Advanced Emissions Solutions, Inc. (NASDAQ: ADES) (the "Company" or

"ADES") an environmental technology company producing activated

carbon and other unique carbon solutions for use in water, air and

soil purification, sustainable energy, sustainable materials, and

energy transition applications, today filed its Quarterly Report on

Form 10-Q and reported financial results for the quarter ended

September 30, 2023.

Business Highlights

- Substantial progress toward the optimization of the Company's

Powder Activated Carbon ("PAC") portfolio through elimination of

unfavorable contracts and shift toward more favorable market

opportunities.

- Announced that Jeremy "Deke" Williamson has been appointed as

Chief Operating Officer ("COO") effective September 18, 2023.

- Subsequent to quarter-end, the Company received its air permit

approval; commenced phase one of construction at Red River to

produce granular activated carbon.

Financial Highlights

- Third quarter consumables revenue was $29.8 million compared to

$28.4 million in the prior year period.

- Third quarter consumables gross margin was 30.6% compared to

24.1% in the prior year period.

- Third quarter net loss was $2.2

million compared to net loss of $2.4 million in the prior year

period.

- Third quarter Consolidated Adjusted

EBITDA was $0.9 million compared to Consolidated Adjusted EBITDA

loss of $0.5 million in the prior year period.

- Cash balances as of

September 30, 2023, including restricted cash, totaled $61.3

million, compared to $76.4 million as of December 31,

2022.

“Throughout the third quarter we intensely focused on measures

designed to improve unit economics by optimizing our PAC

portfolio," said Robert Rasmus, CEO of ADES. “These measures

included eliminating customer contracts at unfavorable margins,

increasing our overall selling price and improving our product mix.

These initiatives improved our financial performance and led to

positive EBITDA in the third quarter while also delivering 5%

revenue growth for our consumables products."

Rasmus continued, “We are pleased with the pace and progression

of the first stage of our strategic plan to repurpose our assets to

produce granular activated carbon products. Our pre-qualification

conversations with potential customers continue to demonstrate high

levels of demand and are very encouraging. Given the nature of

these discussions, we see a path toward meeting our expected

capacity with pre-production contracts. As such, we are evaluating

the practicality and costs associated with accelerating certain

aspects of the expansion plan.”

Third Quarter and Year-to-Date

2023 Results

Third quarter revenues and costs of revenues were $29.8 million

and $20.7 million, respectively, compared to $28.4 million and

$21.6 million for the third quarter of 2022. The increase in

revenue was driven mainly by higher average selling prices and

positive changes in product mix of the Company's consumable

products. Year-to-date revenues and costs of revenues were $71.1

million and $53.2 million, respectively, compared to $79.6 million

and $63.0 million for the comparable period in the prior year. The

revenue decline was the result of lower sales of consumables

products due to lower natural gas prices which negatively impacted

the Company’s Power Generation customers, partially offset by

higher average selling prices. While volumes have declined, the

gross margin per pound has improved from prior year due to higher

average selling prices and better input cost management.

Third quarter other operating expenses were $11.6 million

compared to $9.5 million for the third quarter of 2022.

Year-to-date other operating expenses were $34.3 million compared

to $25.3 million in the prior year period. The increases were

mainly the result of higher payroll and benefits expense as well as

higher general and administrative expenses associated with the

acquisition of substantially all of the subsidiaries of Arq

Limited.

Third quarter operating loss was $2.5 million compared to $2.6

million in the prior year. The improvement was mainly a result of

better gross margin in the Company's consumables products.

Year-to-date operating loss totaled $16.4 million compared to an

operating loss of $8.7 million in the prior year. The decline was

mainly the result of lower consumables revenues driven by the

aforementioned factors and higher operating expenses.

Third quarter interest expense was $0.8 million, compared to

$0.1 million in the third quarter of 2022. Year-to-date interest

expense was $2.2 million compared to $0.3 million in the prior year

period. The increases were primarily driven by incremental interest

expense on the Company’s $10.0 million term loan entered into in

conjunction with the Arq acquisition.

The Company did not recognize any income tax expense or benefit

for the third quarter of 2023 or 2022. The Company recognized a

small income tax benefit during the year-to-date period of 2023,

compared to not recognizing any income tax expense or benefit in

the comparable period of 2022.

Third quarter net loss was $2.2 million compared to a net loss

of $2.4 million in the prior year. The improvement was driven by a

smaller operating loss than the prior year. Year-to-date net loss

was $15.5 million compared to net loss of $5.8 million in the prior

year. The decline was the result of lower operating earnings.

Third quarter Consolidated Adjusted EBITDA was $0.9 million

compared to a Consolidated Adjusted EBITDA loss of $0.5 million in

the prior year period. The improvement was driven by an improvement

in net loss. Year-to-date Consolidated Adjusted EBITDA loss was

$9.8 million compared to Consolidated Adjusted EBITDA of $2.5

million for the comparable period in 2022. The decline was mainly

the result of the larger net loss, which included $4.9 million of

transaction and integration costs related to the Arq acquisition

and $1.3 million of severance expense related to two executives.

See note below regarding the use of the non-GAAP financial measure

Adjusted EBITDA and a reconciliation to the most comparable GAAP

financial measure.

Capital Spending and Balance Sheet

The Company expects to incur between $35.0 to

$40.0 million in capital expenditures in 2023, driven by the plant

expansion to enhance the manufacturing and processing capabilities

to enable future granular activated carbon production and amounts

for the completed plant turnaround, as well as the completion of

certain planned projects that were started in 2022 and were

scheduled to be completed during the turnaround. The change in the

Company's capital expenditure outlook is mainly driven by changes

in the timing of when certain costs are expected to be incurred,

with some now expected to be incurred in early 2024, as well as

lower down payments on equipment than previously expected.

Year-to-date capital expenditures totaled $17.0

million compared to $6.2 million in the prior year. The increase

was the result of initial costs of the growth capital projects as

well as higher spend associated with the annual turnaround.

Cash balances as of September 30, 2023,

including restricted cash, totaled $61.3 million, compared to $76.4

million as of December 31, 2022.

Total debt, inclusive of financing leases, as of

September 30, 2023, totaled $21.2 million compared to $4.6

million as of December 31, 2022. The increase was driven by the

$10.0 million term loan entered into in conjunction with the Arq

acquisition as well as the assumption of Arq's loan.

Conference Call and Webcast

Information

The Company has scheduled a conference call to begin at 9:00

a.m. Eastern Time on Thursday, November 9, 2023. The

conference call webcast information will be available via the

Investor Resources section of ADES's website at

www.advancedemissionssolutions.com. Individuals wishing to join the

call may dial (877)408-0890 (Domestic) or +1(201)389-0918

(International) or may join by webcast at

http://www.webcast-eqs.com/ADES110923. A supplemental investor

presentation will be available on the Company's Investor Resources

section of the website prior to the start of the conference

call.

About Advanced Emissions Solutions,

Inc.Advanced Emissions Solutions, Inc. serves as the

holding entity for a family of companies that provide emissions

solutions to customers in the power generation and other

industries.

| ADA brings together ADA Carbon

Solutions, LLC, a leading provider of powder activated carbon

("PAC") and ADA-ES, Inc., the providers of ADA® M-Prove™

Technology. We provide products and services to control

mercury and other contaminants at coal-fired power generators and

other industrial companies. Our broad suite of complementary

products control contaminants and help our customers meet their

compliance objectives consistently and reliably. |

| |

| CarbPure Technologies LLC,

(“CarbPure”), formed in 2015 provides

high-quality PAC and granular activated carbon

ideally suited for treatment of potable water and wastewater. Our

affiliate company, ADA Carbon Solutions, LLC manufactures the

products for CarbPure. |

| |

| FluxSorb, LLC, formed in 2022,

is an emerging technology company that introduces highly engineered

activated carbons with a focus on the emerging remediation markets.

Our vision is to partner with our customers to collaborate, develop

and deploy best in class activated carbon solutions to meet even

the most extreme challenges. |

| |

| Arq is an environmental

technology business founded in 2015 that has developed a novel

process for producing specialty carbon products from coal mining

waste. Arq has the technology and large-scale manufacturing

facilities to produce a micro-fine hydrocarbon powder, Arq powder™,

that can be used as a feedstock to produce activated carbon and as

an additive for other products. |

Caution on Forward-Looking StatementsThis press

release contains forward-looking statements within the meaning of

Section 21E of the Securities Exchange Act of 1934, which provides

a “safe harbor” for such statements in certain circumstances. When

used in this press release, the words “can,” “will,” “intends,”

“expects,” “believes,” similar expressions and any other statements

that are not historical facts are intended to identify those

assertions as forward-looking statements. All statements that

address activities, events or developments that the Company

intends, expects or believes may occur in the future are

forward-looking statements. These forward-looking statements

include, but are not limited to, statements or expectations

regarding: the anticipated effects from an increase in pricing of

our AC products; the anticipated effects from an increase in costs

of our AC products and related cost increases in supply and

logistics; expected supply and demand for our AC products and

services; increasing competition in the AC market; the effects of

the Arq Acquisition; the ability to successfully integrate Arq's

business; the ability to develop and utilize Arq’s products and

technology; the ability to make Arq's products commercially viable;

the expected future demand of Arq's products; future level of

research and development activities; future plant capacity

expansions and site development projects; the effectiveness of our

technologies and the benefits they provide; probability of any loss

occurring with respect to certain guarantees made by Tinuum Group;

the timing of awards of, and work and related testing under, our

contracts and agreements and their value; the timing and amounts of

or changes in future revenues, backlog, funding for our business

and projects, margins, expenses, earnings, tax rates, cash flows,

royalty payment obligations, working capital, liquidity and other

financial and accounting measures; the amount and timing of future

capital expenditures needed for our APT business and Arq to fund

our business plan; awards of patents designed to protect our

proprietary technologies both in the U.S. and other countries; the

adoption and scope of regulations to control certain chemicals in

drinking water and other environmental concerns; the impact of

adverse global macroeconomic conditions, including rising interest

rates, recession fears and inflationary pressures, and geopolitical

events or conflicts; opportunities to effectively provide solutions

to U.S. coal-related businesses to comply with regulations, improve

efficiency, lower costs and maintain reliability; the impact of

prices of competing power generation sources such as natural gas

and renewable energy on demand for our products; and bank failures

or other events affecting financial institutions. These

forward-looking statements involve risks and uncertainties. Actual

events or results could differ materially from those discussed in

the forward-looking statements as a result of various factors

including, but not limited to, timing of new and pending

regulations and any legal challenges to or extensions of compliance

dates of them; the U.S. government’s failure to promulgate

regulations that benefit our business; changes in laws and

regulations, accounting rules, prices, economic conditions and

market demand; impact of competition; availability, cost of and

demand for alternative energy sources and other technologies;

technical, start up and operational difficulties; our inability to

commercialize our APT technologies on favorable terms; our

inability to ramp up our operations to effectively address recent

and expected growth in our business; loss of key personnel;

availability of materials and equipment for our business;

intellectual property infringement claims from third parties;

pending litigation; as well as other factors relating to our

business strategy, goals and expectations concerning the Arq

Acquisition (including future operations, future performance or

results); our ability to maintain relationships with customers,

suppliers and other with whom we do business, or our results of

operations and business generally; risks related to diverting

management's attention from our ongoing business operations; the

ability to meet Nasdaq's listing standards following the

consummation of the Arq Acquisition; costs related to the Arq

Acquisition; opportunities for additional sales of our lignite AC

products and end-market diversification; our ability to meet

customer supply requirements; the rate of coal-fired power

generation in the U.S., as well as other factors relating to our

business, as described in our filings with the SEC, with particular

emphasis on the risk factor disclosures contained in those filings.

You are cautioned not to place undue reliance on the

forward-looking statements and to consult filings we have made and

will make with the SEC for additional discussion concerning risks

and uncertainties that may apply to our business and the ownership

of our securities. In addition to causing our actual results to

differ, the factors listed above may cause our intentions to change

from those statements of intention set forth in this press release.

Such changes in our intentions may also cause or results to differ.

We may change our intentions, at any time and without notice, based

upon changes in such factors, our assumptions, or otherwise. The

forward-looking statements speak only as to the date of this press

release.

Non-GAAP Financial Measures

This press release presents certain supplemental financial

measures, including Consolidated EBITDA and Consolidated Adjusted

EBITDA, which are measurements that are not calculated in

accordance with U.S. Generally Accepted Accounting Principles

(“GAAP”). Consolidated EBITDA is defined as earnings before

interest, taxes, depreciation and amortization. Consolidated

Adjusted EBITDA is defined as Consolidated EBITDA reduced by the

non-cash impact of equity earnings from equity method investments

and gain on sale of Marshall Mine, increased by cash distributions

from equity method investments, loss on early settlement of a

long-term receivable and loss on change in estimate, asset

retirement obligations. Consolidated EBITDA and Consolidated

Adjusted EBITDA should be considered in addition to, and not as a

substitute for, net income in accordance with GAAP as a measure of

performance.

Source: Advanced Emissions Solutions, Inc.

Investor Contact:

Alpha IR GroupRyan Coleman or Chris

Hodges312-445-2870ADES@alpha-ir.com

TABLE 1

Advanced Emissions Solutions, Inc. and

SubsidiariesCondensed Consolidated Balance

Sheets(Unaudited)

| |

|

As of |

| (in

thousands, except share data) |

|

September 30, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash |

|

$ |

52,529 |

|

|

$ |

66,432 |

|

|

Receivables, net |

|

|

14,225 |

|

|

|

13,864 |

|

|

Inventories, net |

|

|

18,549 |

|

|

|

17,828 |

|

|

Prepaid expenses and other current assets |

|

|

6,171 |

|

|

|

7,538 |

|

|

Total current assets |

|

|

91,474 |

|

|

|

105,662 |

|

| Restricted cash,

long-term |

|

|

8,792 |

|

|

|

10,000 |

|

| Property, plant and equipment,

net of accumulated depreciation of $17,110 and $11,897,

respectively |

|

|

85,709 |

|

|

|

34,855 |

|

| Other long-term assets,

net |

|

|

44,629 |

|

|

|

30,647 |

|

|

Total Assets |

|

$ |

230,604 |

|

|

$ |

181,164 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

13,972 |

|

|

$ |

16,108 |

|

|

Current portion of debt obligations |

|

|

1,991 |

|

|

|

1,131 |

|

|

Other current liabilities |

|

|

6,061 |

|

|

|

6,645 |

|

|

Total current liabilities |

|

|

22,024 |

|

|

|

23,884 |

|

| Long-term debt obligations,

net of current portion |

|

|

19,179 |

|

|

|

3,450 |

|

| Other long-term

liabilities |

|

|

15,107 |

|

|

|

13,851 |

|

|

Total Liabilities |

|

|

56,310 |

|

|

|

41,185 |

|

| Commitments and

contingencies |

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

Preferred stock: par value of $0.001 per share, 50,000,000 shares

authorized including Series A Convertible Preferred Stock: par

value $0.001 per share, 8,900,000 shares authorized, none issued

and outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock: par value of $0.001 per share, 100,000,000 shares

authorized, 37,799,053 and 23,788,319 shares issued, and 33,180,907

and 19,170,173 shares outstanding at September 30, 2023 and

December 31, 2022, respectively |

|

|

38 |

|

|

|

24 |

|

|

Treasury stock, at cost: 4,618,146 and 4,618,146 shares as of

September 30, 2023 and December 31, 2022, respectively |

|

|

(47,692 |

) |

|

|

(47,692 |

) |

|

Additional paid-in capital |

|

|

153,695 |

|

|

|

103,698 |

|

|

Retained earnings |

|

|

68,253 |

|

|

|

83,949 |

|

|

Total Stockholders’ Equity |

|

|

174,294 |

|

|

|

139,979 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

230,604 |

|

|

$ |

181,164 |

|

|

|

|

|

|

|

|

|

|

|

TABLE 2

Advanced Emissions Solutions, Inc. and

SubsidiariesCondensed Consolidated Statements of

Operations(Unaudited)

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in thousands, except per share data) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

Consumables |

|

$ |

29,829 |

|

|

$ |

28,437 |

|

|

$ |

71,079 |

|

|

$ |

79,578 |

|

| Total revenues |

|

|

29,829 |

|

|

|

28,437 |

|

|

|

71,079 |

|

|

|

79,578 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Consumables cost of revenue, exclusive of depreciation and

amortization |

|

|

20,707 |

|

|

|

21,575 |

|

|

|

53,218 |

|

|

|

62,992 |

|

|

Payroll and benefits |

|

|

4,228 |

|

|

|

2,313 |

|

|

|

12,482 |

|

|

|

7,458 |

|

|

Legal and professional fees |

|

|

1,654 |

|

|

|

3,668 |

|

|

|

8,060 |

|

|

|

7,395 |

|

|

General and administrative |

|

|

3,054 |

|

|

|

1,833 |

|

|

|

9,177 |

|

|

|

5,662 |

|

|

Depreciation, amortization, depletion and accretion |

|

|

2,711 |

|

|

|

1,671 |

|

|

|

7,276 |

|

|

|

4,765 |

|

|

Gain on sale of Marshall Mine, LLC |

|

|

— |

|

|

|

— |

|

|

|

(2,695 |

) |

|

|

— |

|

| Total operating expenses |

|

|

32,354 |

|

|

|

31,060 |

|

|

|

87,518 |

|

|

|

88,272 |

|

| Operating loss |

|

|

(2,525 |

) |

|

|

(2,623 |

) |

|

|

(16,439 |

) |

|

|

(8,694 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Earnings from equity method investments |

|

|

412 |

|

|

|

— |

|

|

|

1,512 |

|

|

|

3,222 |

|

|

Interest expense |

|

|

(787 |

) |

|

|

(83 |

) |

|

|

(2,155 |

) |

|

|

(259 |

) |

|

Other |

|

|

725 |

|

|

|

315 |

|

|

|

1,510 |

|

|

|

(19 |

) |

| Total other income |

|

|

350 |

|

|

|

232 |

|

|

|

867 |

|

|

|

2,944 |

|

| Loss before income taxes |

|

|

(2,175 |

) |

|

|

(2,391 |

) |

|

|

(15,572 |

) |

|

|

(5,750 |

) |

| Income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

33 |

|

|

|

— |

|

| Net loss |

|

$ |

(2,175 |

) |

|

$ |

(2,391 |

) |

|

$ |

(15,539 |

) |

|

$ |

(5,750 |

) |

| Loss per common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.07 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.56 |

) |

|

$ |

(0.31 |

) |

|

Diluted |

|

$ |

(0.07 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.56 |

) |

|

$ |

(0.31 |

) |

| Weighted-average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

31,807 |

|

|

|

18,487 |

|

|

|

27,894 |

|

|

|

18,435 |

|

|

Diluted |

|

|

31,807 |

|

|

|

18,487 |

|

|

|

27,894 |

|

|

|

18,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE 3

Advanced Emissions Solutions, Inc. and

SubsidiariesCondensed Consolidated Statements of

Cash

Flows(Unaudited)

| |

|

Nine Months Ended September 30, |

|

(in thousands) |

|

|

2023 |

|

|

|

2022 |

|

|

Cash flows from operating activities |

|

|

|

|

| Net loss |

|

$ |

(15,539 |

) |

|

$ |

(5,750 |

) |

| Adjustments to reconcile net loss

to net cash (used in) provided by operating activities: |

|

|

|

|

|

Depreciation, amortization, depletion and accretion |

|

|

7,276 |

|

|

|

4,765 |

|

|

Gain on sale of Marshall Mine, LLC |

|

|

(2,695 |

) |

|

|

— |

|

|

Operating lease expense |

|

|

2,061 |

|

|

|

1,953 |

|

|

Stock-based compensation expense |

|

|

1,810 |

|

|

|

1,455 |

|

|

Earnings from equity method investments |

|

|

(1,512 |

) |

|

|

(3,222 |

) |

|

Amortization of debt discount and debt issuance costs |

|

|

395 |

|

|

|

— |

|

|

Other non-cash items, net |

|

|

— |

|

|

|

438 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Receivables and related party receivables |

|

|

(359 |

) |

|

|

1,199 |

|

|

Prepaid expenses and other assets |

|

|

3,595 |

|

|

|

(991 |

) |

|

Inventories, net |

|

|

(811 |

) |

|

|

(7,222 |

) |

|

Other long-term assets, net |

|

|

(3,646 |

) |

|

|

2,136 |

|

|

Accounts payable and accrued expenses |

|

|

(12,033 |

) |

|

|

1,827 |

|

|

Other current liabilities |

|

|

148 |

|

|

|

(184 |

) |

|

Operating lease liabilities |

|

|

(140 |

) |

|

|

1,445 |

|

|

Other long-term liabilities |

|

|

305 |

|

|

|

206 |

|

|

Distributions from equity method investees, return on

investment |

|

|

— |

|

|

|

2,297 |

|

|

Net cash (used in) provided by operating activities |

|

|

(21,145 |

) |

|

|

352 |

|

| Cash flows from investing

activities |

|

|

|

|

|

Acquisition of property, plant, equipment, and intangible assets,

net |

|

|

(17,008 |

) |

|

|

(6,178 |

) |

|

Cash and restricted cash acquired in business acquisition |

|

|

2,225 |

|

|

|

— |

|

|

Payment for disposal of Marshall Mine, LLC |

|

|

(2,177 |

) |

|

|

— |

|

|

Acquisition of mine development costs |

|

|

(1,856 |

) |

|

|

(345 |

) |

|

Distributions from equity method investees in excess of cumulative

earnings |

|

|

1,512 |

|

|

|

3,316 |

|

|

Proceeds from sale of property and equipment |

|

|

— |

|

|

|

1,241 |

|

|

Net cash used in investing activities |

|

|

(17,304 |

) |

|

|

(1,966 |

) |

| Cash flows from financing

activities |

|

|

|

|

|

Net proceeds from common stock issued in PIPE |

|

|

15,220 |

|

|

|

— |

|

|

Net proceeds from Term Loan, related party, net of discount and

issuance costs |

|

|

8,522 |

|

|

|

— |

|

|

Net proceeds from common stock issuance, related party |

|

|

1,000 |

|

|

|

— |

|

|

Principal payments on finance lease obligations |

|

|

(855 |

) |

|

|

(913 |

) |

|

Principal payments on Arq Loan |

|

|

(341 |

) |

|

|

— |

|

|

Repurchase of common stock to satisfy tax withholdings |

|

|

(208 |

) |

|

|

(385 |

) |

|

Dividends paid on common stock |

|

|

— |

|

|

|

(45 |

) |

|

Net cash provided by (used) in financing activities |

|

|

23,338 |

|

|

|

(1,343 |

) |

|

Decrease in Cash and Restricted Cash |

|

|

(15,111 |

) |

|

|

(2,957 |

) |

| Cash and Restricted Cash,

beginning of period |

|

|

76,432 |

|

|

|

88,780 |

|

| Cash and Restricted Cash, end

of period |

|

$ |

61,321 |

|

|

$ |

85,823 |

|

| Supplemental disclosure of

non-cash investing and financing activities: |

|

|

|

|

|

Equity issued as consideration for acquisition of business |

|

$ |

31,206 |

|

|

$ |

— |

|

|

Change in accrued purchases for property and equipment |

|

$ |

255 |

|

|

$ |

339 |

|

|

Paid-in-kind dividend on Series A Preferred Stock |

|

$ |

157 |

|

|

$ |

— |

|

|

Acquisition of property and equipment under finance lease |

|

$ |

— |

|

|

$ |

1,641 |

|

|

|

|

|

|

|

|

|

|

|

Note on Non-GAAP Financial Measures

To supplement the Company's financial information presented in

accordance with U.S. Generally Accepted Accounting Principles,

("GAAP"), this press release includes non-GAAP measures of certain

financial performance. These non-GAAP measures include Consolidated

EBITDA and Consolidated Adjusted EBITDA. The Company included

non-GAAP measures because management believes they help to

facilitate comparison of operating results between periods. The

Company believes the non-GAAP measures provide useful information

to both management and users of the financial statements by

excluding certain expenses, gains and losses which can vary widely

across different industries or among companies within the same

industry and may not be indicative of core operating results and

business outlook. These non-GAAP measures are not in accordance

with, or an alternative to, measures prepared in accordance with

GAAP and may be different from, and may not be comparable to,

similarly titled non-GAAP measures used by other companies. In

addition, these non-GAAP measures are not based on any

comprehensive set of accounting rules or principles. These measures

should only be used to evaluate the Company's results of operations

in conjunction with the corresponding GAAP measures.

The Company has defined Consolidated EBITDA (EBITDA Loss) as net

income (loss) adjusted for the impact of the following items that

are either non-cash or that we do not consider representative of

our ongoing operating performance: depreciation, amortization,

depletion, accretion, amortization of upfront customer

consideration, which was recorded in conjunction with the Marshall

Mine Acquisition ("Upfront Customer Consideration"), interest

expense, net and income taxes. The Company has defined Consolidated

Adjusted EBITDA (EBITDA Loss) as Consolidated EBITDA (EBITDA Loss)

reduced by the non-cash impact of equity earnings from equity

method investments and gain on sale of Marshall Mine, LLC,

increased by cash distributions from equity method investments,

loss on early settlement of long-term receivable and the loss on

change in estimate, asset retirement obligation. The Company

believes that the Consolidated Adjusted EBITDA measure is less

susceptible to variances that affect the Company's operating

performance.

The Company presents the non-GAAP measures because the Company

believes they are useful as supplemental measures in evaluating the

performance of the Company's operating performance and provide

greater transparency into the results of operations. The Company's

management uses Consolidated EBITDA and Consolidated Adjusted

EBITDA as a factor in evaluating the performance of its business.

The adjustments to Consolidated EBITDA and Consolidated Adjusted

EBITDA in future periods are generally expected to be similar.

Consolidated EBITDA and Consolidated Adjusted EBITDA has

limitations as an analytical tool, and you should not consider

these measures in isolation or as a substitute for analyzing the

Company's results as reported under GAAP.

TABLE 4

Advanced Emissions Solutions, Inc. and

SubsidiariesConsolidated Adjusted EBITDA

Reconciliation to Net (Loss) Income (Amounts in

thousands)(Unaudited)

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in thousands) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net loss(1) |

|

$ |

(2,175 |

) |

|

$ |

(2,391 |

) |

|

$ |

(15,539 |

) |

|

$ |

(5,750 |

) |

|

Depreciation, amortization, depletion and accretion |

|

|

2,711 |

|

|

|

1,671 |

|

|

|

7,276 |

|

|

|

4,765 |

|

|

Amortization of Upfront Customer Consideration |

|

|

127 |

|

|

|

127 |

|

|

|

381 |

|

|

|

381 |

|

|

Interest expense, net |

|

|

224 |

|

|

|

44 |

|

|

|

822 |

|

|

|

163 |

|

|

Income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

(33 |

) |

|

|

— |

|

| EBITDA (EBITDA loss) |

|

|

887 |

|

|

|

(549 |

) |

|

|

(7,093 |

) |

|

|

(441 |

) |

|

Cash distributions from equity method investees |

|

|

412 |

|

|

|

— |

|

|

|

1,512 |

|

|

|

5,613 |

|

|

Equity earnings |

|

|

(412 |

) |

|

|

— |

|

|

|

(1,512 |

) |

|

|

(3,222 |

) |

|

Gain on sale of Marshall Mine, LLC |

|

|

— |

|

|

|

— |

|

|

|

(2,695 |

) |

|

|

— |

|

|

Loss on early settlement of long-term receivable |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

535 |

|

|

Loss on change in estimate, asset retirement obligation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

34 |

|

| Adjusted EBITDA (Adjusted

EBITDA loss) |

|

$ |

887 |

|

|

$ |

(549 |

) |

|

$ |

(9,788 |

) |

|

$ |

2,519 |

|

(1) Included in Net loss for the three and nine

months ended September 30, 2023 is zero and $4.9 million,

respectively, of transaction and integration costs incurred related

to the Arq Acquisition. Included in Net Loss for the three and nine

months ended September 30, 2022 is $2.4 million and $3.7 million,

respectively, of transaction and integration costs incurred related

to the Arq Acquisition. Additionally, for the nine months ended

September 30, 2023, Net loss included $4.2 million of Arq payroll

and benefit costs. Further included in Net Loss for the three and

nine months ended September 30, 2023 is $1.3 million of severance

expense related to two executive employees.

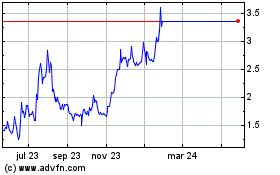

Advanced Emissions Solut... (NASDAQ:ADES)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Advanced Emissions Solut... (NASDAQ:ADES)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024