TIDMTUN

RNS Number : 0713A

Tungsten West PLC

19 May 2023

The following amendments have been made to the Convertible Loan

Notes Documentation announcement released by Tungsten West Plc on

19 May 2023 at 7am under RNS No 9607Z

In the Expected Timetable of Principal Events table:

The Record Date for entitlements under the Open Offer has been

amended to 17 May 2023 and Latest time and date for receipt of

completed Application Forms and payment in full under the Open

Offer and settlement of relevant CREST instructions (as

appropriate) has been amended to 7 June 2023

All other details remain unchanged.

The full amended text is shown below.

19 May 2023

Tungsten West Plc

("Tungsten West", the "Company" or the "Group")

Convertible Loan Notes Documentation

Launch of Open Offer

Posting of Circular and Notice of General Meeting

Tungsten West (AIM:TUN), the mining company focussed on

restarting production at the Hemerdon tungsten and tin mine

("Hemerdon" or the "Project") in Devon in the UK, is pleased to

announce that further to the announcement released on 6 April 2023,

it has executed definitive documentation in respect of the

convertible loan notes.

Overview of the Convertible Loan Notes

-- The Company has raised a total of up to GBP6.95 million

(before expenses) by way of convertible loan notes ("CLNs"), in two

tranches as follows:

(a) an initial tranche of GBP3.975 million to be issued at

completion and following the satisfaction of the conditions

precedent in the Note Purchase Agreement ("Tranche A Notes"). Such

amount comprises a maximum commitment of up to GBP2 million from

funds managed by Lansdowne and up to GBP1.975 million from other

note purchasers; and

(b) an additional tranche ("Tranche B Notes") of GBP2.975

million (comprising a maximum commitment of GBP1 million from funds

managed by Lansdowne and up to GBP1.975 million from the other note

purchasers) following the satisfaction of certain conditions

precedent with the consent of the majority holders of the CLNs

(such consent not to be unreasonably withheld or delayed);

-- In addition, the Company may offer up to a further tranche of

GBP2 million aggregate principal CLNs ("Tranche C Notes") to a

third party procured by Lansdowne, failing which the CLNs may be

offered to the existing Note Purchasers pro rata to their holdings

of CLNs at the time of calculation, in each case with the consent

of the Purchasers of the CLNs (effectively comprising those Note

Purchasers who hold 75 per cent. of the outstanding aggregate

principal amount under the CLNs at the time of the calculation and

with such consent not be unreasonably withheld or delayed). Should

the Tranche C Notes not be taken up by such parties then the

Company may, in the alternative, offer the Tranche C Notes to any

other third party it may procure by itself or through the Joint

Brokers .

-- The CLNs will accrue interest with an effective rate of 20

per cent. per annum compounding every six months with such interest

rounded to the end of the relevant six-month period. All accrued

interest will be payable on Conversion or the Final Termination

Date.

-- The maturity date of the CLNs is 364 days from the date of

the issue of the Tranche A Notes.

-- The Noteholders may convert their CLNs into new Ordinary Shares:

o upon an Equity Raise, at the lesser of 3 pence per share or,

where applicable, a 50 per cent. discount to the offer price of an

Equity Raise; or

o at 3 pence per share upon the occurrence of (i) a Change of

Control, or (ii) the sale of all or substantially all of the assets

of the Group in one or a series of transactions

-- On the Final Termination Date, the CLNs (including any PIK to

be paid on such notes) will convert into new Ordinary Shares at the

lesser of 3 pence per share or, where applicable, a 50 per cent.

discount to the offer price of an Equity Raise

-- The conversion of CLNs held by any Note Purchaser into new

Ordinary Shares shall be subject at all times to a cap of 29.9 per

cent. (including existing shareholders) of the Company's issued

share capital.

-- Upon the occurrence of (i) a Change of Control, or (ii) the

sale of all or substantially all of the assets of the Group, each

Note Purchaser shall be entitled to require the repayment,

redemption or repurchase of all or part of the outstanding CLNs

held by them. Upon redemption, the Company is obliged to pay a sum

equal to two times the principal amount of the relevant tranche of

the CLNs (excluding PIK). The Company does not have a right to

early redemption.

-- The Tranche A Notes are secured with a First Ranking

Debenture over certain assets of the Group.

The above represents an overview of the Convertible Loan Notes.

Further information relating to the CLNs can be found in Part II of

the Circular to be published on the Company's Website later

today.

Related Party Transaction

Baker Steel is a substantial shareholder of the Company (as

defined in the AIM Rules) and it has conditionally agreed to

purchase an aggregate amount of GBP1.2 million of the CLNs pursuant

to the terms of the Note Purchase Agreement on the same terms as

the other Note Purchasers. Baker Steel's participation comprises

the principal amount of GBP600K for the Tranche A Notes and the

principal amount of GBP600K for the Tranche B Notes. Accordingly,

their participation in the Conditional Placing is a related party

transaction pursuant to rule 13 of the AIM Rules.

The Directors consider, having consulted with the Company's

nominated adviser, Strand Hanson, that the terms of subscription

for Convertible Loan Notes by Baker Steel are fair and reasonable

in so far as the Shareholders are concerned.

Launch of Open Offer

Further to the announcement on 6 April 2023, the Company is

offering all qualifying shareholders the opportunity to participate

in the Open Offer from today. The Open Offer will raise up to GBP2

million (assuming full take up of the Open Offer) at an issue price

of 3 pence per new Ordinary Share. Pursuant to the Open Offer, up

to 66,666,666 new Ordinary Shares will be offered to existing

shareholders at the Issue Price on the basis of:

1 Open Offer Share for every 2.7 Ordinary Shares held

The Open Offer will not be underwritten, and any demand not

taken up by qualifying shareholders may be offered in whole or in

part to other interested investors. Any interested party should

contact VSA Capital or Hannam & Partners at the contact details

set out below.

Posting of Circular and Notice General Meeting

The Company is pleased to confirm that a Circular setting out

principal details of the Convertible Loan Notes and Open Offer,

will today be posted.

The Circular contains Notice of the General Meeting which is to

be held at 10.00 a.m. on 8 June 2023. The purpose of the General

Meeting is to grant the Directors sufficient authorities to allot

and issue Ordinary Shares in connection with the Fundraising.

Copies of the Circular and Notice of General Meeting are

available from the Company's website:

https://www.tungstenwest.com/.

The Board considers that the resolutions set out in the Notice

of General Meeting are in the best interests of the Company and of

its shareholders as a whole and unanimously recommends shareholders

to vote in favour of it.

David Cather, Chairman of Tungsten West, commented:

"The GBP6,950,000 fundraise and beginning of the Open Offer

period marks a promising step for the Company in its progress

towards restarting the Hemerdon mine. The intended use of the funds

is to meet near term contractual liabilities and annual

expenditure, as well as financing planning and permitting

activities.

"We continue to work with stakeholders, governmental departments

and organisations, and the local community to ensure funding,

permitting and licensing is in place to develop Hemerdon in

sustainable and cost-effective manner. We look forward to updating

the market on the General Meeting, the closing of funding, and

further updates from Hemerdon in due course."

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Announcement of the Conditional Placing 6 April 2023

Announcement of the launch of Open Offer 19 May 2023

Record Date for entitlements under the Open Offer 6.00 p.m. on 17 May 2023

Posting of this Document, Proxy Form and, to Qualifying 19 May 2023

Non-Crest Shareholders, the Application

Form

Ex-entitlement date of the Open Offer 8.00 a.m. on 19 May 2023

Open Offer Entitlements and Excess CREST Open Offer as soon as practicable after 8.00 a.m. on 22 May 2023

Entitlements credited to stock accounts

in CREST of Qualifying CREST Shareholders

Latest recommended time and date for requesting withdrawal of 4.30 p.m. on 1 June 2023

CREST Open Offer Entitlements

and Excess CREST Open Offer Entitlements

Latest time and date for depositing CREST Open Offer 3.00 p.m. on 2 June 2023

Entitlements and Excess CREST Open Offer

Entitlements

Latest time and date for splitting of Application Forms under 3.00 p.m. on 5 June 2023

the Open Offer ( to satisfy

bona fide market claims only)

Latest time and date for receipt of Forms of Proxy and CREST 10.00 a.m. on 6 June 2023

voting instructions

Latest time and date for receipt of completed Application 10.00 a.m. on 7 June 2023

Forms and payment in full under

the Open Offer and settlement of relevant CREST instructions

(as appropriate)

General Meeting 10.00 a.m. on 8 June 2023

Results of Open Offer and General Meeting announced 8 June 2023

Admission and dealings in the Open Offer Shares expected to 8.00 a.m. on 9 June 2023

commence on AIM

Where applicable, expected date for CREST accounts to be as soon as possible on 9 June 2023

credited in respect of the Open Offer

Shares

Receipt of funds from Tranche A Notes 13 June 2023

Where applicable, expected date for despatch of definitive within 14 days of Admission

share certificates for Open Offer

Shares in certificated form

Notes:

(1) References to times in this Document are to London time,

England (unless otherwise stated). The timing of the events in the

above timetable and in the rest of this Document is indicative only

and may be subject to change.

(2) If any of the above times or dates should change, the

revised times and/or dates will be notified by an announcement

through an RIS.

(3) The timetable above assumes that all the Resolutions in the

Notice of General Meeting are duly passed.

Ends

For further information, please contact:

Enquiries

Tungsten West Strand Hanson

Neil Gawthorpe/ Nigel Widdowson (Nominated Adviser and Financial

Tel: +44 (0) 1752 278500 Adviser)

James Spinney / James Dance /

Abigail Wennington

Tel: +44 (0) 207 409 3494

BlytheRay VSA Capital Limited

(Financial PR) (Financial Adviser and Joint

Tim Blythe / Megan Ray Broker)

Tel: +44(0) 20 7138 3204 Andrew Raca / Andrew Monk

Email: tungstenwest@blytheray.com +44 (0)20 3005 5000

Hannam & Partners

(Joint Broker)

Andrew Chubb / Matt Hasson /

Jay Ashfield

+44 (0)20 7907 8500

Follow us on twitter @TungstenWest

APPIX

Definitions

"acting in concert" a group of persons who, pursuant to an agreement

or understanding (whether formal or informal),

actively co-operate, through the acquisition

and/or ownership of voting shares in the

Company, to obtain or consolidate control

(directly or indirectly) of the Issuer provided

that the persons voting in the same or consistent

manner at any general meeting of the Company

will not be considered to be acting in concert

by virtue only of exercising their votes

in such manner

"AIM" the AIM Market operated by the London Stock

Exchange

"AIM Rules" the AIM Rules for Companies published by

the London Stock Exchange from time to time

"Baker Steel" Baker Steel Resources Trust Limited

" Change of Control" (a) any transaction not approved by the Noteholders'

Representative (acting on the instructions

of all Note Purchasers), resulting in a party

or one or more parties acting in concert

to (i) have the power to remove all or the

majority of the directors of the Company;

(ii) have the power to give directions with

respect to the operating and financial policies

of the Company; (iii) hold all or substantially

all of the assets of the Company; or (iv)

hold more than fifty percent. of the voting

rights attaching to the Company's issued

share capital; or (b) any merger or similar

reorganisation of the Company which is not

approved by the Noteholders' Representative

(acting on the instructions of all Note Purchasers)

resulting in a party or one or more parties

acting in concert to: (i) have the power

to remove all or the majority of the directors

of the Company; (ii) having the power to

give directions with respect to the operating

and financial policies of the Company; (iii)

holding all or substantially all of the assets

of the Company; or (iv) holding more than

fifty percent. of the voting rights attaching

to the Company's issued share capital

"Circular" the circular dated 19 May 2023 (including

the Notice of General Meeting and Open Offer)

to be sent to Shareholders

"Company" or "Tungsten Tungsten West Plc, a public limited company

West" incorporated in England and Wales with registered

number 11310159

"Conditional Placing" the secured financing of the Company through

the proposed issue of the Convertible Loan

Notes pursuant to the terms of the Note Purchase

Agreement placed by the Joint Brokers

"Convertible Loan the convertible loan notes in the aggregate

Notes" principal amount of up to GBP8.95 million

or "CLNs" to be issued by the Company pursuant to the

Note Purchase Agreement

" Equity Raise any issuance by the Company or any member

" of the Group of any equity interests

"Final Termination date falling three hundred and sixty-four

Date" (364) days after the issue of the Tranche

A Notes.

"First Ranking a debenture to be entered between the Company,

Debenture" Aggregates West Limited, Drakelands Restoration

Limited, Tungsten West Services Limited and

the Security Agent, pursuant to which a debenture

will be granted over certain assets of the

Group

"Fundraising" the Conditional Placing and the Open Offer

"General Meeting" the general meeting of the Company to be

held at the offices of Shakespeare Martineau

LLP, 60 Gracechurch Street, London EC3V 0HR

at 10.00 a.m. on 8 June 2023, notice of which

is set out at the end of this Document

"Group" the Company and its subsidiaries from time

to time

"H & P" H & P Advisory Limited, incorporated and

registered in England and Wales with company

number 11120795

"Issue Price" 3 pence per Ordinary Share

"Joint Brokers" H & P and VSA Capital

"Lansdowne" Lansdowne Partners (UK) LLP, acting for and

on behalf of Lansdowne Developed Markets

Master Fund Limited

"Note Purchase the note purchase agreement dated 19 May

Agreement" 2023 entered into, inter alia, between the

Company and the Note Purchasers, pursuant

to which the Note Purchasers agree to purchase

the Convertible Loan Notes on the terms and

conditions set out therein

"Note Purchasers" Lansdowne, Baker Steel and certain other

parties to the Note Purchase Agreement

"Noteholders" the holders of the Convertible Loan Notes

for the time being

"Notice of General the notice convening the General Meeting

Meeting" or "Notice" which is set out at the end of this Document

"Open Offer" the conditional invitation by the Company

made to Qualifying Shareholders to apply

to subscribe for the Open Offer Shares at

the Issue Price on the terms and subject

to the terms and conditions set out in Part

II of this Document and in the Application

Form

"Open Offer Shares" the 66,666,666 new Ordinary Shares which

Qualifying Shareholders will be invited to

subscribe for pursuant to the Open Offer

"Ordinary Shares" ordinary shares of GBP0.01 each in the capital

of the Company

"PIK" an amount calculated at the rate of 20 per

cent. per annum on the principal amount outstanding

under the relevant tranche of the CLN, compounded

every six months and rounded to the end of

the relevant six month period

"Resolutions" the resolutions to be proposed at the General

Meeting as set out in the Notice of General

Meeting

"Registrar" Neville Registrars Limited of Neville House,

Steelpark Road, Halesowen, West Midlands,

United Kingdom, B62 8HD

"Shareholders" the registered holders of Ordinary Shares

"Strand Hanson" Strand Hanson Limited, incorporated and registered

in England and Wales with company number

02780163, acting as the Company's nominated

adviser

"Tranche A Notes" the convertible loan notes for an initial

principal amount of GBP3.975 million to be

issued at completion and following the satisfaction

of the conditions precedent in the Note Purchase

Agreement

"Tranche B Notes" the convertible loan notes for an additional

principal amount of GBP2.975 million to be

issued after the issue of the Tranche A Notes

and following the satisfaction of certain

conditions precedent in the Note Purchase

Agreement with the consent of the majority

Noteholders

"Tranche C Notes" the convertible loan notes for the issue

of up to a further aggregate principal amount

of GBP2 million pursuant to the terms of

the Note Purchase Agreement following the

issue of Tranche A Notes and Tranche B Notes

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCLKLFFXELXBBK

(END) Dow Jones Newswires

May 19, 2023 08:41 ET (12:41 GMT)

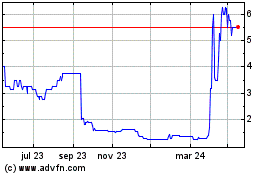

Tungsten West (LSE:TUN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

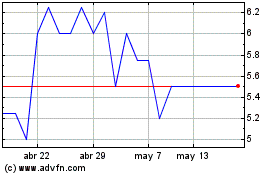

Tungsten West (LSE:TUN)

Gráfica de Acción Histórica

De May 2023 a May 2024