global social media company with over 3.8 billion monthly

active users across its family of applications. After the period end, we sold

this position due to a number of transitional challenges facing the company

such as IDFA, a shift to short-video, competition from Tik Tok and an

investment pivot towards the Metaverse.

NVIDIA Corporation ("NVIDIA")

NVIDIA is the market leader in GPUs (Graphics Processing Unit). Whilst

originally created for graphics processing (particularly for gaming),

specialised GPUs are increasingly being used for AI and Datacentre workloads

due to their relative strength in concurrent computations (also known as

parallel processing). The Datacentre division now accounts for around 40% of

NVIDIA's business. As a result, NVIDIA is positively exposed to growth in data,

AI and cloud computing.

GoDaddy Inc. ("GoDaddy")

GoDaddy is a web platform, allowing customers (primarily small businesses and

individuals) to register, create and host websites. GoDaddy is cash generative

and has historically been undertaking material share repurchases.

All Equity & Debt portfolio holdings

As at 31 July 2022

Stocks Gross Net Delta

(Underlying (inc Net Delta

Only) % of exposure of

NAV options) % of

NAV

Microsoft Corporation 30.3% 30.2%

Alphabet Inc. 26.2% 25.5%

Amazon.com, Inc. 8.6% 9.0%

ASML Holding NV 7.9% 8.2%

Cadence Design Systems Inc. 7.5% 7.5%

Synopsys Inc. 6.0% 6.0%

Adobe Inc. 1.9% 5.1%

Meta Platforms Inc. 1.6% 4.4%

NVIDIA Corporation 3.4% 4.3%

Polar Capital Technology Trust 3.1% 3.1%

plc

Invesco QQQ Trust Series 1 (2.9%) (2.9%)

GoDaddy Inc. 2.8% 2.8%

SPDR S&P 500 ETF TRUST (1.9%) (1.9%)

Advanced Micro Devices Inc. 1.4%

Netflix Inc. 1.4%

Intuitive Surgical Inc. 1.4% 1.1%

Intuit Inc. 1.0% 1.0%

Total 96.9% 106.1%

For an explanation of why we report exposures on a Delta Adjusted basis please

read our FAQ at https://mlcapman.com/faq/

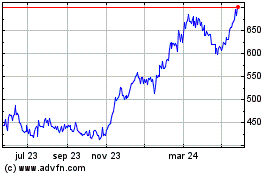

Investment record of the last ten years

Year ended Total Return per Dividend per Net NAV per

return Share* Share assets Share*

(£ (p) (p) (£'000) (p)

'000)

31 July 2013 2,522 11.23 13.75 75,050 334.19

31 July 2014 (6,295) (28.08) 13.75 64,361 293.20

31 July 2015 2,483 11.47 6.00 63,074 293.35

31 July 2016 13,424 62.50 13.36 75,546 350.81

31 July 2017 20,055 92.43 9.00 94,661 429.05

31 July 2018 26,792 115.27 12.00 130,388 532.81

31 July 2019 15,900 58.75 14.00 166,981 568.66

31 July 2020 24,037 74.74 14.00 225,933 625.23

31 July 2021 22,222 57.10 14.00 269,686 665.43

31 July 2022 (61,162) (151.62) 21.00 198,546 493.04

* Basic and fully diluted.

Business model

The Company is an investment company as defined by Section 833 of the Companies

Act 2006 and operates as an investment trust in accordance with Section 1158 of

the Corporation Tax Act 2010.

The Company is also governed by the Listing Rules and the Disclosure Guidance

and Transparency Rules of the Financial Conduct Authority (the "FCA") and is

listed on the Premium Segment of the Main Market of the London Stock Exchange.

A review of investment activities for the year ended 31 July 2022 is detailed

in the Manager's review above.

Investment objective

The investment objective of the Company is to achieve capital appreciation.

Investment policy

Asset allocation

The Company's investment objective is sought to be achieved through a policy of

actively investing in a diversified portfolio, comprising any of global

equities and/or fixed interest securities and/or derivatives.

The Company may invest in derivatives, money market instruments, currency

instruments, contracts for differences ("CFDs"), futures, forwards and options

for the purposes of (i) holding investments and (ii) hedging positions against

movements in, for example, equity markets, currencies and interest rates.

The Company seeks investment exposure to companies whose shares are listed,

quoted or admitted to trading. However, it may invest up to 10% of gross assets

(at the time of investment) in the equities and/or fixed interest securities of

companies whose shares are not listed, quoted or admitted to trading.

Risk diversification

The Company intends to maintain a diversified portfolio and it is expected that

the portfolio will have between approximately 20 to 100 holdings. No single

holding will represent more than 20% of gross assets at the time of investment.

In addition, the Company's five largest holdings (by value) will not exceed (at

the time of investment) more than 75% of gross assets.

Although there are no restrictions on the constituents of the Company's

portfolio by geography, industry sector or asset class, it is intended that the

Company will hold investments across a number of geographies and industry

sectors. During periods in which changes in economic, political or market

conditions or other factors so warrant, the Manager may reduce the Company's

exposure to one or more asset classes and increase the Company's position in

cash and/or money market instruments.

The Company will not invest more than 15% of its total assets in other listed

closed- ended investment funds. However, the Company may invest up to 50% of

gross assets (at the time of investment) in an investment company subsidiary,

subject always to the other restrictions set out in this investment policy and

the Listing Rules.

Gearing

The Company may borrow to gear the Company's returns when the Manager believes

it is in Shareholders' interests to do so. The Company's Articles of

Association ("Articles") restrict the level of borrowings that the Company may

incur up to a sum equal to two times the net asset value of the Company as

shown by the then latest audited balance sheet of the Company.

The effect of gearing may be achieved without borrowing by investing in a range

of different types of investments including derivatives. Save with the approval

of Shareholders, the Company will not enter into any investments which have the

effect of increasing the Company's net gearing beyond the limit on borrowings

stated in the Articles.

General

In addition to the above, the Company will observe the investment restrictions

imposed from time to time by the Listing Rules which are applicable to

investment companies with shares listed on the Official List of the FCA.

No material change will be made to the investment policy without the approval

of Shareholders by ordinary resolution.

In the event of any breach of the investment restrictions applicable to the

Company, Shareholders will be informed of the remedial actions to be taken by

the Board and the Manager by an announcement issued through a regulatory

information service approved by the FCA.

Investment Strategy and Style

The fund's portfolio is constructed with flexibility but is primarily focused

on stocks that

exhibit the attributes of growth.

Target Benchmark

The Company was originally set up by Brian Sheppard as a vehicle for British

retail investors to invest in with the hope that total returns would exceed the

total returns on the UK equity market. Hence, the benchmark the Company uses to

assess performance is one of the many available UK equity indices being the

MSCI UK Investable Market Index (MXGBIM). The Company has used this benchmark

to assess performance for over five years but is not set on using this

particular UK Equity index forever into the future and currently uses this

particular UK Equity index because at the current time it is viewed as the most

cost advantageous of the currently available UK Equity indices (which have a

high degree of correlation and hence substitutability). However, once the

Company announces the use of an index, then this index will be used across all

of the Company's documentation.

Investments for the portfolio are not selected from constituents of this index

and hence the investment remit is in no way constrained by the index, although

the Manager's management fee is varied depending on performance against the

benchmark. It is suggested that Shareholders review the Company's Active Share

Ratio that is on the fund factsheets as this illustrates to what degree the

holdings in the portfolio vary from the underlying benchmark.

Environmental, Social, Community and Governance

The Company considers that it does not fall within the scope of the Modern

Slavery Act 2015 and it is not, therefore, obliged to make a slavery and human

trafficking statement. In any event, the Company considers its supply chains to

be of low risk as its suppliers are typically professional advisers.

In its oversight of the Manager and the Company's other service providers, the

Board seeks assurances that they have regard to the benefits of diversity and

promote these within their respective organisations. The Company has given

discretionary voting powers to the Manager. The Manager votes against

resolutions they consider may damage Shareholders' rights or economic interests

and reports their actions to the Board. The Company believes it is in the

Shareholders' interests to consider environmental, social, community and

governance factors when selecting and retaining investments and has asked the

Manager to take these issues into account. The Manager does not exclude

companies from their investment universe purely on the grounds of these factors

but adopts a positive approach towards companies which promote these factors.

The portfolio's Sustainalytic's Environmental Percentile was 85.8% per cent as

at the Latest Factsheet date.

As an investment trust the Company is exempt from complying with the Task Force

on Climate-related Financial Disclosures; however, the Company fully recognises

the impact climate change has on the environment and society, and information

on the Manager's endeavours on ESG can be found in the full Annual Report. The

Manager continues to work with the investee companies to raise awareness on

climate change risks, carbon emission and energy efficiency.

Stakeholder Engagement

The Company's s172 Statement can be found in the Corporate Governance Statement

in the full Annual Report and is incorporated into this Strategic Report by

reference.

Dividend policy

The Company may declare dividends as justified by funds available for

distribution. The Company will not retain in respect of any accounting period

an amount which is greater than 15% of net revenue in that period.

Recurring income from dividends on underlying holdings is paid out as ordinary

dividends.

Results and dividends

The results for the year are set out in the Statement of Comprehensive Income

and in the Statement of Changes in Equity below.

For the year ended 31 July 2022, the net revenue return attributable to

Shareholders was negative £1,668,000 (2021: negative £1,857,000) and the net

capital return attributable to Shareholders was negative £59,494,000 (2021:

positive £24,079,000). Total Shareholders' funds decreased by 26% to £

198,546,000 (2021: £269,686,000).

The dividends paid/proposed by the Board for 2021 and 2022 are set out below:

Year ended 31 Year ended

July 2022 31 July 2021

(pence per (pence per

Share) Share)

Interim dividend 7.00 7.00

Special dividend 7.00 -

Proposed final dividend 7.00 7.00

21.00 14.00

Subject to the approval of Shareholders at the forthcoming AGM, the proposed

final ordinary dividend will be payable on 25 November 2022 to Shareholders on

the register at the close of business on 4 November 2022. The ex-dividend date

will be 3 November 2022.

Further details of the dividends paid in respect of the years ended 31 July

2022 and 31 July 2021 are set out in note 7 below.

Principal risks and uncertainties

The Board considers that the following are the principal risks and

uncertainties facing the Company. The actions taken to manage each of these are

set out below. If one or more of these risks materialised, it could potentially

have a significant impact upon the Company's ability to achieve its investment

objective. These risks are formalised within the risk matrix maintained by the

Company's Manager.

Risk How the risk is managed

Investment Performance Risk Investment performance is monitored and

The performance of the reviewed daily by M&L Capital Management

Company may not be in line Limited ("MLCM") as AIFM through:

with its investment . Intra-day portfolio statistics; and

objectives. . Daily Risk reports.

The metrics and statistics within these reports

may be used (in combination with other factors)

to help inform investment decisions.

The AIFM also provides the Board with monthly

performance updates, key portfolio stats

(including performance attribution, valuation

metrics, VaR and liquidity analysis) and

performance charts of top portfolio holdings.

It should be noted that none of the above steps

guarantee that Company performance will meet

its stated objectives.

Key Man Risk and The Manager has a remuneration policy that

Reputational Risk incentivises key staff to take a long-term view

The Company may be unable to as variable rewards are spread over a five-year

fulfil its investment period. MLCM also has documented policies and

objectives following the procedures, including a business continuity

departure of key staff at plan, to ensure continuity of operations in the

the Manager. unlikely event of a departure.

MLCM has a comprehensive compliance framework

to ensure strict adherence to relevant

governance rules and requirements.

Fund Valuation Risk NAVs are produced independently by the

The Company's valuation is Administrator, based on the Company's valuation

not accurately represented policy.

to investors.

Valuation is overseen and reviewed by the

AIFM's valuation committee which reconciles and

checks NAV reports prior to publication.

It should be noted that the vast majority of

the portfolio consists of quoted equities,

whose prices are provided by independent market

sources; hence material input into the

valuation process is rarely required from the

valuation committee.

Third-Party Service All outsourced relationships are subject to an

Providers extensive dual-directional due diligence

Failure of outsourced process and to ongoing monitoring. Where

service providers in possible, the Company appoints a diversified

performing their contractual pool of outsourced providers to ensure

duties. continuity of operations should a service

provider fail.

The cyber security of third-party service

providers is a key risk that is monitored on an

ongoing basis. The safe custody of the

Company's assets may be compromised through

control failures by the Depositary or

Custodian, including cyber security incidents.

To mitigate this risk, the AIFM receives

monthly reports from the Depositary confirming

safe custody of the Company's assets held by

the Custodian.

Regulatory Risk The AIFM adopts a series of pre-trade and

A breach of regulatory rules post-trade controls to minimise breaches. MLCM

/ other legislation uses a fully integrated order management

resulting in the Company not system, electronic execution system, portfolio

meeting its objectives or management system and risk system developed by

investors' loss. Bloomberg. These systems include automated

compliance checks, both pre- and

post-execution, in addition to manual checks by

the investment team. The AIFM undertakes

ongoing compliance monitoring of the portfolio

through a system of daily reporting.

Furthermore, there is additional oversight from

the Depositary, which ensures that there are

three distinct layers of independent

monitoring.

Fiduciary Risk The Company has a clear documented investment

The Company may not be policy and risk profile. The AIFM employs

managed to the agreed various controls and monitoring processes to

guidelines. ensure guidelines are adhered to (including

pre- and post- execution checks as mentioned

above and monthly Risk meetings). Additional

oversight is also provided by the Company's

Depositary.

Fraud Risk The AIFM has extensive fraud prevention

Fraudulent actions may cause controls and adopts a zero tolerance approach

loss. towards fraudulent behaviour and breaches of

protocol surrounding fraud prevention. The

transfer of cash or securities involve the use

of dual authorisation and two-factor

authentication to ensure fraud prevention, such

that only authorised personnel are able to

access the core systems and submit transfers.

The Administrator has access to core systems to

ensure complete oversight of all transactions.

In addition to the above, the Board considers the following to be the principal

financial risks associated with investing in the Company: market risk, interest

rate risk, liquidity risk, currency rate risk and credit and counterparty risk.

An explanation of these risks and how they are managed along with the Company's

capital management policies are contained in note 16 of the Financial

Statements below.

The Board, through the Audit Committee, has undertaken a robust assessment and

review of all the risks stated above and in note 16 of the Financial

Statements, together with a review of any emerging or new risks which may have

arisen during the year, including those that would threaten the Company's

business model, future performance, solvency or liquidity. Whilst reviewing the

principal risks and uncertainties, the Board considered the impact of the

COVID-19 pandemic and the implications of the Russia conflict on the Company,

concluding that these events did not materially affect the operations of the

business.

In accordance with guidance issued to directors of listed companies, the

Directors confirm that they have carried out a review of the effectiveness of

the systems of internal financial control during the year ended 31 July 2022,

as set out in the full Annual Report. There were no matters arising from this

review that required further investigation and no significant failings or

weaknesses were identified.

Further discussion about risk considerations can be found in the Company's

latest prospectus available at https://mlcapman.com/

manchester-london-investment-trust-plc/

Year-end gearing

At the year end, gross long equity exposure represented 101.65% (2021: 136.65%)

of net assets.

Key performance indicators

The Board considers the most important key performance indicator to be the

comparison with its benchmark index. This is referred to in the Financial

Summary above.

Other key measures by which the Board judges the success of the Company are the

Share price, the NAV per Share and the ongoing charges measure.

Total net assets at 31 July 2022 amounted to £198,546,000 compared with £

269,686,000 at 31 July 2021, a decrease of 26.4%, whilst the fully diluted NAV

per Share decreased to 493.04p from 665.43p. During the year, Ordinary Shares

were bought back and held in treasury at a cost of £1,509,000.

Net revenue return after taxation for the year was a negative £1,668,000 (2021:

negative £1,857,000).

The quoted Share price during the period under review has ranged from a

discount of 11.4% to 23.7%.

Ongoing charges, which are set out above, are a measure of the total expenses

(including those charged to capital) expressed as a percentage of the average

net assets over the year. The Board regularly reviews the ongoing charges

measure and monitors Company expenses.

Future development

The Board and the Manager do not currently foresee any material changes to the

business of the Company in the near future. As the majority of the Company's

equity investments are denominated in US Dollar, any currency volatility may

have an impact (either positive or negative) on the Company's NAV per Share,

which is denominated in Sterling.

Management arrangements

Under the terms of the management agreement, MLCM manages the Company's

portfolio in accordance with the investment policy determined by the Board. The

management agreement has a termination period of three months. In line with the

management agreement, the Manager receives a variable portfolio management fee.

Details of the fee arrangements and the fees paid to the Manager during the

year are disclosed in note 3 to the Financial Statements.

The Manager is authorised and regulated by the FCA.

M&M Investment Company Limited ("MMIC"), which is controlled by Mr Mark

Sheppard who forms part of the Manager's management team, is the controlling

Shareholder of the Company. Further details regarding this are set out in the

Directors' Report in the full Annual Report.

Alternative Investment Fund Managers Directive (the "AIFMD")

The Company permanently exceeded the sub-threshold limit under the AIFMD in

2017 and MLCM was appointed as the Company's AIFM with effect from 17 January

2018. Following their appointment as the AIFM, MLCM receives an annual risk

management and valuation fee of £59,000 to undertake its duties as the AIFM in

addition to the portfolio management fees set out above.

The AIFMD requires certain information to be made available to investors before

they invest and requires that material changes to this information be disclosed

in the Annual Report.

Remuneration

In the year to 31 July 2022, the total remuneration paid to the employees of

the Manager was £465,000 (2021: £486,000), payable to an average employee

number throughout the year of four (2021: four).

The management of MLCM is undertaken by Mr Mark Sheppard and Mr Richard Morgan,

to whom a combined total of £392,000 (2021: £401,000) was paid by the Manager

during the year.

The remuneration policy of the Manager is to pay fixed annual salaries, with

non-guaranteed bonuses, dependent upon performance only. These bonuses are

generally paid in the Company's Shares, released over a five-year period.

Leverage

The leverage policy has been approved by the Company and the AIFM. The policy

limits the leverage ratio that can be deployed by the Company at any one time

to 275% (gross method) and 250% (commitment method). This includes any gearing

created by its investment policy. This is a maximum figure as required for

disclosure by the AIFMD regulation and not necessarily the amount of leverage

that is actually used. The leverage ratio as at 31 July 2022 measured by the

gross method was 153.8% and that measured by the commitment method was 148.9%.

Leverage is defined in the Glossary below.

Risk profile

The risk profile of the Company as measured through the Summary Risk Indicator

("SRI") score, is currently at a 5 on a scale of 1 to 7 as at 31 July 2022.

This score is calculated on past performance data using prescribed PRIIPS

methodology. Liquidity, counterparty and currency risks are not captured on the

scale. The Manager will periodically disclose the current risk profile of the

Company to investors. The Company will make this disclosure on its website at

the same time as it makes its Annual Report and Financial Statements available

to investors or more frequently at its discretion.

For further information on SRI - including key risk disclaimers - please read

the Fund Key Information Document available at https://mlcapman.com/

manchester-london-investment-trust-plc/

Liquidity arrangements

The Company currently holds no assets that are subject to special arrangements

arising from their illiquid nature. If applicable, the Company would disclose

the percentage of its assets subject to such arrangements on its website at the

same time as it makes its Annual Report and Financial Statements available to

investors, or more frequently at its discretion.

Continuing appointment of the Manager

The Board keeps the performance of MLCM, in its capacity as the Company's

Manager, under continual review. It has noted the good long-term performance

record and commitment, quality and continuity of the team employed by the

Manager. As a result, the Board concluded that it is in the best interests of

the Shareholders as a whole that the appointment of the Manager on the agreed

terms should continue.

Human rights, employee, social and community issues

The Board consists entirely of non-executive Directors. The Company has no

employees and day-to-day management of the business is delegated to the Manager

and other service providers. As an investment trust, the Company has no direct

impact on the community or the environment, and as such has no human rights or

community policies. In carrying out its investment activities and in

relationships with suppliers, the Company aims to conduct itself responsibly,

ethically and fairly. Further details of the Environmental, Social and

Governance policy and of the Company's Board composition and related diversity

considerations can be found in the Statement of Corporate Governance in the

full Annual Report.

Gender diversity

At 31 July 2022, the Board comprised four male Directors. As stated in the

Statement of Corporate Governance, the appointment of any new Director is made

on the basis of merit.

Approval

This Strategic Report has been approved by the Board and signed on its behalf

by:

Daniel Wright

Chairman

20 October 2022

DIRECTORS

Daren Morris (Chairman of the Audit Committee)

Brett Miller

Sir James Waterlow

Daniel Wright (Chairman of the Board and Senior Independent Director)

All the Directors are non-executive. Mr Morris, Sir James Waterlow and Mr

Wright are independent of the Company's Manager.

EXTRACTS FROM THE DIRECTORS' REPORT

Share capital

As at 31 July 2022, the Company's issued share capital comprised 40,528,238

Shares of 25 pence each, of which 258,183 were held in Treasury.

At general meetings of the Company, Shareholders are entitled to one vote on a

show of hands and on a poll, to one vote for every Share held. Shares held in

Treasury do not carry voting rights.

In circumstances where Chapter 11 of the Listing Rules would require a proposed

transaction to be approved by Shareholders, the controlling Shareholder (see

the full Annual Report for further details) shall not vote its Shares on that

resolution. In addition, any Director of the Company appointed by MMIC, the

controlling Shareholder, shall not vote on any matter where conflicted and the

Directors will act independently from MMIC and have due regard to their

fiduciary duties.

Issue of Shares

At the Annual General Meeting held on 3 November 2021, Shareholders approved

the Board's proposal to authorise the Company to allot Shares up to an

aggregate nominal amount of £3,375,070.25. In addition, the Directors were

authorised to issue Shares and sell Shares from Treasury up to an aggregate

nominal value of £1,012,521 on a non-pre-emptive basis. This authority is due

to expire at the Company's forthcoming AGM on 21 November 2022.

There were no share issues during the year.

As at the date of this report, the total voting rights were 40,270,055.

Purchase of Shares

At the Annual General Meeting held on 3 November 2021, Shareholders approved

the Board's proposal to authorise the Company to acquire up to 14.99% of its

issued Share capital (excluding Treasury Shares) amounting to 6,071,076 Shares.

This authority is due to expire at the Company's forthcoming AGM on 21 November

2022.

During the year, 258,183 Shares have been bought back and at the date of this

report there were 40,528,238 Shares in issue of which 258,183 were held in

treasury. The total amount paid for these Shares was £1,509,000 at an average

price of 584 pence per Share.

Sale of Shares from Treasury

At the Annual General Meeting held on 3 November 2021, Shareholders approved

the Board's proposal to authorise the Company to waive pre-emption rights in

respect of Treasury Shares up to an aggregate amount of £1,012,521 and to

permit the allotment or sale of Shares from Treasury at a discount to a price

at or above the prevailing NAV. This authority is due to expire at the

Company's forthcoming AGM on 21 November 2022.

No Shares were sold from Treasury during the year. As at the date of this

report, 258,183 Shares are held in Treasury.

Going concern

The Directors consider that it is appropriate to adopt the going concern basis

in preparing the Financial Statements. After making enquiries, and considering

the nature of the Company's business and assets, the Directors consider that

the Company has adequate resources to continue in operational existence for the

foreseeable future. In arriving at this conclusion, the Directors have

considered the liquidity of the portfolio and the Company's ability to meet

obligations as they fall due for a period of at least 12 months from the date

that these Financial Statements were approved. In making this assessment, the

Directors have considered any likely impact of the current COVID-19 pandemic on

the Company, its operations and the investment portfolio. The Directors

consider that the COVID-19 pandemic has not materially impacted the operations

of the Company.

Cashflow projections have been reviewed and provide evidence that the Company

has sufficient funds to meet both its contracted expenditure and its

discretionary cash outflows in the form of the dividend policy. Additionally,

Value at Risk scenario analyses to demonstrate that the company has sufficient

capital headroom to withstand market volatility are performed periodically.

Viability statement

The Directors have assessed the prospects of the Company over a five-year

period. The Directors consider five years to be a reasonable time horizon to

consider the continuing viability of the Company, however they also consider

viability for the longer-term foreseeable future.

In their assessment of the viability of the Company, the Directors have

considered each of the Company's principal risks and uncertainties as set out

in the Strategic Report above and in particular, have considered the potential

impact of a significant fall in global equity markets on the value of the

Company's investment portfolio overall. The Directors have also considered the

Company's income and expenditure projections and the fact that the Company's

investments mainly comprise readily realisable securities which could be sold

to meet funding requirements if necessary. On that basis, the Board considers

that five years is an appropriate time period to assess continuing viability of

the Company.

In forming their assessment of viability, the Directors have also considered:

* internal processes for monitoring costs;

* expected levels of investment income;

* the performance of the Manager;

* portfolio risk profile;

* liquidity risk;

* gearing limits;

* counterparty exposure; and

* financial controls and procedures operated by the Company.

The Board has reviewed the influence of the COVID-19 pandemic on its service

providers and is satisfied with the ongoing services provided to the Company.

Based upon these considerations, the Directors have concluded that there is a

reasonable expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the five-year period.

By order of the Board

Link Company Matters Limited

Company Secretary

20 October 2022

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RELATION TO THE ANNUAL REPORT AND

FINANCIAL STATEMENTS

The Directors are responsible for preparing the Company's Annual Report and

Financial Statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare Financial Statements for each

financial period. Under that law, they have elected to prepare the Financial

Statements in accordance with International Financial Reporting Standards

("IFRS") as adopted by the European Union. Under Company law, the Directors

must not approve the Financial Statements unless they are satisfied that they

give a true and fair view of the state of affairs of the Company and of the

profit or loss of the Company for that period.

In preparing the Financial Statements, the Directors are required to:

* select suitable accounting policies in accordance with IAS 8 'Accounting

Policies, Changes in Accounting Estimates and Errors' and then apply them

consistently;

* present information, including accounting policies, in a manner that

provides relevant, reliable, comparable and understandable information;

* provide additional disclosure when compliance with specific requirements in

IFRS is insufficient to enable users to understand the impact of particular

transactions, other events and conditions on the Company's financial

position and financial performance;

* state that the Company has complied with IFRS, subject to any material

departures disclosed and explained in the Financial Statements;

* make judgements and estimates that are reasonable and prudent; and

* prepare Financial Statements on a going concern basis unless it is

inappropriate to presume that the Company will continue in business.

The Directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions and disclose with

reasonable accuracy, at any time, the financial position of the Company and to

enable them to ensure that the Financial Statements comply with the Companies

Act 2006 and Article 4 of the IAS Regulation. They are also responsible for

safeguarding the assets of the Company and hence for taking reasonable steps

for the prevention and detection of fraud and other irregularities.

Under applicable law and regulations, the Directors are also responsible for

preparing a Strategic Report, Directors' Report, Directors' Remuneration Report

and Corporate Governance Statement that comply with that law and those

regulations, and ensuring that the Annual Report includes information required

by the Listing Rules and Disclosure Guidance and Transparency Rules of the FCA.

The Financial Statements are published on the Company's website,

www.mlcapman.com/manchester-london-investment-trust-plc, which is maintained on

behalf of the Company by the Manager. The Manager has agreed to maintain, host,

manage and operate the Company's website and to ensure that it is accurate and

up-to-date and operated in accordance with applicable law. The work carried out

by the Auditor does not involve consideration of the maintenance and integrity

of this website and accordingly, the Auditor accepts no responsibility for any

changes that have occurred to the Financial Statements since they were

initially presented on the website. Visitors to the website need to be aware

that legislation in the United Kingdom covering the preparation and

dissemination of the Financial Statements may differ from legislation in their

jurisdiction.

We confirm that to the best of our knowledge:

i. the Financial Statements, prepared in accordance with the IFRS, give a true

and fair view of the assets, liabilities, financial position and profit of

the Company; and

ii. the Annual Report includes a fair review of the development and performance

of the business and position of the Company, together with a description of

the principal risks and uncertainties that it faces.

The Directors consider that the Annual Report and Financial Statements, taken

as a whole, are fair, balanced and understandable and provide the information

necessary for Shareholders to assess the Company's position and performance,

business model and strategy.

On behalf of the Board

Daniel Wright

Chairman

20 October 2022

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 July 2022

2021

2022

Revenue Capital Total Revenue Capital Total

Notes £'000 £'000 £'000 £'000 £'000 £'000

Gains

Gains on investments at 9 275 (58,542) (58,267) 25,117 25,367

fair value through 250

profit or loss

Investment income 2 265 - 265 823 - 823

Gross return 1,073 25,117 26,190

540 (58,542) (58,002)

Expenses

Management fee 3 (1,515) - (1,515) (1,958) - (1,958)

Other operating expenses 4 (598) - (598) (725) - (725)

Total expenses (2,113) - (2,113) (2,683) - (2,683)

Return before finance (1,573) (58,542) (60,115) (1,610) 25,117 23,507

costs and tax

Finance costs 5 (55) (952) (1,007) (205) (1,038) (1,243)

Return on ordinary (1,628) (59,494) (61,122) (1,815) 24,079 22,264

activities before tax

Taxation 6 (40) - (40) (42) - (42)

Return on ordinary (1,668) (59,494) (61,162) (1,857) 24,079 22,222

activities after tax

Return per Share pence pence pence pence pence pence

Basic and fully diluted 8 (4.13) (147,49) (151.62) (4.77) 61.87 57.10

The total column of this statement is the Income Statement of the Company

prepared in accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006. The supplementary revenue

return and capital return columns are presented in accordance with the

Statement of Recommended Practice issued by the Association of Investment

Companies ("AIC SORP").

All revenue and capital items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the year.

There is no other comprehensive income, and therefore the return for the year

after tax is also the total comprehensive income.

The notes below form part of these Financial Statements.

STATEMENT OF CHANGES IN EQUITY

For the year ended 31 July 2022

Share Share Special Capital Retained

capital premium reserve** reserve* earnings** Total

Notes £'000 £'000 £'000 £'000 £'000 £'000

Balance at 1 August 2021 10,132 25,888 107,188 123,240 3,238 269,686

Changes in equity for 2022

Ordinary shares bought back and 14 - - (1,509) - - (1,509)

held in treasury

Total comprehensive (loss) - - (59,494) (1,668) (61,162)

-

Dividends paid 7 - - (6,899) - (1,570) (8,469)

Balance at 31 July 2022 10,132 25,888 98,780 63,746 - 198,546

Balance at 1 August 2020 9,034 107,188 - 99,161 10,550 225,933

Changes in equity for 2021

Shares issued 14 1,098 25,888 - - - 26,986

Cancellation of share premium - (107,188) 107,188 - - -

account

Total comprehensive income/(loss) - - - 24,079 (1,857) 22,222

Dividends paid 7 - - - - (5,455) (5,455)

Balance at 31 July 2021 10,132 25,888 107,188 123,240 3,238 269,686

* Within the balance of the capital reserve, £15,871,000 relates to realised

gains (2021: £35,863,000). Realised gains are distributable by way of a

dividend. The remaining £47,875,000 relates to unrealised gains on financial

instruments (2021: £87,377,000) and is non-distributable.

** Fully distributable.

The notes below form part of these Financial Statements.

STATEMENT OF FINANCIAL POSITION

As at 31 July 2022

2021 2020

2022 (Restated) (Restated)

1 1

Notes £'000 £'000 £'000

Non-current assets

Investments at fair value through 9 128,111 156,919 137,333

profit or loss

Current assets

Unrealised derivative assets 13 2,548 14,917 4,837

Trade and other receivables 10 29 42 18

Cash and cash equivalents 11 48,840 37,021 30,477

Cash collateral receivable from 13 36,394 80,174 79,352

brokers

87,811 132,154 114,684

Creditors - amounts falling due

within one year

Unrealised derivative liabilities 13 (14,284) (19,110) (23,538)

Trade and other payables 12 (1,107) (277) (2,546)

Cash collateral payable to brokers 13 (1,985) - -

(17,376) (19,387) (26,084)

Net current assets/(liabilities) 70,435 112,767 88,600

Net assets 198,546 269,686 225,933

Capital and reserves

Ordinary Share Capital 14 10,132 10,132 9,034

Share premium 25,888 25,888 107,188

Special Reserves 98,780 107,188 -

Capital reserve 63,746 123,240 99,161

Retained earnings - 3,238 10,550

Total equity 198,546 269,686 225,933

Basic and fully diluted NAV per 15 493.04p 665.43p 625.23p

Share

Number of Shares in issue 14 40,270,055 40,528,238 36,135,738

excluding treasury

1 Please refer to note 1 restatement of 2021 and 2020 comparatives.

The Financial Statements were approved by the Board of Directors and authorised

for issue on 20 October 2022 and are signed on its behalf by:

Daniel Wright

Chairman

Manchester and London Investment Trust Public Limited Company

Company Number: 01009550

The notes below form part of these Financial Statements.

STATEMENT OF CASH FLOWS

For the year ended 31 July 2022

2022 2021

£'000 (Restated)

£'000

Cash flow from operating activities

Return on operating activities before tax (61,122) 22,264

Interest expense 968 1,075

Losses on investments held at fair value through 64,501 (26,633)

profit or loss

Decrease/(increase) in receivables 2 (10)

Increase/(decrease) in payables (92) (92)

Exchange Gains/Losses on Currency Balances (5,815) 1,446

Tax (40) (42)

Net cash (used in)/generated from operating (1,598) (1,992)

activities

Cash flow from investing activities

Purchases of investments (86,419) (82,898)

Sales of investments 105,030 84,370

Derivative instrument cashflows (71) (11,953)

Net cash inflow/(outflow) from investing activities 18.540

(10,481)

Cash flow from financing activities

Issue of shares - 26,986

Ordinary shares bought back and held in treasury (1,509) -

Equity dividends paid (8,469) (5,455)

Interest paid (960) (1,068)

Net cash generated in financing activities (10,938) 20,463

6,004 7,990

Net increase/(decrease) in cash and cash equivalents

Exchange gains/losses on Currency Balances 5,815

(1,446)

Cash and cash equivalents at beginning of year 37,021 30,477

Cash and cash equivalents at end of year 48,840 37,021

The notes below form part of these Financial Statements.

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

For the year ended 31 July 2022

1. General information and accounting policies

Manchester and London Investment Trust plc is a public limited company

incorporated in the UK and registered in England and Wales. The principal

activity of the Company is that of an investment trust company within the

meaning of Sections 1158/1159 of the Corporation Tax Act 2010 and its

investment approach is detailed in the Strategic Report.

The Company's Financial Statements have been prepared in accordance with

international accounting standards in conformity with the requirements of the

Companies Act 2006. The Financial Statements have also been prepared in

accordance with the AIC SORP for the financial statements of investment trust

companies and venture capital trusts.

Basis of preparation

In order to better reflect the activities of an investment trust company and in

accordance with the AIC SORP, supplementary information which analyses the

Statement of Comprehensive Income between items of revenue and capital nature

has been prepared alongside the Statement of Comprehensive Income.

The Financial Statements are presented in Sterling, which is the Company's

functional currency as the UK is the primary environment in which it operates,

rounded to the nearest £'000, except where otherwise indicated.

Going concern

The financial statements have been prepared on a going concern basis and on the

basis that approval as an investment trust company will continue to be met.

The Directors have made an assessment of the Company's ability to continue as a

going concern and are satisfied that the Company has adequate resources to

continue in operational existence for a period of at least 12 months from the

date when these financial statements were approved.

In making the assessment, the Directors of the Company have considered the

likely impacts of international and economic uncertainties on the Company,

operations and the investment portfolio. These include, but are not limited to,

the impact of COVID-19, the war in Ukraine, political instability in the UK,

supply shortages and inflationary pressures.

The Directors noted that the Company, with the current cash balance and holding

a portfolio of listed investments, is able to meet the obligations of the

Company as they fall due. The current cash balance, enables the Company to meet

any funding requirements and finance future additional investments. The Company

is a closed-end fund, where assets are not required to be liquidated to meet

day to day redemptions.

The Directors have completed stress tests assessing the impact of changes in

market value and income with associated cash flows. In making this assessment,

they have considered plausible downside scenarios. These tests were driven by

the possible effects of continuation of the COVID-19 pandemic but, as an

arithmetic exercise, apply equally to any other set of circumstances in which

asset value and income are significantly impaired. The conclusion was that in a

plausible downside scenario the Company could continue to meet its liabilities.

Whilst the economic future is uncertain, and the Directors believe that it is

possible the Company could experience further reductions in income and/or

market value, the opinion of the Directors is that this should not be to a

level which would threaten the Company's ability to continue as a going

concern.

The Directors, the Manager and other service providers have put in place

contingency plans to minimise disruption. Furthermore, the Directors are not

aware of any material uncertainties that may cast significant doubt on the

Company's ability to continue as a going concern, having taken into account the

liquidity of the Company's investment portfolio and the Company's financial

position in respect of its cash flows, borrowing facilities and investment

commitments (of which there are none of significance). Therefore, the financial

statements have been prepared on the going concern basis.

Segmental reporting

The Directors are of the opinion that the Company is engaged in a single

segment of business, being investment business. The Company primarily invests

in companies listed on recognised international exchanges.

Accounting developments

In the year under review, the Company has applied amendments to IFRS issued by

the IASB adopted in conformity with UK adopted international accounting

standards. These include annual improvements to IFRS, changes in standards,

legislative and regulatory amendments, changes in disclosure and presentation

requirements. This incorporated:

* Interest Rate Benchmark Reform - IBOR 'phase 2' (Amendments to IFRS 9, IAS

39 and IFRS 7);

* Onerous contracts - Cost of Fulfilling a Contract (Amendments to IAS 37);

* IAS 1 Presentation of Financial Statements and IAS 8 Accounting Policies,

Changes in Accounting Estimates and Errors (Amendment - Disclosure

initiative - Definition of Material); and

* Revisions to the Conceptual Framework for Financial Reporting.

The adoption of the changes to accounting standards has had no material impact

on these or prior years' financial statements. There are amendments to IAS/IFRS

that will apply from 1 August 2022 as follows:

* Classification of liabilities as current or non-current (Amendments to IAS

1);

* Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice

Statement 2);

* Definition of Accounting Estimates (Amendments to IAS 8);

* Deferred Tax Related to Assets and Liabilities Arising from a Single

Transaction - Amendments to IAS 12 Income Taxes; and

* Annual improvements to IFRS Standards.

The Directors do not anticipate the adoption of these will have a material

impact on the financial statements.

Restatement of 2021 and 2020 Comparatives

In assessing the Company's current asset and current liability positions as

part of the annual financial statement process, a classification error has been

identified relating to the presentation of current assets and liabilities

within the Unrealised derivative assets/liabilities and Cash and cash

equivalents account lines. Cash received from the Company's brokers on the

periodic reset of the contract for difference positions was previously

presented as part of the derivative asset/liability balances and collateral

cash held in margin/collateral accounts at the Company's brokers was previously

presented with cash and cash equivalents. These amounts have been reclassified

because cash received from the periodic reset of contracts for difference is

considered to be a realisation and the cash held in margin/collateral accounts

does not meet the definition of cash under IAS 7 and so have been presented

separately as Cash collateral receivable from, or payable to, brokers on the

statement of financial position.

The correction of this classification error has no impact on the Company's net

assets (and the resulting net asset value per share figure) nor on the

Company's Statement of Comprehensive Income. The balances within the Company's

Statement of Financial Position as at 31 July 2021 and 31 July 2020 have been

restated for consistency as shown in the following table. In addition, the

Derivative instrument cashflows in the Statement of Cash Flows for the year

ended 31 July 2021 has been restated from a cash outflow of £21,704,000 to a

cash outflow of £11,953,000.

2021 2021 2020

Original (Restated) Original 2020

£'000 £'000 £'000 (Restated)

£'000

Unrealised derivative assets 14,917

44,903 29,229 4,837

Cash and cash equivalents 82,970 37,021

86,177 30,477

Cash collateral receivable 80,174

from brokers - 79,352

-

Unrealised derivative liabilities (14,871)

(19,110) (24,278) (23,538)

The net assets of the Company are stated below.

2021 2021 2020 2020

(Restated)

Original Original (Restated)

£ £

£'000 '000 '000 £'000

Net assets 269,686 225,933

269,686 225,933

Critical accounting judgements and key sources of estimation uncertainty

The preparation of financial statements in conformity with IFRS requires

management to make judgements, estimates and assumptions that affect the

application of policies and the reported amounts in the financial statements.

The estimates and associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making judgements about

carrying values of assets and liabilities that are not readily apparent from

other sources. Actual results may differ from these estimates.

The areas requiring the greatest level of judgement and estimation in the

preparation of the Financial Statements are: valuation of derivatives; and

accounting for revenue and expenses in relation to equity swaps. The policies

for these are set out in the notes to the Financial Statements.

There were no significant accounting estimates or critical accounting

judgements in the year.

Investments

Investments are measured initially, and at subsequent reporting dates, at fair

value through profit and loss, and derecognised at trade date where a purchase

or sale is under a contract whose terms require delivery within the timeframe

of the relevant market. For listed equity investments, this is deemed to be

closing prices.

Changes in fair value of investments are recognised in the Statement of

Comprehensive Income as a capital item. On disposal, realised gains and losses

are also recognised in the Statement of Comprehensive Income as capital items.

All investments for which fair value is measured or disclosed in the Financial

Statements are categorised within the fair value hierarchy in note 9.

Financial instruments

The Company may use a variety of derivative instruments, including equity

swaps, futures, forwards and options under master agreements with the Company's

derivative counterparties to enable the Company to gain long and short exposure

on individual securities.

The Company recognises financial assets and financial liabilities when it

becomes a party to the contractual provisions of the instrument. Listed options

and futures contracts are recognised at fair value through profit or loss

valued by reference to the underlying market value of the corresponding

security, traded prices and/or third party information.

Notional dividend income arising on long positions is recognised in the

Statement of Comprehensive Income as revenue. Interest expenses on open long

positions are allocated to capital. All remaining interest or financing charges

on derivative contracts are allocated to the revenue account.

Unrealised changes to the value of securities in relation to derivatives are

recognised in the Statement of Comprehensive Income as capital items.

Foreign currency

Transactions denominated in foreign currencies are converted to Sterling at the

actual exchange rate as at the date of the transaction. Monetary assets and

liabilities and non-monetary assets held at fair value denominated in foreign

currencies at the year end are translated at the Statement of Financial

Position date. Any gain or loss arising from a change in exchange rate

subsequent to the date of the transaction is included as an exchange gain or

loss in the capital reserve or the revenue account depending on whether the

gain or loss is capital or revenue in nature.

Cash and cash equivalents

Cash comprises cash in hand and overdrafts. Cash equivalents are short-term,

highly liquid investments that are readily convertible to known amounts of cash

and which are subject to insignificant risk of changes in value.

For the purposes of the Statement of Financial Position and the Statement of

Cash Flows, cash and cash equivalents consist of cash and cash equivalents as

defined above, net of outstanding bank overdrafts when applicable.

Cash held in margin/collateral accounts at the Company's brokers is presented

as Cash collateral receivable from brokers in the financial statements. Any

cash collateral owed back to the brokers on marked to market gains of Equity