United

States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

May 31, 2024

Date of Report (Date of earliest event reported)

Acri Capital Acquisition Corporation

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41415 |

|

87-4328187 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

13284 Pond Springs Rd, Ste 405

Austin, Texas |

|

78729 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 512-666-1277

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant

to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act: None.

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A Common Stock and on-half of one Warrant |

|

ACACU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Class A Common Stock, par value $0.0001 per share |

|

ACAC |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 |

|

ACACW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

As

previously announced in the Current Report on Form 8-K by Acri Capital Acquisition Corporation (the “ACAC”) on February 20,

2024, on February 18, 2024, ACAC entered into a business combination agreement (the “Business Combination Agreement”) with

Acri Capital Merger Sub I Inc., a Delaware corporation and subsidiary of the Company (“PubCo”), Acri Capital Merger Sub II

Inc., a Delaware corporation and subsidiary of the PubCo (“Merger Sub”), and Foxx Development Inc., a Texas corporation (“Foxx”),

pursuant to which: (a) ACAC will merge with and into PubCo, with PubCo as the surviving entity (the “Reincorporation Merger”);

(b) Foxx will merge with and into Merger Sub, with Merger Sub surviving as a wholly-owned subsidiary of PubCo (the “Acquisition

Merger”, collectively with the Reincorporation Merger, the “Business Combination”).

On

May 31, 2024, ACAC, PubCo, Merger Sub, and Foxx entered into an amendment to the Business Combination Agreement (the “BCA Amendment”).

Pursuant to the BCA Amendment, ACAC, PubCo, Merger Sub, and Foxx agreed to revise the lock-up provision, which shall now provide that,

each Pre-Closing Company Stockholder (as defined in the Business Combination Agreement) who holds more than 5% of issued and outstanding

shares of common stock of Foxx (“Foxx Common Stock”) immediately prior to closing of the Business Combination (the “Closing”)

except the Pre-Closing Company Stockholders who hold Foxx Common Stock issuable upon the conversion of certain convertible notes of Foxx,

the Sponsor, and affiliates of the foregoing, will, subject to certain customary exceptions, agree not to sell any share of common stock

of the PubCo (“PubCo Common Stock”) held by them until the earlier to occur of: (A) six months after the Closing,

or (B) the date on which the last reported sale price of the PubCo Common Stock equals or exceeds $12.00 per share (as adjusted for

share splits, share dividends, reorganizations and recapitalizations) for any 20 trading days within any 30-trading day period

commencing after the Closing, or earlier, in any case, if subsequent to the Closing, the PubCo completes a subsequent liquidation, merger,

stock exchange or other similar transaction that results in all of ACAC’s stockholders having the right to exchange their shares

for cash, securities or other property.

A

copy of the BCA Amendment is attached to this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Additional Information about the Transaction

and Where to Find It

The Business Combination has been approved by the boards of directors

of ACAC, PubCo and Foxx, and will be submitted to stockholders of ACAC and the stockholders of Foxx for their approval. In connection

with such approval, PubCo intends to file with the SEC the Proxy Statement/Prospectus. After the Registration Statement that forms a part

of the Proxy Statement/Prospectus has been declared effective, ACAC will mail a definitive proxy statement and other relevant documents

to its stockholders as of the record date established for voting on the proposed transaction. ACAC stockholders are urged to read, once

available, the preliminary Proxy Statement/Prospectus and any amendments thereto and the definitive Proxy Statement/Prospectus in connection

with the proposed transaction, as these materials will contain important information about ACAC, PubCo, Foxx and the Business Combination.

ACAC stockholders will also be able to obtain a free copy of the Proxy Statement/Prospectus, as well as other filings containing information

about ACAC, without charge, at the SEC’s website (www.sec.gov).

Forward-Looking Statements

This

Report includes forward looking statements that involve risks and uncertainties. Forward-looking statements are statements that are not

historical facts and may be accompanied by words that convey projected future events or outcomes, such as “believe,” “may,”

“will,” “estimate,” “continue,” “anticipate,” “design,” “intend,”

“expect,” “could,” “plan,” “potential,” “predict,” “seek,” “target,”

“aim,” “plan,” “project,” “forecast,” “should,” “would,” or variations

of such words or by expressions of similar meaning. Such forward-looking statements, including statements regarding anticipated financial

and operational results, projections of market opportunity and expectations, the estimated post-transaction enterprise value, the advantages

and expected growth of PubCo, the cash position of PubCo following Closing, the ability of ACAC, PubCo or Foxx to consummate the proposed

business combination and the timing of such consummation, are subject to risks and uncertainties, which could cause actual results to

differ from the forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in

the section entitled “Risk Factors” in the final prospectus filed with the SEC on June 10, 2022 (the “IPO Prospectus”),

the Registration Statement on Form S-4 to be filed by PubCo, which will include a proxy statement containing information about the proposed

transaction and the respective businesses of Foxx and ACAC, as well as the prospectus relating to the offer of PubCo’s securities

to be issued to Foxx Stockholders in connection with the completion of the proposed transaction (the “Proxy Statement/Prospectus”),

and in other documents filed by ACAC or PubCo with the SEC from time to time. Important factors that could cause PubCo’s actual

results or outcomes to differ materially from those discussed in the forward-looking statements include: Foxx’s or Pubco’s

limited operating history; the ability of Foxx or PubCo to identify and integrate acquisitions; general economic and market conditions

impacting demand for the products and services of Foxx or PubCo; the inability to complete the proposed Business Combination; the inability

to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, the amount of

cash available following any redemptions by ACAC stockholders; the ability to meet Nasdaq’s listing standards following the consummation

of the proposed Business Combination; costs related to the proposed Business Combination; and such other risks and uncertainties as are

discussed in the IPO Prospectus and the Proxy Statement/Prospectus. Other factors include the possibility that the proposed Business Combination

does not close, including due to the failure to receive required security holder approvals, or the failure of other closing conditions.

ACAC,

PubCo and Foxx each expressly disclaim any obligations or undertaking to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the expectations of ACAC, PubCo or Foxx with respect thereto or any change in events,

conditions or circumstances on which any statement is based, except as required by law.

Participants in the Solicitation

ACAC,

PubCo, Foxx and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation

of proxies from ACAC stockholders with respect to the proposed Business Combination. Information regarding the ACAC’s directors

and executive officers is available in the IPO Prospectus. Additional information regarding the persons who may, under the rules of the

SEC, be deemed to be participants in the proxy solicitation relating to the proposed Business Combination and a description of their direct

and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus when it becomes available.

No Offer or Solicitation

This

Report does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Acri Capital Acquisition Corporation |

| |

|

| Date: June 3, 2024 |

By: |

/s/ “Joy” Yi Hua |

| |

Name: |

“Joy” Yi Hua |

| |

Title: |

Chief Executive Officer |

3

Exhibit

10.1

AMENDMENT TO BUSINESS

COMBINATION AGREEMENT

This

Amendment to Business Combination Agreement (the “Amendment”), dated as of May 31, 2024, by and among, Acri Capital

Acquisition Corporation, a Delaware corporation (the “Parent”), Acri Capital Merger Sub I Inc., a Delaware corporation

formed to become a wholly-owned subsidiary of the Parent (the “Purchaser”), Acri Capital Merger Sub II Inc., a Delaware

corporation formed to become a wholly-owned subsidiary of the Purchaser (“Merger Sub”), and Foxx Development Inc.,

a Texas for profit corporation (the “Company”). Capitalized terms not otherwise defined in this Amendment shall have

the meaning given to them in the Business Combination Agreement (as defined below).

W I T N E S S E T H:

WHEREAS,

Parent, Purchaser, Merger Sub, and the Company are parties to a certain Business Combination Agreement dated as of February 18, 2024 (the

“Business Combination Agreement”);

WHEREAS,

in accordance with the terms of Section 12.11 of the Business Combination Agreement, Parent, Purchaser, Merger Sub and the Company desire

to amend the Business Combination Agreement as set forth herein;

NOW,

THEREFORE, in consideration of the foregoing and the respective covenants and agreements set forth below, and for other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, Parent, Purchaser, Merger Sub and the Company agree as follows:

Section 1. Amendments

to the Business Combination Agreement.

1.1 Article

IX, Section 9.13 of the Business Combination Agreement shall hereby be deleted in its entirety and shall be replaced as follows:

Section 9.13 Lock-Up Agreement

and Insider Trading Policy.

(a) On or before the Closing

Date, the Purchaser shall enter into a Lock-Up Agreement (each a “Lock-Up Agreement”) with each Pre-Closing Company

Stockholder who holds more than 5% of issued and outstanding shares of Company Common Stock immediately prior to the Closing except the

Pre-Closing Company Stockholders who hold the Company Common Stock issuable upon the conversion of certain convertible notes of the Company,

the Sponsor, and affiliates of the foregoing, in the form of Exhibit D, which shall include, among other provisions, restrictions

on transfer of the shares of Purchaser Common Stock issued in connection with the Acquisition Merger hereunder, pursuant to which the

shares of Purchaser Common Stock issued to those holders will be subject to certain lock-up after the Closing.

(b) On or before the Closing

Date, the Purchaser shall adopt and cause to be effective upon and following the Effective Time, an insider trading policy customary for

a public company.

Section 2. Effectiveness

of Amendment. Upon the execution and delivery hereof, the Business Combination Agreement shall thereupon be deemed to be amended as

set forth herein and with the same effect as if the amendments made hereby were originally set forth in the Business Combination Agreement,

and this Amendment and the Business Combination Agreement shall henceforth respectively be read, taken and construed as one and the same

instrument, but such amendments shall not operate so as to render invalid or improper any action heretofore taken under the Business Combination

Agreement. Upon the effectiveness of this Amendment, each reference in the Business Combination Agreement to “this Agreement,”

“hereof,” “hereunder” or words of like import referring to the Business

Combination Agreement shall refer to the Business Combination Agreement as amended by this Amendment.

Section 3. General

Provisions.

(a) Miscellaneous.

This Amendment may be executed in two or more counterparts, each of which shall be deemed an original but all of which together shall

be considered one and the same agreement and shall become effective when counterparts have been signed by each of the parties hereto and

delivered to the other parties, it being understood that all parties need not sign the same counterpart. This Amendment may be executed

and delivered by facsimile or PDF transmission. The terms of Article XII of the Business Combination Agreement shall apply to this Amendment,

as applicable.

(b) Business

Combination Agreement in Effect. Except as specifically and explicitly provided for in this Amendment, the Business Combination Agreement

shall remain unmodified and in full force and effect.

[Remainder of Page

Intentionally Left Blank]

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be duly executed as of the day and year first above written.

|

Parent |

ACRI CAPITAL ACQUISITION CORPORATION |

| |

|

|

| |

By: |

/s/ “Joy” Yi Hua |

| |

Name: |

“Joy” Yi Hua |

| |

Title: |

Chief Executive Officer |

| |

|

|

| Purchaser |

ACRI CAPITAL MERGER SUB I INC., |

| |

|

|

| |

By: |

/s/ “Joy” Yi Hua |

| |

Name: |

“Joy” Yi Hua |

| |

Title: |

Sole Director |

| |

|

|

| Merger Sub |

ACRI CAPITAL MERGER SUB II INC., |

| |

|

|

| |

By: |

/s/ “Joy” Yi Hua |

| |

Name: |

“Joy” Yi Hua |

| |

Title: |

Sole Director |

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be duly executed as of the day and year first above written.

| Company |

FOXX DEVELOPMENT INC. |

| |

|

| |

By: |

/s/ Greg Foley |

| |

Name: |

Greg Foley |

| |

Title: |

Chief Executive Officer |

4

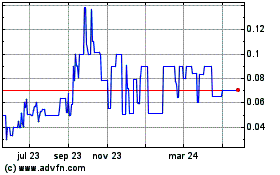

Acri Capital (NASDAQ:ACACW)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Acri Capital (NASDAQ:ACACW)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025