Acer Therapeutics Inc. (Nasdaq: ACER), a pharmaceutical company

focused on the acquisition, development and commercialization of

therapies for serious, rare and life-threatening diseases with

significant unmet medical needs, today reported financial results

for the first quarter ended March 31, 2023 and provided a corporate

update.

“The first quarter of 2023 was marked by considerable progress

and a number of significant milestones in support of our commercial

launch of OLPRUVA™, an innovative treatment option for patients

with certain Urea Cycle Disorders (UCDs),” said Chris Schelling,

CEO and Founder of Acer. “As a result, we are now ahead of our

anticipated launch schedule with drug-in-channel expected in

mid-June 2023. We have also made significant progress in the other

key areas of our OLPRUVA™ commercialization strategy, including

ongoing discussions with commercial and government insurance

providers, physician outreach and awareness, and patient support

and fulfillment. We look forward to continued progress in all of

these areas and to delivering OLPRUVA™ to patients in mid-June

2023.”

Mr. Schelling added, “We have also started a broad outreach

program to physicians who treat vascular Ehlers-Danlos Syndrome

(vEDS) patients and have received overwhelming support for our

ongoing Decentralized

Study of

Celiprolol on

vEDS-related Event

Reduction (DiSCOVER) Phase 3 EDSIVO™ (celiprolol)

clinical trial. As a result, we anticipate enrollment in this trial

to be completed by the end of this year. All of these activities

are subject to additional capital.”

Q1 2023 and Recent Highlights

- OLPRUVA™ (sodium phenylbutyrate) for oral suspension

- In March 2023, Acer announced the presentation of data at the

Annual Meeting of the Society for Inherited Metabolic Disorders

(SIMD) from a survey of UCD healthcare providers sponsored by Acer

that indicated taste and odor were the most important attributes

when considering treatment options and treatment adherence

- Also at the SIMD Annual Meeting, Acer representatives met with

33 metabolic treatment providers -- including nurse practitioners,

registered dieticians, and physicians – from 24 metabolic treatment

centers throughout the U.S. Of those metabolic treatment providers

surveyed by Acer, 70% expressed a high interest in treating at

least one of their patients with OLPRUVA™ in 2023

- In preparation for OLPRUVA™’s planned drug-in-channel in

mid-June 2023, the Company is in discussions with the major

pharmacy benefits managers (PBM) and group purchasing organizations

(GPO) representing a substantial majority of covered lives

- Acer has also established a responsible and competitive pricing

strategy designed to offer UCD patients a new treatment option at a

significant discount to RAVICTI® while delivering predictable

pricing that will not increase beyond the rate of inflation. Acer

also plans to invest a portion of OLPRUVA™ revenue back into

additional solutions aimed at improving outcomes for UCD

patients

- Finally, Acer has established and staffed its patient support

program, Navigator by Acer Therapeutics, that includes a suite of

services designed to provide streamlined and efficient prescription

management -- including benefits verification, education, and home

delivery -- and personalized support for OLPRUVA™ patients

- EDSIVO™ (celiprolol)

- Acer continues to enroll patients in

its ongoing, pivotal Phase 3

Decentralized

Study of

Celiprolol on

vEDS-related Event

Reduction (DiSCOVER) clinical trial of EDSIVO™

(celiprolol) in patients with COL3A1-positive vEDS. The

double-blind portion of the DiSCOVER trial is designed to include

an interim analysis conducted after 28 vEDS related events, which

could occur as early as approximately 18 months after completion of

full enrollment; and end if statistical significance is reached

after 46 vEDS-related events, estimated to occur as early as

approximately 40 months after completion of full enrollment

- ACER-801

- In March 2023, Acer announced

topline results from its Phase 2a trial evaluating ACER-801

(osanetant) for the treatment of moderate to severe Vasomotor

Symptoms (VMS) associated with menopause. The trial showed that

ACER-801 was generally safe and well-tolerated but did not achieve

statistically significant decrease in frequency or severity of hot

flashes in postmenopausal women. As a result, Acer has paused the

ACER-801 program until it has completed a thorough review of the

full data set from the Phase 2a trial

- Corporate

- Ended Q1 2023 with $6.4 million in

cash and cash equivalents. Acer believes its cash and cash

equivalents available at March 31, 2023, together with $0.4 million

from Acer’s ATM facility subsequent to March 31, 2023, will be

sufficient to fund its anticipated operating and capital

requirements into late in the second quarter of 2023

Anticipated Milestones (Subject to Available

Capital)

- Mid-to-Late May 2023: Acer expects to publish

OLPRUVA™’s list price, or wholesale acquisition cost (WAC), in

mid-to-late May 2023

- June 2023: Acer anticipates OLPRUVA™ drug

availability in mid-June 2023

- 2H 2023: Acer expects to begin attaining

OLPRUVA™ commercial insurance coverage in 2H 2023

- Q3 2023: Acer expects to begin attaining

insurance coverage for OLPRUVA™ Medicaid patients starting in Q3

2023

- Year End 2023: Acer anticipates enrollment

completion by end of 2023 in its ongoing, pivotal Phase 3 DiSCOVER

trial of EDSIVO™ in patients with COL3A1-positive vEDS

- Acer also intends to pursue additional opportunities for

potential OLPRUVA™ label expansion, including the potential for

additional dosage strengths to address patients with lower

weights/body surface areas, and potential administration using a

gastrostomy tube (G-tube)

Q1 2023 Financial Results

Cash Position. Cash and cash equivalents were

$6.4 million as of March 31, 2023, compared to $2.3 million as of

December 31, 2022. Acer believes its cash and cash equivalents

available at March 31, 2023, together with $0.4 million from Acer’s

ATM facility subsequent to March 31, 2023, will be sufficient to

fund its anticipated operating and capital requirements into late

in the second quarter of 2023.

Research and Development Expenses. Research and

development expenses were $2.4 million, net of collaboration

funding of $0.7 million, for the three months ended March 31, 2023,

as compared to $3.2 million, net of collaboration funding of $3.0

million, for the three months ended March 31, 2022. This decrease

of $0.8 million was primarily due to decreases in expenses for

contract manufacturing and contract research, employee-related

expenses, and clinical studies related to ACER-801 and EDSIVO™.

Research and development expenses related to ACER-001 decreased in

the three months ended March 31, 2023, resulting in a decrease in

the recognition of the collaboration funding from the Collaboration

Agreement with Relief. Research and development expenses for the

three months ended March 31, 2023 were comprised of $1.0 million

related to EDSIVO™; $0.8 million related to ACER-001, offset by

$0.7 million of collaboration funding; $0.8 million related to

ACER-801; and $0.5 million related to other development

activities.

General and Administrative Expenses. General

and administrative expenses were $2.6 million, net of collaboration

funding of $1.1 million, for the three months ended March 31, 2023,

as compared to $3.9 million, net of collaboration funding of $2.4

million, for the three months ended March 31, 2022. This decrease

of $1.3 million was primarily due to decreases in employee-related

expenses, precommercial expenses, and consulting fees. General and

administrative expenses related to ACER-001 decreased in the three

months ended March 31, 2023, resulting in a decrease in the

recognition of the collaboration funding from the Collaboration

Agreement with Relief.

Net Loss. Net loss for the three months ended

March 31, 2023 was $16.3 million, or $0.77 net loss per share

(basic and diluted), compared to a net loss of $9.2 million, or

$0.64 net loss per share (basic and diluted), for the three months

ended March 31, 2022.

For additional information, please see Acer’s Quarterly Report

on Form 10-Q filed today with the Securities and Exchange

Commission (SEC).

About Acer TherapeuticsAcer is a pharmaceutical

company focused on the acquisition, development and

commercialization of therapies for serious rare and

life-threatening diseases with significant unmet medical needs. In

the U.S., OLPRUVA™ (sodium phenylbutyrate) is approved for the

treatment of urea cycle disorders (UCDs) involving deficiencies of

carbamylphosphate synthetase (CPS), ornithine transcarbamylase

(OTC), or argininosuccinic acid synthetase (AS). Acer is also

advancing a pipeline of investigational product candidates for rare

and life-threatening diseases, including: OLPRUVA™ (sodium

phenylbutyrate) for treatment of various disorders; EDSIVO™

(celiprolol) for treatment of vascular Ehlers-Danlos syndrome

(vEDS) in patients with a confirmed type III collagen (COL3A1)

mutation; and ACER-801 (osanetant) for treatment of Vasomotor

Symptoms (VMS), post-traumatic stress disorder (PTSD) and prostate

cancer. For more information, visit www.acertx.com.

Acer Forward-Looking StatementsThis press

release contains “forward-looking statements” that involve

substantial risks and uncertainties for purposes of the safe harbor

provided by the Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical facts, included

in this press release are forward-looking statements. Examples of

such statements include, but are not limited to, statements about

plans and strategy for the commercialization of OLPRUVA™ for oral

suspension in the U.S. for the treatment of certain patients with

certain UCDs, including launch schedule and timing of drug in

channel, progress with respect to discussions with commercial and

government insurance providers, physicians outreach and awareness,

and patient support and fulfillment, statements with respect to our

EDSIVO clinical trial for patients with vEDS, including enrollment

and timing milestones related thereto, statements about our

anticipated 2023 milestones, statements about our investment of

OLPRUVA revenue, and statements about our capital requirements and

sufficiency and duration of our current cash and cash equivalents.

Our efforts to commercialize OLPRUVA™ for oral suspension in the

U.S. for the treatment of certain patients with UCDs involving

deficiencies of CPS, OTC, or AS are at an early stage, we currently

do not have fully developed marketing, sales or distribution

capabilities, and there is no guarantee that we will be successful

in our commercialization efforts. Our pipeline products (including

OLPRUVA™ for indications other than UCDs as well as EDSIVO™ and

ACER-801) are under investigation and their safety and efficacy

have not been established and there is no guarantee that any of our

investigational products in development will receive health

authority approval or become commercially available for the uses

being investigated. We may not actually achieve the plans, carry

out the intentions or meet the expectations or projections

disclosed in the forward-looking statements and you should not

place undue reliance on these forward-looking statements. Such

statements are based on management’s current expectations and

involve risks and uncertainties. Actual results and performance

could differ materially from those projected in the forward-looking

statements as a result of many factors, including, without

limitation, the availability of financing to fund our

commercialization efforts, our pipeline product development

programs and our general corporate operations as well as risks

related to drug development and the regulatory approval process,

including the timing and requirements of regulatory actions. We

disclaim any intent or obligation to update these forward-looking

statements to reflect events or circumstances that exist after the

date on which they were made. You should review additional

disclosures we make in our filings with the Securities and Exchange

Commission, including our Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q. You may access these documents for no charge

at http://www.sec.gov.

|

|

|

|

ACER THERAPEUTICS INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(Unaudited) |

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

| Research and development (net

of collaboration funding of $718,410 and $2,999,371 in the

three months ended March 31, 2023 and 2022, respectively) |

$ |

2,421,120 |

|

|

$ |

3,171,639 |

|

| General and administrative

(net of collaboration funding of $1,142,596 and $2,372,175 in

the three months ended March 31, 2023 and 2022,

respectively) |

|

2,568,181 |

|

|

|

3,875,601 |

|

| Loss from operations |

|

(4,989,301 |

) |

|

|

(7,047,240 |

) |

| |

|

|

|

|

|

|

|

| Other income (expense),

net: |

|

|

|

|

|

|

|

| Costs of debt issuance |

|

(577,225 |

) |

|

|

(1,168,065 |

) |

| Loss on extinguishment of

debt |

|

(8,191,494 |

) |

|

|

— |

|

| Changes in fair value of debt

instruments |

|

(2,211,685 |

) |

|

|

(962,400 |

) |

| Interest and other income

(expense), net |

|

(286,537 |

) |

|

|

(2,838 |

) |

| Foreign currency transaction

(loss) gain |

|

(24,464 |

) |

|

|

1,539 |

|

| Total other income (expense),

net |

|

(11,291,405 |

) |

|

|

(2,131,764 |

) |

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(16,280,706 |

) |

|

$ |

(9,179,004 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

$ |

(0.77 |

) |

|

$ |

(0.64 |

) |

| |

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - basic and diluted |

|

21,113,166 |

|

|

|

14,310,244 |

|

SELECTED BALANCE SHEET DATA (Unaudited):

| |

|

March 31, |

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

6,379,977 |

|

|

$ |

2,329,218 |

|

|

|

|

|

|

|

|

|

|

|

|

Inventory |

|

$ |

412,038 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

| Prepaid

expenses |

|

$ |

800,777 |

|

|

$ |

759,292 |

|

|

|

|

|

|

|

|

|

|

|

| Deferred

financing costs |

|

$ |

— |

|

|

$ |

408,000 |

|

|

|

|

|

|

|

|

|

|

|

| Other

current assets |

|

$ |

14,638 |

|

|

$ |

20,188 |

|

|

|

|

|

|

|

|

|

|

|

| Property

and equipment, net |

|

$ |

202,097 |

|

|

$ |

214,578 |

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

15,672,096 |

|

|

$ |

11,624,226 |

|

|

|

|

|

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

5,918,621 |

|

|

$ |

7,470,674 |

|

|

|

|

|

|

|

|

|

|

|

| Deferred

collaboration funding |

|

$ |

6,551,965 |

|

|

$ |

8,412,971 |

|

|

|

|

|

|

|

|

|

|

|

| SWK

Loans payable, at fair value |

|

$ |

17,057,110 |

|

|

$ |

5,567,231 |

|

|

|

|

|

|

|

|

|

|

|

|

Convertible note payable current, at fair value |

|

$ |

11,392,167 |

|

|

$ |

6,047,532 |

|

|

|

|

|

|

|

|

|

|

|

| Total

liabilities |

|

$ |

41,785,695 |

|

|

$ |

28,385,498 |

|

|

|

|

|

|

|

|

|

|

|

| Total

stockholders’ deficit |

|

$ |

(26,113,599 |

) |

|

$ |

(16,761,272 |

) |

Corporate and IR Contact

Jim DeNikeAcer Therapeutics

Inc.jdenike@acertx.com+1-844-902-6100

Nick ColangeloGilmartin

Groupnick@gilmartinIR.com+1-332-895-3226

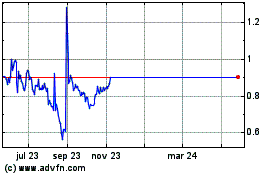

Acer Therapeutics (NASDAQ:ACER)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

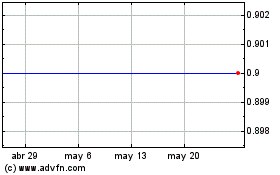

Acer Therapeutics (NASDAQ:ACER)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025