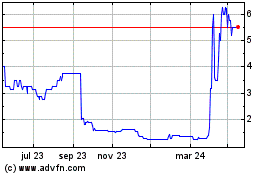

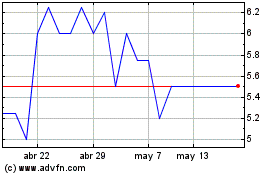

TIDMTUN

RNS Number : 3828M

Tungsten West PLC

14 September 2023

14 September 2023

Tungsten West Plc

("Tungsten West", the "Company" or the "Group")

Final Results for the year ended 31 March 2023 and

Availability of Annual Report

Tungsten West (LON:TUN), the mining company focused on

restarting production at the Hemerdon tungsten and tin mine

("Hemerdon" or the "Project") in Devon, UK, is pleased to announce

its audited results for the year ended 31 March 2023.

Highlights for the Period

-- Updated JORC compliant Ore Reserve Estimate to 101.2 million

tonnes ("Mt"), making the Hemerdon deposit the second largest

reported Committee for Mineral Reserves International Reporting

Standards ("CRIRSCO") standard tungsten reserve globally

-- An updated Feasibility Study highlighted strong project economics, including:

o Average annual production of 2,900 tonnes of WO(3) in

concentrate and 310 tonnes of Tin ("Sn") in concentrate

o Life of Mine ("LOM") of 27 years and an annual average

steady-state mining rate of 3.5 Mt per annum

-- The LOM model assumes stockpiling lower grade killas ore for

processing from Year 17 onwards, significantly extending the mine

life

-- Key permits, including the Mining Waste Facility ("MWF") and

Open Pit Water Abstraction Licence, granted by the Environment

Agency

-- Following the draw down of the Tranche A and Tranche B

convertible loan notes, GBP6.95 million in total, there is not any

current commitment from existing or new noteholders to purchase any

Tranche C notes. If the Group fails to find purchasers for the

Tranche C notes, then, in the absence of other new sources of

finance, it would no longer be able to meet its liabilities as they

fall due in November 2023

o The Board continues to implement a cost reduction programme,

is proactively engaging with loan note holders and is reviewing

other sources of funding to address the short-term liquidity needs

of the business

Post Period Highlights

-- Production of legacy tungsten pre-concentrate and tin concentrate totalling 50 tonnes

-- The Company entered into a strategic collaboration with the

fusion energy company, Oxford Sigma

-- Following the completion of Low Frequency Noise ("LFN")

Trials, the Company made a formal submission to the Environment

Agency to secure the Mineral Processing Facility ("MPF") permit

-- The Company submitted a section 73 (variation of a condition

of existing permission) application to vary the tonnage cap on

truck movements from site

-- Strengthening of the Board with new Non-Executive Directors

Copies of the Company's full Annual Report and Financial

Statements for the financial year to 31 March 2023 will be made

available to download from the Company's website at

www.tungstenwest.com and will shortly be posted to

shareholders.

Ends

For further information, please contact:

Enquiries

Tungsten West Strand Hanson

Neil Gawthorpe (Nominated Adviser and Financial

Tel: +44 (0) 1752 278500 Adviser)

James Spinney / James Dance /

Abigail Wennington

Tel: +44 (0) 207 409 3494

BlytheRay VSA Capital Limited

(Financial PR) (Financial Adviser and Joint

Tim Blythe / Megan Ray Broker)

Tel: +44(0) 20 7138 3204 Andrew Raca / Andrew Monk

Email: tungstenwest@blytheray.com Tel: +44 (0)20 3005 5000

Hannam & Partners

(Joint Broker)

Andrew Chubb / Matt Hasson /

Jay Ashfield

Tel: +44 (0)20 7907 8500

Follow us on twitter @TungstenWest

Chairman's Statement

Overview of FY2023

I am pleased to report on the Group's audited results for the

year ended 31 March 2023. The financial year began with the Board

implementing a pause to the project so that the management team

could evaluate alternative approaches to restarting mining

operations, as the Group faced material inflationary pressures and

uncertainty over costs. Despite this being a difficult decision,

the Group prevented an unsustainable level of capital commitments

and exposure to potentially unviable high operating costs.

In July 2022, development was restarted with the Group

committing to detailed engineering design and re-commencing

construction based on a new development plan (the "Plan"). The

Group invited its preferred funding partner to independently

scrutinise and review the new plan which culminated in a

non-binding term sheet that would fully fund the restart.

Due to the changes required under the new Plan, the Group's

funding partner requested an update to the Feasibility Study of

March 2021. Within six months, the Group released the summary of

results from its updated Feasibility Study ("2022 FS update"). The

quality of work produced in the 2022 update is a reflection of the

dedication and efforts by all employees involved for what was

effectively a full re-run of the 2021 Feasibility Study, including

a review of the re-engineering process and upgrade of the flowsheet

which has significantly reduced the Capex and Opex of the project.

This was a significant task and has demonstrated a robust and

economically viable case for the mine.

Some of the key highlights from the 2022 FS update were:

-- A post-tax Net Present Value ("NPV")(5%) of GBP297 million

(base case) with an Internal Rate of Return ("IRR") of 25%

-- An Upside case post-tax NPV(5%) of GBP415 million with an IRR of 32%

-- Life of Mine ("LOM") of 27 years and an annual average

steady-state mining rate of 3.5 million tonnes ("Mt") per annum

As outlined in the Company's announcement of 19 December 2022,

we were also able to report an update to the 2021 Hemerdon deposit

Mineral Resource Estimate ("MRE") due to changes in costs and

processing assumptions, affecting the breakeven cut-off grade. The

Group reported a 60% increase in ore tonnage and 10% increase in

contained metal from previous 2021 Ore, taking the Hemerdon Ore

Reserve to 101.2Mt. As a result the Hemerdon deposit is estimated

to be the second largest reported CRIRSCO standard tungsten reserve

globally. The lift in both the Ore Reserve and Mineral Resource

could only be achieved from the work that has been undertaken this

year as part of our work on updating the Feasibility Study, cost

saving initiatives and operating efficiencies across the

business.

Throughout the year, the Group continued to engage with their

long-lead capital equipment suppliers, which included placing an

order for the new semi-mobile primary and secondary crushing

circuit which is being supplied by MO Group (Metso-Outotec of

Finland). The seven ore sorters required for the plant upgrade have

been delivered to the Hemerdon Mine. The construction of new

screens and vibrating feeders provided by Vibramech was completed

and these have been delivered to the Hemerdon Mine.

Inside our Mineral Processing Facility ("MPF"), a number of

enhancements and upgrades have been taking place, designed to

increase efficiency, reduce future downtime and reduce future

maintenance, all of which were key factors that caused the previous

operator to incur significant downtime. This enabled the refinery

and magnetic separation end of the plant to be commissioned in

April 2023 and produce approximately 50 tonnes of tin and tungsten

concentrate from materials left by the previous operator.

Sales of aggregates continued until October 2022 when the Group

ceased its production of aggregates from barren material left by

the previous operator. The primary goal was to always demonstrate

the ability to establish a market for the product, and aggregates

production will recommence as the mineral processing ramp up

completes.

Safety and health continued to be our number one priority on

site and to help champion our safety and ESG principles, SHEQ

(Safety, Health, Environmental and Quality) captains were appointed

internally. Team members across all departments were invited to

apply for these roles who felt that could utilise their intimate

knowledge of their job roles in their respective departments. This

was an important change for Tungsten West, as we moved towards

embedding a culture of best practice across all departments, rather

than having one central site 'S&H administration'.

Despite all the efforts during the year to ensure permitting and

construction could run in parallel, it has now become apparent

following investor and lender feedback that this is not the case

due to potential design changes required to achieve permitting. The

Group needs to secure the mineral processing facility permit in

order to obtain the finance required to complete the plant rebuild

and commence production. As a consequence, the Company undertook a

strategic review, and, with the continued risk surrounding volatile

energy prices and a more conservative lending approach, it

announced a number of cost saving initiatives to ensure the project

could continue.

To allow enough time to finalise the full project funding

process, all non-core project construction activities ceased, with

recommencement to begin when the exact design requirements

necessary for obtaining the Mineral Processing Facility were

clarified. A review of staffing requirements inevitably followed

which led to redundancies post year-end. It is never easy to go

through a redundancy process, especially given the high aspirations

and goals of this Company, so I would like to thank all Tungsten

West staff for their level of maturity and understanding during the

process.

In June 2023, the Group raised GBP7.2 million of new funds from

issuing convertible loan notes and open offer. An additional GBP2.0

million notes can be issued if required. These funds were drawn in

order to finance the group through the process of obtaining the

necessary permits. The cost reduction and cash conservation

measures implemented by management triggered a number of defaults

under the terms of the notes. A waiver is in place for these

defaults until 31 January 2024. By 31 January 2024 the board plans

to have obtained the necessary permits and as a result additional

finance.

At the end of the financial year, the Company appointed a new

CEO, Neil Gawthorpe, following the resignation of Max Denning in

July 2022, and acting CEO Mark Thomson in March 2023. Max and Mark

were co-founders of Tungsten West and the Board thanks them for

their significant contribution during the Company's formative

years. Nigel Widdowson, CFO, resigned from the Board in August

2023. Adrian Bougourd, Kevin Ross and Guy Edwards were appointed to

the Board as Non-Executive Directors in September 2023.

The appointment of Neil brings operational and industry

experience to the Senior Management and Director teams and will be

an invaluable asset to the Company during this pivotal time.

Against the backdrop of the challenges the Hemerdon Mine has

faced this year, a positive development has been the release of the

first ever UK Critical Minerals Strategy. There is a real risk of

the UK falling behind in the race to secure responsibly sourced

critical minerals. It is promising to see that the UK Government is

starting to recognise the risks of critical mineral supply chain

shocks.

As a Board and Group, we feel that Hemerdon Mine has never been

more important to the UK to secure and protect its critical mineral

supply, and I am confident that Hemerdon Mine will soon be

producing tungsten and tin, providing a world class supply of

critical minerals, essential in both traditional applications and

aiding the supply of future alternative clean energy sources.

David Cather

Chairman

CEO Report

I joined Tungsten West as CEO near the end of the financial

year, but I have been involved with the Group throughout the

reporting period as a consultant and advisor. I have enjoyed many

years in the mining industry, both in operations and consulting,

and I share the vision of our investors, employees and Government,

that Hemerdon Mine can be a strategic asset for the UK whilst

creating long-term value and delivering strong returns for

shareholders.

Our project is exceptional to the UK in that we have the benefit

of a pre-built world class processing plant, a pre-stripped mine

and fully permitted Mine Waste Facility ("MWF"). We are on the cusp

of bringing mining back to the South-West, however, there remain

some critical milestones to be met, which all bring their own

unique challenges.

Permitting

Permitting is always a significant risk for any mining project,

and alongside funding risk, these are the biggest hurdles the Group

must overcome.

During the year, the Company received its MWF permit, which

outlines the permitting requirements for the commencement and

ongoing monitoring of the waste activities at Hemerdon Mine.

At the time of writing, the Group is yet to obtain a draft MPF

permit. In the Company's efforts to receive this, it is currently

undertaking a series of research and development projects which

will be carried out around the historical issues of the processing

plant which caused low frequency noise. The Group is confident that

the revised Plan has eliminated the issues as well as significantly

mitigating the general noise impact of the project. The Group

continues to liaise with the Environment Agency ("EA") on

timescales required to complete this work.

Alongside the MWF permit, the Group also received its water

abstraction Licences for the open pit, Loughter Mill and Tory Pond,

meaning it now has four of the five EA permits required for

restart.

As a precedent, Wolf Minerals held all necessary permits and

licences to operate the site, therefore the Group are confident

that they will resolve the historical issues with the EA and obtain

the MPF permit.

Financing

Since we paused the project in July 2022, it was expected that

we could operate on the basis that funding and permitting could run

in parallel. However, lender feedback has proven this to not be the

case. Even though the work conducted under the 2022 FS Update led

to an overall improved project, the design changes required have

impacted our ability to achieve permitting in the timeframe

initially envisaged. As such, it is now necessary to prioritise the

process of obtaining all necessary permits required for funding.

The updated timeline is to obtain the necessary permits and close

additional funding by December 2023.

The Board acknowledges and appreciates the support received from

shareholders following the decision to prioritise permitting. The

Group will remain actively engaged with financial and strategic

partners to explore all available funding options. Once the

permitting process is complete, the Board is confident in their

ability to secure the optimal funding package for successfully

executing the project.

Operational Updates

Construction

It was pleasing to see the early stages of the bulk earthworks

and civil engineering that begun in January this year. Additional

to this enabling work, the Group has also received deliveries of

steel rebar and components for the conveyor systems.

Under the revised crushing strategy, the Group has ordered its

new semi-mobile crushing equipment and taken delivery of the

screens and ore sorters which are now secured and stored on

site.

Running in parallel to the front-end rebuild has been the

mineral processing facility enhancements and upgrades. A

considerable amount of work has gone into ensuring the plant is in

the best possible condition for when operations restart. A

dedicated team of fabricators, electricians and engineers have done

some exceptional work with key enhancements being the

following:

Area Enhancements

Chutes Replacement of wear plates in conveyor chutes and installation

of new rock box designs to cut down on wear.

---------------------------------------------------------------

Conveyors Replacement belts and renewal of drums, bearings, and

scrapers throughout the processing plant.

---------------------------------------------------------------

Pumps Removal of previously installed pumps, inspection and

test of the drive motors.

---------------------------------------------------------------

Area 130 - Tertiary Extensive repair and redesign of the surge bin to increase

Crushing Circuit longevity in high-wear areas and minimise future downtime.

---------------------------------------------------------------

Area 140 - Primary Inspection and re-refurbishment of the agitators.

DMS

---------------------------------------------------------------

Area 150 - Primary Refurbishment of the Primary Mill including electrical

Mill inspection and testing. Inspection of drive shaft alignment

and lubrication systems to ensure they are fit for

production.

---------------------------------------------------------------

Area 160 - Shaking Overhaul of all tables and redesign of the spray bar

Tables structures to eliminate points of failure due to excessive

vibration.

---------------------------------------------------------------

Area 180 - Feeders Redesign of both the 180 feeders to include side skirts

and return rollers, new guarding manufactured and installed.

---------------------------------------------------------------

Area 200 - Refinery Mechanical overhaul of both the pre dryer and tin dryer.

The refinery was also commissioned as part of the work

done to process the legacy tungsten pre-concentrate

and tin concentrate, as announced in June 2023.

---------------------------------------------------------------

Area 390 - Raw Design manufacture and installation of an access door

water tank on the tank to allow for removal of silt build up.

This will reduce future downtime for maintenance.

---------------------------------------------------------------

Area 390 - Process Sand blasting and application of a wear resistant paint

water tank will reduce future downtime and maintenance.

---------------------------------------------------------------

2022 Feasibility Update

In January 2023, the Group released a summary update on its 2021

Feasibility Study which strengthened Hemerdon's case as a robust

and economically viable mine. The Feasibility Study highlighted the

project's strong economics and positioned Tungsten West to become

the largest tungsten producer in the Western World.

Processing optimisation

The revised plant design introduces two stages of Ore Sorting.

This provides operational flexibility through significantly

lowering the mass pull which reduces the capital and operating

costs downstream. Furthermore, by lowering the mass pull it reduces

the ratio of iron to tungsten leading to the elimination of the

reduction kiln, significantly reducing diesel consumption and

associated Opex.

A further advantage of the re-engineered flowsheet is to

introduce a secondary crushed stockpile ahead of the ore sorters.

This effectively de-couples the higher wear rate (and resultant

maintenance) of the primary and secondary crushing circuits from

the downstream MPF. This reduces the risk of metal losses created

by circuit instability encountered during the Wolf operation.

Mining operations

The mine plan has been redesigned to reflect the reduced

throughput planned for the MPF in the first two years of

operations, and changes in primary crushing circuit. This means

less waste is mined in the ramp-up period, preserving working

capital.

Direct tipping at a newly sited ROM (Run of the mine) pad

incorporating the introduction of new semi-mobile primary jaw and

secondary cone crushers also reduces Capex and Opex.

Mineral Resources

Through the Company re-engineering the mining and processing

operations, there were improvements in costs and processing

assumptions which lead to a reduction to the breakeven cut-off

grade. This meant that Tungsten West was able to report an update

to the MRE. The new LOM production schedule has increased the LOM

to approximately 27 years.

Aggregates

Sales of aggregates continued throughout the year until October

2022, with GBP118,000 revenue being recognised, providing the Group

with an early and differing revenue stream. The Group ceased its

production of aggregates from barren material after selling 102,000

tonnes of material, demonstrating the ability to establish a market

for the product. Sale of aggregates reduces the amount of barren

rock left on-site and supports Tungsten West in reducing our

environmental footprint. Aggregates production will recommence as

the mineral processing ramp up completes.

ESG

ESG principles are at the core of our operations, and we take

pride in the creative and dedicated efforts of our project team and

partners to address and resolve issues faced by previous

operators.

In line with the Climate Change Act (2008) and the UK

government's target of achieving net-zero carbon emissions by 2050,

the Company recognises its moral obligation to align itself with

this goal, and we are committed to taking proactive measures to

reduce our carbon footprint. Additionally, as part of our

commitment to international best practices, we have aligned

ourselves with the UN Sustainable Development Goals ("SDGs"),

specifically UN SDG 13, which emphasises the urgent need to combat

climate change and its impacts. To address these goals, we have

identified several action points, including the exploration of

renewable energy sources. The Group has undertaken scoping studies

to assess the feasibility of implementing both solar farms and wind

turbines as potential sources of renewable energy. The

collaboration with the fusion energy company, Oxford Sigma,

announced post year-end emphasises tungsten's role as a critical

material for the development of fusion energy, a clean alternative

energy source that can help deliver global net-zero targets.

Throughout the financial year, our community engagement team

maintained active communication with our broader stakeholders and

the local community through regular face-to-face consultations at

County Council, Parish Council and community levels. We believe it

is crucial to provide avenues for the community to understand the

project and to reach out to us and voice their concerns. As part of

our community engagement plan, we have established a regular forum

to facilitate open and transparent communication with local

communities. We also maintain a presence in the Shaugh Prior,

Cornwood, and Sparkwell Parish Councils, ensuring that we remain

connected to the concerns and needs of the local area.

Our team

During the year and post year-end, the Group experienced

challenging periods marked by necessary redundancies, which has

undoubtedly impacted our employees. However, the Board acknowledges

the resilience and commitment demonstrated by our staff during

these tough times.

As we move forward, we encourage open communication,

collaboration, and the sharing of knowledge between all staff

members. Together we form a cohesive team that can achieve a fully

permitted MPF and close the required funding to execute the

project.

Diversity

At Tungsten West, we value diversity and inclusion as essential

elements of our culture and our performance. We are proud to have a

higher percentage of women in our workforce than the global mining

and metals industry average for 2022 of 12.1% (Source: Ernst &

Young ). Despite the employee turnover we experienced during the

year, women still represent 20% (2022: 22%) of our team.

We believe that having a diverse team enhances our productivity,

safety, and creativity. These are key qualities that will help us

overcome the challenges we face in the next 12 months and

beyond.

Market overview

Tungsten is a critical mineral and is essential for sectors such

as energy and defence, and strengthening other metals, including

steel, for components used in the construction, mining, and medical

industries. The global demand for tungsten is forecast to grow by

3%% p.a. over the next 10 years.

The tungsten market is a significant sector within the global

metals industry and supply-wise tungsten remains predominantly

sourced from a small number of countries, with China being the

largest producer and exporter. The concentration of global supply

of tungsten concentrate between China, Russia and Vietnam creates a

degree of supply risk and price volatility, as geopolitical factors

and mining regulations can impact the availability and pricing of

tungsten.

In recent years, there have been efforts to diversify tungsten

supply sources and reduce reliance on Chinese and Russian

production. Exploration and development of tungsten deposits in

countries like Canada, Australia, and the United States continue to

gain attention as countries look to find a western supply of

tungsten.

This makes the Group a strategic asset, with a project of

significant importance to the UK and the West, as outlined in the

UK's first ever Critical Minerals Strategy, which included tungsten

and tin as minerals with high criticality. The report went on to

recognise the South-West as an area of high importance in meeting

commodity security.

Outlook

The 2022 FS Update presented an invaluable opportunity for the

Group to re-evaluate the most effective approach to resuming

operations at Hemerdon. The result was an outstanding

accomplishment, made possible through seamless collaboration across

the entire Company.

In the upcoming 12 months, the Company will enter a pivotal

phase as we look to obtain the required permits and secure funding

to enable construction phase. Successfully achieving these

milestones will pave the way for recommencing construction,

ultimately leading to the revival of mining activities at the

project and in the South-West region.

Unless otherwise defined herein, all capitalised terms in this

announcement shall have the meanings ascribed to them in the

relevant regulatory announcements by the Company.

Neil Gawthorpe

CEO

Consolidated Statement of Comprehensive Income

Year ended 31 March 2023

Note 2023 2022

GBP GBP

--------------------------------- ---- ------------ ------------

Revenue 5 626,460 673,509

Cost of sales (1,984,983) (4,028,123)

--------------------------------- ---- ------------ ------------

Gross loss (1,358,523) (3,354,614)

Administrative expenses (10,160,088) (7,998,774)

Other operating income 6 18,947 4,237

Other gains/(losses) 7 710,710 (846,373)

--------------------------------- ---- ------------ ------------

Operating loss 8 (10,788,954) (12,195,524)

--------------------------------- ---- ------------ ------------

Finance income 454,196 120,002

Finance costs (495,279) (913,466)

--------------------------------- ---- ------------ ------------

Net finance cost 9 (41,083) (793,464)

--------------------------------- ---- ------------ ------------

Loss before tax (10,830,037) (12,988,988)

Income tax credit 13 544,602 -

--------------------------------- ---- ------------ ------------

Loss for the year (10,285,435) (12,988,988)

--------------------------------- ---- ------------ ------------

Total comprehensive loss (10,285,435) (12,988,988)

--------------------------------- ---- ------------ ------------

Profit/(loss) attributable to:

Owners of the Company (10,285,435) (12,988,988)

--------------------------------- ---- ------------ ------------

GBP GBP

--------------------------------- ---- ------------ ------------

Basic and diluted loss per share 14 (0.06) (0.11)

--------------------------------- ---- ------------ ------------

The above results were derived from continuing operations.

Consolidated Statement of Financial Position

Year ended 31 March 2023

31 March 31 March

2023 2022

Note GBP GBP

--------------------------------------------- ---- ------------ ------------

Assets

Non-current assets

Property, plant and equipment 15 19,054,864 8,469,610

Right-of-use assets 16 2,022,672 1,743,736

Intangible assets 17 5,090,016 4,993,254

Deferred tax assets 13 1,390,346 1,397,789

Escrow funds receivable 19 5,146,986 8,370,024

--------------------------------------------- ---- ------------ ------------

32,704,884 24,974,413

--------------------------------------------- ---- ------------ ------------

Current assets

Inventories 22 114,173 156,944

Trade and other receivables 20 6,163,593 3,827,509

Cash and cash equivalents 21 3,438,018 28,755,388

--------------------------------------------- ---- ------------ ------------

9,715,784 32,739,841

--------------------------------------------- ---- ------------ ------------

Total assets 42,420,668 57,714,254

--------------------------------------------- ---- ------------ ------------

Equity and liabilities

Equity

Share capital 27 1,805,516 1,793,682

Share premium 51,882,761 51,610,414

Share option reserve 357,366 241,861

Warrant reserve 740,867 1,408,730

Retained earnings (23,805,018) (14,187,446)

--------------------------------------------- ---- ------------ ------------

Equity attributable to owners of the Company 30,981,492 40,867,241

--------------------------------------------- ---- ------------ ------------

Non-current liabilities

Loans and borrowings 24 1,901,583 1,440,630

Provisions 25 5,701,771 9,526,485

Deferred tax liabilities 13 1,390,346 1,397,789

--------------------------------------------- ---- ------------ ------------

8,993,700 12,364,904

--------------------------------------------- ---- ------------ ------------

Current liabilities

Trade and other payables 23 2,330,603 4,289,623

Loans and borrowings 24 114,873 192,486

--------------------------------------------- ---- ------------ ------------

2,445,476 4,482,109

--------------------------------------------- ---- ------------ ------------

Total liabilities 11,439,176 16,847,013

--------------------------------------------- ---- ------------ ------------

Total equity and liabilities 42,420,668 57,714,254

--------------------------------------------- ---- ------------ ------------

The financial statements were approved by the Board on 13

September 2023 and signed on its behalf by:

Neil Gawthorpe

Director

Company Registration Number: 11310159

Consolidated Statement of Changes in Equity

Year ended 31 March 2023

Share option Retained

Share capital Share premium reserve Warrant reserve earnings Total

GBP GBP GBP GBP GBP GBP

----------------------------- ------------- ------------- ------------ --------------- ------------ ------------

At 1 April 2021 6,856 12,327,484 67,840 754,586 (11,413,116) 1,743,650

Loss for the year - - - - (12,988,988) (12,988,988)

----------------------------- ------------- ------------- ------------ --------------- ------------ ------------

Total comprehensive income - - - - (12,988,988) (12,988,988)

Capital reduction of

share premium account - (10,000,000) - - 10,000,000 -

Issue of bonus shares 752,513 (752,513) - - - -

Conversion of convertible

debt 359,352 10,421,208 - - - 10,780,560

New share capital subscribed 674,961 40,310,822 - - - 40,985,783

Issue of warrants - (696,587) - 785,144 - 88,557

Exercise of warrants - - - (131,000) 131,000 -

Share options charge - - 298,878 - - 298,878

Forfeiture of share options - - (41,199) - - (41,199)

Exercise of share options - - (83,658) - 83,658 -

----------------------------- ------------- ------------- ------------ --------------- ------------ ------------

At 31 March 2022 1,793,682 51,610,414 241,861 1,408,730 (14,187,446) 40,867,241

Loss for the year - - - - (10,285,435) (10,285,435)

----------------------------- ------------- ------------- ------------ --------------- ------------ ------------

Total comprehensive income - - - - (10,285,435) (10,285,435)

New share capital subscribed 11,834 272,347 - - - 284,181

Exercise of warrants - - - (334,378) 334,378 -

Expired warrants - - - (333,485) 333,485 -

Share options charge - - 134,610 - - 134,610

Forfeiture of share options - - (19,105) - - (19,105)

At 31 March 2023 1,805,516 51,882,761 357,366 740,867 (23,805,018) 30,981,492

----------------------------- ------------- ------------- ------------ --------------- ------------ ------------

Consolidated Statement of Cash Flows

Year ended 31 March 2023

2023 2022

Note GBP GBP

------------------------------------------------------ -------------------- ------------ ------------

Cash flows from operating activities

Loss for the year (10,285,435) (12,988,988)

Adjustments to cash flows from non-cash items

Depreciation and amortisation 8 514,394 209,233

Loss on disposal of right to use asset 8 124,528 -

Loss on disposal of intangible asset 8 73,401 -

Impairment of asset under construction 8 108,947 -

Fair value losses on escrow account 7 3,495,064 1,783,221

Fair value gains on restoration provision 7 (4,205,774) (786,849)

Finance income 9 (454,196) (120,002)

Finance costs 9 495,279 913,466

Share-based payment transactions 115,505 174,021

Founder incentives - (149,999)

Impact of foreign exchange 74,724 -

Income tax credit 13 (544,602) -

(10,488,165) (10,965,897)

Working capital adjustments

Income tax received 544,602 -

(Increase) in trade and other receivables 20 (2,336,084) (3,283,213)

(Decrease)/increase in trade and other payables 23 (1,959,020) 2,952,165

Decrease/(increase) in inventories 42,771 (156,944)

------------------------------------------------------ -------------------- ------------ ------------

Net cash outflow from operating activities (14,195,896) (11,453,889)

------------------------------------------------------ -------------------- ------------ ------------

Cash flows from investing activities

Interest received 9 99,082 1,134

Acquisitions of property, plant and equipment 15 (10,892,254) (4,203,803)

Proceeds from sale of vehicle 4,167 -

Acquisitions of intangibles 1 7 (191,523) (80,000)

------------------------------------------------------ -------------------- ------------ ------------

Net cash outflows from investing activities (10,980,528) (4,282,669)

------------------------------------------------------ -------------------- ------------ ------------

Cash flows from financing activities

Interest paid 9 (4,084) (4,955)

Proceeds from issue of Ordinary Shares, net

of issue costs - 41,021,204

Proceeds from the exercise of warrants 284,181 126,577

Proceeds from the exercise of share options - 3,472

Payments to hire purchase (63,294) -

Payments to lease liabilities (357,749) (153,932)

------------------------------------------------------ -------------------- ------------ ------------

Net cash (outflows)/inflows from financing activities (140,946) 40,992,366

------------------------------------------------------ -------------------- ------------ ------------

Net (decrease)/ increase in cash and cash equivalents (25,317,370) 25,255,808

Cash and cash equivalents at 1 April 28,755,388 3,499,580

------------------------------------------------------ -------------------- ------------ ------------

Cash and cash equivalents at 31 March 3,438,018 28,755,388

------------------------------------------------------ -------------------- ------------ ------------

Notes to the Consolidated Financial Statements

Year ended 31 March 2023

1 General information

Tungsten West plc ('the Company') is a public limited company,

incorporated in England and Wales and domiciled in the United

Kingdom.

The address of its The principal place

registered of

office is: business is:

Shakespeare Martineau

LLP Hemerdon Mine

6th Floor Drakelands

60 Gracechurch Street Plympton

London Devon

EC3V 0HR PL7 5BS

United Kingdom United Kingdom

2 Accounting policies

Summary of significant accounting policies and key accounting

estimates

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied to all the years presented, unless

otherwise stated.

Basis of preparation

The Group financial statements have been prepared in accordance

with International Accounting Standards as adopted in the United

Kingdom ('UK adopted IAS') and those parts of the Companies Act

2006 that are applicable to companies which apply UK adopted

IAS.

The financial statements are presented in Sterling, which is the

functional currency of the Group and Company.

Going concern

The Group is still in the pre-production phase of operations and

meets its day to day working capital requirements by utilising cash

reserves from investment made in the Group. In October 2021, the

Group raised GBP36.0 million net of fees by way of an initial

public offering and at the year-end, had GBP3.4 million in cash

reserves.

Further to ongoing discussions with investors and debt

providers, it is clear that access to the capital required to

complete the project will be significantly limited until the Group

has secured the final permit required to operate the MPF and a

Planning Permission relevant to truck movements.

These conditions indicate that a material uncertainty exists

that may cast significant doubt on the Group's ability to continue

as a going concern.

The Group has focussed its short term operating strategy simply

on activities required to secure these permits, maintain the

requirements for the existing permits and secure funding to

complete the project and recommence mining operations.

The Group completed the issue of a convertible loan note

facility and an open offer in June 2023. These collectively raised

GBP7.2 million gross of fees. There is an additional facility in

place to issue a further GBP2.0 million convertible loan note under

the same terms dependant on investor demand at the time. The Board

consider this to be sufficient liquidity to meet its liabilities as

they fall due and to complete the short term strategic objectives

before December 2023. Opex has been significantly reduced and all

material capital commitments deferred until these objectives have

been achieved. As at the end of August 2023 the Group had issued

Tranche A (GBP3.975million) and Tranche B (GBP2.975 million) of the

CLN and had GBP2.5 million in cash reserves. The Group anticipates

issuing GBP2.0 million Tranche C notes in November 2023. There is

not currently any commitment from existing or new noteholders to

purchase any Tranche C notes. If the Group fails to find purchasers

for the Tranche C notes, then, in the absence of other new sources

of finance, it would no longer be able to meet its liabilities as

they fall due in November 2023.

After the year end, the Group took measures to conserve cash by

stopping capex payments, restructuring the cost base and deferring

certain contracted payments to creditors. As a result of this, the

Group has notified the Note Purchasers of multiple defaults on the

terms of the Note Purchase Agreement which relate to payments to

creditors. There are detailed in note 35 this report. Under the

terms of the Note Purchase Agreement, the Noteholders can cancel

any outstanding Notes under the Note Purchase Agreement and demand

immediate redemption unless a waiver is in place. The redemption

sum is two times the loan note principal outstanding along with any

accrued PIK. A waiver for the breaches in place at the time of

signing these accounts has been issued by the noteholders. The

waiver will expire on 31 January 2024 and going concern is reliant

on the Group complying with the terms of the waiver. The waiver

gives the Board sufficient comfort that the group can both meet the

terms of the original loan without further breaches and the terms

of the waiver hence is a going concern. For the Group to remain a

going concern, the Group is reliant on continued support of the

Noteholders by not exercising their rights under the Defaults

should the defaults not be remedied, or the note converted or

redeemed, by 31 January 2024.

As identified earlier in this report, permitting, funding and

macro-economic risks (Geopolitical, Economic instability) are the

most significant risks facing the Company. Lack of or delayed

permits, alongside volatile input costs, forex and commodity

prices, will significantly increase the risk of lack of access to

capital.

The Board is pursuing a strategy of completing the project on a

capital build and operate basis. In light of the noise mitigation

measures now anticipated to be required for securing the MPF

permit, the Board forecasts in excess of GBP60 million remaining

expenditure prior to recommencing operations. Various options for

progress post January 2024 will be considered as further

information becomes available through the intervening period and

are expected to result in the Group continuing as a going concern

once the various permissions are secured.

Going concern is reliant on further funding being secured by the

end of December 2023, without which the group would be unable to

pay its liabilities as they fall due beyond this point. Management

have prepared one forecast as follows:

Model 1 - Additional funding closed December 2023

This scenario models management's intended plan of the expected

future outflows required to complete the capital build once finance

is secured. Sensitivity analysis has been applied in terms of when

the project would restart, availability of additional capital and

the cashflow demands for each scenario. As the terms of any finance

package have not yet been agreed the model does not include costs

of finance.

Management are satisfied there is sufficient headroom to service

the projected cost of debt when this is agreed. As negotiations

with finance providers proceed the model will be updated with the

anticipated finance costs to ensure that a sufficient level of

liquidity is maintained. Management is confident that the project

finance can be secured to complete the capital build under the

updated business plan once the relevant permits are secured.

As a result, there is a material uncertainty over the granting

of the permits and permissions required, within the necessary

timeframes, to allow the group to obtain the finance it requires.

The Board's aim is that it will obtain the necessary permit and

permissions and required funding, allowing the group to operate as

a going concern for the foreseeable future. Consequently, they

continue to adopt the going concern basis in preparing these

financial statements despite the material uncertainty referred to

above.

Basis of consolidation

The Group financial statements consolidate the financial

statements of the Company and its subsidiary undertakings drawn up

to 31 March 2023.

A subsidiary is an entity controlled by the Company. Control is

achieved where the Company has the power to govern the financial

and operating policies of an entity so as to obtain benefits from

its activities. Accounting policies of subsidiaries have been

changed where necessary to ensure consistency with the policies

adopted by the Group.

The purchase method of accounting is used to account for

business combinations that result in the acquisition of

subsidiaries of the Group. The cost of a business combination is

measured as the fair value of the assets given, equity instruments

issued and liabilities incurred or assumed as at the date of

exchange. Identifiable assets acquired and liabilities and

contingent liabilities assumed in a business combination are

measured initially at their fair values at the acquisition date,

including deferred tax if required. Any excess of the cost of the

business combination over the acquirer's interest in the net fair

value of the identifiable assets, liabilities and contingent

liabilities is recognised as goodwill.

Changes in accounting policy

None of the standards, interpretations and amendments effective

for the first time from 1 April 2022 have had a material effect on

the financial statements.

Revenue recognition

In the year revenue has mainly related to the sale of low grade

concentrate which was left behind by the previous mining operator.

This is recognised upon pick up by customers at the fair value of

consideration receivable at that date. The Group has not yet

commenced commercial sales of tungsten and tin.

Tax

Income tax expense consists of the sum of current tax and

deferred tax.

Current tax is based on taxable profit for the year. Taxable

profit differs from profit as reported for accounting purposes

because of items of income or expense that are taxable or

deductible in other years and items that are never taxable or

deductible.

Current tax is calculated using tax rates that have been enacted

or substantively enacted by the end of the reporting period. A

provision is recognised for tax matters that are uncertain if it is

considered probable that there will be a future outflow of funds to

a tax authority. The provision is measured at the best estimate of

the amount expected to become payable. The assessment is based on

the judgement of tax professionals within the Company.

Deferred tax liabilities are generally recognised for all

taxable temporary differences and deferred tax assets are

recognised to the extent that it is probable that taxable profits

will be available against which deductible temporary differences

can be utilised. Such assets and liabilities are not recognised if

the temporary difference arises from the initial recognition of

goodwill or from the initial recognition (other than in a business

combination) of other assets and liabilities in a transaction that

affects neither the taxable profit nor the accounting profit.

The carrying amount of deferred tax assets is reviewed at each

reporting date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered. Deferred tax is

calculated at the tax rates that are expected to apply in the

period when the liability is settled or the asset is realised based

on tax laws and rates that have been enacted or substantively

enacted at the reporting date.

The Group has submitted research and development tax credit

claims. The Group accounts for a claim at the point it considers

the claim to be unchallenged by HMRC.

Property, plant and equipment

Land and buildings are stated at the cost less any depreciation

or impairment losses subsequently accumulated (cost model). Land

and buildings have been uplifted to fair value on

consolidation.

Plant and equipment is stated in the statement of financial

position at cost, less any subsequent accumulated depreciation and

subsequent accumulated impairment losses.

The asset under construction relates to costs incurred to

upgrade the mineral processing facility and in accordance with IAS

16, have capitalised costs if it is probable that future economic

benefits associated with the item will flow to the entity and the

cost can be measured reliably.

Depreciation

Depreciation is charged so as to write off the cost of assets,

other than land and assets under construction over their estimated

useful lives, as follows:

Depreciation method

Asset class and rate

--------------------- ----------------------

Land None

Building 2% Straight Line

Furniture, fittings

and equipment 5% - 20% Straight Line

Other property, plant

and equipment 5%- 33% Straight Line

Motor vehicles 33% Straight Line

Computer equipment 33% Straight Line

--------------------- ----------------------

Goodwill

Goodwill is recognised at cost and reviewed for impairment

annually.

Intangible assets

Contractual mining rights as set out in the mining lease are

recognised as a separate intangible asset on consolidation under

IFRS 3.

The mining rights are subject to amortisation over the useful

life of the mine which is 27 years (2022: 23 years). Amortisation

will be charged from the date the mine is brought into use.

Software is amortised on a straight-line basis using a rate of

33%.

Right-of-use assets

Right-of-use assets consist of a lease for the Hemerdon Mine and

three property leases under IFRS 16. These assets are depreciated

over the shorter of the lease term and the useful life of the

underlying asset. Depreciation starts at the commencement date of

the lease.

Research and development activities

All research costs are expensed. Costs related to the

development of products are capitalised when they meet the

following conditions:

(i) It is technically feasible to complete the development so

that the product will be available for use or sale.

(ii) It is intended to use or sell the product being developed.

(iii) The Group is able to use or sell the product being developed.

(iv) It can be demonstrated that the product will generate

probable future economic benefits.

(v) Adequate technical, financial and other resources exist so

that product development can be completed and the product

subsequently used or sold.

(vi) Expenditure attributable to the development can be reliably measured.

All other development expenditure is recognised as an expense in

the period in which it is incurred.

Capitalised development costs are stated at cost less

accumulated amortisation and accumulated impairment losses (cost

model). Amortisation is recognised using the straight-line basis

and results in the carrying amount being expensed in profit or loss

over the estimated useful lives which range from 5 to 15 years.

Exploration for and evaluation of mineral resources

Costs relating to the exploration for and evaluation on mineral

resources are expensed.

Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and call

deposits, and other short-term highly liquid investments that are

readily convertible to a known amount of cash and are subject to an

insignificant risk of changes in value.

Trade receivables

Trade and other receivables where payment is due within one year

do not constitute a financing transaction and are recorded at the

undiscounted amount expected to be received, less attributable

transaction costs. Any subsequent impairment is recognised as an

expense in profit or loss.

All trade and other receivables are subsequently measured at

amortised cost, net of impairment.

Escrow funds

These funds are held with a third party to be released to the

Group as it settles its obligation to restore the mining site once

operations cease. The debtor has been discounted to present value

assuming the funds will be receivable in 27 years' time which

assumes a 27-year useful life of mining operations.

Trade payables

Trade and other payables are initially recognised at fair value

less attributable transaction costs. They are subsequently measured

at amortised cost.

Convertible debt

The redemption of convertible debt does not give rise to a fixed

number of shares on conversion and so is recognised as a liability

with no equity element initially recorded at the amount of proceeds

received. Interest compounds annually but shall not be payable

until the maturity date.

Provisions

Provisions are recognised when the Group has a present

obligation (legal or constructive) as a result of a past event, it

is probable that the Group will be required to settle that

obligation and a reliable estimate can be made of the amount of the

obligation.

Provisions are measured at the Directors' best estimate of the

expenditure required to settle the obligation at the reporting date

and are discounted to present value where the effect is

material.

This includes a provision for the obligation to restore the

mining site once mining ceases.

Leases

At inception of the contract, the Group assesses whether a

contract is, or contains, a lease. It recognises a right-of-use

asset and a corresponding lease liability with respect to all

material lease arrangements in which it is the lessee. The

right-of-use assets and the lease liabilities are presented as

separate line items in the statement of financial position.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted by using the rate implicit in the lease. If this rate

cannot be readily determined, the Group uses its incremental

borrowing rate. It is subsequently measured by increasing the

carrying amount to reflect interest on the lease liability (using

the effective interest method) and by reducing the carrying amount

to reflect the lease payments made.

Short-term or low-value leases, in accordance with the available

exemption in IFRS 16, are not capitalised on the statement of

financial position and instead recognised as an expense, on a

straight-line or other systematic basis.

Share capital

Ordinary Shares are classified as equity. Equity instruments are

measured at the fair value of the cash or other resources received

or receivable, net of the direct costs of issuing the equity

instruments. If payment is deferred and the time value of money is

material, the initial measurement is on a present value basis.

Share options

Share options granted to shareholders classified as equity

instruments are accounted for at the fair value of cash received or

receivable. Share options granted to shareholders which represent a

future obligation for the Company outside of its control are

recognised as a financial liability at fair value through profit

and loss.

Share options granted to employees are fair valued at the date

of grant with the cost recognised over the vesting period. If the

employee is employed in a subsidiary company, the cost is added to

the investment value, in the financial statements of the parent,

and the expense recognised in staff costs in the statements of the

subsidiary.

Warrants issued in return for a service are classified as equity

instruments and measured at the fair value of the service received.

Where the service received relates to the issue of shares the cost

is debited against the proceeds received in share premium.

Defined contribution pension obligation

A defined contribution plan is a pension plan under which

pension contributions are paid into a separate entity and the group

has no legal or constructive obligations to pay further

contributions if the fund does not hold sufficient assets to pay

all employees the benefits relating to employee service in the

current and prior periods.

For defined contribution plans contributions are paid into

publicly or privately administered pension insurance plans on a

mandatory or contractual basis. The contributions are recognised as

employee benefit expense when they are due. If contribution

payments exceed the contribution due for service, the excess is

recognised as an asset.

Financial instruments

Initial recognition

Financial assets and financial liabilities comprise all assets

and liabilities reflected in the statement of financial position,

although excluding property, plant and equipment, intangible

assets, right of use assets, inventories, deferred tax assets,

prepayments, deferred tax liabilities and the mining restoration

provision. The Group recognises financial assets and financial

liabilities in the statement of financial position when, and only

when, the Group becomes party to the contractual provisions of the

financial instrument.

Financial assets are initially recognised at fair value.

Financial liabilities are initially recognised at fair value,

representing the proceeds received net of premiums, discounts and

transaction costs that are directly attributable to the financial

liability.

All regular way purchases and sales of financial assets and

financial liabilities classified as fair value through profit or

loss ('FVTPL') are recognised on the trade date, i.e., the date on

which the Group commits to purchase or sell the financial assets or

financial liabilities. All regular way purchases and sales of other

financial assets and financial liabilities are recognised on the

settlement date, i.e., the date on which the asset or liability is

received from or delivered to the counterparty. Regular way

purchases or sales are purchases or sales of financial assets that

require delivery within the time frame generally established by

regulation or convention in the marketplace.

Subsequent to initial measurement, financial assets and

financial liabilities are measured at either amortised cost or fair

value.

In particular the Group has previously recognised a financial

liability arising from the founder share incentives at fair value.

Subsequent movements in fair value are recognised through profit or

loss.

Derecognition

Financial assets

The Group derecognises a financial asset when:

-- the contractual rights to the cash flows from the financial asset expire;

-- it transfers the right to receive the contractual cash flows

in a transaction in which substantially all of the risks and

rewards of ownership of the financial asset are transferred; or

-- the Group neither transfers nor retains substantially all of

the risks and rewards of ownership and it does not retain control

of the financial asset.

On derecognition of a financial asset, the difference between

the carrying amount of the asset and the sum of the consideration

received is recognised as a gain or loss in the profit or loss.

Financial liabilities

The Group derecognises a financial liability when its

contractual obligations are discharged, cancelled, or expire.

Significant accounting estimates and judgements

The preparation of the financial statements requires management

to make estimates and judgements that affect the reported amounts

of certain financial assets, liabilities, income and expenses.

The use of estimates and judgements is principally limited to

the determination of provisions for impairment and the valuation of

financial instruments as explained in more detail below:

Significant accounting judgements

Impairment of non-current assets

To consider the impairment of the Group's non-current assets,

management has calculated a value in use of the Group's

cash-generating unit which comprises the Hemerdon Mine. This was

determined using a discounted cashflow approach, supported by

project cashflow forecasts prepared by management. The value of

assets impacted is GBP24.1 million.

The previous model under the Bankable Feasibility Study ('BFS')

has been adapted to reflect the changes in inputs and assumptions

as a result of the project re-evaluation. The inputs and key

assumptions that were used in the determination of value in use

were discount rate, metal prices, metal recoveries, probability of

financing, probability of permit award and foreign exchange.

Discounted cashflows are based on future forecasts which reflect

uncertainty. Therefore, management has prepared a sensitised

discounted cashflow calculation. The underlying assumptions that

were stress tested include the discount rate, FX and metal prices

and recoveries.

Management were satisfied in the recoverability of the Group's

assets and no impairment was required.

Capitalisation of research and development costs

The Directors have reviewed any costs relating to evaluating the

technical feasibility of processing the extracted tungsten ore and

have expensed these costs in line with the current policy. The

Directors have also reviewed research and development costs and

concluded that these costs fail to meet the criteria set out in IAS

38 for the capitalisation of development costs as the Directors

still consider that they are in the research phase. The Group will

commence capitalisation of development costs at the point when

available finance has been secured to complete the project in

accordance with IAS 38. Development costs that are capitalised in

accordance with the requirements of IFRS are not treated, for

dividend purposes, as a realised loss. The Group has currently

capitalised no research and development costs in accordance with

IAS 38. The Group has only capitalised costs associated with the

tangible improvement and installation of property, plant and

equipment under IAS 16.

Capitalisation of asset under construction costs

The Directors have reviewed any costs relating to the upgrade of

the mineral processing facility in accordance with IAS 16 and have

capitalised costs if it is probable that future economic benefits

associated with the item will flow to the entity and the cost can

be measured reliably. At the year end, GBP13.6 million (2022:

GBP3.9 million) of costs have been capitalised.

Founder options

The Directors consider the non-EMI portion of the founder

options meet the definition of equity in the financial statements

of the Group on the basis that the 'fixed for fixed' condition is

met and that they were awarded to shareholders relating to

investing in the share capital of the Group. The accounting

treatment has been applied in accordance with IAS 32, which

requires initial recognition at fair value of consideration paid

less costs. As there was no consideration received at inception,

the value of the options is GBPNil. When exercised the shares are

recognised at option price.

Key sources of estimation uncertainty

Restoration provision

The restoration provision is the contractual obligation to

restore the mining site back to its original state once mining

ceases. The provision is equal to the expected outflows that will

be incurred at the end of the mine's useful life discounted to

present value. As the restoration work will predominantly be

completed at the end of the mine's useful life, these calculations

are subject to a high degree of estimation uncertainty. The key

assumptions that would lead to significant changes in the provision

are the discount rate, useful life of the mine and the estimate of

the restoration costs.

A 1% change in the discount rate on the Group's restoration

estimates would result in an impact of GBP1.2 million to 1.6

million (2022: GBP1.9 million) on the restoration provision. A 5%

change in cost on the Group's restoration estimates would result in

an impact of GBP0.3 million (2022: GBP0.5 million) on the provision

for restoration.

More information on the restoration provision is disclosed in

Note 25.

Escrow account

These are funds being held under escrow with a third party and

will be released back to the Company on the cessation of mining

once restoration works have been completed.

The key assumptions that would lead to significant changes in

the escrow account fair value are the discount rate and the useful

life of the mine.

A 1% change in the discount rate on the Group's escrow account

estimate would result in an impact of GBP1.1 million to GBP1.5

million (2022: GBP1.7 million) on the escrow account valuation. A

one-year change in useful mining life would result in an impact of

GBP0.2 million (2022: GBP0.1 million) on the escrow account

valuation.

More information on the escrow account is disclosed in Note

19.

Discount rates

The Group has had to assess reasonable discount rates based on

market factors to use under IFRS. These discount rates have been

used on the right-of-use assets, escrow funds, the restoration

provision and share based payments. The discount rate on the

right-of-use asset is the rate for an equivalent debt instrument.

The escrow funds are discounted at the risk free rate which is the

yield on an equivalent long-term UK government bond. The

restoration provision is discounted at the risk-free rate plus a

premium based on the specific risk associated with this

liability.

The UK risk-free rate increased over the financial year to 3.7%

(2022: 2.0%).

3 Financial risk management

Group

This note presents information about the Group's exposure to

financial risks and the Group's management of capital.

Credit risk

In order to minimise credit risk, the Group has adopted a policy

of only dealing with creditworthy counterparties (banks and

debtors) and it obtains sufficient collateral, where appropriate,

to mitigate the risk of financial loss from defaults. The most

significant credit risk relates to customers that may default in

making payments for goods they have purchased. To date the Group

has only made a small number of sales and therefore the credit risk

exposure has been low.

Liquidity risk

The Directors regularly monitor forecast and actual cash flows

and to match the maturity profiles of financial assets and

liabilities to ensure proper liquidity risk management for the

day-to-day working capital requirements.

In the view of the Directors, the key risk to liquidity is

raising the additional capital required to meet its estimated Capex

spend. The Group's continued future operations depend on the

ability to raise sufficient capital through the issue of debt. At

present the Group does not have sufficient capital to fund its

estimated Capex spend therefore there is a liquidity risk which

would result in the Group having to pause its future operations

were it to not raise the necessary capital. At present, the Group

is in discussions with financing partners to provide this

additional capital as noted in the previous going concern

policy.

Market risk

Interest rate risk

The Group is exposed to interest rate risk through the impact of

rate changes on interest-bearing borrowings. The interest rates and

terms of repayment are disclosed in Note 24 to the financial

statements. The Company's policy is to obtain the most favourable

interest rates available for all liabilities. Except as outlined

above, the Group has no significant interest-bearing assets and

liabilities.

Foreign exchange risk

The Group in the future will also be exposed to exchange rate

risk on the basis that tungsten prices are principally denominated

in US Dollar. The Group will seek to manage this risk through the

supply contracts it agrees with future customers.

The Group does not use any derivative instruments to reduce its

economic exposure to changes in interest rates or foreign currency

exchange rates at the current time.

Price risk

The Group is exposed to the price fluctuation of its primary

products being tungsten and tin. Given the Group is currently in

the development phase and is not yet producing any revenue, the

costs of managing exposure to commodity price risk exceed any

potential benefits. The Directors monitor this risk on an ongoing

basis and will review this as the Group moves towards

production.

Inflation Risk

The Group is exposed to inflationary pressures that impact the

core materials required for the operations, mainly being reagents,

power and diesel costs. The Directors monitor this risk on an

ongoing basis and will review this as the group moves towards

production.

4 Operating segments

The Chief Economic Decision Maker of the Group is the Board of

Directors which considers that the Group is comprised of one

operating segment representing the Group's mining activities at the

Hemerdon Mine. All operations and assets are located in the United

Kingdom and all revenues are originated in the United Kingdom.

Revenue from customers accounting for 10% or more of Group

revenue was as follows:

2023 2022

GBP GBP

----------- ------- -------

Customer A 118,276 384,000

Customer B - 83,000

Customer C - 144,000

Customer D 508,184 -

----------- ------- -------

5 Revenue from contracts with customers

The analysis of the Group's revenue for the year from continuing

operations is as follows:

2023 2022

GBP GBP

-------------- ------- -------

Tungsten 508,184 232,940

Aggregates 118,276 440,569

-------------- ------- -------

Sale of goods 626,460 673,509

-------------- ------- -------

6 Other income

The analysis of the Group's other operating income for the year

is as follows:

2023 2022

GBP GBP

----------------------- ------ -----

Sale of scrap metal 13,962 4,237

Sublease rental income 4,985 -

----------------------- ------ -----

18,947 4,237

----------------------- ------ -----

7 Other gains and losses

The analysis of the Group's other gains and losses for the year

is as follows:

2023 2022

GBP GBP

------------------------------------------- ----------- -----------

Gain on restoration provision due to

change in discount rate 4,205,774 786,849

Loss on escrow account due to change

in discount rate (3,495,064) (1,783,221)

Gains/(losses) on founder share incentives - 149,999

------------------------------------------- ----------- -----------

Other gains and losses 710,710 (846,373)

------------------------------------------- ----------- -----------

See note 19 and note 25 for further details on other gains and

losses on the restoration provision and the escrow account.

8 Operating loss

Arrived at after charging/(crediting):

2023 2022

GBP GBP

--------------------------------------- --------- ---------

Depreciation of property, plant and

equipment 276,995 101,464

Depreciation of right-of-use assets 216,039 101,169

Loss on disposal of right to use asset 124,528 -

Impairment of asset under construction 108,947 -

Amortisation of intangibles 21,360 6,599

Staff costs 4,593,833 2,465,924

--------------------------------------- --------- ---------

9 Finance income and costs

2023 2022

GBP GBP

------------------------------------------- ---------- ---------

Finance income

Notional interest income on the escrow

funds receivable 272,026 94,775

Other interest income 99,082 1,134

Foreign exchange gains 83,088 24,093

------------------------------------------- ---------- ---------

454,196 120,002

Finance costs

Interest expense on other financing

liabilities (101,772) (556,558)

Notional cost on the restoration provision (381,060) (348,507)

Other interest - (1,133)

Bank charges (4,083) (3,823)

Foreign exchange losses (8,364) (3,445)

------------------------------------------- ---------- ---------

Total finance costs (495,279) (913,466)

------------------------------------------- ---------- ---------

Net finance costs (41,083) (793,464)

------------------------------------------- ---------- ---------

10 Staff costs

The aggregate payroll costs (including Directors' remuneration)

were as follows:

2023 2022

GBP GBP

------------------------------------------------ --------- ---------

Wages and salaries 3,888,672 2,114,626

Social security costs 427,748 234,915

Pension costs, defined contribution

scheme 161,908 116,383

Share based payment 115,505 298,878

Amounts capitalised to asset under construction 968,262 988,917

------------------------------------------------ --------- ---------

5,562,095 3,753,719

------------------------------------------------ --------- ---------

The average number of persons employed by the Group (including

Directors) during the year, analysed by category, was as

follows:

2023 2022

No. No.

------------------------------------- ---- ----

Project, maintenance, administration

and support 74 52

Directors 7 6

------------------------------------- ---- ----

81 58

------------------------------------- ---- ----

11 Directors' remuneration

The Directors' remuneration for the year was as follows:

2023 2022

GBP GBP

------------------------ -------- -------

Remuneration 873,029 524,125

Pension contribution 21,019 13,974

Benefits in kind 2,340 7,483

------------------------ -------- -------

Total cash remuneration 896,388 545,582

Share-based payment 66,993 182,997

------------------------ -------- -------

Total remuneration 963,381 728,579

------------------------ -------- -------

Included in the remuneration above was GBPNil (2022: GBPNil)

paid in shares rather than cash.

Remuneration by each Director is as follows:

2023 2023

2023 2023 2023

2023 Total

Loss of Share-based GBP

Salary Pension office Benefits payment

GBP GBP GBP GBP GBP

-------------------------- --------- --------- --------- --------- ------------ ---------

Francis Johnstone 20,000 - - - - 20,000

------------------ ----------------- --------- --------- --------- ------------ ---------

Stephen Fabian - - - - - -

------------------ ----------------- --------- --------- --------- ------------ ---------

Richard M Maxey 20,000 - - - - 20,000

-------------------------- --------- --------- --------- --------- ------------ ---------

Max Denning** 124,246 9,613 158,411 - 38,781 331,051

-------------------------- --------- --------- --------- --------- ------------ ---------

Mark Thompson 200,000 - 100,000 - 3,134 303,134

-------------------------- --------- --------- --------- --------- ------------ ---------