TIDMTMTA

RNS Number : 2124X

TMT Acquisition PLC

19 December 2023

19 December 2023

TMT Acquisition plc

("TMT Acquisition" or the "Company")

Unaudited Interim Results

TMT Acquisition (LSE: TMTA), the investment business established

to pursue opportunities in the technology, media and telecom

sector, today announces its unaudited interim results for the

period ended 30 September 2023.

Financial Highlights

-- Net cash and financial assets as at 30 September 2023 of

GBP4,736,308 (31 March 2023: GBP4,804,060)

-- Net assets as at 30 September 2023 of GBP4,727,613 (31 March 2023: GBP4,717,188)

-- Operating profit and profit before tax of GBP10,425 (31 March 2023: loss of GBP60,087)

-- Basic and diluted earnings per share of 0.04 pence (31 March

2023: loss per share of 0.22 pence)

Harry Hyman, Non-Executive Chairman of TMT Acquisition,

said:

"As announced on 31 October 2023, the directors of Belluscura

Plc and the directors of TMT Acquisition announced that they had

reached an agreement on the terms of a recommended all share offer

by Belluscura for TMT Acquisition, to be affected by means of a

takeover offer within the meaning of Part 28 of the Companies Act

2006 (the "Offer"). Under the terms of the Offer, holders of TMT

Acquisition shares will be entitled to receive 3 new Belluscura

shares in exchange for every 4 TMT Acquisition shares.

"Based on a closing price of 28.0 pence per Belluscura Share on

30 October 2023 (being the Latest Practicable Date), the Offer will

value each TMT Acquisition Share at approximately 21.0 pence, a

premium of 23.53% to TMT Acquisition's closing share price of 17.0

pence on 2 October 2023 being the closing share price on the date

prior to the announcement of the Potential Offer and a premium of

20.00% to TMT Acquisition's closing share price of 17.5 pence on

the Latest Practicable Date, valuing the entire issued and to be

issued share capital of TMT Acquisition at approximately GBP5.78

million.

"The independent director of TMT Acquisition, Paul Tuson,

believes the Offer to represent a n attractive valuation, providing

the opportunity for all TMT Acquisition Shareholders to participate

in the significant future potential upside of the combination

through the ownership of Belluscura Shares with the structure and

key terms of the Offer being attractive for Belluscura

Shareholders. In conjunction with Belluscura's recent fundraising,

the Offer adds a significant injection of working capital into

Belluscura, enabling it to capitalise on its burgeoning opportunity

in a fast-growing global market. The Offer also enhances

Belluscura's ability to leverage its position as a provider of

innovative oxygen enrichment technology.

"Given the introduction and significant pre-launch demand

expressed for Belluscura's DISCOV-R product, building on top of the

continued sales progress of the X-PLOR, t he directors of

Belluscura and the directors of TMT Acquisition believe the Offer

has compelling strategic logic which significantly increases

Belluscura's ability to execute on its burgeoning sales pipeline

and strategy, whilst creating considerable potential value for all

shareholders of both TMT Acquisition and Belluscura.

"The Company is pleased to confirm it is in receipt of

irrevocable undertakings and a letter of intent to accept the Offer

from TMT Acquisition Shareholders holding, in aggregate, 16,805,418

TMT Acquisition Shares (representing approximately 61.11% of the

issued share capital of TMT Acquisition as at the date of this

announcement).

"It was expected that the offer document, containing the

conditions and further terms to which the Offer will be subject and

the expected timetable, as well as the actions to be taken by TMT

Acquisition Shareholders (the "Offer Document"), would be posted to

TMT Acquisition Shareholders within 28 days of 31 October 2023.

However, with the consent of the Panel on Takeovers and Mergers,

and while the terms of the Offer remain unchanged, there is a short

delay in posting the Offer Document to TMT Acquisition

Shareholders. As announced on 28 November, it is anticipated that

it will shortly post the Offer Document to TMT Acquisition

Shareholders.

!I would like to take this opportunity to thank all my fellow

shareholders for their continued support and look forward to

successfully completing this transaction."

- Ends -

For further information please contact:

TMT Acquisition plc via Dowgate

Harry Hyman

Guild Financial Advisory Limited - david.floyd@guildfin.co.uk

Financial Advisor

David Floyd

Dowgate Capital Limited - Broker

Nicholas Chambers +44 (0)20 3903 7715

Interim Management Report

During the period ended 30 September 2023, the Company recorded

a net profit of GBP10,425 being the interest income received less

the minimal running costs of the Company. The Directors draw no

salary, so any ongoing costs relate to administrative expenses and

listing fees.

As at 30 September 2023, current assets were approximately

GBP4.75 million.

Harry Hyman

Non-Executive Chairman

18 December 2023

Statement of Comprehensive Income

For the period ended 30 September 2023

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 Sep 30 Sep 31 Mar

23 22 23

GBP GBP

----------------------------------- ------------ ------------ ---------

Continuing operations

Administrative expenses (44,736) (45,461) (94,917)

------------ ------------ ---------

Operating loss before

tax (44,736) (45,461) (94,917)

------------ ------------ ---------

Finance income 55,161 - 34,830

Taxation - - -

------------

Total comprehensive profit/(loss)

for the period attributable

to the equity owners 10,425 (45,461) (60,087)

============ ============ =========

Earnings/(loss) per share

Basic and diluted (pence) 0.04 (0.17) (0.22)

------------ ------------ ---------

The above results were derived from continuing operations.

Statement of Financial Position

As at 30 September 2023

Unaudited Unaudited Audited

As at As at As at

30 Sep 30 Sep 31 Mar

23 22 23

GBP GBP GBP

------------------------------- ------------ ---------- -----------

ASSETS

Current assets

Financial assets at amortised

cost - - 4,283,055

Trade and other receivables 14,509 13,582 9,000

Cash and cash equivalents 4,736,308 4,750,869 466,549

Total current assets 4,750,817 4,764,451 4,758,604

------------ ---------- -----------

Total assets 4,750,817 4,764,451 4,758,604

------------ ---------- -----------

LIABILITIES

Current liabilities

Trade and other payables 23,204 32,637 41,416

Total current liabilities 23,204 32,637 41,416

------------ ---------- -----------

Total liabilities 23,204 32,637 41,416

------------ ---------- -----------

NET ASSETS 4,727,613 4,731,814 4,717,188

============ ========== ===========

EQUITY

Share capital 1,100,000 1,100,000 1,100,000

Share premium 3,778,807 3,778,807 3,778,807

Accumulated losses (151,194) (146,993) (161,619)

------------ ---------- -----------

TOTAL EQUITY 4,727,613 4,731,814 4,717,188

============ ========== ===========

The Interim Report and Financial Statements were approved by the

Board of Directors and authorised for issue on 18 December

2023.

Harry Hyman

Non-Executive Chairman

Statement of Changes in Equity

For the period ended 30 September 2023

Share Capital Share Accumulated Total Equity

Premium Losses

GBP GBP GBP GBP

------------------------- -------------- ----------- ------------ -------------

As at 31 March 2022 1,100,000 3,778,807 (101,532) 4,777,275

Comprehensive Income

Loss for the period - - (60,087) (60,087)

As at 31 March 2023 1,100,000 3,778,807 (161,619) 4,717,188

-------------- ----------- ------------ -------------

Comprehensive Income

Profit for the period - - 10,425 10,425

As at 30 September 2023 1,100,000 3,778,807 (151,194) 4,727,613

============== =========== ============ =============

Statement of Cash Flows

For the period ended 30 September 2023

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 Sep 30 Sep 31 March

23 22 23

GBP GBP GBP

---------------------------------------- ------------ ------------ ------------

Cash flow from operating activities

Operating profit/(loss) 10,425 (45,461) (60,087)

Adjustments for non-cash/non-operating

items:

Finance income (55,161) - (34,830)

------------

Cash outflow from operating

activities (44,736) (45,461) (94,917)

------------

Changes in working capital

Increase in trade and other

receivables (5,509) (7,020) (2,438)

(Decrease)/increase in trade

and other payables (18,212) (711) 8,069

------------ ------------ ------------

Net cash used in operating

activities (68,457) (53,192) (89,286)

------------ ------------ ------------

Cash flows from investing activities

Interest received 55,161 - 1,775

Investments in financial assets

at amortised cost - - (4,250,000)

Proceeds from disposal of financial 4,283,055 - -

assets at amortised cost

------------ ------------ ------------

Net cash generated from/(used

in) investing activities 4,338,216 - (4,248,225)

------------ ------------ ------------

Net increase/(decrease) in

cash and cash equivalents 4,269,759 (53,192) (4,337,511)

Cash and cash equivalents at

the beginning of the period/year 466,549 4,804,060 4,804,060

------------ ------------ ------------

Cash and cash equivalents at

the end of the period/year 4,736,308 4,750,869 466,549

============ ============ ============

Notes to the Interim Financial Statements

1. Company information

TMT Acquisition is a public company listed on the London Stock

Exchange. The Company is domiciled in England and its registered

office is 15 Fetter Lane, London, United Kingdom, EC4A 1BW.

The principal activity of the Company is that of identifying and

acquiring investment projects.

2. Accounting policies

2.1 Basis of preparation

These financial statements of the Company have been prepared on

a going concern basis in accordance with UK-adopted International

Accounting Standards (IFRS).

Measurement bases

The financial statements have been prepared under the historical

cost convention. Historical cost is generally based on the fair

value of the consideration given in exchange for assets.

The preparation of the financial statements in compliance with

UK-adopted IFRS requires the use of certain critical accounting

estimates and management judgements in applying the accounting

policies. The significant estimates and judgements that have been

made and their effect is disclosed in note 3.

2.2. Significant accounting policies

The accounting policies applied in preparing the Interim

Financial Statements are consistent with those in the prior year

Annual Report, which is available at www.tmtacquisition.com .

3. Significant judgments and estimates

The preparation of the Company's financial statements under IFRS

requires the Directors to make estimates and assumptions that

affect the reported amounts of assets and liabilities at the

statement of financial position date, amounts reported for revenues

and expenses during the period, and the disclosure of contingent

liabilities, at the reporting date.

Estimates and judgements are continually evaluated and are based

on historical experiences and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

The Directors consider that there are no critical accounting

judgements or estimates relating to the financial information of

the Company.

4. Earnings per share

The earnings per share has been calculated using the profit for

the period and the weighted average number of ordinary shares

entitled to dividend rights which were outstanding during the

period, as follows:

30 Sep 30 Sep 31 March

2023 2022 2023

----------------------------------- ----------- ----------- -----------

Profit/(loss) for the period/year

attributable to equity holders

of the Company (GBP) 10,425 (45,461) (60,087)

Weighted average number of

ordinary shares 27,500,000 27,500,000 27,500,000

----------- ----------- -----------

Earnings/(loss) per share

(pence) 0.04 (0.17) (0.22)

=========== =========== ===========

5. Financial assets

30 Sep 30 Sep 31 March

2023 2022 2023

GBP GBP

Fixed term deposits - - 4,283,055

- - 4,283,055

======== ============================== ==========

In December 2022, the company deposited GBP4,250,000 in a fixed

term deposit account with Lloyds Bank Plc. The account bears

interest of 2.5% per annum. This was accounted for as a financial

asset at amortised cost under IFRS 9, and no impairment to the

carrying amount is recognised.

The duration for which the deposit is held, and interest

accumulated is 6 months from commencement. During the period, the

interest accrued over the period was paid along with the repayment

of the initial deposit.

6. Share capital

Allotted and issued

Number of Share Share Premium

shares Capital GBP

GBP

----------------------------- ------------ ----------- --------------

Issued and fully paid

Ordinary shares of GBP0.04

each 27,500,000 1,100,000 3,778,807

------------ ----------- --------------

As at 31 March 2023 and

30 September 2023 27,500,000 1,100,000 3,778,807

============ =========== ==============

7. Subsequent events

On 31 October 2023, the directors of Belluscura and the

directors of TMT Acquisition announced that they had reached an

agreement on the terms of a recommended all share offer by

Belluscura for TMT Acquisition, to be effected by means of a

takeover offer within the meaning of Part 28 of the Companies Act

2006. Under the terms of the Offer, holders of TMT Acquisition

shares will be entitled to receive 3 new Belluscura shares in

exchange for every 4 TMT Acquisition shares.

Based on a closing price of 28.0 pence per Belluscura Share on

30 October 2023 (being the Latest Practicable Date), the Offer will

value each TMT Acquisition Share at approximately 21.0 pence, a

premium of 23.53% to TMT Acquisition's closing share price of 17.0

pence on 2 October 2023 being the closing share price on the date

prior to the announcement of the Potential Offer and a premium of

20.00% to TMT Acquisition's closing share price of 17.5 pence on

the Latest Practicable Date, valuing the entire issued and to be

issued share capital of TMT Acquisition at approximately GBP5.78

million.

The Company is pleased to confirm it is in receipt of

irrevocable undertakings and a letter of intent to accept the Offer

from TMT Acquisition Shareholders holding, in aggregate, 16,805,418

TMT Acquisition Shares (representing approximately 61.11% of the

issued share capital of TMT Acquisition).

As announced on 28 November, it was expected that the offer

document, containing the conditions and further terms to which the

Offer will be subject and the expected timetable, as well as the

actions to be taken by TMT Acquisition Shareholders (the "Offer

Document"), would be posted to TMT Acquisition Shareholders within

28 days of 31 October 2023. However, with the consent of the Panel

on Takeovers and Mergers, and while the terms of the Offer remain

unchanged, there is a short delay in posting the Offer Document to

TMT Acquisition Shareholders. It is anticipated that the Offer

Document will be posted to TMT Acquisition Shareholders

shortly.

8. Approval of the Interim Report

The Interim Report, which includes the Interim Financial

Statements, were approved by the Board of Directors on 18 December

2023.

9. Availability of the Interim Report

The results for the period end 30 September 2023 will be

available shortly on the Company's website: www.tmtacquisition.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRBDDISBDGXI

(END) Dow Jones Newswires

December 19, 2023 02:00 ET (07:00 GMT)

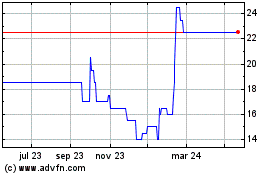

Tmt Acquisition (LSE:TMTA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Tmt Acquisition (LSE:TMTA)

Gráfica de Acción Histórica

De May 2023 a May 2024