Adamis Pharmaceuticals Reports Second Quarter 2023 Financial Results and Provides Corporate Update

21 Agosto 2023 - 8:15AM

Adamis Pharmaceuticals Corporation (NASDAQ: ADMP), a

commercial-stage biopharmaceutical company, today announced

financial results for the second quarter ended June 30, 2023, and

provided an update on recent corporate developments.

Q2 2023 Corporate Highlights

- In May, the Company closed the

merger with DMK Pharmaceuticals Corporation (DMK), a private,

clinical-stage biotechnology company at the forefront of

endorphin-inspired drug design focused on developing novel

treatments for opioid use disorder and other neuro-based diseases.

Ebrahim Versi, MD, PhD, CEO of DMK, was named CEO of Adamis and

Chairman of the Board of Directors. David J. Marguglio, previously

Chief Executive Officer of Adamis, assumed the role of President

and Chief Operating Officer of the combined company. Changes to the

composition of the Board of Directors were also made.

- In June, management participated in

the White House Roundtable with Opioid Reversal Product

Manufacturers hosted by White House Office of National Drug

Control Policy Director, Dr. Rahul Gupta, White House Domestic

Policy Council Advisor Neera Tanden, U.S. Assistant

Secretary for Health Admiral Rachel Levine,

and U.S. Assistant Secretary for Mental Health and

Substance Use Dr. Miriam E. Delphin-Rittmon. While in

Washington, D.C., management also met individually with 12 members

and/or staff of the House of Representatives and Senate, from both

parties, and discussed the opioid crisis and potential ways it

could be mitigated.

- Also in June, the Company announced

that its wholly owned subsidiary DMK was the recipient of a

grant from the National Institute of Alcohol Abuse and Alcoholism

(NIAAA) of the National Institutes of Health (NIH) to

support the development of a novel bifunctional small molecule for

the treatment of alcohol use disorder.

- In July, the Company committed to an

unrestricted research grant to the Leiden University Medical Center

Anesthesia and Pain Research Unit, to fund a ZIMHI® clinical study

by Albert Dahan, MD, PhD, a world expert on opioid-induced

respiratory depression, otherwise known as an opioid overdose. The

objective of the work will be to assess the efficacy of the

Company’s ZIMHI product compared to 4mg of intranasal naloxone,

which is comparable to NARCAN®, and the respective number of doses

required to reverse fentanyl-induced respiratory depression.

Recent Corporate Updates

- On August 4, 2023, the Company announced the closing of a

public offering of 5,930,000 units at a public offering price of

$1.35, with each unit consisting of one share of common stock (or

pre-funded warrant in lieu thereof) and one warrant to purchase one

share of common stock. The Company received gross proceeds of

approximately $8.0 million before deducting fees and other

estimated offering expenses at the closing, and has received

additional proceeds resulting from exercises after the closing date

of some of the warrants issued in the transaction.

Q2 2023 Financial Highlights

- Revenues for the second quarter ending June 30, 2023 were $0.0

million compared to $0.0 million for the same period in 2022.

Revenues were negligible in both periods because no manufacturing

of commercial products occurred in the second quarter in 2023 or

2022. Revenues for the six months ending June 30, 2023 and 2022

were approximately $1.5 million and $1.2 million, respectively. The

increase was due to higher manufacturing demand for ZIMHI in the

first quarter of 2023 versus 2022.

- Selling, general and administrative (SG&A) expenses for the

three months ending June 30, 2023 were $4.0 million compared to

$4.2 million for the second quarter of 2022. SG&A expenses for

the first six months ending June 30, 2023 and 2022 were $8.8

million and $7.6 million, respectively. The increase was primarily

attributable to approximately $1.3 million in transaction costs

associated with the DMK merger.

- Research and development (R&D) expense for the second

quarter of 2023 was $0.4 million compared to $3.2 million in the

second quarter of the prior year. R&D expense for the first six

months of 2023 was $1.7 million, compared to $7.5 million in the

same period in 2022. The decline in both periods was due to

terminating the clinical development activity related to a previous

product candidate.

- Net loss for the combined (continued and discontinued)

operations for the second quarter of 2023 was $8.6 compared to a

net loss of $8.4 million in the second quarter of 2022. The

increase was primarily attributable to a charge of $6.5 million for

DMK’s in-process research and development acquired in the merger.

Net loss for the six months ended June 30, 2023 and 2022 was $17.5

million and $18.8 million, respectively.

- Cash and cash equivalents as of June 30, 2023, were

approximately $0.6 million. Additional cash infusions subsequent to

the close of the second quarter include net proceeds of

approximately $1.8 million from the sale of assets related to the

discontinued US Compounding operations and net proceeds of

approximately $7.0 million from the Company’s equity financing

transaction that occurred in August.

About Adamis Pharmaceuticals

Adamis Pharmaceuticals Corporation is a commercial stage

neuro-biotech company primarily focused on developing and

commercializing products for the treatment of opioid overdose and

substance use disorders. Adamis’ commercial products approved by

the FDA include ZIMHI® (naloxone) Injection for the treatment of

opioid overdose, and SYMJEPI® (epinephrine) Injection for use in

the emergency treatment of acute allergic reactions, including

anaphylaxis. Following its recent merger transaction with DMK

Pharmaceuticals, the Company is also developing novel therapies for

opioid use disorder (OUD) and other important neuro-based

conditions where patients are currently underserved. The Company’s

lead clinical stage product candidate, DPI-125, is being studied as

a potential novel treatment for OUD. Adamis also plans to develop

the compound for the treatment of moderate to severe pain. The

Company’s other development stage product candidates include

DPI-221 for bladder control problems and DPI-289 for severe end

stage Parkinson’s disease. For additional information about Adamis

Pharmaceuticals, please visit our website and follow us on Twitter

and LinkedIn.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are identified by terminology such

as “may,” “should,” “expects,” “plans,” “anticipates,” “could,”

“intends,” “target,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar words. Such forward-looking

statements include those that express plans, anticipation, intent,

contingencies, goals, targets or future development and/or

otherwise are not statements of historical fact. These statements

relate to future events or future results of operations, including,

but not limited to statements concerning the following matters: (i)

the commencement, timing and results of the proposed study to

conducted by Dr. Dahan regarding the Company’s ZIMHI® product; (ii)

the outcome of any current legal proceedings or future legal

proceedings; (iii) whether the combined business of DMK and Adamis

will be successful; (iv) whether any DMK product candidates will be

successfully developed or commercialized; (v) the Company’s ability

to regain compliance with Nasdaq listing standards so that the

Company’s Common Stock continues to be listed on the Nasdaq Capital

Market; (vi) the Company’s ability to raise capital to continue as

a going concern; and (vii) those risks detailed in Adamis’ most

recent Annual Report on Form 10-K and subsequent reports filed with

the Securities and Exchange Commission (“SEC”), as well as other

documents that may be filed by Adamis from time to time with the

SEC. These statements are only predictions and involve known and

unknown risks, uncertainties, and other factors, which may cause

Adamis’ actual results to be materially different from the results

anticipated by such forward-looking statements. Accordingly, you

should not rely upon forward-looking statements as predictions of

future events. Adamis cannot assure you that the events and

circumstances reflected in the forward-looking statements will be

achieved or occur, and actual results could differ materially from

those projected in the forward-looking statements. Factors that

could cause actual results to differ materially from management’s

current expectations include those risks and uncertainties relating

to: our ability to raise capital; the timing and results of the

study to be conducted by Dr. Dahan; our ability to maintain

continued listing of the Common Stock on the Nasdaq Capital Market;

risks associated with development of DMK’s drug product candidates;

our cash flow, cash burn, expenses, obligations and liabilities;

the outcomes of any litigation, regulatory proceedings, inquiries

or investigations that we are or may become subject to; and other

important factors discussed in the Company’s filings with the SEC.

If we do not obtain additional equity or debt funding in the

future, our cash resources will be depleted and we could be

required to materially reduce or suspend operations, which would

likely have a material adverse effect on our business, stock price

and our relationships with third parties with whom we have business

relationships, at least until additional funding is obtained. If we

do not have sufficient funds to continue operations or satisfy out

liabilities, we could be required to seek bankruptcy protection or

other alternatives to attempt to resolve our obligations and

liabilities that could result in our stockholders losing most or

all of their investment in us. You should not place undue reliance

on any forward-looking statements. Further, any forward-looking

statement speaks only as of the date on which it is made, and

except as may be required by applicable law, we undertake no

obligation to update or release publicly the results of any

revisions to these forward-looking statements or to reflect events

or circumstances arising after the date of this press release.

Certain of these risks and additional risks, uncertainties, and

other factors are described in greater detail in Adamis’ filings

from time to time with the SEC, including its annual report on Form

10-K for the year ended December 31, 2022, and subsequent filings

with the SEC, which Adamis strongly urges you to read and consider,

all of which are available free of charge on the SEC’s website at

http://www.sec.gov.

Contact:Adamis Investor RelationsRobert UhlManaging DirectorICR

Westwicke619.228.5886

| ADAMIS

PHARMACEUTICALS CORPORATION AND SUBSIDIARIES |

|

| CONSOLIDATED

BALANCE SHEET DATA (Unaudited) |

|

|

|

|

|

|

|

|

|

|

| |

|

June 30, 2023 |

|

December 31, 2022 |

|

| Cash and

Cash Equivalents |

|

$ |

640,254 |

|

|

$ |

1,081,364 |

|

|

| Total

Current Assets |

|

|

3,450,698 |

|

|

|

9,272,150 |

|

|

| Total

Assets |

|

|

4,749,150 |

|

|

|

10,930,840 |

|

|

| Total

Liabilities |

|

|

16,244,476 |

|

|

|

11,581,605 |

|

|

| Accumulated

Deficit |

|

|

(322,081,115 |

) |

|

|

(304,564,086 |

) |

|

| Total

Stockholders’ Equity |

|

|

(11,825,326 |

) |

|

|

(808,068 |

) |

|

| ADAMIS

PHARMACEUTICALS CORPORATION AND SUBSIDIARIES |

| CONSOLIDATED

STATEMENTS OF OPERATIONS DATA (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months

Ended June 30, |

|

Six Months

Ended June 30, |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenue,

net |

$ |

6,945 |

|

|

$ |

39,847 |

|

|

$ |

1,459,945 |

|

|

|

1,194,361 |

|

| Cost of

Goods Sold |

|

361,394 |

|

|

|

689,178 |

|

|

|

2,149,461 |

|

|

|

2,152,760 |

|

| Selling,

General and Administrative Expenses |

|

4,033,083 |

|

|

|

4,205,934 |

|

|

|

8,815,168 |

|

|

|

7,588,630 |

|

| Research and

Development |

|

376,957 |

|

|

|

3,320,654 |

|

|

|

1,687,486 |

|

|

|

7,542,179 |

|

| Acquired

In-Process Research and Development |

|

6,539,675 |

|

|

|

- |

|

|

|

6,539,675 |

|

|

|

- |

|

| Loss from

Operations |

|

(11,304,164 |

) |

|

|

(8,175,919 |

) |

|

|

(17,731,845 |

) |

|

|

(16,089,208 |

) |

| Total Other

Income (Expense), net |

|

4,300,773 |

|

|

|

(159,535 |

) |

|

|

1,713,846 |

|

|

|

(2,436,000 |

) |

| Net Loss

from Continuing Operations, before taxes |

|

(7,003,391 |

) |

|

|

(8,335,454 |

) |

|

|

(16,017,999 |

) |

|

|

(18,525,208 |

) |

| Net Income

(Loss) from Discontinued Operations, before taxes |

|

(1,570,731 |

) |

|

|

(61,767 |

) |

|

|

(1,499,030 |

) |

|

|

(226,628 |

) |

| Net Loss

Applicable to Common Stock |

$ |

(8,574,122 |

) |

|

$ |

(8,397,221 |

) |

|

$ |

(17,517,029 |

) |

|

$ |

(18,751,836 |

) |

| Basic &

Diluted Loss Per Share |

$ |

(3.40 |

) |

|

$ |

(3.92 |

) |

|

$ |

(7.43 |

) |

|

$ |

(8.77 |

) |

| Basic &

Diluted Weighted Average Shares Outstanding |

|

2,569,400 |

|

|

|

2,140,224 |

|

|

|

2,378,006 |

|

|

|

2,138,816 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

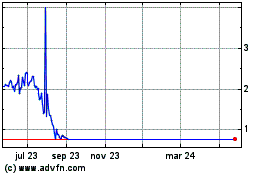

Adamis Pharmaceuticals (NASDAQ:ADMP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Adamis Pharmaceuticals (NASDAQ:ADMP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024