Rights and Issues Investment Trust PLC (RIII)

Rights and Issues Investment Trust PLC: IR-Half-yearly Results

01-Aug-2023 / 16:25 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

RIGHTS AND ISSUES INVESTMENT TRUST PLC

For the six months ended 30th June 2023

A copy of the Company's Half Yearly Financial Report for the six months ended 30th June 2023 will shortly be available

to view and download from www.jupiteram.com/rightsandissues. Neither the contents of this website nor the contents of

any website accessible from hyperlinks on this website (or any other website) is incorporated into or forms part of

this announcement.

Printed copies of the Report will be made available to shareholders shortly. Additional copies may be obtained from the

Corporate Secretary - Apex Fund Administration Services (UK) Limited, Hamilton Centre, Rodney Way, Chelmsford, Essex

CM1 3BY.

INTERIM DIVID

An interim dividend of 11.75p per share has been approved by the Board and is payable on 25th September 2023 to

shareholders on the register as at 25th August 2023 (ex-dividend 24th August 2023).

The following text is copied from the Half Yearly Financial Report.

HALF YEARLY FINANCIAL REPORT

for the six months ended 30th June 2023

Financial Highlights

Financial Highlights for the six months to 30th June 2023

Capital Performance

30th June 31st December

2023 2022

Total assets less current liabilities (GBP'000 137,081 140,783

Ordinary Share Performance

30th June 31st December

2023 2022 % change

Mid market price (p) 2,020.0 1,890.0 +6.9

Net asset value (p) 2,333.8 2,283.2 +2.2

FTSE All-Share Index 4,096.4 4,075.1 +0.5

Dividends per share (p) 11.75 40.0

Discount to net asset value (%)* 13.5 17.2

Ongoing charges ratio (%)* 0.8 0.5

*For definitions of the above Alternative Performance Measures please refer to the Glossary of Terms in the Half Yearly

Report

Market Data

30th June

2023

Issued share capital (Ordinary shares of 25p each) 5,873,611

Total investment return+ 3.5%

Total shareholder return++ 8.4%

Annualised dividend yield 2.0%

+Source: Jupiter, Morningstar

++Source: Trustnet

Chairman's Statement

Market backdrop

Market conditions in the first six months of 2023 can probably

be best described as weak and volatile; against the background of

the devastating war in Ukraine, we have seen other geopolitical

tensions emerge on a regular basis and we are frequently reminded

that the path to recovery from the pandemic will not be simple.

Whilst energy prices seem to be easing, the UK is facing a number

of unique challenges not seen in other developed economies with

borrowing costs at a 16 year high, record wage growth and

persistently high core inflation.

Net asset value and share price returns

Against this background, the Company's net asset value per share

increased from 2283.2p to 2333.8p, an increase of 2.2% over the

six- month period, compared with an 0.5% increase in the FTSE All

Share index. Including dividends, the Company has delivered a total

investment return of 3.5% for the period.

Portfolio changes

Dan Nickols and Matt Cable, our portfolio managers at Jupiter,

have made a number of significant changes to the Company's

investment portfolio in terms of holdings and concentration since

they were appointed, and in the last six months they added four new

positions to the portfolio whilst disposing of the four 'tail'

positions. The full details of the changes are provided in the

Investment Manager's Review.

Jupiter's appointment

Whilst it is still less than 12 months since the appointment of

Jupiter as investment manager, the Board is pleased with the level

of engagement with the managers and with the progress made in

repositioning the portfolio. The first formal review of Jupiter's

performance will take place during the Management Engagement

Committee following the anniversary of their appointment on 3rd

October 2022.

Discount control

At 30th June 2023, the discount to net assets stood at 13.5%, an

improvement from the 17.2% at year-end. That said, discounts across

the sector continue to be volatile and on 26th July, being the

latest practicable date prior to publication of this report, the

Company's discount has widened to 16.6%. During the period, the

Company bought back 292,378 shares for cancellation, which added an

estimated 0.8% to net asset value per share.

Having discussed possible alternative discount management

mechanisms, the Board has concluded that the continuation of the

existing buyback arrangement for a period of 12 months will be in

the best interests of shareholders, providing liquidity for those

shareholders seeking to sell, whilst delivering a modest economic

uplift to those shareholders wishing to remain invested. It is

hoped that the Company's inclusion in the FTSE Russell Index,

effective from 19th June, will similarly help improve

liquidity.

Share split

Conscious that shareholders were not able to vote on a

resolution to approve a proposed 10:1 share split at this year's

AGM, the Board has consulted with, and received feedback from,

certain key shareholders and has concluded that, whilst the merits

of such a scheme are unlikely to have universal support, it is

appropriate to offer all shareholders a vote on this issue.

Therefore, it intends to do so when most economically cost

effective and this is likely to be at the 2024 AGM.

Dividends

The Directors are equally conscious of the importance of income

to shareholders and therefore the Company will be paying an interim

dividend of 11.75p per share, an increase of 9.3%, payable to

shareholders on 25th September 2023.

Board succession

I was appointed to the Board in May 2011 and have now served for

12 years. Due to a change in my own personal circumstances I shall

retire from the Board on 31st August 2023. Upon retirement I am

delighted to report that Dr Andrew Hosty will become Chair; Andrew

has been a director since July 2017 and brings a wealth of

experience and knowledge to the position.

Outlook

Inflation is proving more persistent than expected and interest

rates will likely continue at higher levels for longer, dampening

consumer confidence. Such macro-economic headwinds can impact upon

share prices in the short term but fundamental value should be

reflected across a longer timeframe as quality companies will

deliver superior performance. The Company's long-term record is

strong and the Directors believe Jupiter is well placed to continue

to deliver the Board's successful high conviction strategy.

David M Best

Chairman

1st August 2023

You can view or download copies of the Half Yearly and the

Annual Reports from the Company's website at

www.jupiteram.com/rightsandissues

The Half Yearly Report will also be made available to

shareholders and copies are available at the registered office of

the Company on request.

Investment Manager's Review

Introduction

We are pleased to present our investment report for the first

half of 2023 to shareholders of the Company. As mentioned in the

Chairman's statement above it has been another period of heightened

volatility in global markets, with the FTSE All-Share index ending

the half broadly flat but experiencing significant gains and losses

along the way. With that backdrop we are pleased to have generated

a positive investment return for the period as well as strong

shareholder returns as the Company's discount has narrowed. We have

also made good progress in adjusting the structure of the portfolio

in the way we highlighted in the annual report and as further

discussed below.

Market backdrop

The UK equity market enjoyed a strong start to the year as

investors took the view that inflation was likely to moderate and

central banks would therefore take a less hawkish approach to

interest rates. As the outlook for inflation deteriorated through

the half this view became less credible and markets gave up their

earlier gains. In addition, the market had to digest the fallout

from the collapse of Silicon Valley Bank in the US and the rescue

of Credit Suisse in Switzerland.

While the direct effects of these developments on companies and

earnings appear to be limited so far, the market seems to be

increasingly convinced that a period of lower growth or even

outright recession is likely in the UK.

Performance

In the context of a weak and volatile market we are pleased that

the Company has delivered a total investment return (NAV return

with dividends added back of 2.1%) of 3.5% (Source: Jupiter,

Morningstar) for the period. Furthermore, a narrowing of the

Company's discount resulted in a total shareholder return (share

price return with dividends added back of 6.6%) of 8.4% (Source:

Trustnet).

Given the concentrated nature of the portfolio, investment

performance is generally a consequence of stock selection. Over the

period there were a number of positive and negative contributors to

performance, including:

Hill & Smith (+30%)

As a provider of infrastructure-related products and services,

Hill & Smith is well placed to benefit from increased

government spending across its regions, in particular the USA. The

market's anticipation of higher profits was confirmed in a trading

statement in May which pointed to a stronger than expected outlook

for the year.

Renold (+31%)

Manufacturer of industrial chains and transmissions, Renold

experienced a period of strong trading and issued two positive

trading statements during the half. In addition, rising interest

rates are expected to help reduce Renold's pension deficit, which

has previously been seen as a negative for the share price.

Carr's Group (+24%)

Following a period of significant change which saw Carr's

dispose of its distribution business to focus on agricultural

supplies and engineering, the market has taken a more positive view

of the company's prospects. The shares were suspended for a time

early in the year due to audit delays but have performed strongly

since.

Videndum (-34%)

Manufacturer of products for the content creation markets,

Videndum has seen significant levels of de-stocking in its

retail-oriented channels and, more recently, weakness in

professional markets resulting from the writers' strikes in

Hollywood. While these issues are frustrating, we view both as

ultimately transitory and are therefore retaining our holding in

Videndum.

Spirent (-40%)

A recent addition to the portfolio (see below), Spirent is

exposed to strong medium to long term growth drivers from the

transition to newer mobile technologies (5G) and higher network

data speeds. Unfortunately, these longer term trends have been

interrupted by a period of caution among Spirent's customers which

will result in lower short term growth. While this is negative for

the share price in the near term, we remain positive on the

longer-term opportunity.

Portfolio changes

In the last annual report we said that we planned to retain the

Company's concentrated approach but reduce the proportion of the

portfolio in the very largest positions. We also said that we

wanted to introduce new holdings which would improve the

portfolio's balance from a sector perspective.

At the start of the year the Company held positions in 22 stocks

with the top five positions accounting for 50% of NAY and the top

ten for 76%. On 30th June the Company held 21 stocks with the top

five accounting for 41% of NAY and the top ten for 67%. While

portfolio construction is always a dynamic process and further

changes are likely, we are now broadly happy with the shape of the

portfolio.

As part of the portfolio restructuring we have reduced the size

of some of our largest positions. For example the largest position

in the portfolio is now 10.6% of NAY, down from 12.6% at the start

of the year. We have also disposed of some of the 'tail' of

holdings with very low market capitalisations, including Titon

Holdings (GBP8m market cap) and Coral Products (GBP14m market cap).

We also sold the Company's tiny residual holding in Costain and

some preference shares issued by Santander which we felt did not

fit the Company's stated objectives. Finally, we disposed of the

holding in Castings which we felt offered limited valuation

upside.

We have added four new positions to the portfolio over the first

half of the year.

OSB Group (GBP2bn market cap)

OSB is the UK's largest specialist buy-to-let mortgage lender.

It benefits from a state-of-the-art lending platform, strong

deposit base and a balance sheet free of legacy pre-financial

crisis loans. OSB is very well capitalised and consistently

generates excellent returns, allowing the company to return capital

to shareholders through ordinary and special dividends as well as a

share buy-back programme. As well as a compelling growth and

valuation case, OSB brings exposure to financial services and UK

consumer cyclicality, which was previously a significant

underweight in the portfolio.

Spirent (GBP1bn market cap)

As referenced above, Spirent is a global provider of testing

equipment and software for the telecommunications industry. Its

structural growth drivers include the expansion of 5G technology

and the ever-higher demands for speed in networks and data centres.

Some short-term disruption to the 5G market, especially in the US,

has resulted in a moderation to immediate growth expectations, but

we see the long-term drivers as fully intact. Spirent is very well

capitalised, with over USD200m of net cash on its balance

sheet.

Gresham Technologies (GBP118m market cap)

Gresham is a software business tightly focussed on the market

for advanced data reconciliation. Selling primarily into the

financial services sector, Gresham addresses the ever-increasing

need to fully reconcile large, complex datasets, often across

multiple systems and in real time. This has allowed them to

consistently take market share with their long-term

subscription-based products around the world. We see the growth and

valuation case as highly attractive and, along with Spirent

(above), an important source of exposure to technology for the

portfolio.

Marshalls (GBP610m market cap)

Marshalls is one of the UK's leading providers of heavy building

materials such as blocks, stone and concrete roofing tiles. It

sells into the new-build housing, commercial, infrastructure and

repair and maintenance markets. The well publicised challenges in

some of these markets in recent months have led to a significant

decline in Marshalls' share price which we believe now represents a

significant opportunity for long-term investors to invest in an

excellent business at a very attractive valuation. The inherent

uncertainty in timing the bottom of the cycle means we have started

the holding at a modest position size, with a view to building it

as the path of recovery becomes clearer.

Summary and Outlook

While inflation in the UK remains stubbornly high, it is hard to

see a short-term catalyst to bring the market back into favour with

investors. However the UK, and smaller companies in particular,

remain very modestly valued compared to both international peers

and their own history. Meanwhile economic conditions do not appear

to be causing significant problems for companies beyond moderately

weaker growth rates in the near term. As such, we see the current

valuation environment as an opportunity for investors with a longer

investment horizon and the patience to wait for the market to

change.

We are pleased with progress on adjusting the shape of the

portfolio and introducing a greater degree of sectoral balance.

Over the coming months we will continue this process at a

considered pace while looking for further opportunities to invest

in good businesses at attractive valuations.

Dan Nickols Lead Manager Matt Cable Fund Manager 1st August

2023

Portfolio Statement

30th June 2023 31st December 2022

Market Market

Value Value % of Net

% of Net Assets

GBP'000 Assets GBP'000

Holdings Holdings

UK Investments

Vp 2,450,000 14,333 10.46 2,450,000 16,170 11.49

Macfarlane 12,680,653 13,695 9.99 17,250,000 17,509 12.44

Colefax 1,605,000 11,636 8.49 1,606,500 9,639 6.85

Treatt 1,281,009 7,994 5.83 2,012,000 12,535 8.90

Hill & Smith 522,465 7,847 5.72 1,246,286 14,606 10.37

Renold 28,745,000 7,819 5.70 30,000,000 6,240 4.43

Telecom Plus 459,113 7,759 5.66 263,070 5,774 4.10

Gamma Communications 640,919 7,319 5.34 640,919 6,935 4.93

Alpha Group International 336,513 7,067 5.16 98,611 1,824 1.30

Carr's 4,750,000 6,840 4.99 4,750,000 5,629 4.00

OSB 1,401,694 6,725 4.91 - - -

Spirax-Sarco Engineering 59,668 6,182 4.51 94,415 10,022 7.12

IMI 292,263 4,790 3.49 292,263 3,764 2.67

Morgan Advanced Materials 1,500,000 4,110 3.00 1,500,000 4,718 3.35

RS 464,401 3,530 2.58 838,870 7,512 5.34

Eleco 4,520,781 3,481 2.54 4,520,781 3,029 2.15

Videndum 479,791 3,320 2.42 500,000 5,370 3.81

Gresham Technologies 2,360,303 3,186 2.32 - - -

Spirent Communications 1,322,052 2,163 1.58 - - -

Marshalls 780,016 1,877 1.37 - - -

Dyson 1,000,000 41 0.03 1,000,000 41 0.03

Castings* - - - 400,000 1,384 0.98

Titon* - - - 1,265,000 886 0.63

Santander UK 10.375% Non Cumulative - - - 400,000 540 0.38

Preferred*

Coral Products * - - - 2,000,000 320 0.23

Costain* - - - 41 - -

Total Investments 131,714 96.09 134,447 95.50

Net current assets 5,367 3.91 6,336 4.50

Net Assets 137,081 100.00 140,783 100.00

Unless otherwise specified, the actual holdings are, in each

case, of ordinary shares or stock units and of the nominal value

for which listing has been granted.

*Sold during the period to 30th June 2023.

Risks and uncertainties Principal risks

The principal and emerging risks and uncertainties that could

have a material impact on the Company's performance have not

changed from those set out on pages 22 and 23 of the Annual Report

for the year ended 31st December 2022.

Cautionary statement

This Half Yearly Report contains forward-looking statements that

involve risk and uncertainty. These have been made by the Directors

in good faith based on the information available to them at the

time of their approval of this Report.

The Board is mindful of the continuing uncertain outlook for the

global economy arising from the effects of the COVID-19 pandemic

and, more recently, the conflict between Russia and Ukraine and

significant increases in inflation. The Company's assets and the

potential level of revenue derived from the portfolio remain

exposed to macroeconomic deteriorations. The Directors, having

considered the nature and liquidity of the portfolio, the Company's

investment objectives and projected income and expenditure, are

satisfied that the Company has adequate resources to continue in

operational existence for the foreseeable future and is financially

sound.

Directors' Statement of Responsibility for the Half Yearly

Financial Report

The Directors are responsible for preparing the Half Yearly

financial report in accordance with applicable law and

regulations.

The Directors confirm that to the best of their knowledge:

-- the condensed set of financial statements has been prepared

in accordance with UK adopted InternationalAccounting Standard 34

"Interim Financial Reporting"; and

-- the Half Yearly management report includes a fair review of

the information required by DTR 4.2.7R and4.2.8R. This report was

approved on 1st August 2023.

David M Best Chairman

Statement of Comprehensive Income

for the six months ended 30th June 2023

Six months ended 30th June Six months ended 30th June Year ended 31st December

2023 2022 2022

Notes

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment income 2 2,606 - 2,606 2,473 - 2,473 3,633 - 3,633

Other operating income 2 40 - 40 1 - 1 19 - 19

Total income 2,646 - 2,646 2,474 - 2,474 3,652 - 3,652

Gains/(losses) through fair - 1,912 1,912 - (43,713) (43,713) - (56,774) (56,774)

value

2,646 1,912 4,558 2,474 (43,713) (41,239) 3,652 (56,774) (53,122)

Expenses

Investment management fee 423 - 423 - - - 175 - 175

Other expenses 175 107 282 377 38 415 767 181 948

598 107 705 377 38 415 942 181 1,123

Profit/(loss) before tax 2,048 1,805 3,853 2,097 (43,751) (41,654) 2,710 (56,955) (54,245)

Tax - - - - - - - - -

Profit/(loss) for the period 2,048 1,805 3,853 2,097 (43,751) (41,654) 2,710 (56,955) (54,245)

Earnings per share

34.1p 30.1p 64.2p 28.9p (603.0)p (574.1)p 38.9p (818.2)p (779.3)p

Return per Ordinary Share

Return per share is calculated using the weighted average number

of Ordinary shares in issue during the period ended 30th June 2023

of 5,999,351 (30th June 2022: 7,255,868, 31st December 2022:

6,960,445).

The total column of this statement represents the Statement of

Comprehensive Income, prepared in accordance with International

Financial Reporting Standards as adopted by the UK. The

supplementary revenue return and capital return columns are both

prepared under guidance published by the Association of Investment

Companies. All items in the above statement are those of the single

entity and derive from continuing operations.

The gain for the period disclosed above represents the Company's

total Comprehensive Income. The Company does not have any other

Comprehensive Income.

An interim dividend of 11.75p (2022: 10.75p) per share and

amounting to GBP682,555 (calculated as at 26th July 2023) (2022:

GBP761,191) is payable on 25th September 2023 to shareholders on

the register as at 25th August 2023 (ex-dividend 24th August

2023).

The financial information contained in this Half Yearly

Financial Report does not constitute statutory accounts as defined

in Sections 434 - 436 of the Companies Act 2006. The information

for the six months to 30th June 2023 has not been audited.

The information for the year ended 31st December 2022 has been

extracted from the latest published audited accounts which have

been filed with the Registrar of Companies. The report of the

auditors on those accounts contained no qualification or statement

under Section 498 (2) or (4) of the Companies Act 2006.

Statement of Financial Position

as at 30th June 2023

30th June 30th June 31st December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Non-current assets

Investments - fair value through profit or loss 131,714 162,608 134,447

131,714 162,608 134,447

Current assets

Other receivables 1,098 1,312 561

Cash and cash equivalents 4,755 11,156 6,039

5,853 12,468 6,600

Total assets 137,567 175,076 141,047

Current liabilities

Other payables 486 184 264

486 184 264

Total assets less current liabilities 137,081 174,892 140,783

Net assets 137,081 174,892 140,783

Equity attributable to equity holders

Called up share capital 1,468 1,786 1,542

Capital redemption reserve 787 469 713

Capital reserve 85,247 75,938 67,191

Revaluation reserve 46,993 94,246 69,032

Revenue reserve 2,586 2,453 2,305

Total equity 137,081 174,892 140,783

Net asset value per share

Ordinary shares 2,333.8p 2,447.9p 2283.2p

The number of Ordinary shares in issue as at 30th June 2023 was

5,873,611 (30th June 2022: 7,144,458, 31st December 2022:

6,165,989).

Statement of Changes in Equity

for the six months ended 30th June 2023

Share Capital redemption reserve Capital Revenue

capital reserve Revaluation reserve reserve

GBP'000 Total

GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

For the six months ended 30th June 2023

Balance at 31st December 2022 1,542 713 67,191 69,032 2,305 140,783

Profit for the period - - 23,844 (22,039) 2,048 3,853

Total recognised income and expense 1,542 713 91,035 46,993 4,353 144,636

Ordinary shares bought back and (74) 74 (5,788) - - (5,788)

cancelled

Dividends (Note 3) - - - - (1,767) (1,767)

Balance at 30th June 2023 1,468 787 85,247 46,993 2,586 137,081

Capital redemption

Share reserve Capital Revenue

capital reserve Revaluation reserve reserve

GBP'000 Total

GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

For the six months ended 30th June 2022

Balance at 31st December 2021 1,842 413 81,410 137,959 2,108 223,732

Loss for the period - - (38) (43,713) 2,097 (41,654)

Total recognised income and expense 1,842 413 81,372 94,246 4,205 182,078

Ordinary shares bought back and (56) 56 (5,434) - - (5,434)

cancelled

Dividends (Note 3) - - - - (1,752) (1,752)

Balance at 30th June 2022 1,786 469 75,938 94,246 2,453 174,892

Capital redemption

Share reserve Capital Revaluation Revenue

capital reserve reserve reserve

GBP'000 Total

GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

For the six months ended 31st December

2022

Balance at 31st December 2021 1,842 413 81,410 137,959 2,108 223,732

Loss for the period - - 11,972 (68,927) 2,710 (54,245)

Total recognised income and expense 1,842 413 93,382 69,032 4,818 169,487

Ordinary shares bought back and cancelled (300) 300 (10,838) - - (10,838)

Tender offer - - (15,111) - - (15,111)

Tender offer costs - - (242) - - (242)

Dividends (Note 3) - - - - (2,513) (2,513)

Balance at 31st December 2022 1,542 713 67,191 69,032 2,305 140,783

Statement of Cash Flows

for the six months ended 30th June 2023

30th June 30th June 31st December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cashflows from operating activities

Profit/(loss) before tax 3,853 (41,654) (54,245)

Adjustments for:

Gains/(losses) on investments (1,912) 43,713 56,774

Purchases of investments (25,309) (9,924) (24,439)

Proceeds on disposal of investments 29,954 - 29,615

Operating cash flows before movements in working capital 6,586 (7,865) 7,705

(Increase)/decrease in receivables (537) (671) 80

Increase in payables 222 117 197

Net cash flows from operating activities 6,271 (8,419) 7,982

Cashflows from financing activities

Ordinary shares bought back and cancelled (5,788) (5,434) (10,838))

Tender offer - - (15,111)

Tender costs paid - - (242)

Dividends paid (1,767) (1,752) (2,513)

Net cash used in financing activities (7,555) (7,186) (28,704)

Net decrease in cash and cash equivalents (1284) (15,605) (20,722)

Cash and cash equivalents at beginning of period 6,039 26,761 26,761

Cash and cash equivalents at end of period 4,755 11,156 6,039

Notes to the Half Yearly Financial Report

for the six months ended 30th June 2023

1. Accounting Standards

The half yearly financial statements for the period ended 30th June 2023 have been prepared in accordance with the

Disclosure and Transparency Rules sourcebook of the Financial Conduct Authority and with the UK adopted International

Accounting Standard 34 "Interim Financial Reporting". The accounting policies applied and methods of computation in

this interim statement are consistent with those used in the Company's latest published annual financial statements.

Significant accounting policies

a. Accounting convention

The accounts are prepared under the historical cost basis, except for the measurement of fair value of investments.

b. Adoption of new IFRS standards

There have been minor amendments to IAS 16, 37 and 41 and IFRS 4, 7, 9 and 16 which were effective for annual periods

beginning on or after 1st January 2022 and have not had any material impact on the accounts. Amendments to IAS 1

(Disclosure of Accounting Policies), IAS 8 (Definition of Accounting Estimates), IFRS 4 (Extension of IFRS 9 Deferral)

and IFRS 17 (Insurance Contracts) are effective for annual periods beginning on or after 1st January 2023 and are not

anticipated to have any material impact on the accounts.

c. Income

Dividend income is included in the financial statements on the ex-dividend date. All other income is included on an

accruals basis.

d. Expenses

All expenses are accounted for on an accruals basis. Expenses are charged through the revenue account except as

follows:

-- Expenses which are incidental to the acquisition of an investment are included within the cost of the

investment.

-- Expenses which are incidental to the disposal of an investment are deducted from the disposal proceeds of

the investment

e. Taxation

The charge for taxation is based on the net revenue for the year. Deferred taxation is recognised in respect of all

timing differences that have originated but not reversed at the statement of financial position date. Investment trusts

which have approval under section 1158 of the Corporation Tax Act 2010 are not liable for taxation on capital gains.

f. Dividends

Dividends payable to shareholders are recognised in the financial statements when they are paid or, in the case of

final dividends, when they are approved by the shareholders.

g. Cash and cash equivalents

Cash comprises cash in hand and deposits payable on demand. Cash equivalents are short-term highly liquid investments

that are readily convertible to known amounts of cash.

h. Investments

Investments are classified as fair value through profit or loss as the Company's business is investing in financial

assets

with a view to profiting from their total return in the form of interest, dividends or capital growth.

Changes in the value of investments held at fair value through profit or loss and gains and losses on disposal are

recognised in the Statement of Comprehensive Income as "Gains or losses on investments held at fair value through

profit or loss". Also included within this heading are transaction costs in relation to the purchase or sale of

investments.

All investments, classified as fair value through profit or loss, are further categorised into the following fair value

hierarchy:

Level 1 - Unadjusted prices quoted in active markets for identical assets and liabilities.

Level 2 - Having inputs other than quoted prices included within Level 1 that are observable for the asset or

liability,

either directly (i.e. as prices) or indirectly (i.e. derived from prices).

Level 3 - Having inputs for the asset or liability that are not based on observable data.

Investments traded on active stock exchange markets are valued at their fair value, which is determined by the quoted

market bid price at the close of business at the statement of financial position date. Where trading in a security is

suspended, the investment is valued at the Board's estimate of its fair value.

Unquoted investments are valued by the Board at fair value using the International Private Equity and Venture Capital

Valuation Guidelines.

2. Income

30th June 30th June

31st December 2022

2023 2022

GBP'000

GBP'000 GBP'000

Income from investments:

Franked investment income 2,606 2,473 3,633

Interest 40 1 19

Total income 2,646 2,474 3,652

3. Dividends

30th June 30th June

31st December 2022

2023 2022

GBP'000

GBP'000 GBP'000

Amounts recognised as distributions to equity holders in the relevant period:

Interim dividend for the year ended 31st December 2022 of 10.75p per share

- - 761

Final dividend for the year ended 31st December 2022 of 29.25p per share (year

ended 31st December 2021: 24.0p)

1,767 1,752 1,752

1,767 1,752 2,513

30th June

2023

GBP'000

Proposed interim dividend of 11.75p per share 683

This proposed interim dividend was approved by the Board on 1st August 2023, has been calculated based on shares in

issue at 26th July 2023, being the latest practicable date prior to publication of this report and has not been

included as a liability at 30th June 2023.

4. Valuation of financial instruments

IFRS 13 requires the Company to classify fair value measurements using a fair value hierarchy that reflects the

significance of inputs used in making the measurements. The valuation techniques used by the Company are explained in

the accounting policies note 1 Investments, as set out in the Company's Annual Report and Financial Statements for the

year ended 31st December 2022.

The fair value hierarchy has the following levels:

Level 1 - Unadjusted prices quoted in active markets for identical assets and liabilities.

Level 2 - Having inputs other than quoted prices included within Level 1 that are observable for the asset or

liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).

Level 3 - Having inputs for the asset or liability that are not based on observable data.

Level 1 Level 2 Level 3 Total

30th June 2023

GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair value through profit or loss

UK Equity Listed 94,351 - - 94,351

AIM traded stocks 37,32s2 - - 37,322

Unlisted stock - 41 - 41

Net fair value 131,673 41 - 131,714

Level 1 Level 2 Level 3 Total

30th June 2022

GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair value through profit or loss

UK Equity Listed 135,871 - - 135,871

AIM traded stocks 26,735 - - 26,735

Unlisted stock - 2 - 2

Net fair value 162,606 2 - 162,608

Level 1 Level 2 Level 3 Total

31st December 2022

GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair value through profit or loss

UK Equity Listed 105,533 - - 105,533

AIM traded stocks 28,873 - - 28,873

Unlisted stock - 41 - 41

Net fair value 134,406 41 - 134,447

There were no transfers between Level 1 and Level 2 during the periods.

5. Related Party Transactions

Under IAS 24, the Directors have been identified as related parties. Their fees and interests for the year ended 31st

December 2022 have been disclosed in the Directors' Annual Remuneration Report within the 2022 Annual Report and

Financial Statements.

6. Going Concern

The Company's assets comprise mainly realisable equity securities and cash and the value of its assets is greater than

its liabilities. Additionally, after reviewing the Company's budget, including the current financial resources and

projected expenses for the next twelve months and its medium-term plans, the Directors believe that the Company's

resources are adequate to continue in business for the foreseeable future.

Based on the above, the Board is satisfied that it is appropriate to continue to adopt the going concern basis in

preparing the financial statements. The Board reported on the principal risks and uncertainties faced by the Company in

the Annual Report and Financial Statements for the year ended 31st December 2022.

Company Information

DIRECTORS D. M. BEST (Chairman)

Dr A. J. HOSTY

S. J. B. KNOTT

J. B. ROPER

M. H. VAUGHAN

REGISTERED OFFICE Hamilton Centre

Rodney Way

Chelmsford CM1 3BY

WEBSITE www.jupiteram.com/rightsandissues

JUPITER UNIT TRUST MANAGERS LIMITED

The Zig Zag Building

INVESTMENT MANAGER/ALTERNATIVE INVESTMENT FUND MANAGER

70 Victoria Street

London SW1E 6SQ

investmentcompanies@jupiteram.com

SECRETARY/ADMINISTRATOR APEX FUND ADMINISTRATION SERVICES (UK) LIMITED

(FORMERLY MAITLAND ADMINISTRATION SERVICES LTD)

Hamilton Centre

Rodney Way

Chelmsford CM1 3BY

SOLICITORS EVERSHEDS SUTHERLAND

1 Wood Street

London EC2V 4DJ

AUDITOR BEGBIES

9 Bonhill Street

London EC2A 4DJ

REGISTRARS LINK GROUP

Central Square

29 Wellington Street

Leeds LS1 4DL

BROKER FINNCAP LIMITED

One Bartholomew Close

London EC1A 7BL

CUSTODIAN/DEPOSITARY NORTHERN TRUST COMPANY

50 Bank Street

Canary Wharf

London E14 5NT

Registration Details

Company Registration Number: 00736898 (Registered in England)

SEDOL number: 0739207

ISIN number: GB0007392078

London Stock Exchange (EPIC) Code: RIII

Global Intermediary Identification Number (GIIN) I2ZVNY.99999.SL.826

Legal Entity Identifier (LEI): 2138002AWAM93Z6BP574

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB0007392078

Category Code: IR

TIDM: RIII

LEI Code: 2138002AWAM93Z6BP574

OAM Categories: 1.2. Half yearly financial reports and audit reports/limited reviews

Sequence No.: 261671

EQS News ID: 1693187

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1693187&application_name=news

(END) Dow Jones Newswires

August 01, 2023 11:26 ET (15:26 GMT)

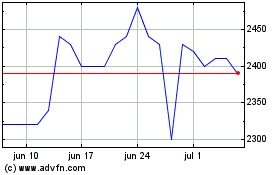

Rights & Issues Investment (LSE:RIII)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Rights & Issues Investment (LSE:RIII)

Gráfica de Acción Histórica

De May 2023 a May 2024