Akoustis Technologies, Inc. (NASDAQ: AKTS) (“Akoustis” or the

“Company”), an integrated device manufacturer (IDM) of patented

bulk acoustic wave (BAW) high-band RF filters for mobile and other

wireless applications, today announced second fiscal quarter

results for the period ended December 31, 2023. Revenue was up 20%

year-over-year to $7.0 million, in line with the Company’s

guidance.

Based on hundreds of active customers, robust

activity in the sales and design win pipelines, and the

semiconductor services business, as well as new product

introductions in Wi-Fi 6E/7 and 5G infrastructure the Company

expects, as previously guided, to report record revenue in the

March quarter in the $8.3 to $8.8 million range, up 18 to 25%

sequentially.

The Company continues to take significant

expense reductions and cost saving measures that are projected to

reduce its operating cash flow burn rate by 30 to 38% for the March

quarter. Given the top-line projections, the refund from the CHIPS

Act investment tax credit (ITC), and a full quarter of cost

savings, the Company currently expects to reach breakeven operating

cashflow by the end of the calendar year.

Jeff Shealy, founder and CEO of Akoustis,

stated, “Akoustis continues to be a leader in technological

innovation and sees sustainable growth. We are driving advancements

in the Wi-Fi AP, 5G Infrastructure, Defense and Automotive sectors,

and anticipating demand to increase in the Wi-Fi 6E and 7 markets.”

Mr. Shealy continued, “Consistent with our early guidance on

fiscal Q3 during last quarter’s investor call, we expect to achieve

record revenue in the March quarter while we continue to focus on

product cost savings and expense reductions.”

Recent Business

Highlights

- Received Wi-Fi 7 design win from Tier-1 US-based carrier with

expected production ramp in September quarter of calendar 2024

- Achieved Wi-Fi 7 design win and volume orders for two new

programs with current Tier-1 Enterprise Wi-Fi solutions provider

with expected production ramp in second half calendar year

2024

- Engaged with a fifth mobile partner offering our XBAW® foundry

process and shipped multiple die for a future multiplexer

application in the Mobile market

- Completed redesign of 5G band 41 and 5G US 3.8 GHz Network

Infrastructure filter solutions

- Secured a wBMS design win with Tier-1 Automotive product

supplier from an Integrated Circuit (IC) reference design expected

to ramp in March quarter of calendar year 2025

- Received a Wi-Fi 7 design win and prototype orders from Tier-1

Enterprise Wi-Fi access point (“AP”) provider to enable production

ramp in second half of calendar year 2024

- Secured a high-volume XBAW® filter order for Wi-Fi 6E design

win from Tier-1 consumer AP customer

- Successfully completed Phase 1 of Defense Advanced Research

Projects Agency (DARPA) contract to pursue new materials and device

manufacturing methods to scale XBAW® technology to 18 GHz and

signed a new multi-year, multi-million-dollar contract for Phase 2

of the DARPA Compact Front-end Filters at the ElEment-level

(COFFEE) program.

- Secured a development order from a leading commercial SATCOM

company and brought our active foundry customer count to four

- Received Wi-Fi NOW Award with HPE Aruba Networking for Best

Enterprise Wi-Fi Solution

- Received a purchase order from Tier-2 5G Mobile and Wi-Fi AP RF

front-end module customer for design iterations of three previously

shipped designs

Akoustis will host an investor call to provide a

business update and outlook, followed by a Q & A session, this

morning at 8:00 am ET. The call-in numbers are 877-407-3982

(domestic) and 201-493-6780 (international). The conference call

will be webcast live on the Company’s website and will be available

for playback at the following URL:

https://ir.akoustis.com/ir-calendar.

Akoustis maintains its momentum with robust

demand and an expanding sales pipeline for its XBAW® filter

products, in addition to its new XBAW®/SAW resonator and oscillator

products, and semiconductor back-end services. The Company

continues to secure new design wins in its target markets including

Wi-Fi, 5G Infrastructure, Automotive and Defense, many of which are

slated to ramp into production in the coming months.

Second Fiscal Quarter Financial

Performance

Akoustis Technologies,

Inc.Condensed Consolidated Balance Sheets (In

thousands, except share data) (Unaudited)

| |

|

December 31, |

|

|

June 30, |

|

| |

|

2023 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

| Cash and cash

equivalents |

|

$ |

12,875 |

|

|

$ |

43,104 |

|

| Accounts receivable, net |

|

|

4,808 |

|

|

|

4,753 |

|

| Inventory |

|

|

5,476 |

|

|

|

7,548 |

|

| Other current assets |

|

|

2,859 |

|

|

|

4,440 |

|

| Total current

assets |

|

|

26,018 |

|

|

|

59,845 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

56,198 |

|

|

|

57,826 |

|

| Goodwill |

|

|

14,559 |

|

|

|

14,559 |

|

| Intangibles, net |

|

|

13,876 |

|

|

|

15,241 |

|

| Operating lease right-of-use

asset, net |

|

|

1,158 |

|

|

|

1,374 |

|

| Other assets |

|

|

74 |

|

|

|

72 |

|

| Total

Assets |

|

$ |

111,883 |

|

|

$ |

148,917 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued

expenses |

|

$ |

13,748 |

|

|

$ |

17,027 |

|

| Deferred revenue |

|

|

56 |

|

|

|

105 |

|

| Operating lease liability |

|

|

478 |

|

|

|

439 |

|

| Total current

liabilities |

|

|

14,282 |

|

|

|

17,571 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

Liabilities: |

|

|

|

|

|

|

|

|

| Convertible notes payable,

net |

|

|

41,653 |

|

|

|

43,347 |

|

| Promissory notes payable |

|

|

1,333 |

|

|

|

667 |

|

| Operating lease liability |

|

|

729 |

|

|

|

976 |

|

| Other long-term

liabilities |

|

|

117 |

|

|

|

117 |

|

| Total Long-Term

liabilities |

|

|

43,832 |

|

|

|

45,107 |

|

| |

|

|

|

|

|

|

|

|

| Total

Liabilities |

|

|

58,114 |

|

|

|

62,678 |

|

| Commitments and Contingencies

(Note 14) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

| Preferred stock, par value

$0.001; 5,000,000 shares authorized; none issued and

outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 175,000,000 shares authorized;

75,435,479, and 72,154,647 shares issued and outstanding at

December 31, 2023 and June 30, 2023, respectively |

|

|

75 |

|

|

|

72 |

|

| Additional paid in

capital |

|

|

360,090 |

|

|

|

356,522 |

|

| Accumulated deficit |

|

|

(306,396 |

) |

|

|

(270,355 |

) |

| Total Stockholders’

Equity |

|

|

53,769 |

|

|

|

86,239 |

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

111,883 |

|

|

$ |

148,917 |

|

Akoustis Technologies,

Inc.Condensed Consolidated Statements of

Operations(In thousands, except per share

data)(Unaudited)

|

|

|

For the Three Months Ended December 31,

2023 |

|

|

For the Three Months Ended December 31,

2022 |

|

|

For the Six Months Ended December 31,

2023 |

|

|

For the Six Months Ended December 31,

2022 |

|

|

Revenue |

|

$ |

7,017 |

|

|

$ |

5,865 |

|

|

$ |

14,019 |

|

|

$ |

11,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

6,336 |

|

|

|

5,274 |

|

|

|

14,422 |

|

|

|

11,727 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss) |

|

|

681 |

|

|

|

591 |

|

|

|

(403 |

) |

|

|

(295 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

6,411 |

|

|

|

7,645 |

|

|

|

16,758 |

|

|

|

17,730 |

|

|

General and administrative expenses |

|

|

9,294 |

|

|

|

5,838 |

|

|

|

19,518 |

|

|

|

12,833 |

|

|

Total operating expenses |

|

|

15,705 |

|

|

|

13,483 |

|

|

|

36,276 |

|

|

|

30,563 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(15,024 |

) |

|

|

(12,892 |

) |

|

|

(36,679 |

) |

|

|

(30,858 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest (expense) income |

|

|

(679 |

) |

|

|

(702 |

) |

|

|

(1,164 |

) |

|

|

(1,445 |

) |

|

Other (expense) income |

|

|

1 |

|

|

|

5 |

|

|

|

— |

|

|

|

(9 |

) |

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

1,616 |

|

|

|

— |

|

|

|

1,170 |

|

|

Change in fair value of derivative liabilities |

|

|

(7 |

) |

|

|

818 |

|

|

|

2,006 |

|

|

|

839 |

|

|

Total other (expense) income |

|

|

(685 |

) |

|

|

1,737 |

|

|

|

842 |

|

|

|

555 |

|

|

Net loss before income taxes |

|

$ |

(15,709 |

) |

|

$ |

(11,155 |

) |

|

$ |

(35,837 |

) |

|

$ |

(30,303 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Taxes |

|

|

2 |

|

|

|

1 |

|

|

|

3 |

|

|

|

(56 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

|

$ |

(15,711 |

) |

|

$ |

(11,156 |

) |

|

$ |

(35,840 |

) |

|

$ |

(30,247 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share - basic and diluted |

|

$ |

(0.21 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.49 |

) |

|

$ |

(0.53 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic and

diluted |

|

|

73,084,663 |

|

|

|

57,583,844 |

|

|

|

72,695,676 |

|

|

|

57,369,118 |

|

The following non-GAAP measures should not be

considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP. These non-GAAP measures exclude

significant expenses that are required by GAAP to be recorded in

the Company’s financial statements and are subject to inherent

limitations. Please see reconciliations to comparable GAAP measures

below and descriptions of these non-GAAP measures under “Non-GAAP

Measures.”

Non-GAAP operating loss and non-GAAP net loss for the three and

six months ended December 31, 2023, and 2022 were as follows:

|

Akoustis Technologies, Inc. |

|

Unaudited Reconciliations of Non-GAAP Financial

Measures |

| |

|

|

| |

Three Months Ended |

| |

December 31, 2023 |

December 31,2022 |

| (in

thousands) |

| GAAP operating

loss |

$ (15,024) |

$ (12,892) |

| Amortization of

acquisition-related intangible assets |

646 |

348 |

|

Recognition of acquisition-related promissory note |

333 |

- |

| Gain on sale of

fixed assets |

203 |

15 |

| Common stock

issued for services |

316 |

1,895 |

| Non-GAAP

operating loss |

$ (13,526) |

$ (10,634) |

| |

|

|

| Weighted

average common shares outstanding - basic and diluted |

73,084,663 |

57,583,844 |

| Non-GAAP

operating loss per common share - basic and diluted |

$ (0.19) |

$ (0.18) |

| |

|

|

| |

|

|

| |

Three Months Ended |

| |

December 31, 2023 |

December 31,2022 |

| (in

thousands) |

| GAAP net

loss |

$ (15,711) |

$ (11,156) |

| Change in fair

value of contingent consideration |

- |

(1,616) |

| Change in fair

value of derivative liabilities |

7 |

(818) |

| Amortization of

acquisition-related intangible assets |

646 |

348 |

|

Recognition of acquisition-related promissory note |

333 |

- |

| Debt discount

amortization |

158 |

146 |

| Gain on sale of

fixed assets |

203 |

15 |

| Common stock

issued for services |

316 |

1,895 |

| Non-GAAP net

loss |

$ (14,048) |

$ (11,186) |

| |

|

|

| Weighted

average common shares outstanding - basic and diluted |

73,084,663 |

57,583,844 |

| Non-GAAP net

loss per common share - basic and diluted |

$ (0.19) |

$ (0.19) |

| |

|

|

| |

|

|

| |

|

|

| |

Six Months Ended |

| (in

thousands) |

December 31, 2023 |

December 31,2022 |

| GAAP net

loss |

$ (36,679) |

$ (30,858) |

| Amortization of

acquisition-related intangible assets |

1,293 |

695 |

|

Recognition of acquisition-related promissory note |

666 |

- |

| Gain on sale of

fixed assets |

268 |

16 |

| Common stock

issued for services |

2,199 |

4,244 |

| Non-GAAP net

loss |

$ (32,253) |

$ (25,903) |

| |

|

|

| Weighted

average common shares outstanding - basic and diluted |

72,695,676 |

57,369,118 |

| Non-GAAP net

loss per common share - basic and diluted |

$ (0.44) |

$ (0.45) |

|

|

|

|

| |

Six Months Ended |

| (in

thousands) |

December 31, 2023 |

December 31,2022 |

| GAAP net

loss |

$ (35,840) |

$ (30,247) |

| Change in fair

value of contingent consideration |

- |

(1,170) |

| Change in fair

value of derivative liabilities |

(2,006) |

(839) |

| Amortization of

acquisition-related intangible assets |

1,293 |

695 |

|

Recognition of acquisition-related promissory note |

666 |

- |

| Debt discount

amortization |

312 |

290 |

| Gain on sale of

fixed assets |

268 |

16 |

| Common stock

issued for services |

2,199 |

4,244 |

| Non-GAAP net

loss |

$ (33,108) |

$ (27,011) |

| |

|

|

| Weighted

average common shares outstanding - basic and diluted |

72,695,676 |

57,369,118 |

| Non-GAAP net

loss per common share - basic and diluted |

$ (0.46) |

$ (0.47) |

Non-GAAP Measures

We regularly review a number of metrics,

including non-GAAP operating loss and non-GAAP net loss, which are

not financial measures calculated in accordance with generally

accepted accounting principles in the United States (“GAAP”).

Non-GAAP operating loss represents operating loss before common

stock issued for services, amortization of acquisition-related

intangible assets, recognition of acquisition-related promissory

note, and gain or loss on the sale of fixed assets. Non-GAAP

net loss represents net loss before change in fair value of

contingent consideration, change in fair value of derivative

liabilities, debt discount amortization, gain on extinguishment of

debt, gain or loss on disposal of fixed assets, recognition of

acquisition-related promissory note, amortization of

acquisition-related intangible assets, tax adjustments related to

acquisitions and common stock issued for services. The Company

believes these non-GAAP measures provide useful information to

management, investors, and financial analysts regarding certain

financial and business trends relating to the Company’s financial

condition and results of operations. We use these non-GAAP measures

to evaluate our business, measure our performance, identify trends

affecting our business, formulate financial projections, and make

strategic decisions.

About Akoustis Technologies,

Inc.

Akoustis® (http://www.akoustis.com/) is a

high-tech BAW RF filter solutions company that is pioneering

next-generation materials science and MEMS wafer manufacturing

to address the market requirements for improved acoustic wave RF

filters — targeting higher bandwidth, higher operating frequencies

and higher output power compared

to legacy polycrystalline BAW technology. The Company

utilizes its proprietary and patented XBAW® manufacturing

process to produce bulk acoustic wave RF filters

for mobile and other wireless markets, which facilitate

signal acquisition and accelerate band performance between the

antenna and digital back end. Superior performance is

driven by the significant advances of poly-crystal,

single-crystal, and other high purity piezoelectric materials and

the resonator-filter process technology which enables optimal

trade-offs between critical power, frequency and bandwidth

performance specifications.

Akoustis plans to service the fast growing

multi-billion-dollar RF filter market using its integrated

device manufacturer (IDM) business model. The Company owns and

operates a 125,000 sq. ft. ISO-9001:2015

registered commercial wafer-manufacturing facility located in

Canandaigua, NY, which includes a class 100 / class 1000 cleanroom

facility — tooled for 150-mm diameter wafers — for the

design, development, fabrication and packaging of RF filters, MEMS

and other semiconductor devices. Akoustis Technologies,

Inc. is headquartered in the Piedmont technology

corridor near Charlotte, North Carolina.

Forward-Looking Statements

This document includes “forward-looking

statements” within the meaning of Section 27A of the Securities

Act, and Section 21E of the Securities Exchange Act of 1934, each

as amended, that are intended to be covered by the “safe harbor”

created by those sections. These forward-looking statements

include, but are not limited to, statements about our estimates,

expectations, beliefs, intentions, plans or strategies for the

future (including our possible future results of operations,

profitability, business strategies, competitive position, potential

growth opportunities, potential market opportunities and the

effects of competition), and the assumptions underlying such

statements. Forward-looking statements include all statements that

are not historical facts and typically are identified by use of

terms such as “may,” “might,” “would,” “will,” “should,” “could,”

“project,” “expect,” “plan,” “strategy,” “anticipate,” “attempt,”

“develop,” “help,” “believe,” “think,” “estimate,” “predict,”

“intend,” “forecast,” “seek,” “potential,” “possible,” “continue,”

“future,” and similar words (including the negative of any of the

foregoing), although some forward-looking statements are expressed

differently. Forward-looking statements are neither historical

facts nor assurances of future results, performance, events or

circumstances. Instead, these forward-looking statements are

based on management’s current beliefs, expectations and

assumptions, and are subject to risks and

uncertainties. Factors that could cause actual results to

differ materially from those currently anticipated include, without

limitation, risks relating to our limited operating history; our

inability to generate revenues or achieve profitability; the

failure of our common stock to meet the minimum requirements for

continued listing on the Nasdaq Capital Market, the impact of a

pandemic or epidemic or natural disaster, including the COVID-19

pandemic, the Russian-Ukrainian and Middle East conflicts and other

sources of volatility on our operations, financial condition and

the worldwide economy, including our ability to access the capital

markets; increases in prices for raw materials, labor, and fuel

caused by rising inflation; our inability to obtain adequate

financing and sustain our status as a going concern; the results of

our research and development activities; our inability to achieve

acceptance of our products in the market; general economic

conditions, including upturns and downturns in the industry;

existing or increased competition; our inability to successfully

scale our New York wafer fabrication facility and related

operations while maintaining quality control and assurance and

avoiding delays in output; contracting with customers and other

parties with greater bargaining power and agreeing to terms and

conditions that may adversely affect our business; the possibility

that the anticipated benefits from business acquisitions will not

be realized in full or at all or may take longer to realize than

expected; the possibility that costs or difficulties related to the

integration of acquired businesses’ operations will be greater than

expected and the possibility of disruptions to our business during

integration efforts and strain on management time and resources;

risks related to doing business in foreign countries, including

rising tensions between the United States and China; any

cybersecurity breaches or other disruptions compromising our

proprietary information and exposing us to liability; our limited

number of patents; failure to obtain, maintain, and enforce our

intellectual property rights; claims of infringement,

misappropriation or misuse of third party intellectual property,

including the lawsuit filed by Qorvo, Inc. in October 2021, that,

regardless of merit, has resulted in significant expense; our

inability to attract and retain qualified personnel; the outcome of

current and any future litigation; our reliance on third parties to

complete certain processes in connection with the manufacture of

our products; product quality and defects; our inability to

successfully manufacture, market and sell products based on our

technologies; our ability to meet the required specifications of

customers and achieve qualification of our products for commercial

manufacturing in a timely manner; our failure to innovate or adapt

to new or emerging technologies, including in relation to our

competitors; our failure to comply with regulatory requirements;

stock volatility and illiquidity; our failure to implement our

business plans or strategies; our failure to maintain effective

internal control over financial reporting; our failure to obtain or

maintain a Trusted Foundry accreditation or our New York

fabrication facility; and shortages in supplies needed to

manufacture our products, or needed by our customers to manufacture

devices incorporating our products. These and other risks and

uncertainties are described in more detail in the Risk Factors and

Management’s Discussion and Analysis of Financial Condition and

Results of Operations sections of the Company’s most recent Annual

Report on Form 10-K and in subsequently filed Quarterly Reports on

Form 10-Q. Considering these risks, uncertainties and assumptions,

the forward-looking statements regarding future events and

circumstances discussed in this document may not occur, and actual

results could differ materially and adversely from those

anticipated or implied in the forward-looking statements. You

should not rely upon forward-looking statements as predictions of

future events. The forward-looking statements included in this

document speak only as of the date hereof and, except as required

by law, we undertake no obligation to update publicly or privately

any forward-looking statements, whether written or oral, for any

reason after the date of this document to conform these statements

to new information, actual results or to changes in our

expectations.

Contact:

COMPANY:

Kenneth Boller

Akoustis Technologies

Chief Financial Officer

(704) 274-3598

kboller@akoustis.com

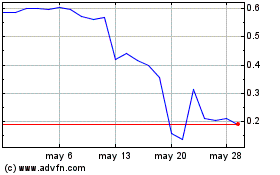

Akoustis Technologies (NASDAQ:AKTS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Akoustis Technologies (NASDAQ:AKTS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025