TIDMSSIT

RNS Number : 9025T

Seraphim Space Investment Trust PLC

20 November 2023

SERAPHIM SPACE INVESTMENT TRUST PLC

(the "Company" or "SSIT")

Q1 Results

Seraphim Space Investment Trust plc (LSE: SSIT), the world's

first listed SpaceTech investment company, announces its first

quarter results for the three-month period ended 30 September

2023.

The full Q1 report can be found here. A summary is set out

below.

Financial Summary

30-Sep-23 30Jun-23 Change 30-Sep-22 Change

---------------------- ---------- --------- ------ --------- ------

NAV GBP228.9m GBP222.4m 2.9% GBP250.3m -8.5%

NAV per share 96.51p 92.90p 3.9% 104.57p -7.7%

Portfolio valuation GBP199.9m GBP187.4m 6.6% GBP207.0m -3.5%

Portfolio fair value

vs. cost 102.8% 98.5% - 110.9% -

Market capitalisation GBP102.6m GBP64.6m 58.7% GBP144.7m -29.1%

Share price 43.3p 27.0p 60.2% 60.5p -28.5%

-Discount/+premium -55.2% -70.9% - -42.2% -

Liquid resources GBP29.7m GBP35.3m -15.8% GBP43.8m -32.2%

---------------------- ---------- --------- ------ --------- ------

Q1 Highlights

-- Further GBP4.1m deployed, across two new investments and three follow-on investments.

-- Portfolio valuation up GBP12.4m to GBP199.9m, driven by

additional investments, unrealised fair value net gains and an

unrealised FX gain.

-- Main driver of underlying fair value increase was D-Orbit,

reflective of a transaction that reached a conditional completion

post period, pending regulatory approvals .

-- Fair value weighted-average cash runway of private portfolio

(98% of fair value) from 30 September 2023 is 18 months.

-- 86% of fair value of private holdings has a cash runway to 30

September 2024 or beyond.

-- Cash balance of GBP29.7m at 30 September 2023.

Transactions C ompleted D uring Q1

Cost

Company Segment Sub-sector HQ Type (GBPm)

-------------------------- --------- ----------------- --- --------------- -------

ALL.SPACE Downlink Ground terminals UK Follow-on 2.8

New

2 early stage investments investment 0.9

2 early stage investments Follow-on 0.5

Total 4.1

------------------------------------------------------------------------------ -------

Will Whitehorn, Chair of Seraphim Space Investment Trust plc,

commented : "Despite the global geopolitical and macroeconomic

environment, the space sector continues to grow at an unprecedented

rate due to the critical nature of technology and insight it

provides. The Company's portfolio addresses two of the biggest

threats we will collectively face over this decade: firstly,

geopolitical tensions and the ever-present potential for the

escalation of war and, secondly, the growing symptoms of climate

change. Our portfolio companies are delivering innovative ways to

gather unique datasets about our planet in high resolution from

space and then applying AI to create insightful solutions.

Over the period we have made two new and three follow-on

investments and have adequate cash reserves to support portfolio

fundraisings as required in the year ahead. The strength of our

existing portfolio and our focused investment strategy, combined

with the positive start to the new financial year, gives us

confidence that SSIT is well positioned to deliver on its core

objective of generating capital growth."

Mark Boggett, Chief Executive Officer, Seraphim Space Manager

LLP, said: "During the first quarter of the year we have continued

to focus on the highest calibre companies as part of our deployment

strategy. We are confident the Company's cash reserves are

sufficient to support this more selective approach through

2024.

Industry data for Q3 CY23 has shown further signs of recovery in

the SpaceTech sector with an increase in total investment, both

globally and in the US, and M&A at an all-time high. There has

also been a return to growth investment, with more capital deployed

in later-stage SpaceTech businesses and larger growth rounds. With

the secular trends relating to global security, food security,

climate change and sustainability expected to accelerate, we

believe the Company is well-positioned to take advantage of the

resultant opportunities. We anticipate that demand for the products

and services of the Company's portfolio companies, particularly

from governments, should result in the portfolio delivering strong

growth metrics for the reminder of the year."

Analyst and Investor Presentations

There will be a webinar for equity analysts at 09:00 (UK time)

today and an online presentation for retail investors at 10:00 (UK

time) today. To register for either event, please contact SEC

Newgate by email at seraphim@secnewgate.co.uk .

Both webinars will be hosted by the Seraphim Space Manager LLP's

CEO, Mark Boggett, and CIO, James Bruegger.

- Ends -

Media Enquiries

Seraphim Space Manager LLP (via SEC Newgate)

Mark Boggett, CEO / James Bruegger, CIO / Rob

Desborough

SEC Newgate (Communications advisers) seraphim@secnewgate.co.uk

Clotilde Gros / Bob Huxford / George Esmond +44 (0) 20 3757 6767

Deutsche Numis

Mark Hankinson / Gavin Deane / Neil Coleman +44 (0) 20 7545 8000

J.P. Morgan Cazenove

William Simmonds / Jérémie Birnbaum

/ Rupert Budge +44 (0) 20 7742 4000

Ocorian Administration (UK) Limited seraphimteam@ocorian.com

Lorna Zimny +44 (0) 28 9078 5880

Notes to Editors

About Seraphim Space Investment Trust plc

Seraphim Space Investment Trust plc (the "Company") is the

world's first listed fund focused on SpaceTech. The Company seeks

exposure predominantly to early and growth stage private financed

SpaceTech businesses that have the potential to dominate globally

and that are sector leaders with first mover advantages in areas

such as climate, communications, mobility and cyber security.

The Company is listed on the Premium Segment of the London Stock

Exchange.

Further information is available at:

https://investors.seraphim.vc .

About Seraphim Space Manager LLP

Seraphim Space Manager LLP ("Seraphim Space" or the "Manager")

is based in the UK and manages Seraphim Space Investment Trust

plc.

Further information is available at www.seraphim.vc .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFEADFNFDFDFFA

(END) Dow Jones Newswires

November 20, 2023 02:00 ET (07:00 GMT)

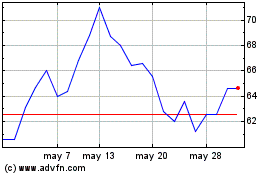

Seraphim Space Investment (LSE:SSIT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Seraphim Space Investment (LSE:SSIT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025